What Do Asset Classes Return?

Understanding what different asset classes are expected to return over the medium term (5-10 years) can help investors and traders make informed decisions, balance risk, and achieve their particular financial goals.

Let’s look into the expected returns for various asset classes, the nuances of their performance, and the factors driving those returns.

Returns of Asset Classes

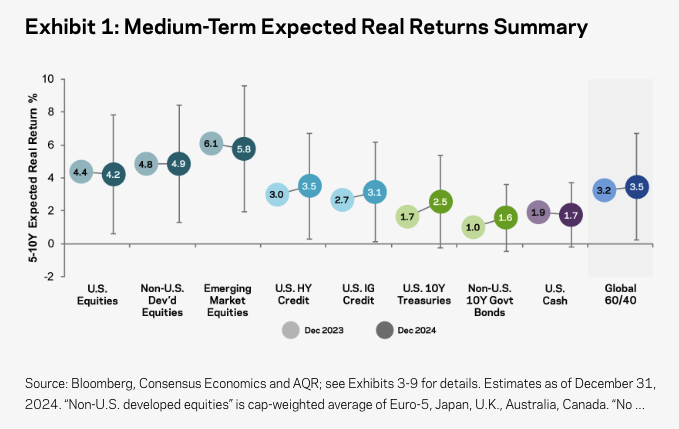

The chart, courtesy of investment manager AQR, summarizes the medium-term (5-10 year) expected real (i.e., inflation-adjusted) returns across various asset classes.

The data reflects higher return potential for riskier assets (e.g., emerging markets and high-yield credit).

Key Takeaways

- Equities – Emerging market equities are projected to have the highest real returns (~6%), outperforming US equities (~4.4%) and non-US developed equities (~4.8%).

- Fixed Income – US high-yield credit (~3.5%) outpaces US investment-grade credit (~3%) and government bonds, with US 10-year Treasuries (~2.5%) slightly outperforming non-US government bonds (~1.6%).

- Cash – US cash yields (~1.7%) are stable but provide limited growth potential.

- Global 60/40 Portfolio – Expected returns (~3.5%) highlight balanced diversification benefits.

US Equities

US equities have consistently been a cornerstone for investors looking for growth over time.

For traders, it’s a benchmark of what to expect.

In the medium term, US equities are expected to deliver real returns in the range of 4-5%.

It’s slightly lower compared to certain other equity categories, such as emerging markets.

This reflects the high prices they currently trade at.

While they look good when looking backward, this often means returns have been pulled forward if they’re outpacing earnings growth.

How US Equities Compare to Other Asset Classes

US equities have been relatively stable and reliable, but don’t always dominate the performance leaderboard.

Over a long enough timeframe, they’re likely to underperform compared to emerging market equities, which have higher expected returns due to their riskier nature.

US equities remain more attractive than bonds, cash, or investment-grade credit for investors who can tolerate equity market volatility.

Non-US Developed Equities

Non-US developed equities represent markets such as Europe, Japan, and Australia.

These equities have slightly lower expected real returns than US equities, typically around 4-4.5% over the medium term.

They provide diversification benefits for global investors but carry risks such as slower economic growth.

Why Non-US Developed Equities Trail US Equities

One reason non-US developed equities slightly underperform US equities is due to differences in economic dynamism.

Developed markets outside the US often have strong institutions and mature economies, but much of the innovation in the developed world has still come out of the US.

Also, currency fluctuations can impact dollar-based traders/investors, either boosting or eroding returns.

So, if someone is looking at markets outside their domestic currency, their real returns aren’t just nominal returns minus inflation, but nominal returns minus inflation +/- currency effects.

For example, if a trader received 10% nominal returns, with a 3% inflation rate, but lost 8% because of FX, they would be down 1% in real terms after factoring in FX effects.

Emerging Market Equities: The Highest Growth Potential

Emerging market equities stand out as the asset class with the highest expected medium-term real return, typically around 6-7%.

These markets, including countries like China, India, and Brazil, tend to have faster growth, rising consumer demand, and favorable demographics.

Comparing Emerging Market Equities to Other Equity Classes

Emerging market equities – over the long run – are expected to outperform both US and non-US developed equities in expected returns.

Nonetheless, this higher return potential comes with greater risk, such as political instability, regulatory unpredictability, and currency volatility.

Those willing to take on these challenges are often rewarded for their risk tolerance.

Fixed Income: Stability With Tradeoffs

US High-Yield Credit: A Riskier Fixed-Income Option

US high-yield credit (often called “junk bonds“) offers expected medium-term real returns in the range of 3-4%.

These bonds provide higher yields to compensate for the greater risk of default by the issuing companies.

High-yield credit typically outperforms other bond categories but still lags behind equities in terms of total return potential.

But it also depends on the type of high-yield bond. As far as an index is concerned, equities generally outperform high-yield over the long term.

Investment-Grade Credit: Reliable but Conservative

Investment-grade credit delivers lower returns than high-yield credit, often around 2-3% in real terms.

These bonds are issued by companies with strong credit ratings and are considered safer investments.

These bonds are a suitable choice for conservative investors or those looking for income rather than growth.

Government Bonds: The Backbone of Fixed-Income Portfolios

US 10-Year Treasuries: Safe but Modest

US 10-year Treasuries, often viewed as a type of benchmark or standard for fixed income, have expected real returns in the range of 1.5-2%.

While they are one of the safest investments available, their low return potential reflects their minimal credit risk.

These bonds are best suited for risk-averse investors or as a hedge during economic disinflationary downturns.

Non-US 10-Year Government Bonds

Non-US government bonds typically offer slightly lower returns than US Treasuries, with real returns around 1-1.5%.

Factors such as currency risk and differing monetary policies are at play in this discrepancy.

For dollar-based traders, the return can vary significantly depending on the strength or weakness of the foreign currency relative to the US dollar.

Cash

Cash investments, such as money market funds and short-term Treasury bills, provide expected real returns close to zero, sometimes slightly positive in higher interest rate environments.

While cash lacks growth potential, it’s important in portfolios as a liquidity reserve and a buffer against volatility.

The Global 60/40 Portfolio: A Diversification Champion

The Global 60/40 portfolio, consisting of 60% equities and 40% bonds, is a common approach for portfolios with a stock/bond mix.

With expected real returns of 3-4% over the medium term, this portfolio offers moderate growth with somewhat reduced volatility compared to an all-equity portfolio.

Since equities are more volatile than bonds (due to structurally longer duration), 85-90% of the risk is still in stocks.

Equities drive growth, while bonds provide stability and reduce drawdowns to some extent during market downturns.

For long-term investors looking for a balance between risk and return, this portfolio remains a benchmark.

Understanding Ranges in Expected Returns

Comparing US and Emerging Market Equities

The range of expected returns (uncertainty) is generally narrower for US equities compared to emerging market equities.

This reflects the relative stability of the US economy and its established capital markets.

In contrast, emerging markets face higher levels of political and economic unknowns, so there’s a wider range of potential outcomes.

Which Asset Class Is Most Predictable?

Investment-grade credit and government bonds show the least variability in expected returns.

These asset classes are influenced by factors like interest rates and credit risk, which tend to be more stable compared to equities.

Factors Driving Differences in Expected Returns

Equity vs. Fixed Income

The primary reason equities offer higher expected returns than bonds is the risk premium demanded for taking on greater volatility and potential for loss.

Equities are linked to corporate profitability and economic growth, while bonds provide fixed payments regardless of market conditions.

Emerging Markets vs. Developed Markets

Emerging market equities are expected to generate higher returns due to their growth potential and relatively low starting valuations.

Developed markets, on the other hand, are more mature and often trade at higher valuations.

Credit Quality and Risk

Within fixed-income categories, high-yield credit offers higher returns than investment-grade bonds because of the increased default risk.

Similarly, US Treasuries provide lower returns but are backed by the federal government.

Returns Expectations and How Traders and Investors Use the Information

Expected returns provide a framework for decision-making based on potential risk and reward.

They offer a forward-looking estimate of how much an asset or portfolio might earn over a given period, which enables financial planning and strategy development.

Investors

For investors, who typically have a long-term perspective, expected returns help in building diversified portfolios aligned with their goals and risk tolerance.

Investors can optimize asset allocation when they understand return, risk, and correlations expectations to achieve steadier growth while managing downside risks.

For instance, higher expected returns in emerging market equities may appeal to growth-focused investors, while the stability of bonds might attract those nearing retirement.

A mix might be preferable to those looking to better optimize return relative to risk given different assets have different environmental biases.

Traders

For traders, who operate with a shorter time horizon, expected returns can guide tactical decisions and position sizing.

Traders are more concerned with short-term market movements and volatility.

For example, a trader might:

- Use the higher return potential of high-yield credit or emerging markets to take calculated risks during bullish periods, or

- Make a tactical bet on interest rates falling by going long longer-duration US Treasuries.

Conclusion

Understanding the expected returns of different asset classes is important for knowing what to expect and for constructing a well-balanced portfolio.

Equities, particularly emerging markets, offer the highest growth potential, but they come with greater risks.

Fixed-income investments provide stability but lower returns, making them important for conservative investors or those nearing retirement.

A mix of asset classes tailored to your risk tolerance and investment goals will help you weather market volatility and achieve sustainable long-term growth.

By knowing what each asset class can realistically return, you can make smarter, more informed decisions.