Forward P/E ratios vs. 10-Year Forward Returns

Understanding the dynamics between forward price-to-earnings (P/E) ratios and subsequent 10-year returns is an exercise that can be used to help better make informed decisions in equity markets.

In general, one of the fundamental questions of markets is simply – what can I expect?

If I buy a stock index, what’s that likely to deliver over the next X number of years?

The historical relationship between valuations and future returns offers a look into what to expect.

We look at the implications of high P/E ratios, the lessons from historical data, and how traders and investors can interpret this relationship in the context of their portfolios.

Key Takeaways – Forward P/E ratios vs. 10-Year Forward Returns

- When valuations begin at higher levels, future returns are typically weaker.

- Conversely, starting at lower valuations often results in greater returns.

- When valuations are high by traditional measures (e.g., P/E ratios), market participants should generally temper their expectations and plan accordingly.

- Forward P/E ratios are looked at in the context of such a long-term timeframe (10 years in this case) because valuations tend to be a very weak short-term trading signal.

What Are Forward P/E Ratios?

Defining the Metric

A forward P/E ratio measures a company’s current share price relative to its expected earnings per share (EPS) over the next 12 months.

Unlike trailing P/E, which is based on historical earnings, the forward P/E reflects expectations about future profitability.

For broader indices like the S&P 500, the forward P/E represents the aggregate valuation of all its constituent companies.

Example

So if a company is expected to earn $5 billion in annual revenue and has $4 billion in expenses, it has $1 billion in profits per year.

If there are 1 billion shares outstanding, that gives it an EPS of $1.

If its share price is $15, it has a P/E ratio of $15/$1 = 15x.

Why Forward P/E Ratios Matter

Forward P/E ratios serve as a valuation gauge.

They help traders and investors understand whether the market – or a specific stock – is expensive, fairly valued, or cheap compared to its future earning potential.

As this metric takes into account expectations, it also helps better understand sentiment, market optimism, or caution.

Historical Insights

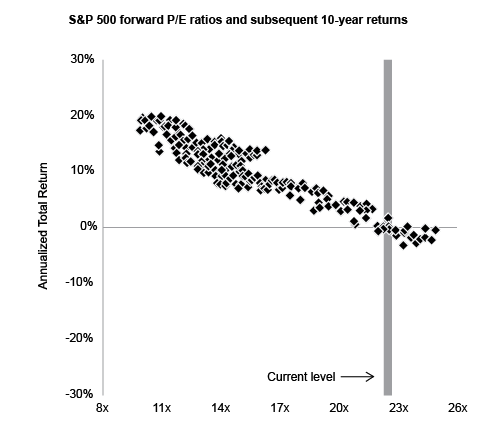

J.P. Morgan Asset Management’s data spanning 1988 to late 2024 provides one perspective on forward P/E ratios and subsequent returns.

Over nearly 324 monthly observations, the dataset reveals the relationship between starting valuations and annualized returns over the next decade.

The Core Observation

You can find a clear trend: higher starting valuations consistently lead to lower future returns, while lower starting valuations yield higher returns.

This inverse relationship shows the principle that price matters when investing.

For example, buying the S&P 500 when the forward P/E is low has historically resulted in stronger 10-year returns compared to purchasing during periods of elevated valuations.

Today’s Context

As of this writing, the forward P/E ratio of 22 places the market into fairly expensive territory.

(Of course, this is US-centric, given the S&P 500 is the index used. In Europe and China, stock prices tend to be lower as a whole.)

Historically, such elevated valuations have corresponded to subdued long-term returns.

From the dataset, investors who purchased the S&P 500 at similar multiples earned annualized returns ranging from +2% to -2% over the subsequent decade.

These modest returns contrast with the higher returns seen during periods of lower valuations.

Average of About 16x

A 16x P/E multiple is about typical for US markets.

At the same time, that doesn’t mean an investor will recoup their investment in 16 years because it’s about the present value of future earnings, not a direct payback period.

The P/E ratio incorporates the time value of money, meaning future earnings are discounted back to their value in today’s terms.

For example, if a company is expected to generate $1 of earnings each year, those earnings are worth less in the present because of the discount rate – typically based on interest rates or the investor’s required rate of return.

At a discount rate of 5%-10% (which is typical), a dollar of earnings expected 10 years from now is worth significantly less today.

Depending on the discount rate applied, the cumulative value of future earnings implied by a 16x P/E multiple could stretch over 20 or more years.

Higher discount rates make future earnings even less valuable, extending this timeframe further.

So, growth is important.

Why Valuation Influences Returns

The Mechanism

Returns are fundamentally linked to the price paid for an asset relative to its intrinsic value.

When valuations are high, much of the anticipated future growth is already baked into the price, which leaves less room for upside.

Conversely, when valuations are low, investors have a margin of safety and greater potential for price appreciation as earnings grow.

The Role of Multiples

Valuation multiples like the forward P/E are a lens into market expectations.

A high multiple suggests optimism and potentially higher expectations for earnings growth.

For example, if a stock market has a P/E of 25, long-term investors don’t generally want to hold expecting a 4% return long term.

They’re expecting growth on top of that 4% in order to justify taking the risk over bonds, cash, or other alternatives.

If these expectations aren’t met, the market may correct, leading to lower future returns.

On the other hand, low multiples often indicate caution or pessimism, which can create opportunities for outsized returns if sentiment improves.

P/E Ratios Are Not a Short-Term Trading Signal

Forward P/E ratios are primarily used to gauge long-term investment potential rather than short-term trading opportunities because their predictive power strengthens over extended periods.

In the short term, market movements are often driven by factors not related to the earnings of a company – such as news events, interest rate changes, changes in discounted growth/inflation expectations, or sentiment – that can overshadow the influence of valuations.

For example, if a company is trading at a P/E of 20x, it’s only earning 1/80th of its valuation every quarter.

So, over the short-term earnings is less of a signal than it is over 10 years, where it would approximate half its valuation.

Accordingly, over time, fundamentals like earnings growth and mean reversion in valuations play a more significant role in shaping returns.

As a result, high or low forward P/E ratios may not immediately translate into corresponding market gains or losses.

So, elevated forward P/E ratios often align with subdued long-term returns, while lower ratios typically lead to stronger outcomes.

Therefore, forward P/E ratios serve as more of a signal for strategic, long-term planning rather than tactical, short-term trades.

Lessons From History

Dot-Com Bubble

The late 1990s and early 2000s offer an example of how high forward P/E ratios can predict subdued or negative returns.

During the dot-com bubble, the S&P 500’s forward P/E climbed to levels that hadn’t been seen before.

Investors who entered the market at these peaks endured a painful correction during 2000–2002 and experienced years of lackluster returns as valuations normalized.

Mid-2010s

Similarly, the mid-2010s saw elevated valuations, though not as extreme as the dot-com era.

Returns for investors during this period were moderate, aligning with historical trends that tie high starting multiples to lower forward returns.

Periods of Low Valuation

In contrast, the early 1980s and post-2008 financial crisis periods saw low forward P/E ratios.

Investors who entered the market during these times enjoyed quality long-term gains.

For instance, after the 2008 crash, the S&P 500’s forward P/E dropped, reflecting widespread pessimism.

Recent performance tends to become extrapolated.

Those who invested in 2009 saw high returns over the next decade as earnings recovered and multiples expanded due to low short-term and longer-term interest rates (via ZIRP and QE policies).

Implications for Today’s Investors

Current Valuation: What It Tells Us

For a forward P/E of 22, such valuations have been associated with low to negligible returns over the following decade.

This doesn’t necessarily mean the market will necessarily decline, but it does suggest more limited upside potential.

Investors must weigh the risks of buying at these levels against the possibility of further multiple expansion or exceptional earnings growth.

The Risk of a Sharp Correction

One scenario is a gradual normalization of valuations over the next decade, which could result in modest returns near around zero.

A more concerning possibility would be correction, where valuations compress rapidly, similar to the downturns in 1973–74 or 2000–02.

For example, if a stock you own is trading at 50x forward earnings, the easy way to lose 80% is when it compresses down to 10x forward earnings – i.e., its fundamentals don’t even change despite the severe loss.

Such corrections often stem from economic shocks, interest rate changes, or shifts in sentiment (e.g., changes in term premium or what one asset or asset class is expected to yield versus another).

The Importance of Earnings Growth

While high valuations typically lead to lower returns, strong earnings growth can offset some of the downside.

If companies deliver the earnings growth that justifies their high multiples, it may still be a good trade or investment.

Strategies in High-Multiple Environments

Diversification

You can reduce the risks of high valuations by diversifying.

This may include allocating to asset classes with more attractive valuations, such as international equities, fixed income, or alternatives.

Diversification helps spread risk and reduces reliance on the performance of expensive equities or expensive equity markets as a whole.

Value Orientation

Periods of high market valuations often coincide with opportunities in undervalued sectors or individual stocks.

Value-based trading or investing approaches can take advantage of these opportunities by identifying companies trading at reasonable multiples relative to their earnings potential.

Maintaining a Long-Term Perspective

Despite the challenges of high valuations, maintaining a long-term perspective is important.

This is true no matter your trading style, from day trading to long-term investing.

Periods of low returns, and periods of cash outperforming riskier longer-duration assets, are often followed by periods of strong performance.

The Limitations of the Data

Overlapping Periods

One critique of the dataset is the presence of overlapping periods, which may limit the independence of observations.

For example, a 10-year return calculated from January 2000 to January 2010 overlaps significantly with the return from February 2000 to February 2010.

While this doesn’t invalidate the general findings, it’s important to critically evaluate data.

External Factors

The relationship between forward P/E ratios and future returns is influenced by external factors such as interest rates, economic growth, inflation, geopolitical events, and other things.

These variables can amplify or reduce the impact of valuations, making it essential to consider the broader context.

Looking Ahead

The Role of Interest Rates

Interest rates are important in shaping valuations and returns.

Low rates have supported high P/E ratios by reducing the discount rate applied to future earnings.

Nonetheless, if rates rise, valuations could come under pressure and lead to lower returns.

The Case for Active Management

In a low-return environment, active management may offer advantages.

Skilled managers can identify mispriced securities and adapt to generate returns that are less likely to be achieved from passive indexing.

Conclusion

The relationship between forward P/E ratios and 10-year forward returns shows a fundamental reality: the price you pay for an investment matters.

High valuations have historically led to subdued returns – though not necessarily in the short-term – while low valuations have been more likely to lead to strong performance.