Multi-Leg Options Strategies

Multi-leg options strategies involve using two or more options contracts to create a combined position to achieve specific risk-return profiles.

These strategies can be employed to hedge risk, speculate on price movements, or take advantage of market inefficiencies.

The primary objective is to manage risk, customize exposures, and perhaps leverage by simultaneously holding various positions in options.

Key Takeaways – Multi-Leg Options Strategies

- Multi-leg options strategies include:

- Spreads

- Straddles and Strangles

- Ratio Spreads

- Butterfly Spread

- Iron Condor

- Iron Butterfly

- There are of course many variations off of these.

Types of Multi-Leg Options Strategies

Spreads

Vertical Spread

A vertical spread involves buying and selling options of the same type (either calls or puts) with the same expiration date but different strike prices.

- Bull Call Spread – A bull call spread nvolves buying a call option with a lower strike price and selling a call option with a higher strike price. This strategy profits from a moderate rise in the underlying asset’s price.

- Bear Put Spread – Involves buying a put option with a higher strike price and selling a put option with a lower strike price. This strategy does best from a modest decline in the underlying’s price.

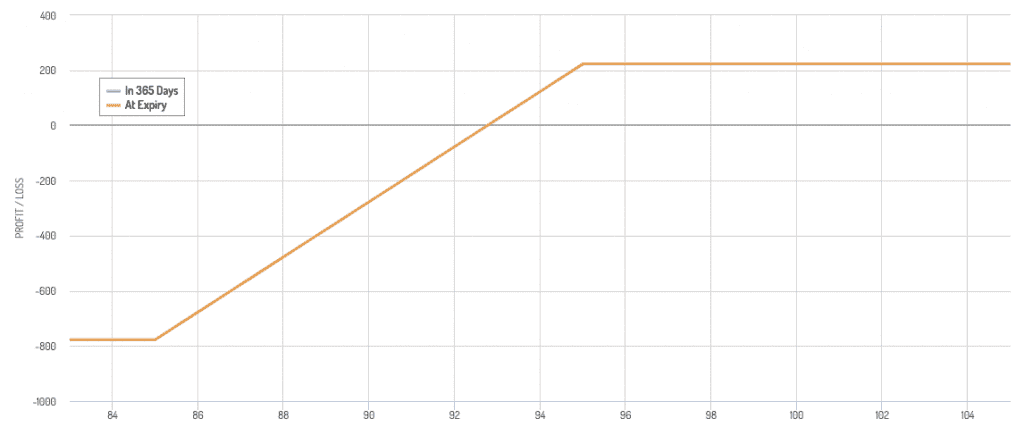

This is a call spread:

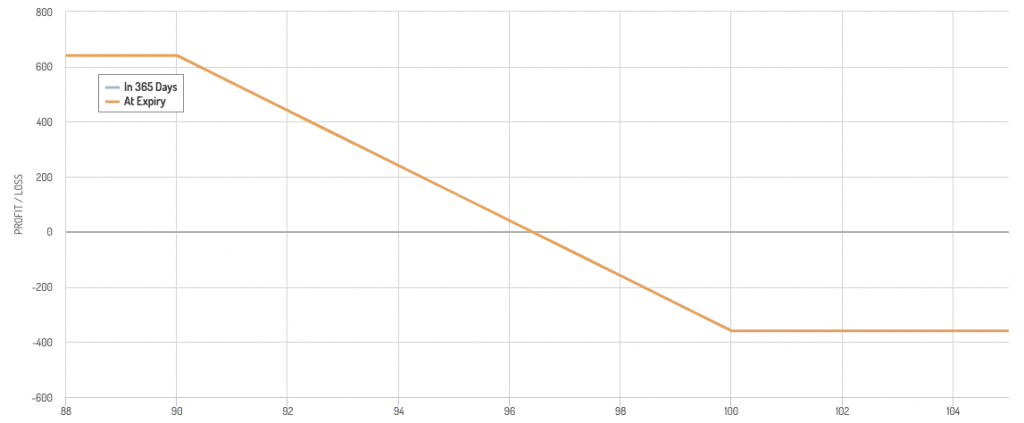

This is a put spread:

Horizontal Spread (Calendar Spread)

A horizontal spread involves buying and selling options of the same type with the same strike price but different expiration dates.

- Calendar Spread – Typically involves buying a longer-term option and selling a shorter-term option. The strategy profits from the difference in the rate of time decay (theta) between the two options.

Straddles and Strangles

Straddle

A straddle involves buying both a call and a put option at the same strike price and expiration date.

- Long Straddle – Profits from significant price movements in either direction. It’s used when a trader expects high volatility but is unsure of the direction. An example popular use would be buying a straddle right before earnings announcements when stock prices become more volatile.

- Short Straddle – Profits from low volatility when the underlying asset’s price remains close to the strike price.

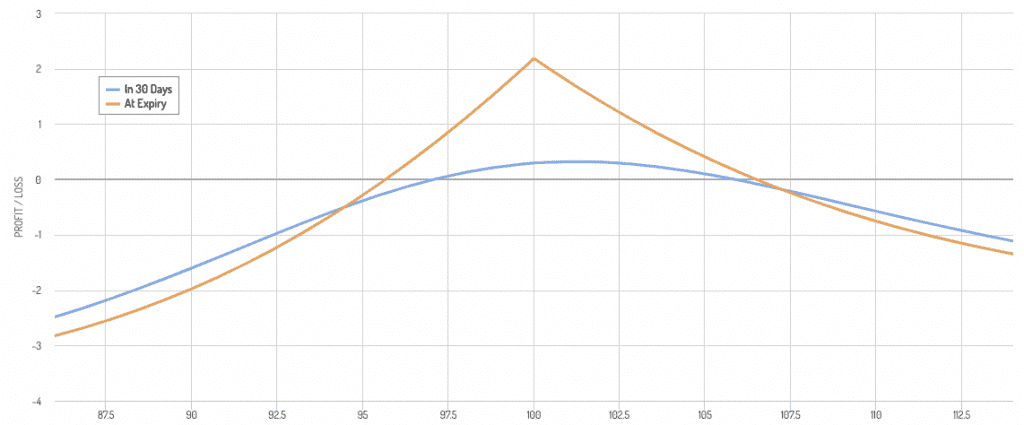

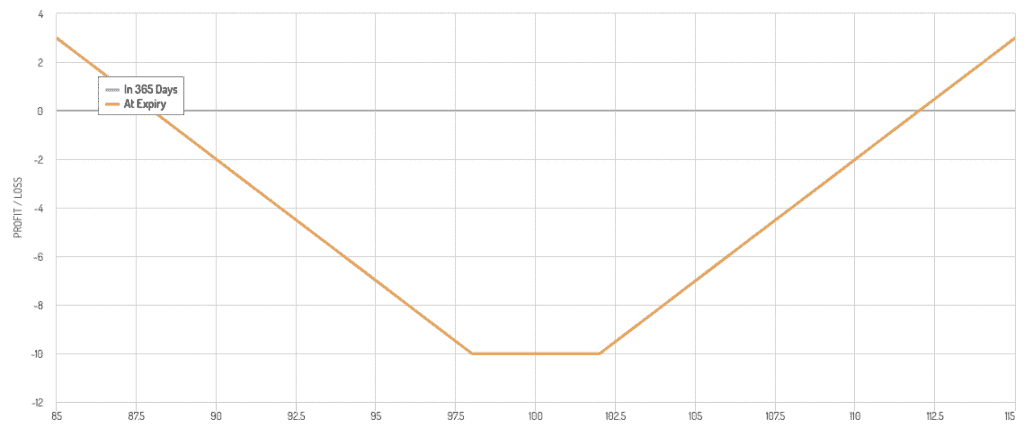

The payoff diagram below shows a long straddle:

Strangle

A strangle involves buying both a call and a put option with different strike prices but the same expiration date.

- Long Strangle – Profits from large price movements in either direction. The strike prices are different.

- Short Strangle – Profits from low volatility when the price of the underlying asset stays between the two strike prices.

Here’s a long strangle payoff diagram:

Ratio Spreads

Ratio Call Spread

A ratio call spread involves buying a certain number of call options and selling a higher number of call options with a higher strike price.

- Purpose – Used to take advantage of slight upward price movements while limiting the cost of the position.

- Risk – Unlimited risk if the underlying asset’s price goes up a lot.

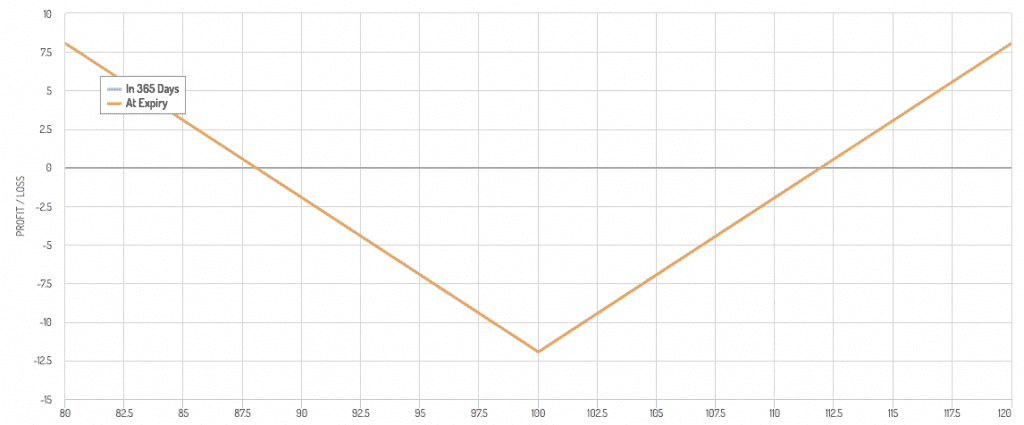

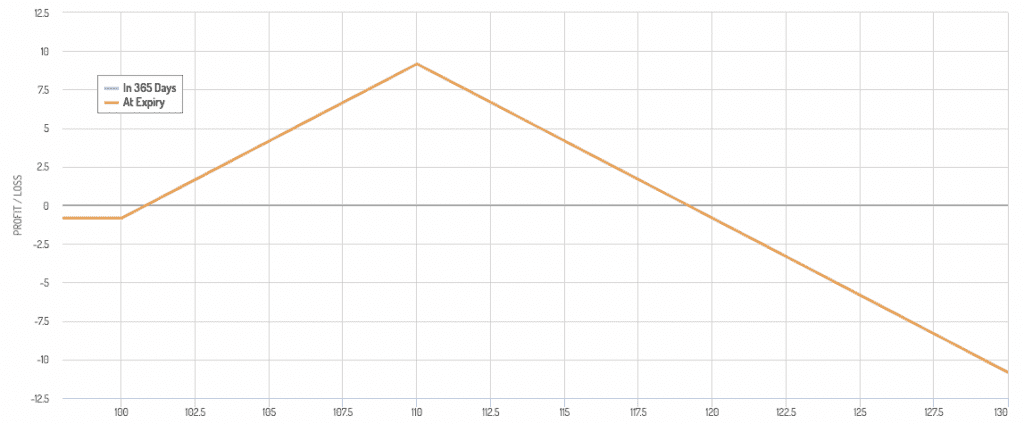

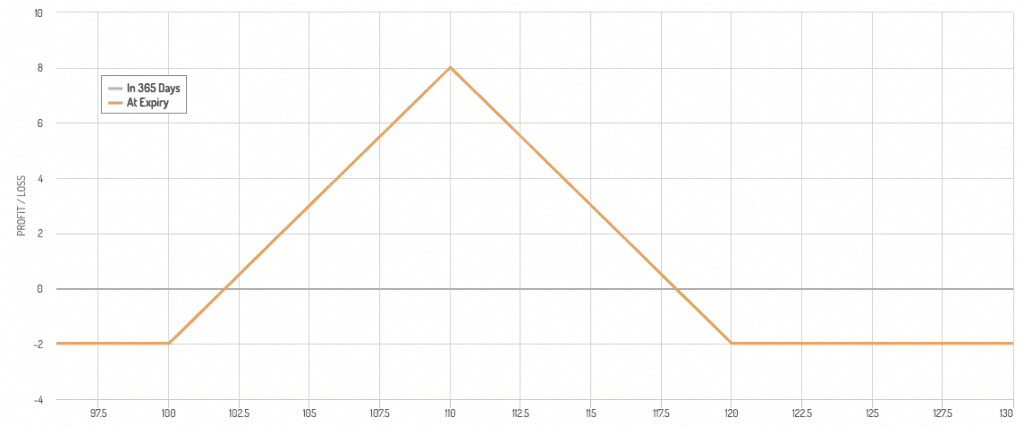

Here’s the payoff diagram of a ratio call spread – long 1 call and short 2 calls:

You can see from the payoff diagram that the risk is the asset going up by too much due to the overweight on the short calls.

Ratio Put Spread

A ratio put spread involves buying a certain quantity of put options and selling a greater number of put options with a lower strike price.

- Purpose – Used to benefit from slight downward price movements while keeping the initial cost low.

- Risk – Unlimited risk if the underlying asset’s price falls significantly.

Butterfly Spread

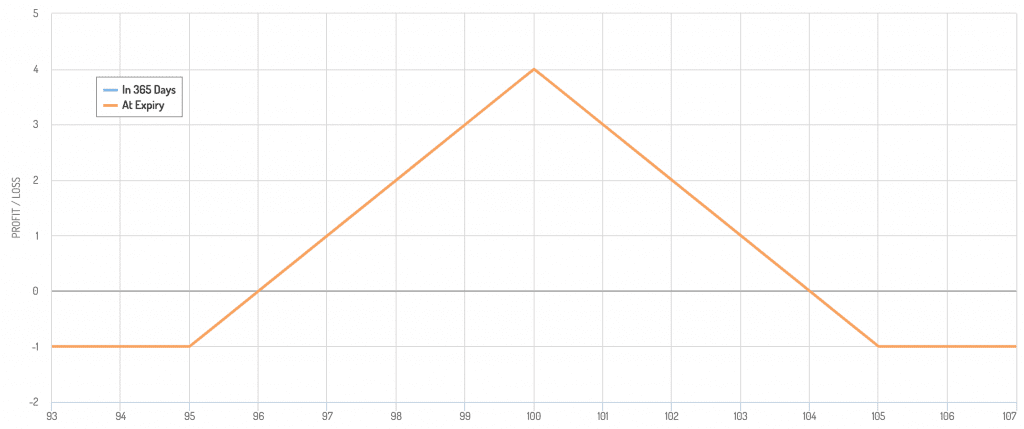

A butterfly spread combines both bull and bear spreads, using three strike prices with the same expiration date.

- Long Butterfly Spread with Calls – Involves buying one call option at the lowest strike price, selling two call options at a middle strike price, and buying one call option at the highest strike price. This strategy profits from low volatility when the underlying asset’s price is near the middle strike price at expiration.

- Long Butterfly Spread with Puts – Similar to the call butterfly spread but using put options. It profits when the underlying asset’s price is close to the middle strike price at expiration.

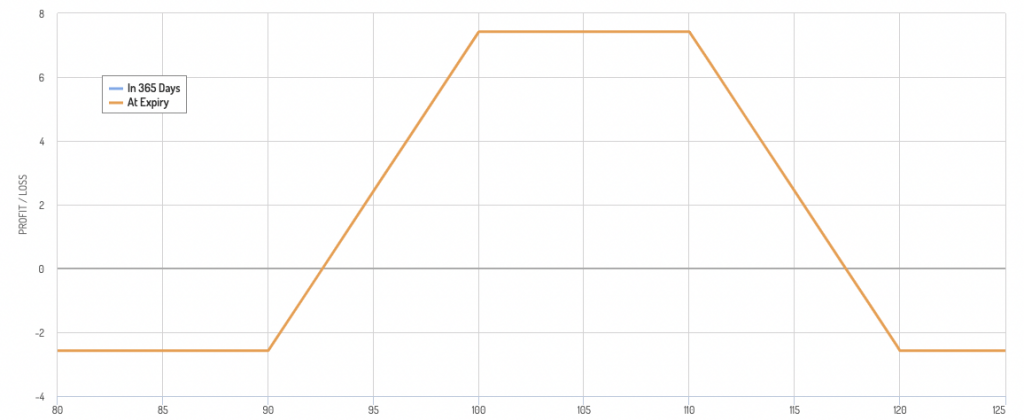

Iron Condor

An iron condor has four options contracts: two calls and two puts.

They have different strike prices but the same expiration date.

- Setup:

- Sell one out-of-the-money call.

- Buy one further out-of-the-money call.

- Sell one out-of-the-money put.

- Buy one further out-of-the-money put.

- Purpose – Profits from low volatility when the underlying asset’s price stays within the two middle strike prices.

- Risk – Limited risk but limited reward.

The payoff diagram involving an iron condor:

Iron Butterfly

An iron butterfly combines a straddle and a protective wingspan by using four options contracts.

- Setup:

- Sell one at-the-money call.

- Sell one at-the-money put.

- Buy one out-of-the-money call.

- Buy one out-of-the-money put.

- Purpose – Profits from low volatility when the underlying asset’s price stays near the strike price of the sold options.

- Risk – Limited risk and limited reward, similar to the iron condor but with a potentially higher return if the underlying asset stays near the middle strike price.

Let’s look at some trades involving multi-leg options strategies.

These examples provide a breakdown of how each multi-leg options strategy can be set up, including specific steps and amounts.

Vertical Spread

Bull Call Spread

Here the goal is to profit from a moderate rise in the underlying asset’s price.

Steps:

- Identify the underlying asset – Assume stock XYZ is trading at $50.

- Buy one call option – Buy 1 XYZ 50 Call at $3.00 (total cost = $300, given 100 shares per contract).

- Sell one call option – Sell 1 XYZ 55 Call at $1.50 (total premium received = $150).

- Net cost = $300 (cost) – $150 (premium received) = $150

Straddles and Strangles

Long Straddle

Here you’re trying to profit from big price movements in either direction.

Steps:

- Identify the underlying asset: Assume stock XYZ is trading at $50.

- Buy one call option: Buy 1 XYZ 50 Call at $3.00 (total cost = $300).

- Buy one put option: Buy 1 XYZ 50 Put at $2.50 (total cost = $250).

- Total cost = $300 + $250 = $550

Long Strangle

Here the goal is to profit from significant price movements in either direction with lower upfront costs compared to a straddle.

Steps:

- Identify the underlying asset: Assume stock XYZ is trading at $50.

- Buy one out-of-the-money call option: Buy 1 XYZ 55 Call at $1.50 (total cost = $150).

- Buy one out-of-the-money put option: Buy 1 XYZ 45 Put at $1.00 (total cost = $100).

- Total cost = $150 + $100 = $250

Butterfly Spread

Long Butterfly Spread with Calls

The goal in this case is to profit from low volatility when the underlying asset’s price is near the middle strike price at expiration.

Steps:

- Identify the underlying asset: Assume stock XYZ is trading at $50.

- Buy one lower strike call option: Buy 1 XYZ 45 Call at $7.00 (total cost = $700).

- Sell two middle strike call options: Sell 2 XYZ 50 Calls at $4.00 each (total premium received = $800).

- Buy one higher strike call option: Buy 1 XYZ 55 Call at $1.50 (total cost = $150).

- Net cost = $700 (cost) – $800 (premium received) + $150 (cost) = $50 credit

Iron Condor

Now we want to profit from low volatility when the underlying asset’s price stays within the two middle strike prices.

Steps:

- Identify the underlying asset: Assume stock XYZ is trading at $50.

- Sell one out-of-the-money call option: Sell 1 XYZ 55 Call at $1.50 (total premium received = $150).

- Buy one further out-of-the-money call option: Buy 1 XYZ 60 Call at $0.50 (total cost = $50).

- Sell one out-of-the-money put option: Sell 1 XYZ 45 Put at $1.50 (total premium received = $150).

- Buy one further out-of-the-money put option: Buy 1 XYZ 40 Put at $0.50 (total cost = $50).

- Net credit = $150 (call) + $150 (put) – $50 (call) – $50 (put) = $200

Iron Butterfly

Similar to the iron condor, you want to profit from low volatility when the underlying asset’s price stays near the strike price of the sold options.

Steps:

- Identify the underlying asset: Assume stock XYZ is trading at $50.

- Sell one at-the-money call option: Sell 1 XYZ 50 Call at $3.00 (total premium received = $300).

- Sell one at-the-money put option: Sell 1 XYZ 50 Put at $2.50 (total premium received = $250).

- Buy one out-of-the-money call option: Buy 1 XYZ 55 Call at $1.50 (total cost = $150).

- Buy one out-of-the-money put option: Buy 1 XYZ 45 Put at $1.00 (total cost = $100).

- Net credit = $300 (call) + $250 (put) – $150 (call) – $100 (put) = $300

Conclusion

Multi-leg options strategies provide traders with versatile ways to:

- manage risk

- optimize returns, and

- customize their exposures based on various markets

Each strategy has its own risk-reward profile and is suited for different market expectations, whether it be volatility, price direction, or time decay.

Understanding these strategies allows traders to make better tailor their approaches to their individual market outlooks.