What Are the Next Central Banks to Throw in the Towel?

In interest rate swap contracts, traders betting on rates declining will do what’s called “receiving” – or receive the fixed rate while paying the floating rate. Those who bet on interest rates rising will “pay” – pay the fixed rate and receive the floating rate.

Central banks throughout the developed world are in an easing cycle. Namely, they are in the process of lowering rates (and/or buying assets to help lower long-run yields) in response to slowing growth and inflation expectations.

What central banks are expected to ease next?

Canada

The Bank of Canada (BoC) has some of the highest dovish reassessment potential. Accordingly, CAD rates are likely to be another upcoming receiver case. Canada is a debtor country with twin deficits (i.e., fiscal and current account deficit). Their inflation and growth prospects are skewed to the downside, which is true in almost all developed economies.

Canadian inflation is sticking to around the 2% range.

Core inflation (excluding energy) boosts inflation to 2.6%, which is high these days for a G10 economy. (Most central banks prefer using core inflation by excluding volatile commodity items, such as energy and food. Studying the trend is more important than measuring the exact number.)

The BoC is also traditionally behind the US Federal Reserve, preferring to follow the world’s most influential central bank rather than leading it. This could be short-term bullish for CAD due to the widening rate differential, or the rates paid on CAD versus those paid on USD, which is often a material determinant of a currency’s relative price. Currencies are heavily driven by their domestic rates and credit markets.

Nonetheless, back in 2014-15 when both the European Central Bank and Bank of Japan had quantitative easing running, rate differentials could explain 30 percent of the daily movement in the USD. Now rate differentials only explain about 15 percent of the daily movement for the USD, and they explain none of the daily movement in the euro.

Great Britain

Another likely receiver case is GBP, perhaps even more so than CAD. The 5-year / 5-year-forward rate has declined markedly in USD and EUR, next is GBP.

Headline inflation is currently hovering around 2%. (Core is slightly lower at 1.8%.)

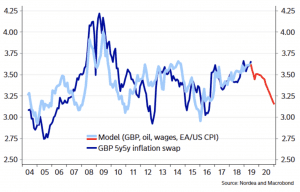

The graph below shows the recent divergence in US and EU inflation expectations versus those of the UK moving forward:

Nordea bank’s forward model of UK inflation based on the relative strength of the pound, oil, wages, and euro area and US inflation is as follows (points down):

Without access to inflation swaps, your closest bets are on UK gilts and the GBP. If you believe that inflation is heading lower and the Bank of England will need to ease more than anticipated going forward, being long gilts and short the GBP would be ways to play that expectation (disclaimer: not advice).

Will the US dollar decline going forward?

The short-run

Dollar outperformance versus other G10 currencies is largely due to the US economy doing better than its developed world counterparts. This has helped push USD relative real (inflation-adjusted) rate differentials higher. This has made it more attractive to hold dollars.

The US starts their easing cycle from a relatively high level from the rest of the world. Overnight rates are 240 basis points and the Fed has been selling off its asset portfolio, which effectively reduces the money supply, holding all else equal. This helps create a scarcity of dollars. Scarcity helps to boost the price of any commodity, holding demand constant.

But the US dollar isn’t expected to depreciate materially against either the euro or Japanese yen unless the quantitative easing programs of these two countries is unwound and they see higher real rates. That’s not particularly likely. Even taking into account the US current account deficit, the USD isn’t particularly overvalued in the short-term.

The long-run

It is my opinion that the USD is overvalued in the long-run. The US trade deficit is higher than what is sustainable in terms of debt stability. Net external debt is around 45% of GDP.

As a whole, there are too many liabilities in terms of debt and non-debt items (e.g., healthcare and pension obligations) and there won’t be enough assets produced to make good on these claims.

This means central banks (the Fed, in the case of the US) will need to “print” money in order to help service these claims. Other countries have these same issues, so developed market currencies are likely to depreciate relative to gold.

The US dollar has a negative correlation to gold, which largely stems from the Bretton Woods system (1944-1971) and its status as the world’s top reserve currency. The agreement put the US dollar on the gold standard (i.e., the USD was convertible to gold at an agreed-upon price) and established it as the primary currency to be used in global commerce. Other currencies had the obligation to maintain a fixed exchange rate with the dollar.

Gold is considered a shadow currency or an alternate currency. It has been used, along with silver to a lesser extent, as a currency backing throughout history, to create a more disciplined monetary regime. Nonetheless, when debt conditions become onerous enough, governments inevitably prefer to break the hard backing and devalue their currency instead. It’s typically the easiest way out of a debt crisis when the capacity to lower interest rates is limited and austerity and wealth transfer payments are too painful or not feasible.

How much stimulus is left in the tank?

In the US, there still remains some amount of traditional stimulation capacity remaining to squeeze more out of stocks and bonds going forward. However, after the rates and bond market stimulus channels are no longer effective – when rates are somewhat below the zero lower-bound – central banks will need to branch out over to different stimulus forms.

This includes debt monetizations and currency devaluations. That’ll drive more assets to “inflation-hedge” assets like gold. Lower real rates are broadly supportive of commodities more generally.

I should note that calling gold an “inflation-hedge” can be misleading because you don’t need inflation for it to be a good thing to hold in a portfolio. The policy measures that drive a material fraction of its movement are inherently inflationary. For example, lower rates, quantitative easing, debt monetization, and currency devaluation are all stimulative, “inflationary” measures.

Why don’t they necessarily cause inflation? Because these measures, as employed during and after the financial crisis and to an increasing extent now, are directly counteracting deflationary or disinflationary forces. If the amount of money put into the system offsets the deflationary impulse generated from a slowing economy, then prices won’t move at all.

While the traditional mindset might say that “printing” a lot of money is inflationary, if this is simply counteracting deflation, then prices won’t move at all. In fact, if the stimulus measures aren’t sufficient then prices will contract.

Gold’s valuation is a function of, and proportional to, the amount of money and reserves in circulation relative to the global gold stock.

Of any currency moving forward, I think gold is best suited to thrive. Secondarily, creditor countries that don’t have dollar- or foreign-denominated debt issues – e.g., Japan (JPY) and Switzerland (CHF) – are places that may be well-suited to taking advantage of this trend as well.