False Diversification

What Is False Diversification?

False diversification is the state of having many positions in a portfolio but little actual diversification due to the high level of correlation between positions.

Example of False Diversification

Let’s say a trader is employing the following book:

- Long Brazilian Real vs US Dollar

- Long industrial commodities

- Long oil

- Short Treasuries

- Long stocks

Those might be five different positions but they are basically the same “risk-on” type of trade.

All of these trades tend to do well when growth is good, so the portfolio will be biased toward that particular environment.

A high number of positions traded or assets owned ≠ Diversification

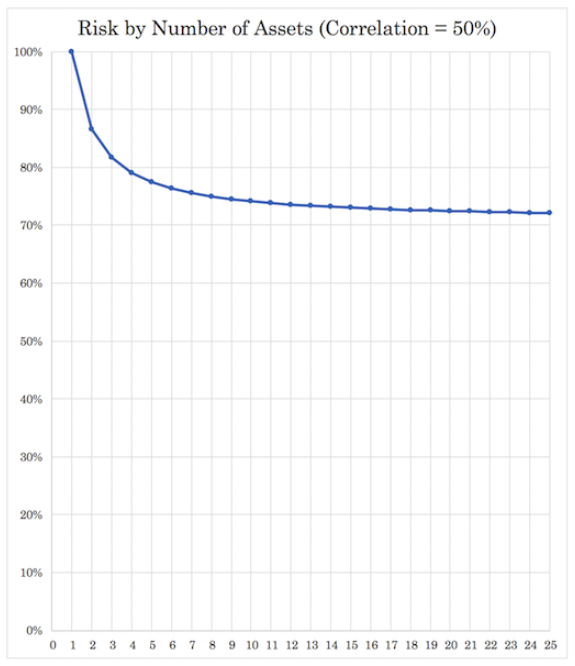

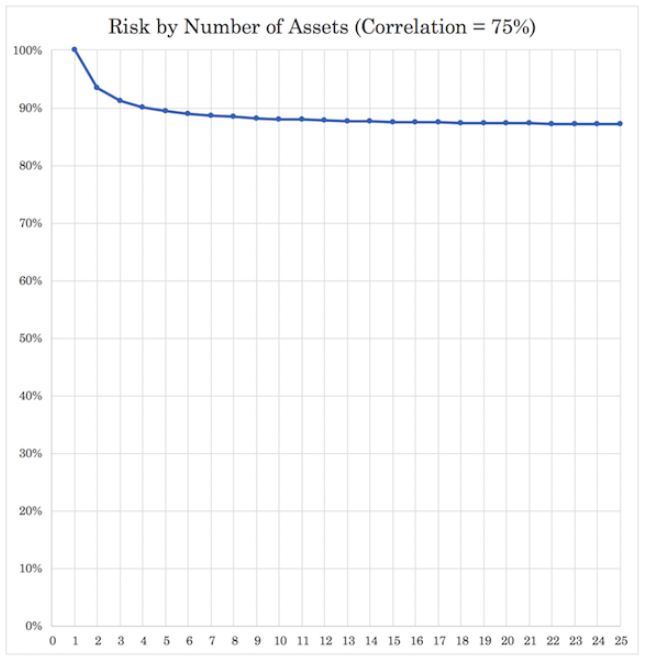

Even if you pick a bunch of stocks, your diversification is not much beyond a handful because most stocks’ returns are quite highly correlated to each other – generally 50-80 percent.

Even if you assume only 50 percent, you can see mathematically that once you get beyond just a handful, the marginal value of that diversification begins to thin out substantially.

It becomes more acute the tighter the correlation.

The key is to have uncorrelated returns streams. If you have 25 returns streams that are 75 percent correlated, you are only cutting your risk by 13 percent versus 80 percent for 25 uncorrelated returns streams.

Things that seem uncorrelated are often not

Even things that seem uncorrelated are often not.

For example, let’s say someone has two assets in their portfolio – an informational website earning money from display ads and owns part of a teakwood plantation in Panama.

When economic activity slows there will be less demand for teakwood, which is an industrial input for making furniture, stairs, flooring, ship decks, among other uses.

Companies are also likely to cut their ad spending when activity falls to protect their operating margins, which means those in the ad-selling business are likely to see earnings fall.

So, even though both deal with two totally different things in terms of what drives their cash flow, they are both in reality quite correlated and likely to suffer together in the event of a macro-related growth slowdown.

FAQs – False Diversification

What is false diversification?

False diversification occurs when a portfolio contains many positions that are highly correlated to each other, meaning the portfolio does not have true diversification.

How can I achieve true diversification?

To achieve true diversification, it is important to create a portfolio of uncorrelated returns streams, such as a mix of stocks, bonds, commodities, currencies, and other asset classes.

It is also important to diversify within each asset class by investing in different sectors and countries.

What is the risk of false diversification?

The main risk of false diversification is that many (or all) positions in the portfolio will be affected negatively if one position suffers.

This can lead to losses that are greater than expected due to the lack of true diversification in the portfolio.

Therefore, it is important to create a portfolio with true diversification to reduce overall risk.

What are the benefits of true diversification?

True diversification creates a portfolio that is more resilient to market volatility and can generate higher returns over the long term.

You will also have lower left-tail risk, shallower drawdowns, shorter underwater periods, and better return per each unit of risk.

It also helps reduce overall risk by spreading out the risk across different asset classes and sectors, as well as reducing exposure to any one particular asset class or sector.

This allows investors to create a portfolio of investments that are better able to withstand market fluctuations.

Overall, true diversification can help investors achieve their financial goals with a better chance of success.