Algorithmic Stablecoins: Cutting-Edge or Dangerous?

A new form of cryptocurrencies, called algorithmic stablecoins, is seeking to replicate the stability of the US dollar. But critics of these stablecoins say they are just another disaster waiting to happen.

The rise in popularity of algorithmic stablecoins

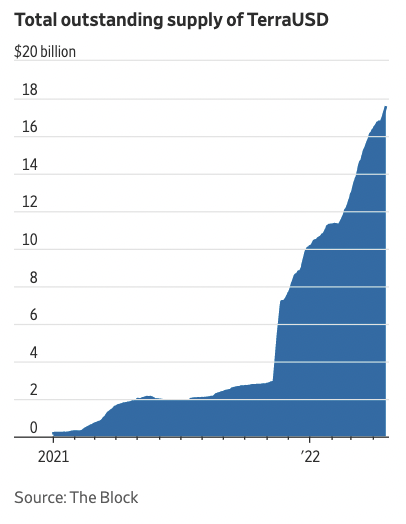

Algorithmic stablecoins surged in popularity starting in early-2022, stirring debate over whether they are a good development for the cryptocurrency industry.

They are the edgy upstart sibling of traditional stablecoins – digital currencies that seek to peg themselves in a one-to-one relationship with a traditional currency, typically the dollar, given it’s the world’s top reserve currency.

Proponents say algorithmic stablecoins are better than regular stablecoins because they aren’t run by a single centralized entity.

The algorithmic variety run autonomously on blockchain-based networks, instead relying on traders who could be anywhere in the world to help keep them tied to the dollar or reference currency.

Conventional stablecoins vs. Algorithmic stablecoins

The issuers of conventional stablecoins say they hold cash, bonds, or other reserves so each of their digital coins is backed by real assets, with one stablecoin dollar equal to one dollar of real money.

But algorithmic stablecoins aren’t necessarily backed by any assets or monetary reserves at all.

With associated collateral, they rely on financial engineering to maintain their link to the dollar or reference currency.

Criticisms of algorithmic stablecoins

Critics say algorithmic stablecoins are just another example of the speculative excesses in the nascent and unregulated world of digital assets.

Many of these projects have no revenue, no profits, and often haven’t even released a working product with a clear value-add or purpose.

Algorithmic stablecoins are also raising red flags with regulators.

The US Securities and Exchange Commission (SEC) has warned investors that some algorithmic stablecoins (like other cryptocurrencies) could be classified as securities. This would subject them to stricter rules around registration, disclosure, and trading.

The SEC’s warning is significant because it could make it harder for algorithmic stablecoin issuers to raise money from investors and get their projects off the ground.

So far there hasn’t been a cryptocurrency project that algorithmic stablecoins are really needed for.

Some have criticized crypto and the blockchain from the beginning as solutions for problems that don’t exist.

Algorithmic stablecoins might be seen as the quintessential example of this.

Problems with algorithmic stablecoins

However, like many cryptocurrency projects, some have failed, and have saddled investors with losses.

Algorithmic stablecoins are a new and untested technology. Many could fail and have failed and investors could lose all their money.

Investors should tread carefully before investing in any algorithmic stablecoin project and be sure they really understand the technology and what exactly they’re trading before diving in.

Let’s look a few of the main issues that might be associated with algorithmic stablecoins.

Broken pegs

Algorithmic stablecoins have been criticized for their reliance on so-called “oracles” to provide price data that helps keep the coins pegged to the dollar.

But these oracles can be unreliable, and there have already been several cases where algorithmic stablecoins have broken their peg to the dollar.

For example, an algorithmic stablecoin could break its peg with a major hack of the network it’s built on. This could cause the value to plunge significantly.

Or demand could significantly overwhelm supply and push the coin off its peg, not unlike what happens with traditional currencies. Of course, the converse can happen (and has happened) where demand evaporates and the coin enters a so-called “death spiral”.

So while algorithmic stablecoins should theoretically be more stable, they are not immune to the same kinds of risks that affect other cryptocurrencies.

High costs

Another issue with algorithmic stablecoins is that they often require users to post collateral in order to trade them.

This can make them very expensive to trade, and could limit their utility.

For example, if you want to buy $100 worth of an algorithmic stablecoin, you might have to post that much in collateral.

Or if the price falls and you want to sell, you might not be able to get out at the price you want if liquidity thins out.

Supply stablization issues

Algorithmic stablecoins can also be subject to supply shocks that can send their price soaring or plunging.

For example, if a large holder of an algorithmic stablecoin decides to sell, it could cause the price to drop sharply.

So while algorithmic stablecoins have the potential to be more stable than other cryptocurrencies, they’re not perfect and come with some risks that investors should be aware of before trading or investing.

Examples of notable algorithmic stablecoins

Examples of popular algorithmic stablecoins currently include TerraUSD, FRAX, RAI, and FEI.

The two largest stablecoins are tether and USD Coin.

TerraUSD (UST)

For example, consider the third-largest stablecoin TerraUSD (UST), which shot up in popularity in late-2021.

If the price of TerraUSD dips below $1, traders can “burn” the coin, which means permanently take it out of circulation, in exchange for a dollar’s worth of new units of another cryptocurrency called Luna.

That reduces the supply of TerraUSD and therefore raises its price.

Conversely, if TerraUSD goes above $1, traders can burn Luna and create new TerraUSD in the process. That increases supply of the stablecoin and will lower its price back toward $1.

This process is a result of traders looking to make quick arbitrage profits, which in theory should keep TerraUSD within a relatively tight band around the $1 mark.

Luna, in effect, is a shock absorber for TerraUSD, and helps to reduce volatility in TerraUSD.

Death spirals in algorithmic stablecoins

TerraUSD is vulnerable to what cryptocurrency traders call a death spiral.

In such a scenario, an algorithmic stablecoin drops below $1 and traders, fearing that there isn’t enough liquidity in the market, step back from the arbitrage process that keeps it pegged to the dollar.

If there aren’t enough traders who are willing to buy the coin and help bring it back to $1, the market could lose confidence in the peg.

That could cause more traders to lose confidence in the market, accelerating the coin’s decline.

Iron, a separate algorithmic stablecoin, collapsed in a death spiral in June 2021, which ended up costing investors in the project about $2 billion.

Iron was partially collateralized, a type of stablecoin-algorithmic stablecoin hybrid.

Iron fell from $1 to about $0.75, or approximately the level of collateral backing the coin.

A related cryptocurrency called Titan, which had been used in a shock-absorber role like Luna, went from $64.04 to about zero within hours. It was the equivalent of a bank run or what can happen in any financial market when confidence erodes.

In May 2022, TerraUSD, fell as low as 94 cents, causing a flood of investors to sell their holdings, undermining confidence in it.

How do algorithmic stablecoins become popular?

TerraUSD, for example, became popular with the help of an incentive scheme offered by Anchor Protocol, which is a type of decentralized bank for crypto traders and investors that are built on the Terra network of Do Kwon, a South Korean crypto developer.

Anchor started providing annual interest rates of around 20 percent on TerraUSD deposits.

This helped attract capital into it, even though it’s unclear what exactly is supporting the 20 percent returns to make them sustainable.

Nonetheless, people get paid that yield and it’s better than the traditional zero percent or near-zero yields that people are getting on their bank deposits, so it attracts inflows.

Of course, it’s easy to worry that those drawn into TerraUSD or other algorithmic stablecoins by high yields will ultimately be hurt if they collapse.

While algorithmic stablecoins are “stable” in theory, they could ultimately prove unstable.