What is Form 1099-INT? (How to File)

1099-INT is a form used to report interest income.

This form is used by banks and other financial institutions to report the interest earned on deposits and other investments. It does not include dividend income.

1099-INT forms are typically sent out by January 31st of each year.

If you didn’t receive a 1099-INT form for the previous tax year, you may still be required to report the interest income on your tax return.

Be sure to keep track of all the interest income you earn so that you can accurately report it on your tax return.

Who Can File 1099-INT: Interest Income?

You should receive a 1099-INT form if you earned interest income of $10 or more during the year.

This includes interest earned on savings accounts, CDs, money market accounts, bonds, and other fixed income instruments.

How to File Form 1099-INT: Interest Income

To report interest income, you’ll need to file 1099-INT forms with the IRS.

1099-INT forms are typically sent out by January 31st of each year. If you didn’t receive a 1099-INT form for the previous tax year, you may still be required to report the interest income on your tax return.

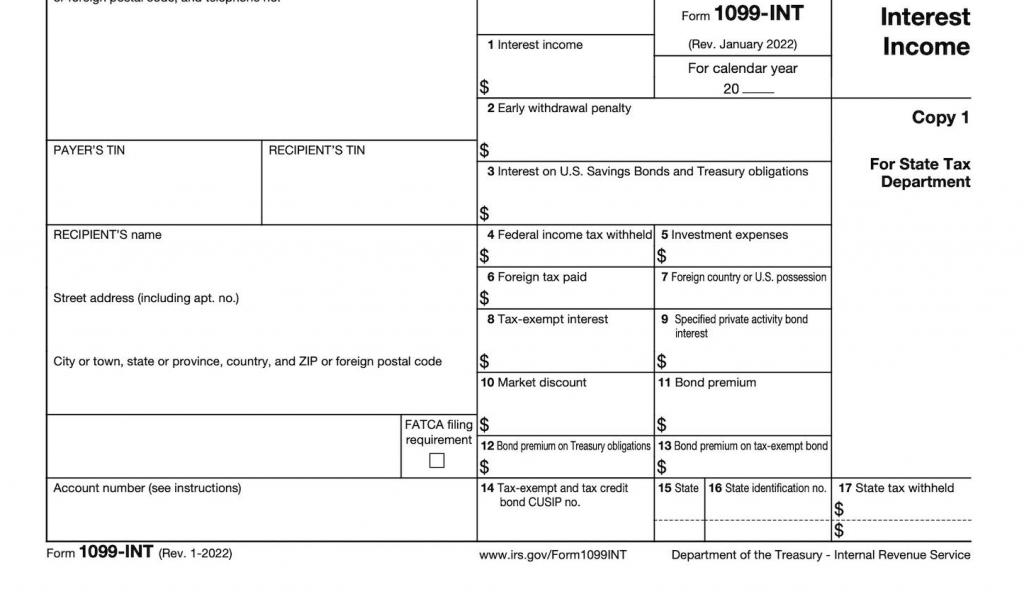

How to Fill Out and Read Form 1099-INT: Interest Income

Information in Form 1099-INT includes:

- Name and address of payer

- Name and address of the recipient

- Payer’s and recipient’s identification numbers

- Amount of interest paid ($10 or more)

- Foreign tax paid

- Market discount

- Amount of tax-exempt interest (e.g., municipal bonds)

- Amount of interest paid on US savings bonds and Treasury obligations (some of which may be tax-exempt)

- Federal income tax withheld

- State tax withheld

- Bond premium

- Bond premium on tax-exempt bonds

Download Form 1099-INT: Interest Income

Form 1099-INT is available on the IRS website.

You can download a copy of Form 1099-INT here.

Form 1099-INT – FAQs

What is 1099-INT?

1099-INT is a form used to report interest income. This form is used by banks and other financial institutions to report the interest earned on deposits and other investments.

1099-INT forms are typically sent out by January 31st of each year.

Even if you don’t receive a 1099-INT form, you’re still required to pay taxes on the interest income you earned.

What is a 1099-G form and how is it different from 1099-INT?

Form 1099-G is a statement that certain government entities, such as state unemployment agencies, use to report payments made to individuals.

Form 1099-G is used to report government benefits, such as unemployment compensation.

The 1099-INT form is used by banks and other financial institutions to report the interest earned on deposits and other investments that earn interest (as distinct from dividends, capital gains, and other forms of financial income).

Do I need to file a 1099-R form?

1099-R forms are used by retirement plan administrators to report distributions. It applies to few.

How do I get a 1099-INT form?

You can download it from the IRS website here.

Why did I get a 1099-INT form?

You should receive a 1099-INT form if you earned interest income of $10 or more during the year.

This includes interest earned on savings accounts, cash deposits, money market accounts, bonds and fixed income.

When is 1099-INT due?

The 1099-INT form is typically sent out by January 31st of each year.

If you didn’t receive a 1099-INT form for the previous tax year, you still need to report any interest income that you earned.

Conclusion – Form 1099-INT

Form 1099-INT is used to report interest income. This form is used by banks and other financial institutions to report the interest earned on deposits and other investments.

1099-INT forms will usually be sent out by January 31st of each year.

Those who don’t receive a 1099-INT form for the previous tax year will still need to report the interest income on their tax return. So, it’s important to properly keep track of all interest earned with or without formally receiving a 1099-INT.

If you have any questions about 1099-INT forms, be sure to speak with a tax professional. They can help you understand the form and make sure you’re correctly reporting your interest income on your tax return.