Selling Options: When Do You Receive the Premium?

Options premium is often a confusing topic for those newer to this form of trading, particular when it comes to selling (often called “writing”) options.

This should first be prefaced by saying that it’s never a good idea to sell options naked. In other words, don’t sell options without having the underlying position covered.

There are 100 shares of a stock embedded within each option’s contract. That means if you sell one call option contract on Apple (AAPL) stock, in order to have that fully covered you will need to own 100 shares of AAPL. If you do not, and the option falls in-the-money (ITM) you will be on the hook for needing to sell 100 shares of AAPL to the individual owning the call option at the given strike price.

If the option does land ITM, your position nets out to zero – that is, you owned 100 shares and sold 100 shares. Selling those options without covering them – by either owning the shares or having enough equity in the account to cover it if the option landed ITM – would potentially be a recipe for disaster.

In fact, many brokers will not allow their clients to sell options naked unless they have it covered by a sufficient amount of collateral.

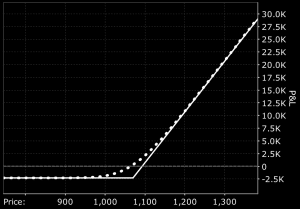

The image below shows the profit and loss (“P&L”) potential from an option buyer’s perspective. Options buyers are giving up a relatively small amount relative to what they can earn. Of course, one person’s earnings is another individual’s liabilities. As a seller one would need to pay whatever amount is stipulated depending on whether an option lands ITM and how far ITM (i.e., the premium minus the liability). If this position is covered by owning the underlying asset, you are fine. If it is not, that can result in a massive loss.

When people blow out their accounts it is usually due to one of three main things:

1) poor risk management (often betting too much and losing all-or-nothing wagers)

2) uneducated use of leverage

3) selling options naked

With that said, we’ll focus on the profitability aspect of selling options premium.

When Do You Receive Options Premium?

Many become confused over when they receive options premium when they sell these instruments.

The answer is that you don’t actually receive the premium until the transaction closes. This is because the trade doesn’t settle until the option expires.

What you sell options, you form an asset and corresponding liability. The asset is the premium derived from selling the option while the liability is the option itself, which can expire ITM. If the option expires out-of-the-money (OTM), it is worthless, which is the optimal outcome for the seller. As a result, the transaction would be settled and the premium is credited to you.

If the option expires ITM, then it becomes more complicated. You receive the premium, but the effect of the liability will need to be calculated.

If the option is fully covered – for example, you sell a call on AAPL and own 100 shares of the underlying stock – and the option lands ITM, you forgo the extra profit you would have received by being long the stock only. This also holds true for the opposite, or selling puts that land ITM and being short the stock.

The owner of an ITM option at expiration has the right, but not the obligation, to buy or sell the underlying asset (depending on whether it’s a call or put option) at the strike price by the expiration date to the seller.

Example

Let’s say you sold one contract of a 200 call on AAPL and you owned 100 shares of the stock. The premium you received was $100.

That means the breakeven on the option is $201 or the point at which someone who was selling these naked would begin to lose money if the stock went above. This is calculated as the strike price ($200) plus the cost of the premium per share, or $100 divided by 100 shares per contract. For puts you would subtract the premium, so a 200 put’s breakeven would be $199 if $100 per contract or $1 per share.

If the stock closes at $205 at expiration, that means you’ll incur a $400 loss from the option, or the difference of $205 and $201 multiplied by the number of shares per contract.

But since you owned the underlying, you also profit $500 from the price rising $5 above the $200 strike ($5 per share multiplied by 100 shares). This $500 offsets the $400 loss from the option and nets you a $100 gain. In other words, you earned the premium and nothing more.

If you had never sold the option, you would have profited $500, or the price appreciation of the stock. Accordingly, these types of covered strategies tend to work best when the stock remains around its current price.

Also, the buyer of the option may exercise his right to buy or sell the underlying shares from you. It is then up to you whether to re-up the position in the security. There would be no net profit/loss or margin requirement change for your portfolio, outside of the commission costs, since you would simply be selling something then buying it right back (or the opposite depending on the type of option).

Now if you had sold options naked (i.e., you didn’t own the underlying security) and the option buyer exercised his right to buy or sell the securities, you would be on the hook for that. This can be very bad if you don’t have the capital available to do so.

This, unfortunately, is how many traders wipe out their accounts. Accordingly, it is highly recommended to never sell options without owning the underlying or, at the very least, having the collateral available to do so.

Summary

– You receive the option’s premium once the transaction settles (at expiration).

– If the option is fully covered throughout the duration of the trade (i.e., you have at least that many shares matching what are embedded in the option), you are guaranteed to net the premium.

– If the option is covered and it lands ITM, your cost is effectively the extra profit you have foregone by selling the option. This is because the option eats up the profit in the underlying.

– A general word of caution should be noted on selling options naked, or without owning the underlying asset embedded in the option (100 shares per contract). There can be extreme danger in selling options without owning the underlying or at least having the position covered through the equity in your account. It acts as a liability with unlimited downside. It’s a type of tail risk that you never want and should be avoided.