Theta (Option Greek)

Theta, often referred to as time decay, is one of the most popular “Greeks” in options trading.

It measures the rate at which an option’s value decreases as time passes – assuming all other factors remain constant.

Understanding Theta is important for options traders, as it directly impacts the profit/loss of their positions.

Key Takeaways – Theta

- Theta accelerates as expiration nears, causing options to lose value faster.

- Plan exit strategies accordingly, especially in the final weeks before expiration.

- At-the-money options have the highest Theta, making them attractive for selling strategies but risky for buying.

- Higher implied volatility decreases Theta’s impact.

- Consider this when trading options during volatile market conditions.

The Basics of Theta

Definition

Theta represents the expected daily decrease in an option’s value due to the passage of time.

It’s typically expressed as a negative number, indicating the amount of value an option loses each day as it approaches expiration.

Calculation

Theta is calculated using complex mathematical models, such as the Black-Scholes model.

While the exact formula is beyond the scope of this overview, note that Theta is influenced by various factors, including the option’s strike price, time to expiration, and the underlying asset’s volatility.

Theta’s Impact on Option Types

Call Options

For call options, Theta works against the option buyer and in favor of the option seller.

As time passes, the probability of the underlying asset reaching the strike price decreases, causing the option’s value to decline.

Put Options

Similarly, put options also experience time decay.

The value of a put option decreases as time passes, benefiting the seller and working against the buyer.

Theta Decay (Theta Burn)

Theta decay, also known as theta burn, refers to the reduction in the value of an option as it approaches its expiration date, which reflects the erosion of the option’s time value.

Factors Affecting Theta

Time to Expiration

Theta’s effect is most pronounced as an option approaches its expiration date.

The rate of time decay accelerates in the final weeks and days before expiration.

Those who want to minimize theta decay use longer-term options.

Moneyness

At-the-money options typically have the highest Theta values, while deep in-the-money and far out-of-the-money options have lower Theta values.

Volatility

Higher implied volatility generally results in lower Theta values, as increased volatility suggests a greater likelihood of price movement in the underlying asset.

Trading Strategies Involving Theta

Theta Decay Strategies

Experienced traders often employ strategies that take advantage of Theta decay.

These may include:

- Selling options (writing calls or puts)

- Credit spreads

- Iron condors and multi-leg options strategies

- Calendar spreads

Long-Term Options

Traders holding long-term options (LEAPs) may be less affected by Theta in the short term but should still consider its impact over the life of the option.

Managing Theta Risk

Rolling Positions

To reduce Theta risk, traders may choose to roll their positions forward.

They exchange near-term options for those with later expiration dates.

Adjusting Strike Prices

Traders can also manage Theta risk by adjusting strike prices, moving to options that are further in-the-money or out-of-the-money, depending on their strategy.

Theta and Other Greeks

Relationship with Delta

Theta and Delta are closely related.

As an option’s Delta increases (becomes more sensitive to price changes in the underlying asset), its Theta typically increases as well.

Interaction with Gamma

Gamma, which measures the rate of change in Delta, also influences Theta.

Higher Gamma values often correspond to higher Theta values, particularly for at-the-money options.

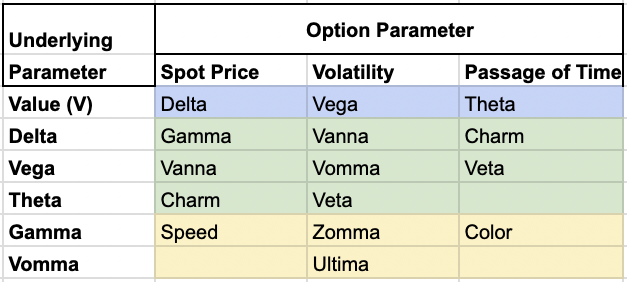

Secondary Greeks of Theta

Secondary Greeks of Theta, such as Charm and Veta, provide deeper insights into how the passage of time impacts options pricing and help in managing the complexities of an options portfolio.

Charm

Charm measures the rate of change of Delta with respect to the passage of time.

It indicates how Delta will evolve as the option approaches expiration.

This Greek is important for traders managing the time decay of options, as it helps them anticipate changes in Delta, allowing for more precise hedging strategies.

For instance, an option with a high Charm value will see its Delta change significantly as time progresses (requiring frequent adjustments to maintain a neutral Delta position).

Veta

Veta measures the rate of change of Vega with respect to the passage of time, showing how the option’s sensitivity to volatility changes as expiration nears.

This is for volatility traders who need to understand how their Vega exposure will diminish as the option’s time to expiration decreases.

A high Veta value suggests that the option’s Vega will decay rapidly, impacting the effectiveness of volatility-based strategies.

Traders can use Veta to fine-tune their portfolios, so they’re not overly exposed to volatility risks that diminish as the option’s expiration date approaches.

Color

Color, also known as Gamma decay, measures the rate of change of Gamma with respect to the passage of time.

Color helps traders understand how an option’s convexity will evolve as it approaches expiration.

This Greek helps traders understand the acceleration of Delta changes due to time decay, important for managing the risks associated with options nearing their expiration dates.

Overall

By incorporating Charm and Veta into their analysis, traders gain a more nuanced understanding of how time decay affects their positions beyond the primary Theta.

This allows for more sophisticated risk management and optimization of options strategies, especially in markets where time decay and volatility are important in options pricing.

Conclusion

Understanding Theta is important for options traders, as it directly impacts the profitability of their positions.

By considering Theta alongside other Greeks and market factors, traders can make better decisions about entering, managing, and exiting their options trades.

While Theta generally works against option buyers and in favor of option sellers, its effects can be reduced or leveraged through various strategies and careful position management.