Risk Management

Risk management in day trading involves:

- identifying potential risks

- assessing their impact quantitatively and qualitatively, and

- employing mitigation strategies such as diversification and stop-loss orders

Continual monitoring and adjustments based on market conditions are important for maintaining an effective risk management approach.

This guide to trading risk management for beginners covers all the angles.

Top 4 Brokers For Good Risk Management

-

1

Plus500 USWelcome Deposit Bonus up to $200Trading with leverage involves risk.

Plus500 USWelcome Deposit Bonus up to $200Trading with leverage involves risk.

Ratings

$1000.0 LotsCFTC, NFAFutures on Forex, Commodities, Cryptos, Indices, Interest RatesWebTrader, AppACH Transfer, Wire Transfer, Debit Card, Mastercard, VisaUSD -

2

NinjaTrader

NinjaTrader

RatingsTrust Platform Assets Mobile Fees Accounts Research Education Support 4.5

$00.01 Lots1:50NFA, CFTCForex, Stocks, Options, Commodities, Futures, CryptoNinjaTrader Desktop, Web & Mobile, eSignalACH Transfer, Debit Card, Wire Transfer, ChequeUSD -

3

Interactive Brokers

Interactive Brokers

RatingsTrust Platform Assets Mobile Fees Accounts Research Education Support 4.3

$0$1001:50FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFMStocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, CryptocurrenciesTrader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, QuantowerCheque, ACH Transfer, Wire Transfer, Automated Customer Account Transfer Service, TransferWise, Debit CardUSD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF -

4

eToro USAInvest $100 and get $10Securities trading offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk. https://www.daytrading.com/ is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

eToro USAInvest $100 and get $10Securities trading offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk. https://www.daytrading.com/ is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

RatingsTrust Platform Assets Mobile Fees Accounts Research Education Support 4.1

$100$10SEC, FINRAStocks, Options, ETFs, CryptoeToro Trading Platform & CopyTraderACH Transfer, Debit Card, PayPal, Wire TransferUSD

Brokers With The Best Risk Management Tools

Download our free Risk Management PDF.

Key Takeaways – Risk Management

- Identify and Assess Risks

- Understand the types of risks (market, credit, operational) affecting your trades and assess their potential impact using both qualitative and quantitative analysis.

- Implement Mitigation Strategies

- Use diversification, position sizing, stop-loss orders, and hedging to reduce risk exposure and protect your portfolio from significant losses.

- Continuously Monitor and Adjust

- Regularly review your risk thresholds, performance, and market conditions.

- Adjust your strategies as necessary.

Risk Identification

Market risk, often referred to as systematic risk, encompasses the potential for traders to experience losses due to factors that affect the overall performance of the financial markets.

Key components of market risk include:

Fluctuations in asset prices

This refers to the volatility observed in the prices of assets such as stocks, bonds, and commodities.

Price fluctuations can be driven by various factors including changes in supply and demand, sentiment/flows, and macroeconomic indicators.

Interest rate changes

Interest rates have a big impact on the financial markets.

An increase in interest rates typically leads to lower bond prices and can also affect the stock market, as higher rates increase borrowing costs for companies.

It also decreases the present value of future cash flows, so (all else equal) cash flows need to rise by a concomitant amount to offset the higher rates.

Exchange rate fluctuations

For traders involved in the foreign exchange market or those holding assets in foreign currencies, exchange rate risk is a significant concern.

Currency values can be influenced by economic indicators, interest rate differences between countries, and geopolitical stability.

Geopolitical events

Political events and unknowns can lead to market volatility.

Elections, changes in government policies, trade conflicts, and tensions between countries can all influence confidence and asset prices.

Liquidity Risk

Liquidity risk involves the difficulty in buying or selling a security at a fair price and is particularly pertinent in less liquid markets.

Difficulty buying or selling a security at a fair price

In markets or with securities that lack depth, executing large orders can significantly impact the price.

This makes it difficult to enter or exit positions without affecting the market.

Impact of large trades in illiquid markets

Large trades in illiquid markets can lead to substantial price discrepancies, which can be detrimental to traders attempting to execute sizeable transactions.

Operational Risk

Operational risk covers losses stemming from failures in internal processes, people, and systems, or from external events.

This category includes:

Technology failures

The reliance on technology in trading means that hardware or software failures can lead to significant losses.

Human error

Mistakes made in the execution of trades, data entry, or management decisions can result in financial loss.

Fraud or legal risks

This includes the risk of losses due to fraudulent activities or legal penalties from failing to comply with regulations.

Credit Risk

Credit risk is heavily relevant to derivatives trading and involves the risk of loss due to a counterparty’s failure to fulfill its financial obligations.

Risk of default by a counterparty

In derivatives trading, the counterparty’s inability to perform as agreed upon can lead to significant losses, especially if the default occurs during poor market conditions.

Risk Assessment

In the qualitative assessment phase, traders and risk managers evaluate the potential scenarios and the likelihood of risk events, along with understanding the severity of potential impacts.

This involves:

Identifying potential scenarios

This includes brainstorming sessions, expert opinions, analysis of historical data, and stress testing to outline possible risk events and their triggers.

Understanding the severity of potential impacts

Assessing the financial and reputational damage that could result from each identified risk.

This considers both direct and indirect effects on the trading operation.

Quantitative Analysis

Quantitative analysis employs mathematical models to quantify the risks associated with trading activities.

Key methods include:

Value at Risk (VaR)

VaR is a widely used risk management tool that estimates the maximum loss a portfolio could face over a specified period with a given confidence level.

It provides a single number summarizing the total risk in a portfolio, but it has limitations, including the assumption of normal market conditions and historical data as a predictor of future risk.

Stress Testing

This involves simulating extreme market conditions to evaluate how a portfolio would perform under such scenarios.

Stress tests help identify potential vulnerabilities in a trading strategy or portfolio.

Scenario Analysis

Similar to stress testing, scenario analysis evaluates the impact of specific hypothetical events (e.g., a sudden increase in oil prices or a major geopolitical event) on a portfolio.

It helps in understanding the implications of various possible futures.

Sensitivity Analysis

This technique examines how changes in market conditions (such as changes in interest rates, exchange rates, or asset prices) affect the value of a portfolio.

It helps in identifying which securities or market factors a portfolio is most sensitive to.

Risk assessment, both qualitative and quantitative, is important for understanding the potential risks facing a trading operation and for preparing effective strategies to manage and mitigate those risks.

Risk Mitigation Strategies

Effective risk management in trading involves implementing strategies designed to mitigate the identified risks without overly compromising potential returns.

Key strategies include:

Position Sizing

- Allocating appropriate amounts of capital to each trade – This involves determining the optimal size for each position within a portfolio to control risk exposure. Position sizing is done such that a single loss doesn’t significantly impact the overall portfolio.

- Diversification across asset classes and markets – Diversification is a fundamental risk management technique that involves spreading investments, trades, or returns streams across various asset classes (e.g., stocks, bonds, commodities) and geographical markets to reduce the impact of any single investment’s poor performance on the overall portfolio.

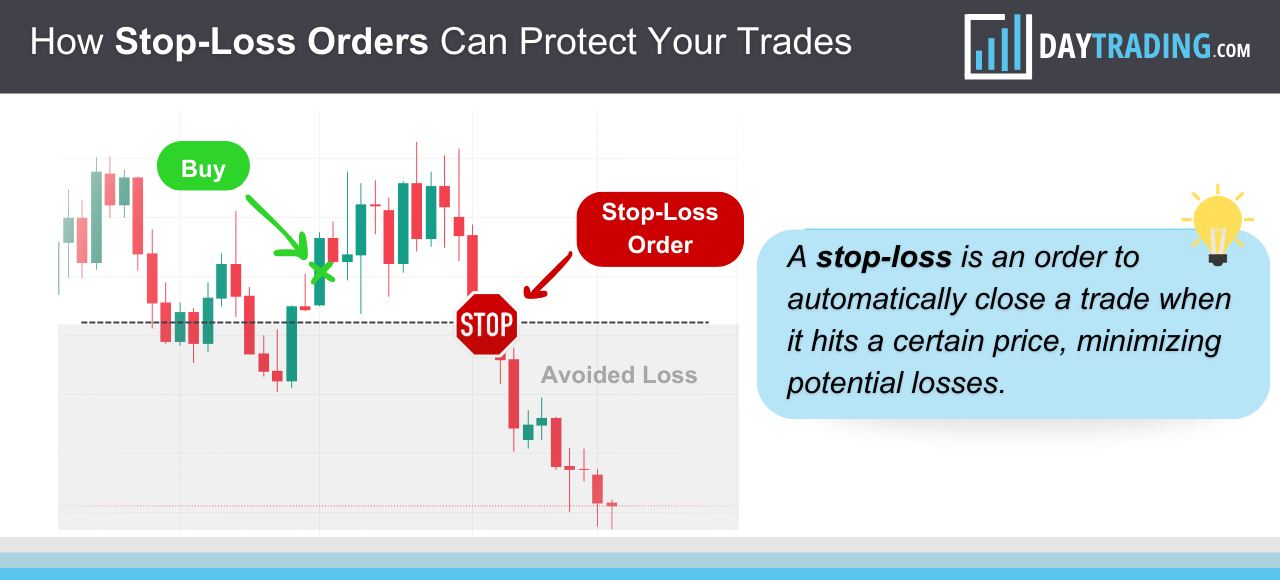

Stop-Loss Orders

Stop-loss orders are mechanisms to automatically close a position at a predefined loss level and a direct method to control losses on individual trades.

By setting a stop-loss order, a trader can specify the maximum amount they are willing to lose on a trade, such that positions are automatically closed before losses escalate.

Hedging

Hedging involves taking positions in derivatives or other assets that are expected to move inversely to a vulnerable asset in the portfolio.

For example, options contracts can be used to insure against price declines in stock positions.

It could also involve futures or positions in other assets (e.g., shorting).

Insurance

For trading firms and professionals, obtaining insurance coverage can provide financial protection against operational risks such as fraud, legal liabilities, and professional errors.

Monitoring and Control

Continual monitoring and control mechanisms are important for maintaining the efficacy of risk management strategies over time.

Setting Risk Thresholds and Limits

Define acceptable levels of risk on a per-trade, portfolio, and overall account basis.

Establishing clear risk thresholds helps in maintaining discipline in trading activities and in avoiding excessive risk-taking.

These limits should be based on the trader’s or institution’s risk tolerance and financial objectives.

Ongoing Performance Analysis

- Regularly reviewing positions, profit/loss, and risk metrics – Continuous monitoring of trading performance and risk exposure is necessary for early detection of potential issues. This includes reviewing not only the profitability of trades but also how closely the actual risk taken aligns with the intended risk levels.

- Adjusting strategies as needed – Based on the performance analysis, trading strategies and risk management approaches may need to be adjusted to respond to changing market conditions or deviations from expected performance.

Maintaining a Risk Management Plan:

Keeping a documented plan that is updated as markets and strategies evolve.

A formal risk management plan provides a framework for decision-making and consistently applying risk management practices.

This plan should be reviewed and updated regularly to reflect changes in market dynamics, trading strategies, and risk tolerance.

Additional Considerations

Beyond the fundamental strategies of risk identification, assessment, mitigation, and monitoring, there are additional considerations in the overarching framework of risk management for trading.

These include:

Trader Psychology

Managing emotions like greed and fear, and sticking to a disciplined approach.

Greed can lead to taking excessive risks, while fear can result in missed opportunities.

A disciplined approach, supported by a well-defined trading and risk management plan, helps traders navigate emotional challenges and make rational decisions based on analysis rather than emotion.

External Factors

Staying informed about macroeconomic conditions and potential market-moving events.

External economic factors such as inflation rates, unemployment figures, geopolitical tensions, and central bank policies can impact financial markets.

Staying informed about these factors allows traders to anticipate market movements and adjust their strategies accordingly.

Continuous Learning

The financial markets are always evolving.

New products, technologies, and regulatory changes constantly emerge.

Continuous learning and adaptation are necessary to maintain an edge in trading and risk management.

This includes staying updated with the latest risk management techniques, market analysis tools, and financial products.

Conclusion

Risk management is a complex and important element of successful trading.

The outlined framework serves as a foundation, but traders and risk management professionals need to customize their approach based on specific trading goals, risk tolerance, and the markets in which they operate.

Effective risk management not only involves protecting against potential losses but also maximizing the efficiency of capital use and enhancing the potential for profitability.

While the strategies and considerations discussed provide a structured approach to managing risk, financial markets require a flexible and informed approach to risk management.

Success in trading and risk management is achieved through a combination of disciplined strategy implementation, continuous monitoring, and adaptation to changing markets.