Ethereum Trading

Day trading Ethereum has boomed alongside wider cryptocurrency growth. Our tutorial explains Ethereum (ETH) and how to trade it. We offer tips, analysis and day trading strategies. We also explain how and where to find the best exchanges to trade this, and other, cryptos. With trading hours, volume and volatility all suiting intraday trades, Ethereum offers great opportunities for active traders.

Top Ethereum Trading Platforms

What Is Ethereum?

Ethereum is the second most valuable form of digital currency (after Bitcoin). But despite the Ethereum market being supported by a lot of the same exchanges and infrastructure that the bitcoin network has been built on, there remains an important difference.

Ethereum, unlike bitcoin was not created to be a global digital currency. It is designed to pay for only specific actions on the ethereum network, utilising blockchain technology. Anonymous purchases can be transferred all over the world and transactions stored in a decentralised ledger, the blockchain. As a result, ethereum has been adopted by online and physical stores all over the world.

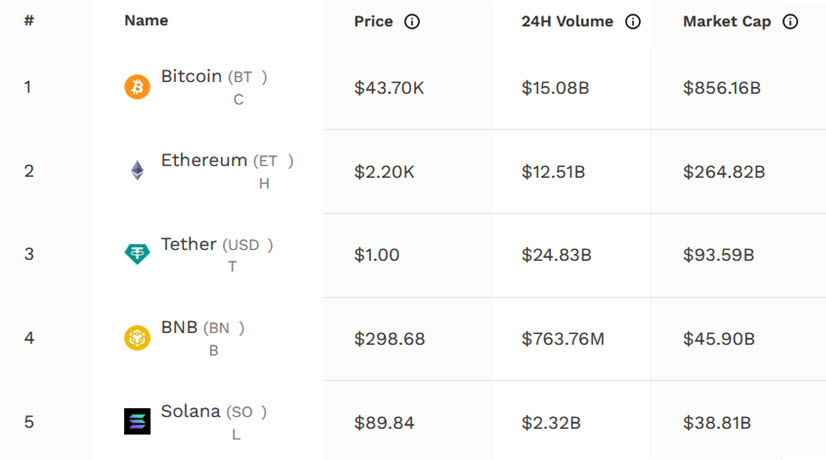

There are over 100 types of cryptocurrency that sell for more than $1 USD, but as the table below shows, ethereum is one of the big players, offering day traders attractive financial opportunities.

Why Trade Ethereum?

- Cost – Compared to traditional exchanges, you can pay just 0.25% if you choose your exchange wisely. If you haven’t got a lot of capital, day trading ethereum is a great place to start.

- Accessibility – Ethereum trading hours are 24 hours a day, 356 days a year, plus you can trade it from anywhere on the planet. All you need is an internet connection.

- Leverage – Some exchanges will offer you leveraged trading. This will grant you exposure to greater upside and downside price risk than your trading budget may normally allow. With greater risk comes greater potential profit.

- You can forget about the complexities – If you’re day trading you don’t need to have an in-depth technical knowledge of how ethereum works. You don’t need to hold a long term view on these experimental cryptocurrencies.

Comparing Ethereum Exchanges

Just a year ago there were but a handful of platform you could turn to live trade ethereum, including the most famous ‘Coinbase’. In a years time the ones that do not will be the exception. With increasing choice then, what should you look for in ethereum brokers?

Financial Factors

- Fees – Ethereum trading fees vary drastically amongst providers. Unlike buying stocks or bonds, your platform will probably charge you a percentage. Look for sites that charge a flat rate instead of opting for a percentage model.

- Margin – You can find websites that offer generous ethereum trading margins. This will enable you to borrow capital, maximising profits on a potential move. Look for brokerages that offer low interest rates when you trade on margin.

- Account types – The type of ethereum trading account you have can seriously impact on your success. Many providers will offer a number of account options. Look for companies that offer customisability, competitive spreads, and straightforward withdrawals. Going for the cheapest account may cost you profit in the long term.

- Liquidity – In the ethereum market day traders are looking to buy or sell, so it’s important to take into account the amount of liquidity the ethereum trading exchange can have. Liquidity enables you to sell without the price being substantially impacted.

Other Factors

- Trading robots – An ethereum trading bot could save you a lot of painstaking hours staring at a computer screen. An increasing number of firms offer these automated services, where once you’ve programmed in your rules, the bot will do all the heavy lifting. If you go down this route, find a company offering a continuously updated ethereum trading algorithm. It’s imperative their calculator bot changes along with market conditions.

- Customer service – With ethereum trading times running 24 hours a day, you need to choose a website who will be there to remedy any problems whatever the time. Check a brand’s customer service reviews before you sign up. Some will even promise a wait time of less than one minute for phone support.

- Trading platform – The ethereum trading platform you use will be your door to the market. Make sure you opt for a provider with a user friendly and powerful platform. You can test drive your company first to ensure their ethereum trading software will cut the mustard. But before you even do that, check ethereum trading platform reviews.

- Deposits – There is an increasing number of brokers that accept Ethereum payments. This can make it easier to trade and finance ETH positions. Alternatively, the top sites support deposits and withdrawals via other cryptos and fiat currencies.

- Mobile apps – The successful day trader is always connected to the market, but you can’t always be at your computer. Many ethereum exchanges offer intelligent and easy to use trading apps. These may save you serious money one day when the kettles boiling and the market starts to plunge.

- Regulation – You may find ethereum trading in Pakistan to be riskier than ethereum trading in the UK. This is because you need a well regulated exchange. The regulatory body will protect the market and you as the trader from a wide range of potential pitfalls.

Everyones day trading needs are different so there is no such thing as the ‘perfect universal platform.’ Instead decide which of the factors above are most important to you and go about your research with those in mind.

Ethereum Trading Forecast

Ethereum has blossomed from the cryptocurrency boom in recent years. After the gigantic profits of some of the early bitcoin followers, cryptocurrencies have gone viral. 18 months after Ethereum’s launch in the Autumn of 2015, its market capitalisation had sky rocketed to $4 billion.

Everyone wants a slice of the action and that has led to extraordinary market valuations that some argue are difficult to justify. Due to the unpredictable future of ethereum and other virtual currencies, they remain a relatively risky asset to trade.

Maybe Tim Draper, venture capitalist will be proved right when he asserted “this is much like the internet was early on. It could be bigger than anything we’ve ever seen.” However, perhaps it will be Jamie Dimon, chief executive of JP Morgan who will be closer to the mark when he called cryptocurrencies little more than a “fraud” (sending bitcoin prices plummeting by 10%).

Who will be correct is likely to be determined in the coming years as governments and corporations scramble to regulate and find a place for cryptocurrencies in the modern world. Whilst this makes placing a long term bet on ethereum risky, the volatility and exceptional ethereum trading volume make it rich hunting ground for the day trader.

Video – Ethereum Explained

Ethereum Trading Tips

The price inflation that has come with ethereum’s success means your mistakes could be extremely costly. One tip for the ethereum day trader is to be aware of momentum.

Ethereum picks up momentum extremely quickly and if you don’t react swiftly you can lose more than you make simply by missing out on price jumps. Timing is everything. It could jump up on $6 and then you might price it to buy $3 lower again, but it only comes down to $4 before jumping another $10. Then it may not even come back down to the price you sold it at, so you have to buy it back for several dollars more than you sold it for, if you want to hit the next price jump.

Trading News & Discussion Boards

Ethereum trading 101 – the world of virtual currencies is fragile, so keeping abreast of new developments is essential. When day trading ethereum you need to do everything you can to find and maintain an edge. Below are links to news resources and discussion boards that will help you stay up to date on all things ethereum.

- Coindesk

- The Street

- Coin Telegraph

- Cryptocoin News

- CNBC

- Brave New Coin

- Cyrpto Insider

Hands-On Education

With such a competitive market, simply keeping up with the news is no longer enough. You need to look to other resources for an edge. Consider ethereum trading forums and blogs to guide you through the trading process. You can also find chat websites where you can get everything explained by experienced traders.

Strategies

Capitalise On Volatility

Volatility measures the price difference of a specific financial instrument (e.g. ethereum), within a certain period of time. History shows us ethereum’s price has fluctuated up to and above 31% in a single day. Ethereum and other cryptocurrencies are known for their high volatility. Although this brings with it more risk, it also offers the smart day trader greater opportunities to turn a profit. So, make sure you look at data, patterns for signals that indicate volatility.

Technical Analysis

Those that make a profit day trading are those that hone their edge. To solidify that edge you need to be able to make market decisions based primarily on price charts. Mastering ethereum trading analysis takes time and practice. Set up a demo account to get familiar with the basics of charts and patterns. These simulator accounts are funded with virtual money, allowing you to flush out any mistakes before you put real money on the line.

Money Management

An essential component of your day trading ethereum strategy needs to be money management. You can never predict with total accuracy what will happen in the market, so you need an effective money management strategy at all times. This will minimise your losses when you make mistakes and maximise your profits when you get it right.

Price

The price of ethereum fluctuates massively, which is part of the reason it makes for a dynamic  and exciting instrument to be trading in. Look for the ethereum trading symbol in the price chart below. Here you will be able to view the ethereum trading price and rate before you start day trading.

and exciting instrument to be trading in. Look for the ethereum trading symbol in the price chart below. Here you will be able to view the ethereum trading price and rate before you start day trading.

Regional Differences

Regulation

Ethereum trading in India and Singapore may be different from ethereum trading in Australia and the Philippines. This is mainly down to regulation. As countries and companies rush to react to the emerging market, cryptocurrencies are susceptible to serious knocks. For example, in September of 2017, the Chinese government stated they were banning the raising of funds through Initial Coin Offering (ICO). As a result, trading in Ethereum dropped by a massive 23%.

However, despite ICO bans in China and South Korea, ethereum trading in Malaysia, South Africa, the UAE, UK and Europe remains on the rise. It is Japan who has a big part to play in this revival. Retailers, airlines and hotels have all started to integrate cryptocurrency as a transfer method. No other region on the earth comes close to the adoption of cryptocurrencies that Japan has.

So, before you start trading ethereum in Canada, Dubai or anywhere else, find out how the country is or planning to regulate virtual currencies, otherwise you may find yourself in an expensive predicament.

Once you’ve got the green light, look at specialist trading platforms. Certain ethereum trading sites and platforms in India, for example, have been streamlined for ethereum trading. You may find a specialist platform will give you faster execution speeds and more competitive spreads if you want to make ethereum your bread and butter.

Taxes

The other varying factor to be aware of is taxes. Ethereum trading in Hong Kong may cost you significantly more in tax than trading ethereum in Nigeria. If you’re going to start day trading ethereum you must look at that countries tax regulations first, otherwise you might lose an unnecessary amount of profit to unfavourable tax rules. Find out what sort of tax you will have to pay and in what quantities.

Take Away Points

Ethereum is a volatile and unpredictable asset class to start day trading. However, whilst its future remains uncertain, there’s plenty of opportunity to yield substantial profits. With technical analysis, news, and an effective money management strategy, you’re in a strong position to start trading ethereum today.