Long Gamma Trading

Gamma trading is a options trading strategy that’s used primarily by market makers and professional traders.

It involves managing the gamma of an options portfolio, which is the rate of change of the option’s delta with respect to the underlying asset’s price.

Key Takeaways – Long Gamma Trading

- Profit from Volatility or Directional Moves

- Long gamma positions thrive in volatile markets or when they go directionally in a specific way (for trades setup that way).

- In certain trade structures (e.g., straddles, strangles), can capture profits from large price movements in any direction by continuously adjusting the delta.

- A typical example of a good long gamma trade would be losing a little bit when you’re wrong but making a lot when you’re right.

- High Transaction Costs

- Frequent adjustments needed in strategies that try to stay delta-neutral can lead to significant transaction costs, making the strategy resource-intensive and most suitable for professional traders.

Understanding Gamma

Gamma (Γ)

The second derivative of the option’s price with respect to the price of the underlying asset.

It measures the sensitivity of the delta to changes in the price of the underlying asset.

Delta (Δ)

The first derivative of the option’s price with respect to the underlying’s price.

Represents the change in the option’s price for a one-unit change in the price of the underlying.

Related: Other Greeks to Know for Options Trading

Gamma Trading Strategies

Gamma trading involves maintaining a dynamic hedging strategy where the trader frequently adjusts the position to stay delta-neutral, thereby managing gamma exposure.

In trading parlance, you often hear being “long gamma” and “short gamma.”

To oversimplify, being “long gamma” means owning options while being “short gamma” means being short options.

Being Long Gamma

Being “long gamma” refers to holding a position in options where the gamma is positive.

This means that as the underlying asset’s price moves, the delta of the position increases (for call options) or decreases (for put options).

This in turn provides a convex payoff structure.

With “American” options, positions can be sold before expiration (as many contracts are).

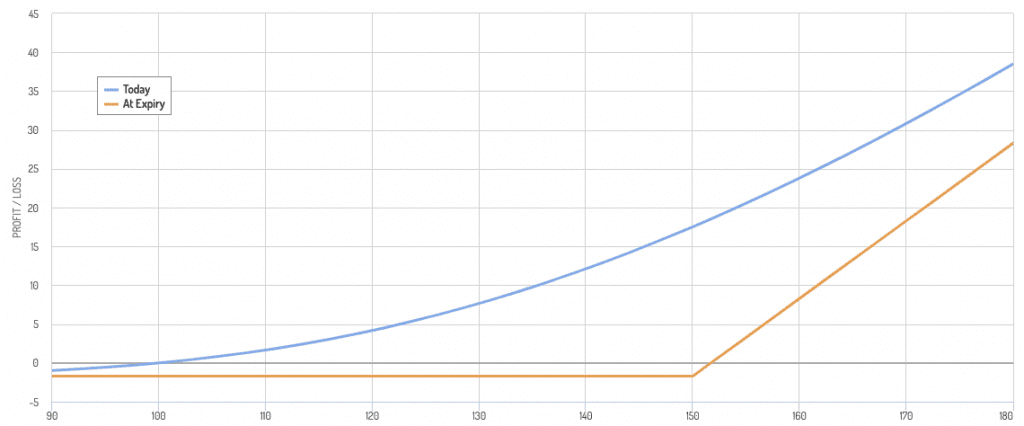

The convexity of the payoff is largest for out-of-the-money (OTM) options, as shown in the payoff diagram below (asset price assumed to be at 100):

Key Characteristics

Convex Payoff

Positions with long gamma benefit from large price movements in the underlying asset, regardless of the direction of the movement.

This is because the delta of the position becomes more favorable as the asset price deviates from the strike price.

Gamma Scalping Strategies

To maintain a delta-neutral position, traders must frequently buy or sell the underlying asset as its price changes.

This process is known as “gamma scalping.”

Volatility Benefits

Long gamma positions benefit from increased volatility, as larger price swings in the underlying asset result in more opportunities for profitable adjustments.

Example

Suppose a trader is long gamma through owning call options on a stock.

If the stock price rises, the delta of the call options increases, meaning the position gains more sensitivity to further price increases.

The trader then sells some of the underlying stock to neutralize the delta, locking in profits.

Conversely, if the stock price falls, the delta decreases, and the trader buys the underlying stock to rebalance the position, again locking in profits.

Advantages

Profit from Volatility

Long gamma positions are profitable in volatile markets or in favorable directional moves as they can capture profits from large price movements.

Risk Management

In cases where traders can dynamically hedge the delta, traders can manage their risk exposure effectively, limiting losses from adverse price movements.

Disadvantages

High Transaction Costs

Frequent adjustments to the position can result in significant transaction costs, especially in less liquid markets.

Complexity

Managing a long gamma position – especially where hedging is a consideration – and requires sophisticated modeling and constant monitoring.

This can be resource-intensive.

Practical Realities

Favorable Markets

Long gamma strategies are most effective in markets with high volatility and frequent/favorable price movements.

Liquidity

High liquidity in the underlying asset and the options market is important to minimize transaction costs and for efficient execution of hedging transactions.

Risk Management

Effective risk management systems must be in place to monitor and adjust positions continuously.

Long Gamma in the Context of Portfolio Allocation

Integrating a long gamma strategy within a balanced portfolio can enhance the overall risk-return profile.

Here’s a look at how being long gamma fits into a balanced portfolio allocation.

Balanced Portfolio Allocation

A balanced portfolio typically includes a mix of various asset classes such as equities, bonds, commodities, and cash to achieve diversification and reduce risk.

The goal is to balance the portfolio to perform well across different economic environments, so that it’s not overly dependent on quality growth/moderate inflation environments.

Purpose and Benefits

- Volatility Management – A long gamma strategy can provide a cushion during periods of high volatility by reducing losses and potentially capturing gains.

- Risk Reduction – Structuring positions with options and defined risk/reward structures can provide an additional layer of risk management.

Implementation

1. Identify Suitable Options

- Selection Criteria – Choose options on underlying assets that are part of the balanced portfolio. For instance, if the portfolio includes major equity indices, select index options with high liquidity. SPY for US-centric stock positioning, for example.

- Maturity and Strike Prices – Opt for options with appropriate maturities and strike prices that align with the portfolio’s risk management goals.

2. Establish the Long Gamma Position

- Buy Options – Acquire call or put options to achieve a positive gamma exposure. This can be done through outright purchase of options or through spreads that provide the desired gamma profile.

- Delta Neutrality (optional) – This is more for those looking to capture the volatility risk premium. Continuously adjust the position to maintain a delta-neutral stance, ensuring that the portfolio benefits from volatility irrespective of the direction of market movements.

Example of Long Gamma in a Balanced Portfolio

Portfolio Composition

- Equities – 40% (via options)

- Bonds – 45%

- Commodities – 10% (via options or owning the underlying)

- Cash – 5%

Adding Long Gamma

- Options on Equity Indices – Purchase call and put options on major equity indices, so that the gamma is positive.

Strategic Allocation

Some allocation considerations:

Proportion of Options

Allocate the appropriate percentage of the overall portfolio to options trading.

For example, some might dedicate their bonds and cash positions (in this case, half the notional value of the portfolio) to owning the underlying outright, while structuring their equities and commodities positions with options.

Volatility Exposure

Be sure that the exposure to long gamma positions complements the rest of the portfolio – either to enhance returns or lower risks.

Advantages in a Balanced Portfolio

- Improve Returns – During volatile periods, long gamma positions can generate additional returns or at least cut risk and improve the overall performance of the portfolio.

- Risk Reduction – By profiting from price swings, long gamma positions can offset losses in other parts of the portfolio, thus reducing overall risk.

Disadvantages and Considerations

- Transaction Costs – Options require more frequent trading due to their limited life. Frequent trading – especially for strategies involving maintaining delta neutrality – can lead to high transaction costs, impacting net returns.

- Complexity – Managing long gamma positions requires sophisticated analysis and expertise, which might not be feasible for all traders.

- Market Dependence – The effectiveness of long gamma strategies is contingent on market volatility. In stable markets, these strategies might not generate significant returns and could incur losses due to the time decay of options.

- Cost – Options have cost and if the payoff doesn’t compensate for the premium, then using underlying instruments could be more useful.

- Taxes – Options expire more quickly and generate capital gains/losses more frequently, which could incur additional taxes.

Conclusion

Gamma trading, particularly being long gamma, is a powerful strategy for capturing profits from volatile markets.

By maintaining a delta-neutral position and dynamically hedging gamma exposure, traders can benefit from large price movements in the underlying asset.

However, the strategy requires sophisticated tools and constant monitoring, and it involves significant transaction costs.

Therefore, it is typically employed by professional traders and market makers with the necessary expertise and resources.