Gone Fishing Portfolio

The Gone Fishing Portfolio (GFP) offers a straightforward approach to asset allocation, making it an attractive option for those looking to build a diversified and relatively low-maintenance investment portfolio.

This portfolio strategy consists of 65% stocks, 30% fixed income, and 5% commodities.

In this article, we look into the allocation strategy, advantages, and disadvantages of the Gone Fishing Portfolio and discuss who might be the best suited for this investment approach.

Key Takeaways – Gone Fishing Portfolio

- The Gone Fishing Portfolio (GFP) is a simple and diversified investment strategy consisting of 65% stocks, 30% fixed income, and 5% commodities.

- It offers a straightforward approach to asset allocation, making it an attractive option for investors looking for a low-maintenance portfolio.

- The GFP has advantages such as simplicity, diversification, and accommodating different investment objectives and risk tolerances.

- But it also has limitations, including still having most of its risk concentrated in equities and potentially lower returns.

- The GFP is best suited for investors who value simplicity, seek a more balanced investment strategy, have a moderate risk tolerance, and a long-term investment horizon.

- It can be implemented using low-cost index funds or ETFs and can be incorporated into tax-advantaged accounts like IRAs or 401(k)s.

- We ran a backtest of the Gone Fishing Portfolio vs. the S&P 500 to look at its absolute and comparative performance historically.

Gone Fishing Portfolio Allocation

The GFP is designed with simplicity in mind, consisting of three primary asset classes:

- stocks

- fixed income, and

- commodities

The allocation strategy breaks down as follows:

- 65% Stocks: This portion of the portfolio aims to provide capital appreciation and growth, typically by investing in a mix of domestic and international equities.

- 30% Fixed Income: The fixed income allocation, often in the form of government and corporate bonds, seeks to provide a steady stream of income and preserve capital.

- 5% Commodities: The smallest portion of the portfolio, commodities are included to offer a hedge against inflation, currency devaluation, and potential diversification benefits. Commodities can mean a diversified basket of them, it can mean gold, or something “hard.”

Essentially it’s the 60/40 portfolio with a twist – 5% more allocated to stocks and 5% more allocated to commodities.

Gone Fishing Portfolio Advantages

The GFP has several advantages that may appeal to a wide range of investors:

Simplicity

The GFP is easy to understand and implement, making it a good option for novice investors or those seeking a low-maintenance approach.

Diversification

The allocation across multiple asset classes helps reduce risk and increase the potential for long-term growth.

Better Balance over Pure Concentration

By incorporating both growth-oriented and income-producing assets, the GFP can accommodate a variety of investment objectives and risk tolerances.

Better Risk-Adjusted Returns

A natural consequence of diversifying among different asset classes (in a reasonable, balanced way) is getting more return per each unit of risk.

Gone Fishing Portfolio Disadvantages

Despite its simplicity and diversification benefits, the GFP has some potential drawbacks:

Limited Flexibility

The GFP may not be suitable for investors with specific financial goals or preferences, as the allocation is relatively rigid.

Lack of Active Management

The passive nature of the GFP means that investors may miss out on potential opportunities for higher returns through active management strategies. (However, active management is not best for most.)

Potentially Lower Returns

With 30% of the portfolio allocated to fixed income, the GFP may underperform compared to more aggressive, equity-heavy strategies during strong market conditions.

Who Is the Gone Fishing Portfolio Best For?

The Gone Fishing Portfolio is best suited for investors who:

- Value a simple and a hands-off approach to investing

- Seek a diversified, balanced investment strategy

- Have a moderate risk tolerance and a long-term investment horizon

Gone Fishing Portfolio Performance

We compared the Gone Fishing Portfolio to an all-stocks approach.

Let’s see how they did. This data is from 1972 forward:

| Portfolio | Initial Balance | Final Balance | CAGR | Stdev | Best Year | Worst Year | Max. Drawdown | Sharpe Ratio | Sortino Ratio | Market Correlation |

|---|---|---|---|---|---|---|---|---|---|---|

| Gone Fishing Portfolio | $10,000 | $1,132,777 | 9.65% | 10.69% | 30.97% | -17.67% | -29.74% | 0.50 | 0.74 | 0.96 |

| S&P 500 | $10,000 | $1,554,061 | 10.33% | 15.75% | 37.82% | -37.04% | -50.89% | 0.42 | 0.61 | 1.00 |

Naturally, the Gone Fishing Portfolio does better than a concentrated approach when it comes to various matters:

- lower volatility

- lower “worst year”

- lower maximum drawdown

- better risk-adjusted returns (better Sharpe ratio and Sortino ratio)

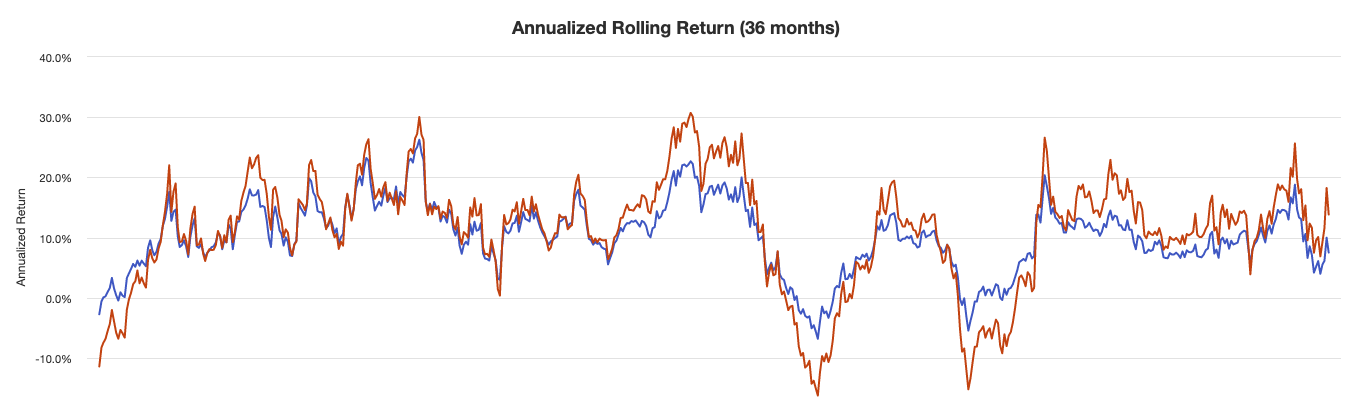

You don’t get the big ups and downs like you do with the all-stocks approach because the portfolio isn’t quite as environmentally biased:

You see this with the flatter returns of the Gone Fishing Portfolio (blue line) versus the S&P 500 (red line).

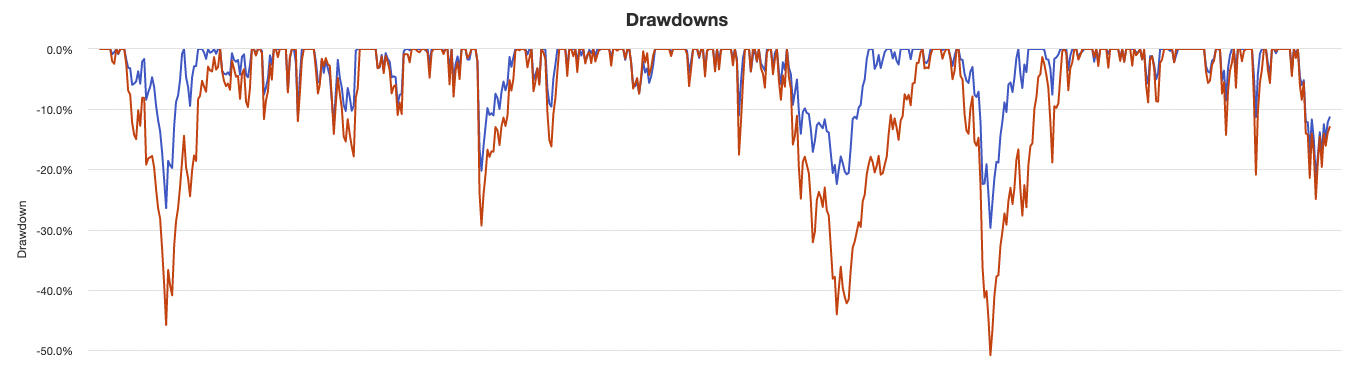

The drawdowns are also shallower:

But the Gone Fishing Portfolio is still dominated by equity risk because equities are more volatile than bonds.

We see in the stats above that it still has a 0.96 market correlation (with 1.00 being full market correlation).

When we looked at the return decomposition, stocks were about 92% of the risk of the 65/30/5 approach.

| Name | Gone Fishing Portfolio | S&P 500 |

|---|---|---|

| US Stock Market | 92.04% | 100.00% |

| Bonds | 6.64% | |

| Commodities | 1.32% | |

| Risk attribution decomposes portfolio risk into its constituent parts and identifies the contribution to overall volatility by each of the assets. | ||

We also have some more complete performance statistics for anyone interested:

Performance Statistics of Gone Fishing Portfolio vs. S&P 500

| Metric | Gone Fishing Portfolio | S&P 500 |

|---|---|---|

| Arithmetic Mean (monthly) | 0.82% | 0.93% |

| Arithmetic Mean (annualized) | 10.28% | 11.71% |

| Geometric Mean (monthly) | 0.77% | 0.82% |

| Geometric Mean (annualized) | 9.65% | 10.33% |

| Standard Deviation (monthly) | 3.09% | 4.55% |

| Standard Deviation (annualized) | 10.69% | 15.75% |

| Downside Deviation (monthly) | 1.89% | 2.96% |

| Maximum Drawdown | -29.74% | -50.89% |

| Stock Market Correlation | 0.96 | 1.00 |

| Beta(*) | 0.65 | 1.00 |

| Alpha (annualized) | 2.54% | 0.00% |

| R2 | 92.96% | 100.00% |

| Sharpe Ratio | 0.50 | 0.42 |

| Sortino Ratio | 0.74 | 0.61 |

| Treynor Ratio (%) | 8.23 | 6.69 |

| Calmar Ratio | 0.35 | 0.55 |

| Active Return | -0.68% | 0.00% |

| Tracking Error | 6.14% | 0.00% |

| Information Ratio | -0.11 | N/A |

| Skewness | -0.43 | -0.52 |

| Excess Kurtosis | 1.66 | 1.92 |

| Historical Value-at-Risk (5%) | -4.36% | -7.14% |

| Analytical Value-at-Risk (5%) | -4.26% | -6.55% |

| Conditional Value-at-Risk (5%) | -6.41% | -10.11% |

| Upside Capture Ratio (%) | 69.54 | 100.00 |

| Downside Capture Ratio (%) | 61.37 | 100.00 |

| Safe Withdrawal Rate | 4.61% | 4.31% |

| Perpetual Withdrawal Rate | 5.22% | 5.81% |

| Positive Periods | 402 out of 616 (65.26%) | 384 out of 616 (62.34%) |

| Gain/Loss Ratio | 1.06 | 1.02 |

| * US stock market is used as the benchmark for calculations. Value-at-risk metrics are based on monthly values. | ||

FAQs – Gone Fishing Portfolio

How do I start building a Gone Fishing Portfolio?

To start building a GFP, first determine the appropriate allocation of stocks, fixed income, and commodities based on your risk tolerance and investment objectives.

Then, select low-cost index funds, ETFs, or individual securities that represent the desired asset classes.

Rebalance your portfolio annually or as needed to maintain the target allocation.

Can I adjust the allocations within the Gone Fishing Portfolio to suit my risk tolerance?

Yes, you can adjust the allocations to better suit your risk tolerance and investment goals.

For example, if you’re more conservative, you might consider increasing the fixed income portion and reducing the stock allocation.

If you’re more aggressive, you could increase the stock allocation while reducing fixed income exposure.

How often should I rebalance my Gone Fishing Portfolio?

Rebalancing helps ensure your portfolio stays aligned with your desired allocation.

You should aim to rebalance at least annually, or when your allocations deviate significantly from the target percentages due to market fluctuations.

How does the Gone Fishing Portfolio compare to a traditional 60/40 portfolio?

A traditional 60/40 portfolio allocates 60% to stocks and 40% to bonds, while the GFP adds commodities exposure and adjusts the stock/bond ratio to 65/30.

This results in a somewhat more diversified portfolio (a little bit of an allocation to a different asset class) that can potentially offer better protection against inflation and market volatility.

Is the Gone Fishing Portfolio suitable for investors nearing or in retirement?

The GFP can be suitable for investors nearing or in retirement as it maintains a balanced approach between growth and income.

However, it’s essential to adjust the allocations based on your specific needs, risk tolerance, and time horizon in retirement.

How can I implement the GFP using low-cost index funds or ETFs?

Implementing the GFP using low-cost index funds or ETFs involves selecting funds that provide exposure to the desired asset classes, such as domestic and international equities, government and corporate bonds, and commodities.

Look for funds with low expense ratios and a good track record of tracking their respective indexes.

Can the Gone Fishing Portfolio be incorporated into a tax-advantaged account, like an IRA or a 401(k)?

Yes, the GFP can be incorporated into tax-advantaged accounts like IRAs and 401(k)s.

Using tax-advantaged accounts can provide additional benefits like tax deferral or tax-free growth, depending on the account type.

Be aware of any limitations on investment options within these accounts and consult with a tax professional or financial advisor for guidance.

Conclusion

The Gone Fishing Portfolio offers an uncomplicated approach to asset allocation that can provide diversification benefits and a balance between growth and income.

While it may not be suitable for all savers and investors, the GFP can be an attractive option for those seeking a low-maintenance and relatively conservative investment strategy.

Related

- Harry Browne Permanent Portfolio

- Golden Butterfly Portfolio

- Yale Portfolio (David Swensen Lazy Portfolio)

- Paul Merriman Ultimate Buy & Hold Portfolio