Trading Municipal Bonds

Municipal bonds (munis) are debt securities issued by states, municipalities, or counties to finance public projects.

These can include infrastructure developments like roads, schools, and hospitals.

Trading municipal bonds involves buying and selling these securities in various market environments – e.g., either underweighting them or overweighting them in a portfolio based on specific circumstances.

Key Takeaways – Trading Municipal Bonds

- Tax Benefits

- Interest earned on municipal bonds is often exempt from federal, state, and local taxes.

- Makes them attractive for tax-sensitive investors.

- Credit Quality and Ratings

- Assess the credit quality using ratings from agencies like Moody’s, S&P, and Fitch to evaluate the risk of default.

- Market Dynamics

- Municipal bonds are traded over-the-counter (OTC), with major platforms like EMMA and Bloomberg providing essential data and trading capabilities.

- This OTC nature can impact liquidity and pricing.

- ETFs

- ETFs like MUB or HYD can provide diversified exposure.

Types of Municipal Bonds

General Obligation Bonds (GOs)

- Secured by the issuer’s taxing power.

- Often considered less risky due to the backing by the issuer’s ability to tax residents.

Revenue Bonds

- Secured by specific revenue sources, such as tolls or fees from a project.

- Generally riskier than GOs since repayment depends on the success of the revenue-generating project.

Build America Bonds (BABs) – Direct-Pay Bonds

Build America Bonds – aka direct-pay bonds – were introduced in 2009 as part of the American Recovery and Reinvestment Act.

Unlike traditional munis, BABs are taxable, but issuers receive a federal subsidy to offset higher borrowing costs.

This program expanded the municipal bond market to new market participants, including pension funds and foreign buyers typically uninterested in tax-exempt bonds.

While the program ended in 2010, existing BABs continue to trade in the secondary market.

Traders should be aware of their unique characteristics, including potentially higher yields and different tax treatment compared to traditional munis.

Green Bonds

Municipal green bonds finance environmentally friendly projects such as renewable energy, clean transportation, and water conservation.

This growing market segment appeals to environmentally conscious investors and may offer pricing advantages due to high demand.

Traders should be aware of green bond standards and certifications, as well as potential differences in liquidity compared to traditional munis.

Some investors are willing to accept lower yields for green bonds, a phenomenon known as the “greenium.”

Understanding the green bond market becomes increasingly important for municipal bond traders as climate concerns grow.

Credit Default Swaps on Munis

Credit default swaps (CDS) are financial derivatives that provide insurance against bond defaults.

In the municipal bond market, CDS can be used to manage credit risk or express views on an issuer’s creditworthiness.

Traders might use municipal CDS to hedge bond positions or create synthetic exposures.

However, the muni CDS market is less liquid than corporate CDS markets, and not all municipal issuers have actively traded CDS contracts.

Understanding CDS spreads can provide valuable information about market perceptions of credit risk, and complement traditional credit ratings and analysis.

Naturally, many traders tend to trust market assessments of risk rather than the information from credit rating agencies and other institutions that may not directly have skin in the game.

Synthetic Municipal Bonds

Synthetic municipal bonds combine Treasury bonds with tax-exempt derivatives to replicate the returns of actual municipal bonds.

This strategy can be used by traders seeking tax-exempt income but preferring the liquidity of Treasury markets.

Traders might create synthetic munis using Treasury bonds and interest rate swaps or total return swaps.

This approach can offer advantages in terms of customization and potentially lower transaction costs.

Nonetheless, it requires a sophisticated understanding of derivatives and may introduce counterparty risk.

Synthetic structures can also be used to arbitrage pricing discrepancies between cash bonds and derivatives markets.

Key Characteristics

Tax Benefits

Interest earned on municipal bonds is often exempt from federal income tax and may be exempt from state and local taxes.

Credit Quality

Ratings provided by agencies like Moody’s, S&P, and Fitch help assess the risk of default.

Maturity

Ranges from short-term (1-3 years) to long-term (30+ years).

Liquidity

Typically lower than other bonds due to smaller issue sizes and fewer trades.

Concepts in Muni Bond Trading

Callability

Many municipal bonds are callable, meaning the issuer can redeem them before maturity at a predetermined price.

This feature affects pricing and trading strategies.

Callable bonds typically offer higher yields to compensate investors for the risk of early redemption.

Traders must consider the likelihood of a call when valuing these bonds.

If interest rates fall, issuers may call bonds to refinance at lower rates.

This potentially leaves traders to reinvest at less favorable yields.

Sophisticated traders may use option-adjusted spread (OAS) analysis to evaluate callable bonds.

Secondary Market Premiums/Discounts

In the secondary market, municipal bonds often trade at prices above (premium) or below (discount) their face value.

This occurs due to changes in interest rates, credit quality, or market demand.

Premium bonds offer higher coupon rates than current market rates, while discount bonds offer lower rates.

Traders must consider how these premiums or discounts affect yield-to-maturity and potential capital gains or losses.

Tax implications also differ: for certain types of munis, the market discount may be taxed as ordinary income when the bond matures or is sold.

Duration

Duration measures a bond’s price sensitivity to interest rate changes.

It’s expressed in years and represents the weighted average time to receive all cash flows from a bond.

A higher duration indicates greater price volatility when interest rates change.

Municipal bond traders use duration to manage portfolio risk and compare bonds with different maturities and coupon rates.

Modified duration, a variation of this concept, directly estimates the percentage price change for a 1% change in yield.

Understanding duration is important for implementing effective hedging strategies and assessing interest rate risk.

Tax-Equivalent Yield

Tax-equivalent yield (TEY) allows traders/investors to compare taxable and tax-exempt bonds on an equal footing.

To calculate TEY, divide the tax-exempt yield by (1 – marginal tax rate).

For example, if a municipal bond yields 4.00% and the investor’s marginal tax rate is 20%, the TEY is 5.00% (4% / (1 – 0.20)).

This means a taxable bond would need to yield 5% to match the after-tax return of the municipal bond.

Traders use TEY to identify relative value opportunities between taxable and tax-exempt bonds, considering both federal and state tax rates where applicable.

Market Participants

Retail Investors/Traders

Often purchase municipal bonds for tax-exempt income.

Given these are smaller markets overall, there tends to be lower levels of institutional ownership.

Institutional Investors

Including mutual funds, insurance companies, and banks.

Broker-Dealers

Facilitate the trading of municipal bonds and provide liquidity.

Trading Platforms

Municipal bonds are primarily traded over-the-counter (OTC) rather than on centralized exchanges.

Major platforms include:

Electronic Municipal Market Access (EMMA)

Provided by the Municipal Securities Rulemaking Board (MSRB), offering free data on muni bonds.

Bloomberg

Provides a platform for institutional trading and data analytics.

Trading Strategies

Buy and Hold

- Suitable for investors seeking steady, tax-exempt income.

- Focuses on bonds with good credit quality and attractive yields.

- Certain ETFs are available that provide liquidity to these bond markets (e.g., MUB, HYD).

Active Trading

- Involves buying and selling bonds to capitalize on market movements and interest rate changes.

- Requires in-depth market knowledge and access to real-time data.

Laddering

- Diversifies maturity dates to manage interest rate risk and ensure liquidity.

- Traders buy bonds maturing at different intervals, providing regular income and reducing reinvestment risk.

Impact of Demographic Shifts

Demographic changes significantly influence municipal bond markets.

Aging populations may increase demand for healthcare and senior services, affecting the types of projects financed through munis.

Population migrations between states (high tax states -> low tax states) can impact tax bases and the fiscal health of issuers.

Growing cities may need to issue more bonds to fund infrastructure expansion, while shrinking municipalities might struggle with debt repayment.

Traders must consider these long-term trends when assessing the creditworthiness of issuers and the potential for price appreciation in different geographic areas.

Risks

Credit Risk

Risk of issuer defaulting on payments.

Interest Rate Risk

Bond prices inversely related to interest rates.

Rising rates can reduce bond prices.

Liquidity Risk

Difficulty in buying or selling bonds without significantly affecting the price.

Regulatory Environment

Municipal Securities Rulemaking Board (MSRB)

Governs the issuance and trading of municipal bonds.

Securities and Exchange Commission (SEC)

Ensures transparency and fairness in the municipal bond market.

Economic Factors Impacting Municipal Bonds

Interest Rates

Central bank policies and inflation expectations impact bond prices.

Fiscal Health of Issuers

State and local government budgets and economic conditions.

Legislative Changes

Tax laws and federal funding policies can affect the attractiveness of municipal bonds.

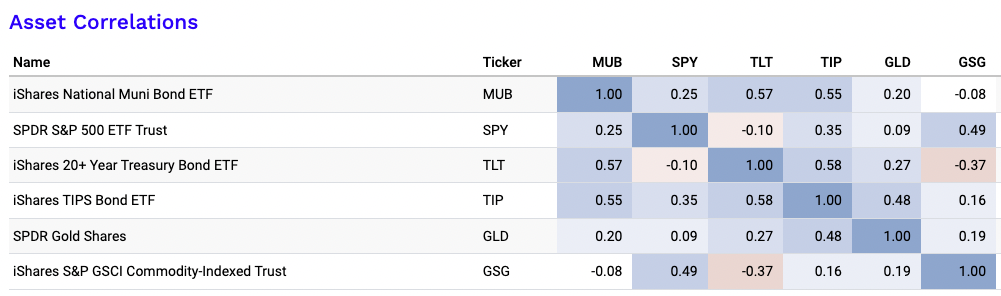

Correlation to Other Bond & Asset Types

Here are some correlations with other asset types, using the MUB ETF.

Municipal bonds have tended to show just a modest positive correlation with stocks over time (+0.25) and have tended to correlate mildly strongly (+0.50 to +0.60) with traditional bond indices as represented by TLT and TIP.