What Are ETNs? ETNs vs. ETFs

Exchange-traded notes (ETNs) are unsecured, senior debt securities issued by an underwriting bank and traded on a major exchange.

ETNs represent a promise by the issuing institution to pay the note holder a cash amount equal to the performance of a specified market index, minus fees and expenses.

ETNs are similar to other debt securities, such as bonds, in that they offer investors exposure to the underlying asset. However, there are some key differences that investors should be aware of before investing in ETNs.

First, unlike bonds, ETNs do not have a maturity date. This means that investors are not guaranteed any principal repayment at maturity.

Second, ETNs are subject to the credit risk of the issuer. This means that if the issuing bank defaults on its obligations, investors could lose some or all of their investment.

Lastly, ETNs are taxed as ordinary income, rather than capital gains. This means that investors will be subject to higher taxes on their ETN investment than they would on other types of investments.

Risks of ETNs

Investors seeking exposure to a specific market index without the credit risk of bonds may find ETNs to be an attractive option.

However, it is important to be aware of the risks involved before investing in ETNs.

First, as mentioned, ETNs are subject to the credit risk of the issuing banks. If the issuer defaults on its obligations, anyone in these instruments could lose some or all of their investment.

Early-redemption clauses represent another danger. The potential to delist from an exchange makes it tougher to sell, and when a bank can stop creating units, this risks opening up a valuation gap between the note and what it is tracking.

Arbitrageurs have the incentive to close this gap if they are out of whack. But there may also be structural impediments that can cause a lagging value in an ETN or other basket relative to the aggregate value of the individual securities.

ETNs are also unsecured debt securities. This means that they are not backed by any collateral and are therefore riskier than other types of debt securities.

ETNs are subject to market risk. This means that the value of ETNs can fluctuate up or down in response to changes in the underlying market index.

The asset class also is relatively expensive, costing between 75 and 100 basis points annually, much more than most ETFs.

If you play a game where you alternate equal percent wins and equal percent losses, you’ll eventually run out of money.

Another important source of risk to be aware of is that ETN returns usually compound daily.

This can magnify volatility or lead to significant gaps from the simple annual return of an asset, particularly for leveraged notes.

If you play a game where you alternate equal percent wins and equal percent losses, you’ll eventually run out of money.

Example

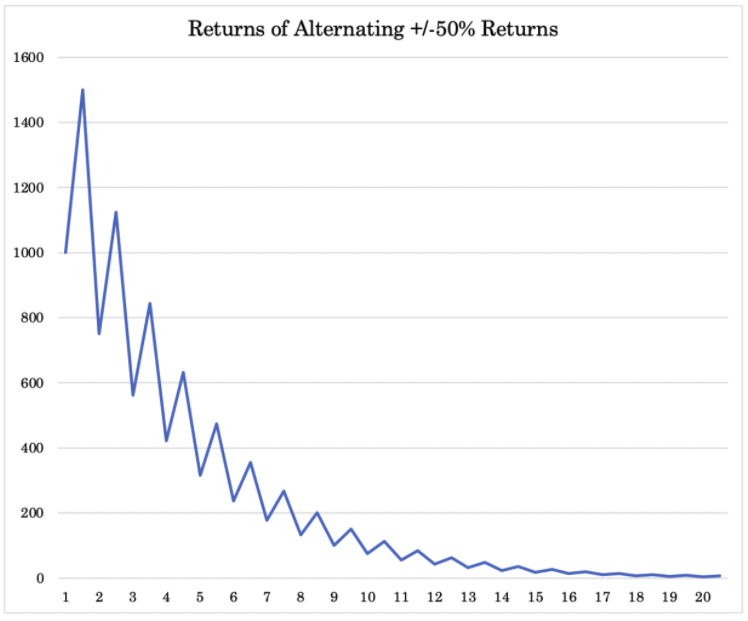

For instance, let’s say you have alternating gains and losses of 50 percent each.

And say you begin with $1,000.

You gain 50 percent in the iteration (you’re now at $1,500) and lose 50 percent to end the round (down to $750).

Then in round two, you gain 50 percent (up to $1,125), lose 50 percent ($562.50), and so on.

Each round of this game that you go through, you’ll have less money.

Why does this happen?

To pay off a 50 percent loss, you need a 100 percent gain, not just the corresponding loss.

Your 50 percent gain simply isn’t anywhere near enough even though it’s the same magnitude.

At the start of the fourth round – three wins and three losses – you’ll already be down more than 50 percent of your original investment at just above $400.

After just ten rounds of this game, you’ll have lost about 90 percent of your original investment.

After 15 rounds, you’ll be down more than 97 percent.

And after 20 rounds, you’ll be down more than 99 percent – to just $6 left of your original $1,000.

Graphically the results look as follows:

As with any investment, it is important to consult with a financial advisor before investing in ETNs. Exchange-traded notes can be a helpful tool for diversifying a portfolio, but they come with risks.

The popularity of ETNs

ETNs appear to be rising in popularity with investors.

In 2021, around $2.5 billion poured into them. These were the first annual inflows since 2017, according to Morningstar’s data.

This level of inflows continued in 2022.

Not all this activity is a function of the Reddit/WSB crowd, but it tracks the broader trend of individual investors using leverage or trying to take advantage of volatility, which has also driven a big rise in the popularity of options trading.

Among the most popular exchange-traded products are exotic ones that bet against the NASDAQ (a tech-heavy index that is more volatile than the S&P 500 and Dow Jones Industrial Average) in one case and magnify its daily return in another.

Investors expecting a bear market or a lot of volatility might be better off diversifying broadly. Or if they’re really that fearful, just staying in safe assets.

ETNs vs. ETFs

Exchange-traded funds (ETFs) have been around for decades and are much better known than their newer cousins, ETNs.

ETFs are baskets of securities that track an index, sector, commodity, or other asset, and they trade on exchanges like stocks.

Like ETNs, ETFs offer exposure to a wide range of assets, but there are some key differences between the two products.

First, ETFs are investment companies that are regulated by the SEC in the United States (and securities regulators in other jurisdictions). This means that they must disclose their holdings on a daily basis.

Second, ETFs are subject to The Investment Company Act of 1940, which means that they can only invest in certain types of assets.

Third, ETFs must maintain a certain level of liquidity in their portfolios.

Fourth, ETFs can only issue a limited amount of shares.

Lastly, ETFs are taxed as capital gains, rather than ordinary income. This means that investors will be subject to lower taxes on their ETF investment than they would on other types of investments.

ETNs, on the other hand, are unsecured debt securities that are not subject to the 1940 Act.

This means that ETNs can invest in a wider range of assets, including illiquid and leveraged assets. ETNs also do not have to disclose their holdings on a daily basis.

Unlike ETFs, which must be run by a separate investor-focused board, ETNs can be managed by issuers as they please.

Conclusion

Exchange-traded notes are a type of investment that has grown in popularity in recent years.

ETNs offer exposure to a wide range of assets, but they come with risks. Before investing in ETNs, it is important to know what you’re getting into or consult with a financial advisor.