Lazy Portfolios

These lazy portfolios offer a range of strategies for those seeking simplicity, diversification, and balanced risk and return.

Each portfolio has its own unique approach to achieving these goals, catering to different preferences and risk tolerances.

Portfolio allocations are often more toward the sphere of investing, but can also be used by traders seeking the discipline of structure in their portfolio in the context of their trading activities.

We have individual articles to many of these portfolios, which we’ll link to where appropriate.

Key Takeaways – Lazy Portfolios

- We look at various lazy “portfolios” that strive to balance risk and returns through diversification and are simple to follow.

- We provide the allocations and explain their purpose.

Rick Ferri Core Four Portfolio

Allocation

- Total Stock Market: 40%

- Total International Stock Market: 20%

- Total Bond Market: 40%

Explanation

The Rick Ferri Core Four Portfolio is designed to provide a simple approach to investing by including the basic asset classes that cover a broad spectrum of the market.

It’s essentially the 60/40 portfolio, but with an explicit amount earmarked for international equities.

Total Stock Market (40%):

- This component includes a wide range of US stocks across various sectors and market capitalizations.

- The goal is to capture the overall performance of the US equity market.

- Benefits:

- Broad diversification within the US market.

- Exposure to large, mid, and small-cap stocks.

Total International Stock Market (20%):

- This allocation invests in international equities, providing exposure to developed and emerging markets outside the US.

- Benefits:

- Geographic diversification.

- Potential to benefit from growth in global markets.

Total Bond Market (40%):

- This part of the portfolio consists of a diversified mix of US bonds, including government, corporate, and mortgage-backed securities.

- Benefits:

- Income generation.

- Reduced volatility compared to equities.

- A cushion during market downturns.

The Rick Ferri Core Four Portfolio tries to balance growth and stability, making it suitable for a wide range of investors/traders.

The equities portion (60%) targets growth, while the bonds (40%) provide stability and income.

Bill Bernstein No Brainer Portfolio

Allocation

- Total Stock Market: 25%

- Total International Stock Market: 25%

- Intermediate-Term Treasury Bonds: 25%

- Short-Term Treasury Bonds: 25%

Explanation

The Bill Bernstein No Brainer Portfolio is structured to simplify allocation decisions while ensuring broad diversification and risk management.

It’s essentially a 50/50 portfolio.

The equities portion is split between domestic and international in equal amounts.

The bond portfolio goes lighter on duration.

Total Stock Market (25%):

- Similar to the Rick Ferri Core Four, this component includes a broad range of US stocks.

- Benefits:

- Broad exposure to the US market (though can be applied to anyone’s home market).

Total International Stock Market (25%):

- Provides exposure to international stocks, ensuring geographic diversification.

- Benefits:

- Access to opportunities in developed and emerging markets outside the US.

- Reduces country-specific risks.

Intermediate-Term Treasury Bonds (25%):

- Focuses on US Treasury bonds with intermediate maturities.

- Benefits:

- Moderate interest rate risk.

- Reliable income stream.

- High credit quality and safety.

Short-Term Treasury Bonds (25%):

- Invests in short-term US Treasury bonds.

- Benefits:

- Low interest rate risk.

- High liquidity.

- Safe haven during market turbulence.

The Bill Bernstein No Brainer Portfolio balances risk and return through equal allocations to US stocks, international stocks, and a mix of intermediate and short-term bonds.

This simplicity in structure makes it easy to implement and manage.

Stocks/Bonds (60/40) Portfolio

Allocation

- Stocks: 60%

- Bonds: 40%

Explanation

The Stocks/Bonds (60/40) Portfolio is one of the most classic and widely used asset allocation strategies. (It’s even commonly used as a benchmark.)

It tries to provide a balance between growth and income.

It’s popular since most don’t want all of their liquid net worth in stocks.

However, stocks are more volatile than bonds (bonds have a fixed duration whiles the duration of equities is theoretically perpetual), so 60/40 portfolio still heavily concentrate the bulk of their risk and price movement in stocks (generally 85-90%).

Stocks (60%):

- This portion is typically allocated to a diversified mix of US and international stocks.

- Benefits:

- Potential for higher returns compared to bonds.

- Diversification across various sectors and regions.

- Participation in the long-term growth of the economy.

Bonds (40%):

- This portion generally includes a mix of government and corporate bonds.

- Benefits:

- Provides steady income.

- Reduces overall portfolio volatility.

- Acts as a buffer during stock market downturns.

The 60/40 allocation is considered a balanced approach, suitable for investors seeking moderate growth with some level of safety.

It’s designed to capture equity market growth while reducing risk through bond exposure.

Larry Swedroe Simple Portfolio

Allocation

- US Total Stock Market: 30%

- International Total Stock Market: 15%

- Short-Term Treasury Bonds: 10%

- Intermediate-Term Treasury Bonds: 45%

Explanation

The Larry Swedroe Simple Portfolio is designed to provide a straightforward approach focusing on diversification and risk management.

It’s 45% equities and 55% bonds.

US Total Stock Market (30%):

- Captures the broad US equity market across all sectors and sizes.

- Benefits:

- Broad exposure to the US market.

- Growth potential from various sectors.

- For those outside the US, can be adapted to their own domestic market instead.

International Total Stock Market (15%):

- Includes international equities from developed and emerging markets.

- Benefits:

- Geographic diversification.

- Opportunities outside the US.

Short-Term Treasury Bonds (10%):

- Invests in US Treasury bonds with shorter maturities.

- Benefits:

- Low interest rate risk.

- High liquidity and safety.

Intermediate-Term Treasury Bonds (45%):

- Focuses on US Treasury bonds with intermediate maturities.

- Benefits:

- Moderate interest rate risk.

- Reliable income stream.

The Larry Swedroe Simple Portfolio emphasizes safety and income through a significant allocation to Treasury bonds while maintaining growth potential through US and international equities.

Mebane Faber Ivy Portfolio

Allocation

- US Equities: 20%

- International Equities: 20%

- Commodities: 20%

- Real Estate (REITs): 20%

- Bonds: 20%

Explanation

The Mebane Faber Ivy Portfolio looks to provide a diversified investment approach by including a mix of asset classes that traditionally perform well in different market environments.

It takes five assets and puts equal amounts in each.

Equities take up 60% of the portfolio, with 20% to bonds and 20% to commodities.

US Equities (20%):

- Exposure to the broad US stock market.

- Benefits:

- Growth potential from the US economy.

- Diversification across sectors.

International Equities (20%):

- Includes stocks from developed and emerging markets outside the US.

- Benefits:

- Geographic diversification.

- Access to global growth opportunities.

Commodities (20%):

- Investments in a range of commodities such as gold, oil, and agricultural products.

- Benefits:

- Hedge against inflation and input costs.

- Diversification from traditional asset classes.

- Can include precious metals, energy, livestock, agriculture, base metals, softs.

Real Estate (REITs) (20%):

- Real Estate Investment Trusts (REITs) provide exposure to the real estate market.

- Benefits:

- Income through dividends.

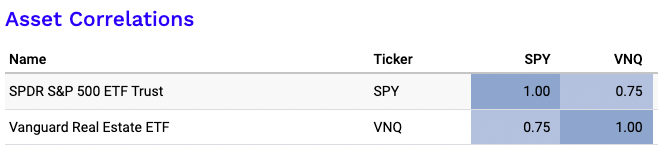

REITs and broad stock market exposure still have a correlation of approximately +0.75 over time.

Bonds (20%):

- A mix of government and corporate bonds.

- Benefits:

- Income generation.

- Reduced portfolio volatility.

The Mebane Faber Ivy Portfolio looks to balance growth, income, and inflation protection through a diverse set of asset classes.

Scott Burns Couch Potato Portfolio

Allocation

- Total Stock Market: 50%

- Total Bond Market: 50%

Explanation

The Scott Burns Couch Potato Portfolio is designed for simplicity and ease of management, with a focus on equal allocations between the two main assets classes.

Total Stock Market (50%):

- Includes a wide range of US stocks.

- Benefits:

- Captures overall US market performance.

- Broad diversification across sectors and market caps.

Total Bond Market (50%):

- Consists of a diversified mix of US bonds.

- Benefits:

- Provides income.

- Reduces portfolio volatility.

- Acts as a buffer during market downturns.

The Scott Burns Couch Potato Portfolio tries to provide a balanced approach with minimal effort, making it ideal for those looking for a straightforward strategy.

Bill Schultheis Coffee House Portfolio

Allocation

- US Large Cap Value: 10%

- US Small Cap Value: 10%

- US Total Stock Market: 10%

- International Stocks: 10%

- REITs: 10%

- Short-Term Bonds: 10%

- Intermediate-Term Bonds: 40%

Explanation

The Bill Schultheis Coffee House Portfolio is structured to provide broad diversification across different asset classes and investment styles.

This portfolio allocates to 7 distinct styles, with a focus on value when it comes to equities.

Overall, it’s a version of the 50/50 portfolio.

US Large Cap Value (10%):

- Focuses on large, established US companies with a value investment style.

- Benefits:

- Stability and dividends from established companies.

US Small Cap Value (10%):

- Invests in small-cap US companies with a value orientation.

- Benefits:

- Potential for higher growth from smaller companies.

US Total Stock Market (10%):

- Captures the entire US stock market.

- Benefits:

- Broad diversification across all sectors and sizes.

International Stocks (10%):

- Includes stocks from developed and emerging markets outside the US.

- Benefits:

- Geographic diversification.

- Access to global growth opportunities.

REITs (10%):

- Real Estate Investment Trusts provide exposure to real estate.

- Benefits:

- Income through dividends. Can be attractive for those focused on monthly spending needs.

Short-Term Bonds (10%):

- Invests in short-term bonds.

- Benefits:

- Low interest rate risk.

- High liquidity.

Intermediate-Term Bonds (40%):

- Focuses on bonds with intermediate maturities.

- Benefits:

- Reliable income stream.

- Moderate interest rate risk.

The Bill Schultheis Coffee House Portfolio emphasizes diversification and balance, combining equities, bonds, and real estate for a well-rounded strategy.

Marc Faber Portfolio

Allocation

- US Equities: 25%

- International Equities: 25%

- Commodities: 25%

- Bonds: 25%

Explanation

The Marc Faber Portfolio aims to provide a diversified investment strategy with a focus on growth, income, and inflation protection.

The equity piece is split between domestic and international, with commodities and bonds each getting a quarter of the allocation.

US Equities (25%):

- Exposure to the broad US stock market.

- Benefits:

- Growth potential from the US economy.

- Diversification across sectors.

International Equities (25%):

- Includes stocks from developed and emerging markets outside the US.

- Benefits:

- Geographic diversification.

- Access to global growth opportunities.

Commodities (25%):

- Investments in a range of commodities such as gold, oil, and agricultural products.

- Benefits:

- Hedge against inflation.

- Diversification from traditional asset classes.

Bonds (25%):

- A mix of government and corporate bonds.

- Benefits:

- Provides income.

- Reduces portfolio volatility.

The Marc Faber Portfolio seeks to balance growth, income, and inflation protection through a diverse set of asset classes.

David Swensen Yale Endowment

Allocation

- US Equities: 30%

- International Equities: 15%

- Emerging Market Equities: 10%

- Real Estate (REITs): 20%

- Treasury Inflation-Protected Securities (TIPS): 15%

- Bonds: 10%

Explanation

The David Swensen Yale Endowment Portfolio is inspired by the investment strategy used by David Swensen for Yale University’s endowment.

It tries to achieve quality returns through diversified investments.

The portfolio is structured similarly to an endowment, with roughly 75% in equities and 25% in bonds (weighted slightly more toward inflation-protected securities).

US Equities (30%):

- Exposure to the broad US stock market.

- Benefits:

- Growth potential from the US economy.

- Diversification across sectors.

International Equities (15%):

- Includes stocks from developed markets outside the US.

- Benefits:

- Geographic diversification.

- Access to growth opportunities in other developed economies.

Emerging Market Equities (10%):

- Focuses on stocks from emerging markets.

- Benefits:

- Higher growth potential from developing economies.

- Equity diversification.

- Currency diversification.

Real Estate (REITs) (20%):

- Real Estate Investment Trusts provide exposure to real estate.

- Benefits:

- Income through dividends.

Treasury Inflation-Protected Securities (TIPS) (15%):

- Bonds that provide protection against inflation.

- Benefits:

- Preservation of purchasing power.

- Safe investment with inflation protection.

Bonds (10%):

- A mix of government and corporate bonds.

- Benefits:

- Provides income.

- Reduces portfolio volatility.

The David Swensen Yale Endowment Portfolio looks to balance growth, income, and inflation protection through a diversified mix of asset classes.

Harry Browne Permanent Portfolio

Allocation

- Stocks: 25%

- Bonds: 25%

- Gold: 25%

- Cash: 25%

Explanation

The Harry Browne Permanent Portfolio is designed to perform well in any economic environment by balancing four distinct asset classes.

It takes four distinct asset classes and simply allocates 25% to each for simplicity.

Stocks (25%):

- Exposure to the stock market.

- Benefits:

- Growth potential during prosperous economic times.

Bonds (25%):

- Focuses on long-term government bonds.

- Benefits:

- Income and stability during deflationary periods.

Gold (25%):

- Investment in gold.

- Benefits:

- Hedge against currency depreciation and economic uncertainty.

- Non-financial asset.

Cash (25%):

- Includes cash or cash equivalents.

- Benefits:

- Provides liquidity and stability during recessions or bear markets.

The Harry Browne Permanent Portfolio prioritizes safety and performance across various economic environments through a simple yet effective allocation.

Harry Brown Permanent Portfolio vs. S&P 500

It won’t perform like a 100% stocks portfolio over the long-run, but will display better risk-adjusted returns.

The Brown Permanent Portfolio’s Sharpe ratio historically has been 0.52 (vs. 0.44 for stocks) and a Sortino ratio of 0.83 (vs. 0.64 for stocks).

Here’s a fuller rundown of various statistics:

Risk and Return Metrics

| Metric | S&P 500 (100% Stocks) | Permanent Portfolio |

|---|---|---|

| Arithmetic Mean (monthly) | 0.95% | 0.68% |

| Arithmetic Mean (annualized) | 12.00% | 8.46% |

| Geometric Mean (monthly) | 0.85% | 0.66% |

| Geometric Mean (annualized) | 10.62% | 8.19% |

| Standard Deviation (monthly) | 4.54% | 2.05% |

| Standard Deviation (annualized) | 15.74% | 7.11% |

| Downside Deviation (monthly) | 2.94% | 1.07% |

| Maximum Drawdown | -50.89% | -13.19% |

| Benchmark Correlation | 1.00 | 0.58 |

| Beta(*) | 1.00 | 0.26 |

| Alpha (annualized) | 0.00% | 5.15% |

| R2 | 100.00% | 33.98% |

| Sharpe Ratio | 0.44 | 0.52 |

| Sortino Ratio | 0.64 | 0.83 |

| Treynor Ratio (%) | 6.93 | 14.02 |

| Calmar Ratio | 0.30 | 0.28 |

| Modigliani–Modigliani Measure | 11.39% | 12.65% |

| Active Return | 0.00% | -2.43% |

| Tracking Error | 0.00% | 12.96% |

| Information Ratio | N/A | -0.19 |

| Skewness | -0.51 | 0.23 |

| Excess Kurtosis | 1.87 | 2.51 |

| Historical Value-at-Risk (5%) | 7.11% | 2.31% |

| Analytical Value-at-Risk (5%) | 6.53% | 2.70% |

| Conditional Value-at-Risk (5%) | 10.01% | 3.54% |

| Upside Capture Ratio (%) | 100.00 | 35.67 |

| Downside Capture Ratio (%) | 100.00 | 15.65 |

| Safe Withdrawal Rate | 4.30% | 5.19% |

| Perpetual Withdrawal Rate | 6.08% | 3.95% |

| Positive Periods | 393 out of 629 (62.48%) | 408 out of 629 (64.86%) |

| Gain/Loss Ratio | 1.03 | 1.33 |

| * US Stock Market is used as the benchmark for calculations. Value-at-risk metrics are monthly values. | ||

Golden Butterfly Portfolio

Allocation

- Total Stock Market: 20%

- Small Cap Value Stocks: 20%

- Long-Term Treasury Bonds: 20%

- Short-Term Treasury Bonds: 20%

- Gold: 20%

Explanation

The Golden Butterfly Portfolio is designed to provide balance and stability through a diversified mix of assets.

Overall, it’s 40% in stocks, 40% in bonds, and 20% in gold.

Total Stock Market (20%):

- Broad exposure to the US stock market.

- Benefits:

- Growth potential from various sectors and market caps.

Small Cap Value Stocks (20%):

- Focus on small-cap value stocks.

- Benefits:

- Higher growth potential from smaller, undervalued companies.

Long-Term Treasury Bonds (20%):

- Investment in long-term government bonds.

- Benefits:

- Income and stability during deflationary periods.

Short-Term Treasury Bonds (20%):

- Focus on short-term government bonds.

- Benefits:

- Low interest rate risk and high liquidity.

Gold (20%):

- Investment in gold.

- Benefits:

- Hedge against inflation and economic uncertainty.

The Golden Butterfly Portfolio aims to combine growth, stability, and inflation protection through a balanced and diversified allocation.

Golden Butterfly vs. S&P 500

Due to the diversification – and with reasonable weights – the Golden Butterfly Portfolio compares well in various risk metrics.

Risk and Return Metrics

| Metric | Golden Butterfly | S&P 500 |

|---|---|---|

| Arithmetic Mean (monthly) | 0.77% | 0.95% |

| Arithmetic Mean (annualized) | 9.66% | 12.00% |

| Geometric Mean (monthly) | 0.74% | 0.85% |

| Geometric Mean (annualized) | 9.26% | 10.62% |

| Standard Deviation (monthly) | 2.48% | 4.54% |

| Standard Deviation (annualized) | 8.58% | 15.74% |

| Downside Deviation (monthly) | 1.39% | 2.94% |

| Maximum Drawdown | -18.16% | -50.89% |

| Benchmark Correlation | 0.76 | 1.00 |

| Beta(*) | 0.42 | 1.00 |

| Alpha (annualized) | 4.52% | 0.00% |

| R2 | 58.11% | 100.00% |

| Sharpe Ratio | 0.56 | 0.44 |

| Sortino Ratio | 0.86 | 0.64 |

| Treynor Ratio (%) | 11.54 | 6.93 |

| Calmar Ratio | 0.15 | 0.30 |

| Modigliani–Modigliani Measure | 13.26% | 11.39% |

| Active Return | -1.36% | 0.00% |

| Tracking Error | 10.75% | 0.00% |

| Information Ratio | -0.13 | N/A |

| Skewness | -0.10 | -0.51 |

| Excess Kurtosis | 1.47 | 1.87 |

| Historical Value-at-Risk (5%) | 3.19% | 7.11% |

| Analytical Value-at-Risk (5%) | 3.30% | 6.53% |

| Conditional Value-at-Risk (5%) | 4.51% | 10.01% |

| Upside Capture Ratio (%) | 49.55 | 100.00 |

| Downside Capture Ratio (%) | 33.14 | 100.00 |

| Safe Withdrawal Rate | 5.43% | 4.30% |

| Perpetual Withdrawal Rate | 4.90% | 6.08% |

| Positive Periods | 405 out of 629 (64.39%) | 393 out of 629 (62.48%) |

| Gain/Loss Ratio | 1.24 | 1.03 |

| * US Stock Market is used as the benchmark for calculations. Value-at-risk metrics are monthly values. | ||

Paul Merriman Ultimate Buy & Hold Portfolio

Allocation

The Paul Merriman Ultimate Buy and Hold isn’t a static allocation like practically all the ones listed in this article.

This is one such interpretation.

- Large-Cap US Stocks: 10%

- Large-Cap International Stocks: 10%

- Small-Cap US Stocks: 10%

- Small-Cap International Stocks: 10%

- Emerging Market Stocks: 10%

- US Real Estate Investment Trusts (REITs): 10%

- International Real Estate Investment Trusts (REITs): 10%

- US Government Bonds: 10%

- International Government Bonds: 10%

- Inflation-Protected Bonds (TIPS): 10%

The allocation to each varies and is provided on Merriman’s official website.

This particular rendition of it would be 70% equities and 30% bonds.

Explanation

Large-Cap US Stocks (10%):

- Description: Investment in large, established US companies.

- Benefits:

- Stability and dividends (to some extent) from established companies.

- Broad exposure to the US market.

Large-Cap International Stocks (10%):

- Description: Investment in large companies outside the US, in developed markets.

- Benefits:

- Geographic diversification.

- Access to growth opportunities in other developed economies.

Small-Cap US Stocks (10%):

- Description: Investment in smaller US companies with higher growth potential.

- Benefits:

- Potential for higher returns compared to large-cap stocks.

- Diversification within the US market.

Small-Cap International Stocks (10%):

- Description: Investment in smaller companies outside the US.

- Benefits:

- Higher growth potential from international small-cap companies.

- Geographic and market cap diversification.

Emerging Market Stocks (10%):

- Description: Investment in companies located in emerging markets.

- Benefits:

- Exposure to rapidly growing economies.

- Potential for higher returns, albeit with higher risk.

US Real Estate Investment Trusts (REITs) (10%):

- Description: Investment in US real estate through publicly traded REITs.

- Benefits:

- Income through dividends.

- Diversification into real estate sector.

- Potential hedge against inflation (though real estate is far from perfect to this extent).

International Real Estate Investment Trusts (REITs) (10%):

- Description: Investment in international real estate through publicly traded REITs.

- Benefits:

- Geographic diversification within the real estate sector.

- Income through dividends from international properties.

US Government Bonds (10%):

- Description: Investment in US government debt securities.

- Benefits:

- Safety and stability.

- Regular income.

- Acts as a potential cushion during equity market downturns.

- Government bonds do best in a certain type of environment (low growth and low inflation).

International Government Bonds (10%):

- Description: Investment in government bonds from countries outside the US.

- Benefits:

- Geographic diversification in fixed income.

- Potential for higher yields in certain international markets.

- Reduced correlation with US bonds.

Inflation-Protected Bonds (TIPS) (10%):

- Description: US Treasury bonds that are indexed to inflation.

- Benefits:

- Protection against inflation.

- Preservation of purchasing power.

- Safe investment with government backing.

Overall Benefits of the Portfolio

- Diversification – This portfolio includes a mix of equities, real estate, and bonds from both US and international markets, reducing risk through diversification across asset classes and geographies.

- Growth Potential – Equities (large-cap, small-cap, and emerging markets) offer opportunities for capital appreciation.

- Income Generation – REITs and bonds provide regular income through dividends and interest payments.

- Inflation Protection – TIPS and REITs offer a hedge against inflation.

- Risk Management – The inclusion of government bonds, both US and international, adds stability and reduces overall portfolio volatility.

Gone Fishing Portfolio

Allocation

- US Total Stock Market: 30%

- International Stocks: 20%

- Emerging Market Stocks: 10%

- REITs: 10%

- Bonds: 30%

Explanation

The Gone Fishing Portfolio tries to provide a simple, diversified strategy with a balance between growth and stability.

US Total Stock Market (30%):

- Broad exposure to the US stock market.

- Benefits:

- Captures overall US market performance.

- Diversification across sectors and market caps.

International Stocks (20%):

- Includes stocks from developed markets outside the US.

- Benefits:

- Geographic diversification.

- Access to growth opportunities in other developed economies.

Emerging Market Stocks (10%):

- Focus on stocks from emerging markets.

- Benefits:

- Higher growth potential from developing economies.

- Diversification benefits.

REITs (10%):

- Real Estate Investment Trusts provide exposure to real estate.

- Benefits:

- Income through dividends.

- Diversification and inflation protection.

Bonds (30%):

- A mix of government and corporate bonds.

- Benefits:

- Provides income.

- Reduces portfolio volatility.

- Acts as a potential buffer during market downturns (at the very least, a different type of exposure).

Overall, the Gone Fishing Portfolio tries to provide a balanced approach with minimal effort, making it ideal for investors looking for a straightforward investment strategy.

3-Fund Bogleheads Portfolio

Allocation

- Total Stock Market: 50%

- Total International Stock Market: 30%

- Total Bond Market: 20%

Explanation

The 3-Fund Bogleheads Portfolio is designed to provide a simple, diversified investment strategy that covers a broad spectrum of the market.

It’s one of many variations that combine stocks and bonds, but weight the stocks portion the highest.

Total Stock Market (50%):

- Includes a wide range of US stocks across various sectors and market capitalizations.

- Benefits:

- Broad diversification within the US market.

- Exposure to large, mid, and small-cap stocks.

Total International Stock Market (30%):

- This allocation invests in international equities, providing exposure to developed and emerging markets outside the US.

- Benefits:

- Geographic diversification.

- Potential to benefit from growth in global markets.

Total Bond Market (20%):

- This part of the portfolio consists of a diversified mix of US bonds, including government, corporate, and mortgage-backed/asset-backed securities.

- Benefits:

- Income generation.

- Reduced volatility compared to equities.

- A cushion during market downturns.

The 3-Fund Bogleheads Portfolio aims to balance growth and stability, making it suitable for a wide range of investors.

The equities portion (80%) targets growth, while the bonds (20%) provide stability and income.

Warren Buffett 90/10 Portfolio

Allocation

- Stocks: 90%

- Short-Term Government Bonds: 10%

Explanation

The Warren Buffett 90/10 Portfolio is a simple and aggressive investment strategy recommended by Warren Buffett for long-term investors.

Stocks (90%):

- Typically invested in a low-cost S&P 500 index fund.

- Benefits:

- High growth potential.

- Broad exposure to large-cap US companies.

- Low fees and diversification.

Short-Term Government Bonds (10%):

- Investment in short-term US Treasury bonds.

- Benefits:

- Low risk and high liquidity.

- Provides a buffer against market volatility.

- A source of liquidity to buy market dips.

The Warren Buffett 90/10 Portfolio is designed for investors with a long-term horizon who can tolerate significant volatility in exchange for potentially higher returns.

Balanced Portfolio (All Weather)

Allocation

This is considered the Dalio Balanced Portfolio mix:

- US Equities: 30%

- Intermediate Bonds: 15%

- Long-Term Treasury Bonds: 40%

- Commodities: 7.5%

- Gold: 7.5%

Explanation

The Balanced Portfolio, also known as the All Weather Portfolio, looks to perform well across various economic environments through diversified investments.

The stocks allocation is lower than most.

This is done in order to try to balance the bonds exposure with that of the equities.

Since bonds have structurally lower volatility due to their lower duration, weighting them higher can better manage the risk between them.

US Equities (30%):

- Exposure to the broad US stock market.

- Benefits:

- Growth potential from the US economy.

- Diversification across sectors.

Intermediate Bonds (15%):

- Bonds of moderate duration, balancing yield with interest rate risk.

- Benefits:

- Deflation asset with limited duration risk.

Long-Term Treasury Bonds (40%):

- Investment in long-term government bonds.

- Benefits:

- Income and stability during deflationary periods.

Commodities (7.5%):

- Investments in a range of commodities.

- Benefits:

- Hedge against inflation.

- Diversification from traditional asset classes.

Gold (7.5%):

- Investment in gold.

- Benefits:

- Currency hedge.

The Dalio Balanced Portfolio aims to balance risk and reward through diversification. It looks to provide stability and performance across different market environments.