Magical Formula Investing (Origin, Principles, Formula)

Magical Formula Investing is a financial market strategy developed by Joel Greenblatt, a well-respected finance professor and fund manager.

This method combines two key financial metrics:

- earnings yield and

- return on capital

The goal is to systematically identify high-quality companies at bargain prices.

We’ll look at the approach and also distill how day traders and shorter-term traders can benefit from the approach as well.

Key Takeaways – Magical Formula Investing

- Value and Quality Focus

- Magical Formula Investing prioritizes undervalued, high-quality companies.

- It uses earnings yield and return on capital as metrics.

- Systematic Approach

- It employs a disciplined, rule-based strategy to select and rotate stocks annually (help reduce emotional biases).

- Longer-term Strategy

- Designed for long-term investment.

- Emphasizes patience and consistency over quick gains.

The Origin and Principles

Joel Greenblatt introduced this strategy in his book, “The Little Book That Beats the Market.”

Greenblatt argues that by focusing on two fundamental factors – a company’s earnings yield (profits relative to price) and return on capital (how effectively a business uses its resources) – traders/investors can systematically identify quality companies at bargain prices.

Greenblatt’s “magic formula” ranks companies based on these factors. Buying high-ranking stocks and holding them for at least a year offers a straightforward path to generating above-average returns.

The book emphasizes that market fluctuations are inevitable, but by sticking to the formula and maintaining a long-term perspective, traders/investors can significantly boost their chances of financial success. Greenblatt backs up his claims with a clear investment philosophy and performance data from his own hedge fund.

This aligns with the philosophy of value investing.

This isn’t to say that day trading isn’t valid; it’s just that Magical Formula Investing has a different focus.

Core Principles of the Value Approach

Intrinsic Value

Greenblatt believes every company has an intrinsic value – its true worth determined by its ability to generate future cash flows.

The market price of a stock doesn’t always reflect this true value, creating opportunities for traders/investors.

Mr. Market

Drawing on Benjamin Graham’s analogy, Greenblatt views the stock market as “Mr. Market,” an irrational individual prone to mood swings.

Mr. Market often offers you companies at prices far above or below their intrinsic worth, and the value investor’s job is to capitalize on these mispricing

Margin of Safety

Value investors like Greenblatt insist on a margin of safety – buying stocks trading well below their intrinsic value.

This margin provides a buffer against unforeseen circumstances and increases the potential for significant returns when the market eventually realizes the stock’s true worth.

Core Components of the Formula

Earnings Yield

Earnings yield may be calculated by dividing a company’s earnings before interest and taxes (EBIT) by its enterprise value (EV).

Sometimes it’s simply earnings per share (EPS) divided by the share price (if debt is ignored).

This metric helps in identifying undervalued stocks.

It provides a comparative measure of a company’s profitability against its current market price.

Return on Capital

Return on Capital (ROC) is another element.

It’s determined by dividing EBIT by the total capital employed (net working capital + net fixed assets).

A high ROC indicates a company’s efficiency in generating profits from its capital.

This highlights businesses with a competitive advantage.

Application of the Formula

Investors using the Magical Formula rank stocks based on earnings yield and return on capital.

They typically select the top-ranked companies to create a diversified portfolio.

By ranking companies based on a combination of cheapness (earnings yield) and quality (ROC), Greenblatt’s formula tries to identify great companies temporarily undervalued by the market.

The formula suggests re-evaluating the portfolio annually – i.e., selling off the underperformers that no longer fit the threshold, and reinvesting in newly ranked top companies.

Investment Style: Value with a Quantitative Edge

Greenblatt’s philosophy is primarily value investing, but the magic formula adds a quantitative element:

Value-Oriented

It focuses on buying undervalued assets with a margin of safety.

Quantitative Approach

The use of specific metrics and a ranking system adds a systematic, unemotional element to the investment process.

Why it Works (According to Greenblatt)

Greenblatt believes his approach works because the market often overreacts to both good and bad news, creating opportunities to buy great companies at bargain prices.

By being disciplined, sticking to the formula, and adopting a long-term perspective, traders/investors can allow the market to eventually recognize the true value of their holdings – leading to outsized returns.

Key Concepts and Strategies

The Magic Formula is Greenblatt’s core framework provides a systematic method for finding “good companies at bargain prices.”

Here’s how it works:

1) Ranking

Large companies (usually those in the top 3000 by market capitalization) are separately ranked based on:

- Earnings Yield = EBIT / Enterprise Value

- Return on Capital = EBIT / (Net Working Capital + Net Fixed Assets)

Combined Ranking

The two rankings are combined to determine an overall magic formula rank.

Stocks with the lowest combined rank (the top of the list) are considered the most attractive potential investments.

Example

Company A has a high earnings yield (cheap) but a low ROC (potentially lower quality).

Company B has a low earnings yield (expensive) but a high ROC (high quality).

The magic formula would rank both companies in the middle.

Company C with a high earnings yield AND a high ROC would be ranked among the most desirable investments.

2) Buying and Holding

Greenblatt’s philosophy isn’t about trading for quick profits. Here’s the approach:

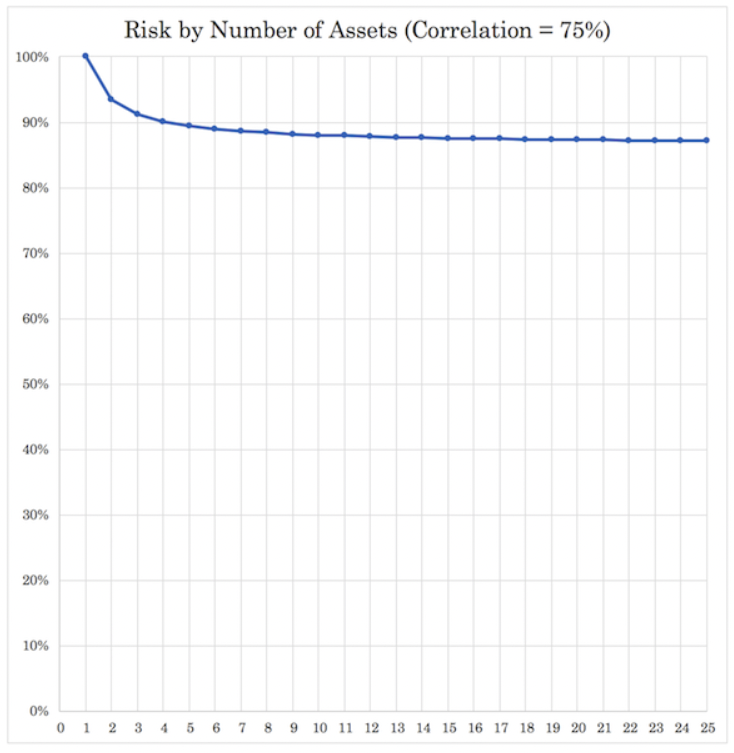

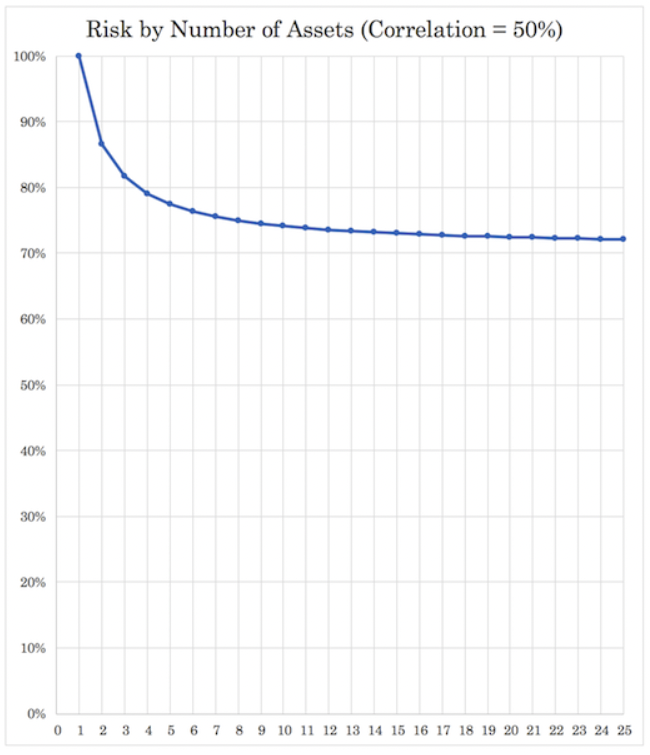

- Portfolio Construction: Buy a basket of the highest-ranked stocks (e.g., top 20-30) according to the magic formula. Past a point, the extra diversification gains are low, as we illustrate below, given individual stocks are relatively highly correlated (60-75% usually).

- Rebalancing: Periodically (about once a year), re-run the formula, selling those that have dropped out of the top ranks and investing in new top- ranked companies.

- Long-Term View: Hold stocks for at least a year to allow time for the market to recognize their value and for the benefits of the magic formula to be realized

3) Special Situations

Apart from applying the magic formula directly, Greenblatt discusses “special situations” that can create trading or investment opportunities.

These include:

- Spin-offs: When a parent company spins off a subsidiary, the new company may be temporarily mispriced, creating a value opportunity.

- Mergers and Acquisitions: The market often reacts to announced mergers or acquisitions before fully understanding the deal’s potential impact, creating a chance for investors to find mispriced stocks.

- Restructurings: Companies undergoing significant changes might be misvalued by the market due to the uncertainty surrounding their future performance.

- Example: A well-run subsidiary is spun off from a larger conglomerate. Due to lack of immediate attention from investors, this new, independent company may be trading below its true value.

4) Importance of Patience and Discipline

Greenblatt repeatedly emphasizes these qualities as vital for success:

- Market Volatility: The stock market fluctuates. Don’t get discouraged by short-term declines; focus on the long-term potential of your investments.

- Follow the Formula: Sticking to the magic formula ranking process helps prevent emotionally driven decisions and reduces the risk of making impulsive investment choices.

Important Considerations

- No guarantees: Greenblatt presents compelling data on the formula’s past performance, but markets are dynamic, and past success doesn’t ensure future results.

- Customization: Some investors adapt the formula by adding filters for specific industries or adjusting the weights given to earnings yield and ROC.

Step-by-Step Process or Application

Here’s a breakdown of the step-by-step process outlined in “The Little Book That Beats the Market”:

Screening and Ranking

- Universe of Stocks: Start with a broad list of companies, typically those with a market capitalization above a certain threshold (e.g., $50 million). Greenblatt used the top 3000 companies for his analysis.

- Calculate Metrics: For each company, calculate Earnings Yield (EBIT / Enterprise Value) and Return on Capital (EBIT / Invested Capital).

- Rank Stocks: Rank companies separately based on their earnings yield and ROC. Then, combine these rankings to create a final magic formula ranking.

Portfolio Construction

- Selection: Invest in a diversified portfolio of the highest-ranking stocks (generally, the top 20-30 from your list).

- Equal Allocation: Greenblatt recommends allocating capital equally across your chosen stocks for simplicity and to spread risk out.

Rebalancing

- Frequency: Re-run the magic formula periodically (Greenblatt suggests annually) to update your stock rankings.

- Sell Losers, Buy Winners: Sell stocks that have fallen out of the top ranks and replace them with newly identified high-ranking stocks.

Risk Management and Monitoring

- Long-term Hold: Aim to hold your investments for at least a year to allow the formula to work, and to maximize tax benefits.

- Diversification: By holding a portfolio of multiple stocks, you spread your risk across different companies and sectors.

- Stay Informed: The formula is designed to be mechanical, but it’s still wise to monitor the general health and fundamental news of the companies you invest in.

Additional Tips

Online Tools

Greenblatt provides a website (https://www.magicformulainvesting.com/) with resources and tools, and there are other online screeners as well.

Special Situations

Keep an eye out for spinoffs, mergers, and companies undergoing change – these may present opportunistic value investments.

Strengths

Here’s an assessment of the strengths and weaknesses of Greenblatt’s approach:

- Simplicity: The magic formula is easy to understand and implement, making it accessible to investors of all experience levels.

- Discipline: The formula promotes a systematic approach, reducing emotional decision-making and the temptation to chase hot stocks.

- Backed by Evidence: Greenblatt provides historical data supporting the formula’s potential to outperform the market.

- Focus on Value: The emphasis on buying undervalued, quality companies aligns with timeless value investing principles.

Relevance Today

The magic formula remains valuable, but it’s best used as one component of a broader investment strategy.

Traders/investors should consider:

Market Dynamics

Today’s markets are heavily influenced by investor sentiment (money and credit flows) and technical factors, alongside fundamentals.

Customization

Adapting the formula with additional filters or weighting adjustments could lead to improved results.

Combining Strategies

Using the magic formula in conjunction with other value approaches or fundamental analysis can create a more robust process.

Performance

The Magical Formula has demonstrated commendable performance in backtested scenarios, often outperforming market averages.

Its simplicity and systematic nature reduce behavioral biases and decision-making errors.

Critiques and Limitations

Some critics argue that the formula oversimplifies complex market dynamics.

Past Data

For one, it’s based on looking at past data.

So, this strategy tends to apply more effectively to staid businesses – e.g., consumer staples, utilities – rather than tech companies or those where trends and growth are most applicable.

Earnings Yields & ROC Differ Based on Sector

It also may not recognize sector-specific nuances.

Bear Markets

Additionally, its performance in volatile or bear markets may vary.

When the environment is bad for stocks more generally, they all tend to decline, though it’s a matter of degree.

Backtest Reliance

Past results aren’t a guarantee of future performance.

Market conditions can change.

Oversimplification

Market efficiency has arguably increased.

The magic formula may not uncover the same level of hidden value it once did.

Ignores Macro Factors

The formula doesn’t account for broader economic trends or company-specific risks that can impact stock prices.

Not for All Stocks

Small-cap companies and those in sectors like financials and utilities may not be suitable for analysis using the magic formula.

Application of Joel Greenblatt’s Magical Formula for Day Traders/Short-term Traders

Greenblatt’s Magical Formula is meant for investors who are prepared to hold stocks for at least one year to realize potential gains.

It emphasizes systematic selection and a disciplined approach to reduce emotional biases.

Challenges and Adaptations for Day Traders

Long-term Orientation

The formula’s focus on annual rebalancing and long-term holding periods isn’t aligned with the typical day trading or short-term trading strategies that capitalize on short-term market volatilities and price movements.

Metrics Used

Earnings yield and return on capital are metrics that typically require a longer timeframe to demonstrate the value they predict.

Short-term price movements are often driven by market sentiment, news, and other factors not directly related to these metrics.

Potential Benefits for Short-term Traders

Despite its long-term focus, certain aspects of Greenblatt’s approach could be adapted by day traders or short-term traders:

Quality Screening

Day traders can use the earnings yield and return on capital as filters to identify fundamentally strong companies.

This could provide a list of potential stocks that are more resilient during market fluctuations, even if the trade horizon is short.

Every little advantage can add up.

Systematic Approach

The disciplined, rule-based nature of the formula can be applied to short-term trading strategies.

Developing a systematic approach for entering/exiting trades based on specific short-term signals while using Greenblatt’s criteria as a quality filter could potentially reduce risk.

Value Identification

Short-term traders can leverage the concept of buying undervalued stocks by applying it to buying dips during intraday trading.

Stocks that rank high on Greenblatt’s formula but experience temporary price drops could present buying opportunities for short-term gains.

Adaptation Strategies

Intraday Value Strategy

Implement a version of the formula that focuses on intraday price movements of stocks that are fundamentally strong according to the earnings yield and return on capital.

Event-driven Trading

Use the formula to select a portfolio of stocks before earnings announcements or other significant events.

Stocks with high earnings yield and ROC will react positively to positive news.

Sector Rotation

Apply the formula to identify the best sectors or industries and then trade the best stocks within these sectors on a short-term basis.

Use additional technical analysis for timing entries and exits.

Conclusion – Actionable Takeaways

The Power of Value and Patience

Buying undervalued companies and holding them long-term is a historically proven path to growing wealth in the stock market.

The magic formula offers a way to systematically practice this principle.

Discipline Matters

Removing emotion from the investment process can improve outcomes.

Greenblatt’s formula offers a structured methodology to avoid impulsive decisions.

Keep it Simple

Successful investing doesn’t always require complex strategies.

Focusing on a few key metrics can help identify potentially mispriced, high-quality companies.

How Different Traders/Investors Can Benefit

- Beginners: The book provides a clear, beginner-friendly introduction to value investing concepts, making it a great starting point.

- Experienced Investors: Even seasoned traders/investors can gain value from its emphasis on discipline and focus on fundamentals.

- Long-term Mindset: This book mainly benefits those with a long-term investment horizon, not those looking for quick gains. But it can be adapted.

Overall Perspective

“The Little Book That Beats the Market” is a worthwhile read for its clarity, straightforwardness, and its emphasis on sound investment principles.

The magic formula shouldn’t be treated as a holy grail, but it has merit as a tool for identifying undervalued companies.

The true value of the book lies in its potential to mold an investor’s mindset; emphasizing patience, focusing on intrinsic value, and encouraging a disciplined approach.

These are timeless qualities that can benefit any trader/investor, regardless of their specific strategy.

Related

- Day Trading Books

- 60/40 Portfolio

- Balanced Beta Approach

- Risk Parity

- Harry Browne Permanent Portfolio

- Golden Butterfly Portfolio

- Yale Portfolio (David Swensen Lazy Portfolio)

- Paul Merriman Ultimate Buy & Hold Portfolio

- Gone Fishing Portfolio

- 3-Fund Bogleheads Portfolio

- Scott Burns Couch Potato Portfolio

- Buffett Portfolio

- Peter Lynch Strategy

- Intertemporal Portfolio Choice

- Maslowian Portfolio Theory

- How Often Should You Rebalance a Portfolio?