Swing Trading Crypto

Swing trading crypto is popular among investors of all experience levels. Strategies appeal due to the longer timescales compared to day trading and the volatility of digital currencies like Bitcoin. This investing guide covers the basics of how to swing trade cryptos using charts, bots and our top tips. We also list the best brokers and platforms for swing trading cryptocurrencies in 2025.

Crypto Brokers

-

1

Interactive Brokers

Interactive Brokers -

2

Plus500 USTrading with leverage involves risk.

Plus500 USTrading with leverage involves risk. -

3

NinjaTrader

NinjaTrader -

4

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

UpholdTerms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

UpholdTerms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

This is why we think these brokers are the best in this category in 2025:

- Interactive Brokers - IBKR lets you purchase and hold Bitcoin, Bitcoin Cash, Ethereum, and Litecoin at competitive commission rates and without needing a crypto wallet. Additionally, there is a range of other diverse assets to explore, such as crypto indices like the NYSE Bitcoin Index, as well as futures contracts like the BAKKT Bitcoin Futures.

- Plus500 US - Plus500’s Micro-Bitcoin and Micro-Ethereum futures only allow traders to scratch the surface of crypto trading with bets on the two most popular digital assets. Importantly, you cannot buy and own the cryptos with these derivative contracts - you are speculating on their price.

- NinjaTrader - You can get exposure to micro Bitcoin futures through the CME Group’s centralized exchange, which is highly regulated by the US CFTC. Micro contracts allow you to trade a fractional size of one Bitcoin, giving you more risk control and order flexibility.

- eToro USA - eToro US offers 24 tradeable cryptoassets, with just a 1% buying/selling fee added to the spread. Additionally, there are 80 different coins available through the broker’s proprietary wallet service. You can also practice your crypto strategies easily by switching between live and demo mode. Crypto asset investing is highly volatile and unregulated. No consumer protection. Tax on profits may apply.

- OANDA US - Cryptocurrency trading is offered via Paxos, a separate entity from Oanda. You can speculate on the world’s biggest cryptos by market cap. Commissions are lower than many peers starting at 0.25%. Through the broker’s partnership with Paxos, clients can spot trade cryptocurrencies on the itBit exchange through the OANDA native platform.

- Uphold - You can buy and sell 250+ crypto assets with fiat currencies or in crypto pairs using the straightforward mobile app or through Uphold's browser-based account homepage. This is significantly more than many rivals. You can also earn up to 16% APY by staking one or more out of 32 valid tokens, or send tokens to an external wallet.

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Coins | BTC, LTC, ETH, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.12%-0.18% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

Plus500 US

"Plus500 US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500 US Quick Facts

| Bonus Offer | Welcome Deposit Bonus up to $200 |

|---|---|

| Coins | MicroBitcoin, MicroEthereum |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Regulator | CFTC, NFA |

| Account Currencies | USD |

Pros

- The trading app provides a terrific user experience with a modern design, a clean layout and mobile-optimized charts

- Plus500 US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

- The Futures Academy is an excellent resource for new traders with engaging videos and easy-to-follow articles, while the unlimited demo account is great for testing strategies

Cons

- Although support response times were fast during tests, there is no telephone assistance

- While Plus500 US continues to broaden its investment offering, it's currently restricted to around 50+ futures with no stocks

- Despite competitive pricing, Plus500 US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Coins | BTC |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Floating |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Account Currencies | USD |

Pros

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- You can get thousands of add-ons and applications from developers in 150+ countries

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

Cons

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

- There is a withdrawal fee on some funding methods

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Bonus Offer | Invest $100 and get $10 |

|---|---|

| Coins | BTC, ETH, BCH, DASH, LTC, ETC, MIOTA, XLM, EOS, NEO, ZEC, XTZ, MKR, COMP, LINK, UNI, YFI, DOGE, AAVE, ALGO, MANA, ENJ, BAT, MATIC, FLR, SHIBxM |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | BTC 0.75% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Regulator | SEC, FINRA |

| Account Currencies | USD |

Pros

- The online broker offers an intuitive social investment network with straightforward copy trading on cryptos

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- A free demo account means new users and prospective day traders can try the broker risk-free

Cons

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- Average fees may cut into the profit margins of day traders

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Coins | BTC, ETH, LTC, BCH, PAXG, LINK, UNI, AAVE |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | $100 |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- The broker offers a transparent pricing structure with no hidden charges

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

- Day traders can enjoy fast and reliable order execution

Cons

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

Uphold

"Uphold remains a top choice for crypto investors looking for a one-stop-shop solution to accessing the markets. There are over 250 tokens to buy, sell and trade through flexible platform options."

William Berg, Reviewer

Uphold Quick Facts

| Coins | BTC, BTCO, AAVE, ALCX, DYDX, INH, XYO, API3, GHST, LSK, AUDIO, GLMR, NMR, CAKE, GODS, REQ, CHR, TRB, DAO, ROOK, XRP, ETH, BAT, ADA, ALGO, ATOM, AVAX, AXS, BCH, BAL, BTG, CSPR, COMP, CRV, DASH, DCR, DGB, DOGE, DOT, EGLD and many more |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Up to 1.5% |

| Crypto Lending | No |

| Crypto Staking | Yes |

| Platforms | Desktop Platform, Mobile App |

| Minimum Deposit | $0 |

| Account Currencies | USD, EUR, GBP |

Pros

- UK users can get the Uphold card with up to 2% cashback in XRP

- Over 250 cryptos are available including major tokens like Bitcoin and Ethereum

- The proprietary app is extremely easy to use with a slick design and navigation

Cons

- The charting analysis features on the platform trail specialist exchanges

- There is a 2.49% fee if you want to use debit or credit cards

- Customer service is slow based on tests, with limited contact options

Swing Trading Crypto Explained

Swing trading is a strategy whereby traders aim to profit from price movements across a short to medium time frame. The idea is to catch any ‘swings’ in the market over days, weeks, or months.

There are two swings that investors generally look out for:

- Swing highs – When the market peaks before pulling back, providing an opportunity for a short trade

- Swing lows – When the market dips and bounces, providing an opportunity for a long trade

Swing trading strategies work well with trending markets, including forex, stocks, and cryptocurrencies. The best crypto coins for swing trading, especially if you’re a beginner, include Bitcoin, Ethereum and Tether. This is because they have the largest market capitalization and are some of the most actively traded and volatile coins on the market.

Successful crypto swing traders typically use technical analysis to observe short to medium-time frame charts to catch daily and weekly trends. The use of fundamental analysis is also helpful, as economic events can often unroll over days or weeks.

Day Trading Crypto Vs Swing Trading Crypto

The timescale is the main difference between day trading cryptos and swing trading cryptos. Day traders aim to profit from short-term price moves within a day. As a result, they are more active than swing traders and typically do not leave their positions open for longer than one day.

There is also normally a greater emphasis on technical analysis in day trading. In contrast, swing traders tend to focus on fundamentals. In fact, some crypto investors may base their analysis solely on news events and company announcements, for example, when Binance halted Bitcoin withdrawals in June 2022 following a downturn in the market.

Deciding between day trading or swing trading crypto ultimately depends on individual investing styles and goals. While some prefer to carry out all their trades during the day, others are not phased by the prospect of holding positions overnight. In addition, some investors may thrive in high-pressure environments, while others prefer to take a more passive approach.

Either way, trying out different strategies within a demo account is often a good idea before rolling it into your trading plan.

Swing Trading Crypto Strategies

There is a range of approaches that you can implement when swing trading crypto, though it will take some time to determine which one you prefer most. We’ve provided two popular examples below.

‘Stuck In A Box’

This strategy follows a market range by utilizing support and resistance levels. As a result, the market is sometimes known as being stuck in a box between the two lines above and below.

Once the price breaks below support, the trader waits for a strong price rejection (a candle closed above support) and then goes long on the next candle open. The aim is to essentially exit the trade before the selling pressure comes in at resistance.

To ensure success with this swing trading crypto strategy, you will need a sound understanding of your daily candlestick chart and support and resistance levels. Your stop-loss and take-profit will also be important to ensure that you don’t exceed these levels.

‘Catch The Wave’

As the name suggests, this strategy aims to catch one move in a trending market, whereby you enter after the pullback has ended.

To catch the wave, investors identify a trend concerning, for example, a 50-period moving average. Suppose the Bitcoin market approaches the moving average. In that case, traders will wait for a bullish price rejection before going long on the next candle.

As a rule of thumb, you should set your stop-loss below the candle low and set the take-profit just before the market swings high.

Swing Trading Crypto Tools

Whether you’re investing in Bitcoin or other altcoins, multiple tools can enhance your swing trading strategy and give you confidence when things get challenging.

Social & Copy Trading

Suppose you’re a beginner curious to see swing trading cryptos in action. In that case, you could always look for a broker offering copy trading. This allows you to share trading ideas and copy other successful deals, making it a useful feature for investors still finding their feet.

You can also search for copy-trading providers who have mastered their swing trading strategy within the platform. eToro, for example, has one of the best social and copy trading platforms for cryptocurrency beginners.

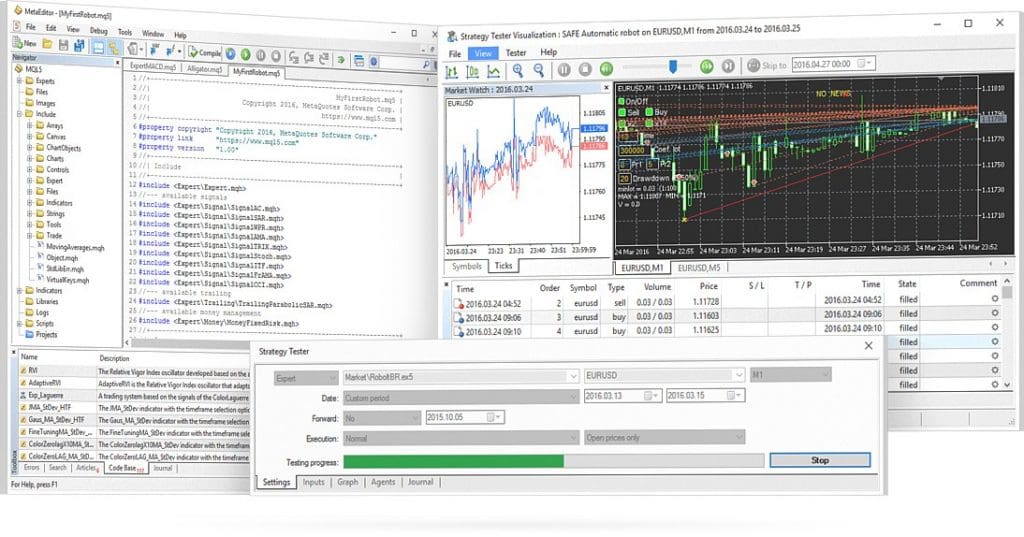

Automation & Signals

Automated tools such as crypto bots and signals can help you execute more positions faster. Trading robots basically scan the market and automatically buy and sell assets once defined criteria have been met.

There are many types of robots to choose from, which can suit various swing trading strategies. You can program bots based on volume, orders, time, and price to suit your preferences.

Similarly, some platforms offer a range of signal providers, which can be managed by another trader or fully automated. These can work well with swing trading crypto strategies as they can operate overnight when positions are still open.

Furthermore, because cryptocurrency markets are open 24/7, 365 days a year, robots can conduct deals beyond regular trading hours in any time zone. This applies even on weekends.

Technical Analysis

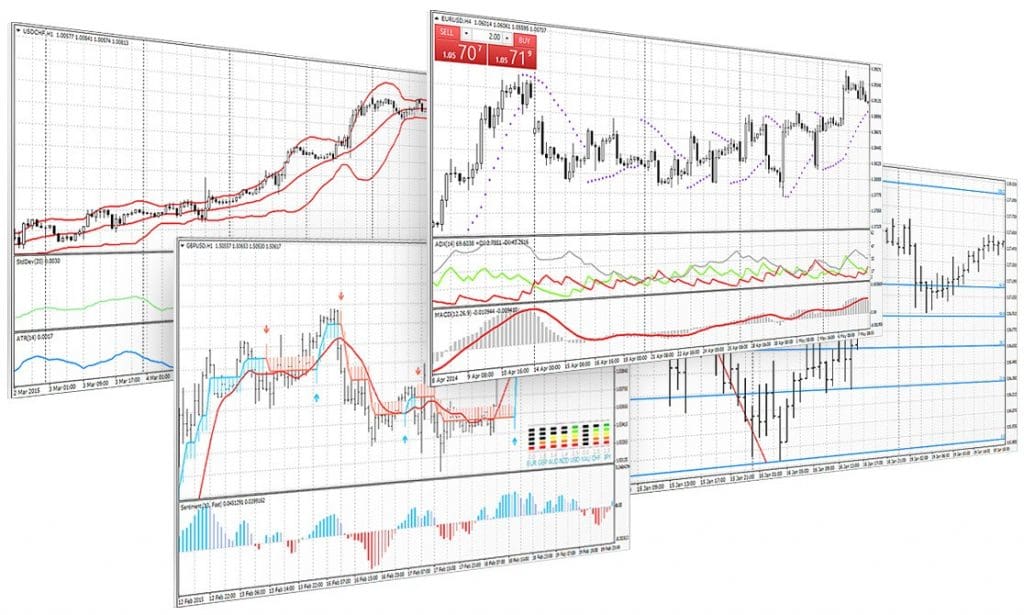

Crypto swing traders typically aim to analyze price action and candlestick chart patterns using support and resistance levels, Relative Strength Index (RSI), Bollinger Bands, Fibonacci Retracement, Volume, Stochastic oscillator, and moving averages.

Technical tools help investors identify bullish and bearish zones within the chart where they can buy and sell. Traders will therefore aim to identify two types of opportunity: trends and breakouts. Trends are long-term market movements characterized by short-term oscillations. Breakouts mark the beginning of a new trend.

Moving averages are one of the most popular tools used in swing trading. These calculate the mean of a crypto asset’s price movement over a period of time. If a crossover is identified, this can indicate a bullish or bearish momentum. You can also use moving averages as your support and resistance levels.

Risk Tools

A golden rule with any swing trading crypto strategy is not to risk more than you can afford to lose. Once you’re in a trade, setting stop-loss parameters is the best way to mitigate your risk. And since swing trading often requires holding positions overnight, stop losses can be set to protect your funds while you’re not at your computer.

These ensure that any losses do not entirely wipe out your account and that you take profit at a reasonable level. The idea here is to keep your losses small and manageable so that over time, they will be outnumbered by your crypto gains.

Other useful tools include risk management features, profit calculators, and live streams from official news platforms. Some brokers also provide simulators or demo accounts that can be used to practice swing trading strategies on crypto products.

Storage & Safety

Those interested in swing trading cryptocurrency over longer durations may discover that physically acquiring and retaining tokens is the best choice. This strategy is usually only possible without leverage, yet significant fluctuations can still provide gains. Here are a few ways to protect your long-term investments:

Hot Wallets

Hot wallets, such as MetaMask, are digital wallets that remain online. These software wallets enable speedy crypto trading by immediately connecting to exchanges.

However, because the wallet is continually linked to the internet, this easier access creates a greater danger of hackers. Exodus, Binance Chain Wallet, MyEtherWallet, and Mycelium are some popular hot wallet options.

Cold wallets

Cold wallets are a more secure means of storing cryptocurrency on a hardware device that may be unplugged from the internet, such as a hard disk drive. Because they are entirely offline and can only be attacked when plugged in, they are more protected than hot wallets.

However, because these are physical wallets, you must be mindful not to neglect the drive, or you will lose the crypto you have stored permanently. Popular options include the Ledger Nano X and the Trezor Model T, both are suitable for swing trading crypto.

Security

While investing in digital currencies, keeping your accounts and assets safeguarded is important. Risk management alerts and two-factor authentication (2FA) should be included in software systems to provide easy risk assessment and account login validation.

Regulations & Rules

Because crypto trading is still a fairly new business, laws and policies are not as detailed versus those for forex or stocks and shares trading.

Furthermore, decentralized finance (DeFi) is exactly that: decentralized. This implies that no government has the ability to trace, regulate, or ban cryptocurrency purchases (unless you use regulated derivatives brokers). Having said that, authorities are gradually catching up and imposing laws and limits.

Swing Trading Crypto Tips

Demo Account

A demo account will let you access the crypto markets in real-time and practice trading systems and techniques. Most brokers offer a free demo account that will include virtual funds, so you never risk your capital when testing a swing trading strategy.

Pay Attention To Bitcoin

Most altcoins are closely linked to the movement of Bitcoin. If the price of BTC surges, the price of other cryptocurrencies can sometimes drop. This is due to people exiting the altcoin market to ride the Bitcoin wave. With that said, if the price of BTC suddenly falls, the value of the crypto markets usually follows suit.

Fees & Costs

Since swing trading cryptos involves placing fewer trades over longer periods, the spread is also charged less frequently and is generally smaller. However, swing traders normally accumulate swap fees. Daily interest rate charges are levied on overnight positions.

Some brokers may also charge high commissions or other account-related fees, so check these before signing up. Depending on your jurisdiction, you may also be subject to crypto trading taxes.

Education

Swing trading crypto can often attract novices looking to ease themselves into medium to long-term trading. With that said, you will still need access to good educational resources and additional tools that can help you develop your knowledge.

This might include a crypto training course, a community forum, or even an online swing trading book. It’s essential to take this into account when choosing your crypto broker. Some of the best platforms even run dedicated investing academies.

Analysis

Effective swing trading crypto strategies are built on technical tools as well as fundamental analysis.

A good understanding of daily candlestick charts and basic indicators will set you off to a good start. Still, it is important to keep on top of fundamental events and financial reports that can cause swings in the market.

For cryptocurrencies, it could be worth following reputable sources such as Binance, Coin Metrics, CoinDesk, or Coin Telegraph.

Identify the Appropriate Token

The cryptocurrency market is growing at a rapid pace. There are now around 10,000 tokens available. Of course, some cryptocurrencies are more unpredictable than others. Focus on digital currencies with a significant market capitalization if you’re new to investing. These frequently traded tokens are available on numerous exchanges and marketplaces. Several of the most interesting cryptocurrencies to start with are Bitcoin (BTC), Tether (USDT), and Ethereum (ETH).

News

Announcements, events, and news are all elements to keep an eye on since they can impact the value of cryptocurrencies. Look out for what popular cryptocurrency traders, celebrities, corporations, and limited companies have to say.

Also watch for tokens to be accepted as legitimate payment by businesses, cities, or nations. Bitcoin was accepted for city fees in Zug – Switzerland, and as a legal tender in El Salvador.

Pros Of Swing Trading Crypto

Swing trading can be an excellent strategy to master and is ultimately not as demanding as other crypto investing strategies. In addition, there are other benefits:

- Longer term strategy– Compared to other forms of investing, there is no need to spend hours monitoring positions because trades can last days or weeks.

- Lower intensity– Many traders consider swing trading cryptos less stressful than day trading because of the longer timescales and lower frequency of investments.

- Trade part-time– Because of the above, it is possible to trade around your lifestyle and maintain a full-time job.

- Volatility– Due to the nature of swing trading cryptos such as Bitcoin, volatility is key. The cryptocurrency market is highly volatile, which can be lead to substantial profits.

Cons Of Swing Trading Crypto

Unsurprisingly, swing trading cryptocurrencies can also present challenges both for the inexperienced and the professional investor:

- Overnight risk– Swing trading can lead to large losses because you are holding positions for longer than day traders. You also need to take into account any overnight swap fees.

- Price gaps– Some investors may experience price gaps when holding positions overnight or over the weekend. This can happen when developments and reports occur during the after-hours market.

- Market timing– Timing market swings can be tricky, even for the experienced investor, especially in the notoriously volatile cryptocurrency space.

Final Word On Swing Trading Crypto

The allure of swing trading in the crypto market is primarily thanks to its comparatively lower level of time commitment and stress versus other forms of investing. With that said, new investors should take time to learn how to swing trade cryptocurrency assets and practice with a demo account before committing cash. Once you’ve nailed the basics, you can start determining which swing trading crypto strategies will best meet your needs. See our list of top swing trading cryptocurrency brokers in 2025 to get started today.

FAQs

What Is The Difference Between Day Trading Vs Swing Trading Cryptos?

The main difference between day trading and swing trading cryptos is the time frame used to execute trades. Day trading focuses on short-term price moves within the course of a day, whereas swing trading aims to profit from longer-term moves over days or weeks.

Is Day Trading Crypto Better Than Swing Trading Crypto?

This will depend on your personal preference and risk profile. Day trading is ideal for individuals who have the time to commit to frequent daily trades. In contrast, swing trading crypto works better for those who prefer to hold investments for longer.

How Are Crypto Swing Traders Taxed?

This depends on the jurisdiction but in the UK, for example, the HMRC taxes day trading activities based on different classifications (depending on what you are investing and how you trade them). To find out how you might be taxed, visit the respective governmental agency’s website in your jurisdiction.

What Is The Best Crypto Trading Bot?

For the best technical features, a good option is 3Commas, a web-based crypto trading bot that can implement multiple strategies. If you are looking for unique automated trading bots, Bitsgap is a popular choice for any experience level, offering a 14-day free trial for new users.

What Is The Best Indicator For Swing Trading Cryptos?

This depends on the trader, but among the best indicators for swing trading cryptos is moving averages (MA), which calculates the mean of a market’s price movements over a certain period. This helps smooth out any short-term spikes and is ideal for longer-term swing trading.

Can I Swing Trade Crypto On Robinhood, And Is It Safe?

Yes, you can swing trade cryptocurrencies on Robinhood. However, the brokerage has come under fire for mistreating and misleading retail traders and should be avoided.. It should also be noted that Robinhood is not yet available to clients outside of the United States.

Is Swing Trading Crypto Halal Or Haram?

Many Islamic scholars believe that cryptocurrency trading is permissible. Therefore Muslims can buy, keep, and trade Bitcoins under Sharia law. This applies to Muslims worldwide, not only in nations and places like Dubai, Kuwait, and Qatar. However, consult a local religious leader for official guidance.

Are There Any Swing Trading Crypto Platforms With No Fees?

It is doubtful that you will find a swing trading crypto exchange with zero fees. Most platforms take a cut through spreads, commissions or account fees to cover the costs of their services and to generate a profit. See our list of the top crypto swing trading brokers to find a firm with low costs.

Where Is Swing Trading Crypto Legal?

In most parts of the world, acquiring cryptocurrencies and swing trading derivatives is legal. This includes the United Kingdom, New Zealand, Zimbabwe, and EU nations such as the Netherlands. Even when limitations are in place, they tend to target crypto derivatives and brokers instead of traders. Having said that, other nations, such as China, prohibit all cryptocurrency-related operations. If you do reside in a country where crypto trading firms are banned, some investors turn to offshore firms to facilitate investment activities.