Why do repo market rates often spike?

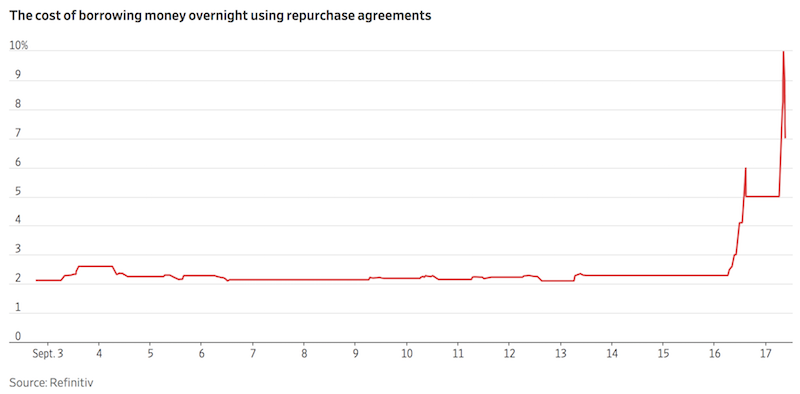

Recently, rates in the overnight USD funding market – of which the repo market is a subset – spiked higher.

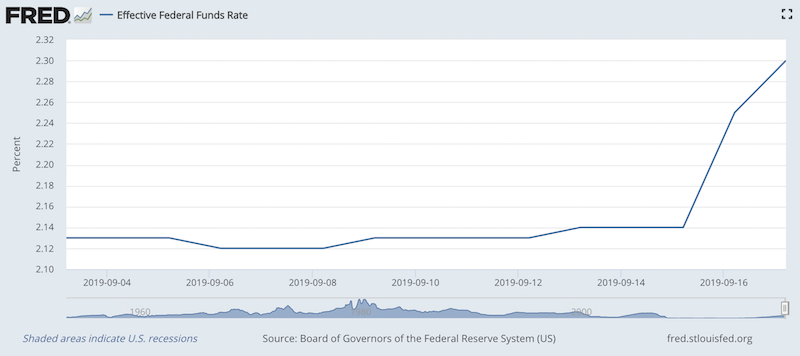

The effective fed funds rate (EFFR) also went higher, which also happened to be the eve of FOMC lowering the rate 25 basis points (0.25 percent).

Some wire houses reported repo levels at or near 10 percent. This compares to the overnight rate set by the Fed of just slightly over 2 percent.

While the extent of the move was unexpected, some with knowledge on the short-term / overnight funding markets anticipated that stress would occur during September through year-end, pending a resolution (potential ways of which we’ll get into down below).

Part of this had to do with the US Treasury Department’s recent announcement that it would need to substantively increase its borrowing while increasing its General Cash Account at the Federal Reserve.

When financing needs rise, this reduces reserves (i.e., cash held at banks) from the financial system. Primary dealers purchase the securities in exchange for cash. This represents a cash transfer out of the private sector and into the Treasury.

The reduction in reserves leads to a bidding up of the costs of overnight financing, as cash is less available.

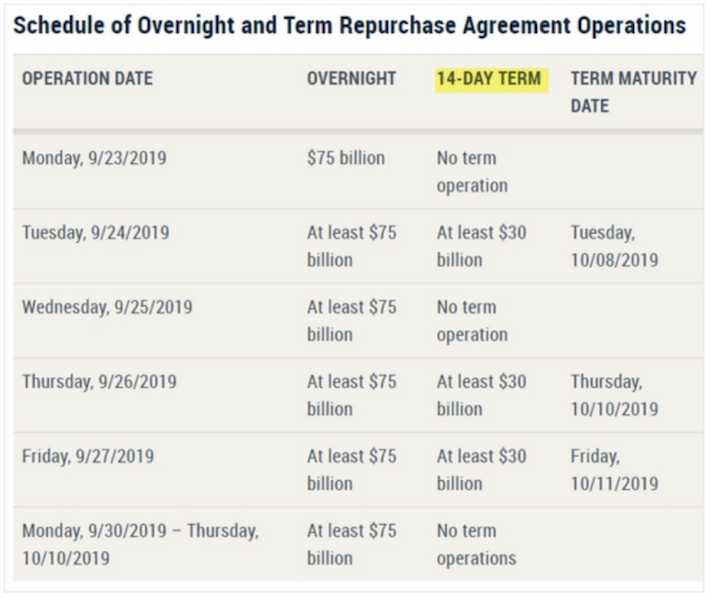

Given the Fed lacks a standing repo facility, which is in the works (but takes time to implement), the Fed is limited to temporary reserve injections. The Fed creates reserves – basically creating money out of thin air – and participates in the repo market directly. The New York Fed put more than $100 billion into the banking system earlier this week to keep cash available for borrow and push the rate back down into the desired range.

If the reserve shortfalls were to persist, then the Fed would need to engage in another round of quantitative easing (a type of “soft QE4”). This would be more for technical reasons and to keep the repo market rate on par with the fed funds rate that the central bank controls, rather than for fundamental reasons like in previous quantitative easing programs.

Repo Market Background

First, let’s cover some background in more detail:

(1) What is the repo market?

(2) Who are the main players in it?

(3) Why is it important?

(4) What is the inter-linkage between Fed monetary policy (which is a key driver of where financial markets move) and the repo market?

(5) How big of a deal is this for other asset markets?

(6) How could we quantify the effect on asset markets?

(7) What does it mean for you as a trader?

(8) And what should the Fed do about it, which can have a material impact on markets?

(9) How does this impact SOFR, LIBOR’s eventual replacement?

What is the repo market?

A repo transaction is a short-term lending agreement where one party will lend out cash in exchange for the equivalent value of securities as collateral. This allows companies that own securities to borrow cash cheaply while allowing companies with cash to earn a small amount of interest while taking negligible risk.

The agreement generally states that a cash borrower will agree to repurchase (“repo” for short) the securities at a later date at a slightly higher price. Often, it is as soon as the next day. The differential in this price, when annualized, forms the repo rate.

Not all repo market transactions have set maturity dates.

Many do, called term repo transactions.

Some are open-ended contracts, called open repo transactions. These have flexible maturity dates. Namely, it will mature unless renewed at the discretion of either party. Or have no agreed upon maturity date but can be terminated by one party or the other based upon some predetermined timeframe.

Spikes in the repo rate can happen for numerous reasons.

Higher budgets deficits, which lead to more debt issuance, can lead to a higher rate. Dealers will have more of these bonds to use as collateral and can charge more for loans. At the same time, when there is a shortage of cash in the system, borrowers are more likely to pay a higher rate to access it. Cash shortages are more likely to occur when the central bank is running a tight monetary policy. Companies are less likely to be able to borrow at favorable rates, which may slow down the economy and reduce risk appetite in risk asset markets (e.g., stocks).

Who are the main players in the repo market?

The repo market affects most participants in the financial system, from large institutional firms to individuals with savings accounts.

Investment banks and hedge funds with large inventories of securities are often lenders in the repo market. They have securities, but wish to repo them out for cash to fund the everyday operations of their business.

Cash providers include other types of asset managers and money-market funds that lend out their cash for extra return.

Why is it important?

The supply and demand for short-term funding will tend to closely match the overnight rate (sometimes known as a “cash rate” or “deposit rate”) set by the central bank. This rate is closely monitored by traders as it works to set interest rates throughout the entire economy. It works to determine, for example, the rate that savers will earn interest on their deposits and the rates at which borrowers will pay in the capital markets.

Interest rates are the bedrock of finance. With respect to asset prices, is the rate at which future cash flows are discounted back to the present. It is largely the changes in the term structure of interest rates that causes asset prices to move, particularly at the macro level.

The other part of the equation, earnings or cash flows, are relatively predictable over the long-run. So, it’s interest rates that primarily dictate the volatility. Strong economies can be accompanied by falling stock prices if it means credit markets will tighten through higher rates than what’s discounted into the forward curve.

Some central banks use the repo rate as their main or one of their main policy levers. In the US, the difference between the fed funds rate and repo rate is typically small, as they roughly run in parallel and capture the same type of lending rate (overnight, daily, or intra-day lending).

Whenever there is a wide disparity between the two – as there was when the repo rate blew out to 6 percent on September 16 and then again to 10 percent on September 17 – and explanations as to why are limited, it raises concern of a possible liquidity crunch. Many companies use the short-term lending market to help keep the lights on overnight, particularly multinational corporations. The inability to access funds for basic working capital requirements needs could through some businesses for a loop operationally.

What is the inter-linkage between Fed monetary policy and the repo market?

When the Federal Reserve adjusts interest rates, it is adjusting the fed funds rate. The fed funds rate represents the rate at which banks and other parties borrow from each other on an unsecured basis (i.e., no collateral required).

Reserves are a form of money that is held at the Fed. (It is important to distinguish money from credit. Money is what you settle your payments with. Credit is a promise to pay.)

Reserves are money, not a promise to pay, because they settle payments and other forms of business transactions between banks. The borrowing rate is the fed funds rate and normally kept within a 25-bp range.

When the Fed lends in the repo market, it lends reserves.

Where do these reserves come from? The Fed makes them. That’s part of the central bank’s statutory power.

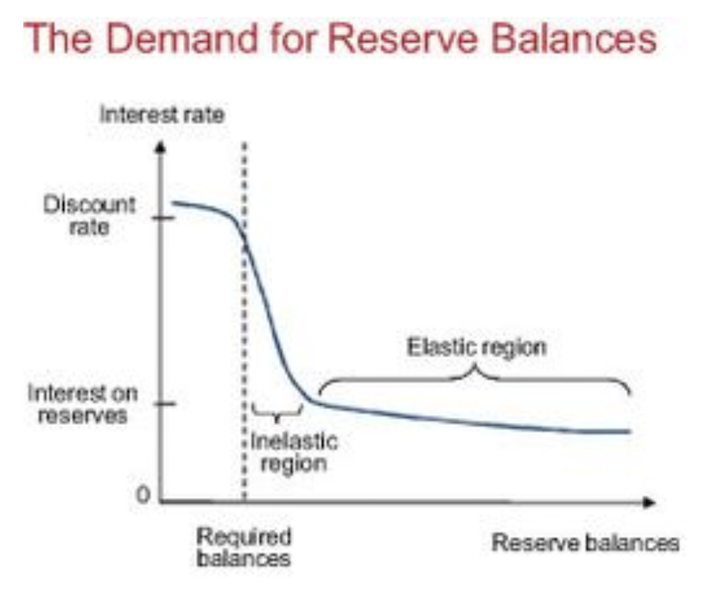

The Fed is able to add more reserves through its participation in the repo market. When the supply of reserves is insufficient relative to their demand, this can cause the equilibrium repo rate to increase. If the same scarcity of reserves is also present in the fed funds market, this can cause the fed funds rate to spike as well.

How big of a deal is this for other asset markets?

Because the repo market involves such short-term transactions, borrowers may not be overly sensitive day-to-day as to the interest cost, as it’s relatively small.

For example, let’s say a company wants $10 million in cash. If the repo rate is 2.25 percent, and we assume a flat 365 days per year, the daily interest cost on that is $616. For any company borrowing that much to fund short-term working capital requirements, $616 is a relatively small sum.

If there is a scarcity of cash available on the repo market, but the company still wants to borrow $10 million, it might not view paying 5.50 percent on a repo loan as that extravagant if it’s simply a one-off event. That means the daily interest cost is only an extra $900 (about $1,500 total). If the repo rate is back to normal the next day, that additional interest expense paid is very small.

So, in the short-term, there is not acute sensitivity to the price on these loans. It’s usually a one-time extra interest charge that is mostly trivial for the types of companies who demand these lending arrangements.

The problem, of course, would be if there was a longer-term scarcity of cash available in the repo market and the rate remained elevated. In this case, the Federal Reserve would be forced to step in to resolve the issue as the liquidity backstop of the economy.

Because the issue is typically transitory and has a very small effect on overall corporate capital costs, these spikes generally don’t propagate much, if at all, into other markets like stocks.

How could we quantify the effect on asset markets?

Let’s look at some more concrete data to illustrate why risk asset markets don’t care much about repo market spikes, assuming they’re ephemeral in nature.

Over the past three months, $7.236 trillion of volume has been done in the tri-party / GCF repo market. That comes to roughly $40.7 billion in interest expense if we assume a rate of 2.25 percent. Even if the repo rate doubled to 4.50 percent and stayed elevated over two days, that’s only an extra $905 million in interest expense. This assumes perfectly inelastic demand.

(Inelastic demand meaning if they want or need the cash and view the higher repo rate as a one-time extra expense, they may still be quite likely to borrow anyway. It’s not a perfect assumption, but will give a feel for how costly these spikes are likely to be and the impact on asset markets.)

Annual corporate earnings of US companies, public and private, are approximately $1.9 trillion per quarter. $905 million is about 0.05 percent of that assuming the matter remains wholly localized in the repo market with no knock-on effects in others. So, equity markets don’t pay very much attention.

Why did the repo market move?

There’s likely a confluence of factors. Fundamentally, the repo rate spiked because cash borrowers (i.e., securities lenders) were willing to pay a higher price to obtain cash.

September 16 was the deadline for companies to submit their quarterly tax payments. Money-market funds were drawn down to help fund these payments.

On Monday, the US Treasury Department also held auctions to sell $78 billion worth of securities. This means liquidity was taken out of the financial system. In other words, cash was exchanged from private sector institutions to the Treasury for securities.

The Fed will be committed to rolling its financing operations through mid-October in order to contain any liquidity gaps in the funding markets. It will also offer some term financing, with a maturity of 14 days.

What does it mean for you as a trader?

When repo rates see a sudden spike upward, traders will want to know whether this is a temporary phenomenon where the dislocation will be transitory or whether it is representative of a more serious underlying problem in the short-term lending market.

If there is a lack of cash in the financial system that the central bank is slow to rectify, or there is a certain systemic reason why banks and companies (or banks amongst each other) aren’t doing business with each other, then it could be evidence that deeper underlying issues are brewing.

But all in all, if you are not directly involved in the repo market lending out securities or borrowing cash, it probably doesn’t impact you very much either business-wise or in the markets you trade.

What should the Fed do about it?

The Federal Reserve moved from a corridor to floor system in October 2008 and sets its policy through paying interest on excess reserves.

The fewer excess reserves that are available, the harder it is to control the fed funds rate within the targeted range.

Moreover, the lack of reserves can bleed over into problems in the repo market.

The Fed has the following options:

(1) Introduce a standing repo facility (SRF)

In the FOMC minutes from earlier this year, the Fed is considering the implementation of a new standing repo facility to avoid undesirable changes in the fed funds rate due to an insufficient supply of reserves and also to incentivize banks to hold other types of securities in their liquid portfolios outside of reserves. This would boost global dollar liquidity.

But this will take some time. It took over a year for the Fed to get the ON RRP system going.

(2) Put a cap on the foreign RRP facility

There is approximately $300 billion worth of dollar liquidity held within the Fed from foreign official accounts.

The New York Federal Reserve has the authority over the extent to which foreign official accounts can park liquidity with the Fed. Capping the RRP would boost reserve availability in the banking system and force foreign official accounts to either buy other assets or increase lending to the private sector (rather than comfortably generating returns on reserves by simply holding them).

(3) Restart balance sheet purchases on some moderate level (a type of soft QE4)

The Fed will need to do this anyway very soon. Cash in circulation tends to grow at around 7 percent per year. This is a liability of the government. Thus, they need a corresponding asset to keep the balance sheet balanced.

(4) Cut IOER (interest on excess reserves) rates while keeping RRP rates steady

When the interest paid on excess reserves is less, banks are less incentivized to hold them, making them more freely available.

Options 1, 2, and 3 would all be positive news for dollar liquidity. Any positive dollar liquidity news would boost US Treasury yields, be negative for the dollar, and have positive effects in the real economy, such as manufacturing.

How does this impact SOFR, LIBOR’s eventual replacement?

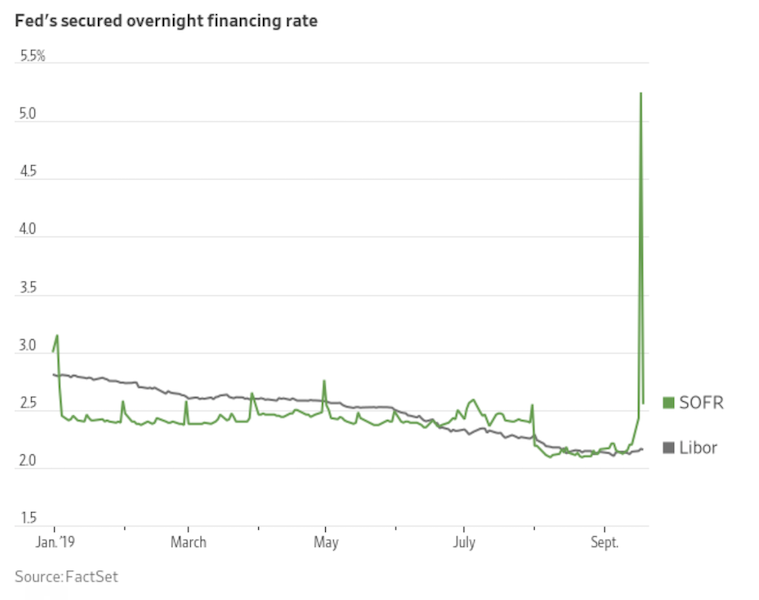

The repo market volatility has spurred additional concern by traders, regulators, and bankers regarding LIBOR’s eventual replacement, called the secured overnight financing rate (SOFR). LIBOR is the current reference rate for hundreds of trillions of dollars of derivatives and floating rate bonds, loans, and other credit securities. However, it fell out of favor after a manipulation scandal convinced central bankers and other market overseers that it should be phased out by December 2021.

The New York Fed has convened a committee from various disciplines to direct the transition away from LIBOR, known as the Alternative Reference Rate Committee, or ARRC.

All are in agreement that it is necessary to have a reference rate that:

a) accurately reflects the risks associated with short-term lending, and

b) is supported by a liquid market that operates in a consistent, predictable way.

Properly setting the rate on business and consumers loans is important to determine whether loans are affordable for borrowers and profitable for lenders.

When SOFR appears unstable it undermines confidence in the rate as a fallback to LIBOR. When repo rates spike well above the fed funds rate it indicates that the Fed has lost control of the short-term funding markets. Moreover, the extra volatility also raises concerns whether the SOFR to LIBOR transition will be completed within the next two-year window.

SOFR is calculated based on the rates pertaining to certain Treasury repo transactions. While LIBOR remained stable during the repo spike, SOFR spiked about 3 percent higher.

If these funding gaps that induce volatility in the repo market become more frequent, it could reduce confidence in SOFR as a viable LIBOR replacement as the new reference rate.

Nonetheless, this risk isn’t perceived to be very high. SOFR has some integrated guardrails to smooth the rate over time.

SOFR excludes any extreme high and low transaction rates so that the published rates are less susceptible to volatile market conditions. During the mid-September spike, certain transaction rates were over 9 percent, though the published SOFR rate was approximately 5.25 percent. This was an increase of 2.8 percent over the previous day, but less than the 6 to 7 percent peak to trough figure.

Moreover, the values of most traded rates contracts, including SOFR, are averaged over the course of one month. When SOFR is used in transactions, the rate is averaged out over 90 days. This helps to considerably smooth out any day to day volatility.

Final Thoughts

For those interested in the details of monetary policy and how the “plumbing” of the system works, the repo market spike was fascinating. For traders in all other markets, it doesn’t matter much, as the change was driven by duller monetary technicalities.

Higher amounts of volatility in the repo market can act as a type of warning sign in the trading and investing community, as this niche of the market became dysfunctional during the financial crisis as well.

However, the picture is very different relative to back then. Banks are not stressed for funding. Moreover, mortgage-backed securities are not the focal point of the issue. Instead the demand was driven by Treasuries, which are broadly considered the safest forms of bonds available globally.

September’s liquidity squeeze in the repo market was some combination of high corporate tax receipts and a large issuance of Treasury bills occurring on the same day. This drained bank reserves.

With a lack of bank reserves, some financial institutions had to scramble in order to meet certain regulatory requirements. The repo market is a primary source of reserve funds, and this spilled into other short-term lending markets such as fed funds, in which banks lend to each other overnight.

This triggered action by the Federal Reserve, which created over $100 billion in reserves and participated in the repo market directly in order to get these short-term funding rates back down into the desired range.

These funding gaps are more technical and mechanical rather than fundamental or systemic. They reflect an issue with the financial plumbing of the banking system that can occur when there are insufficient reserves in the financial system.

Other markets, such as US Treasuries, equities, and high-yield credit, had no perceptible response to the repo market issue. This reflects, correctly, that these spikes are unlikely to bear any macroeconomic or systemic consequences provided that they remain infrequent and don’t raise lending rates for very long when they do. The Fed has the ability to counteract these moves as necessary through its open market operations.

After the 2008 financial crisis, regulatory measures have put a large emphasis on bank liquidity. Part of this includes the need to hold reserves in order to effectively handle rougher economic waters in the future, such as a large drop in economic growth or a higher rate of unemployment.

US banks are required to hold at least $1 trillion more in total reserve balances beyond what is required – called “excess reserves”. These provide a buffer source of liquidity and have various uses within the payments system.

One way to reduce the risk of these liquidity shortfalls occurring in the future would be to set up a standing repo facility. This would act like a permanent liquidity release valve that would help self-correct any liquidity gaps. The Fed is likely to develop and implement this sometime in the future, and perhaps as soon as next year.