Commodity Yield Enhancement

Commodity Yield Enhancement (CYE) strategies are designed to improve the returns on commodity trades or investments beyond the typical spot price movements.

These strategies leverage various financial instruments and market mechanisms to better optimize returns and manage risks in commodity markets.

Key Takeaways – Commodity Yield Enhancement

- Strategic Roll Timing

- Roll futures contracts at optimal times to capture positive roll yields and minimize negative roll yields by analyzing forward curves.

- Enhanced Indexing

- Use commodity indices with smart roll strategies, such as rolling into contracts with favorable pricing structures.

- Can improve returns over traditional passive indices.

- Active Management

- Engage in active trading, including speculation on commodity price movements and tactical asset allocation, for those who can exploit market inefficiencies.

- Collateral Management

- Leveraging futures for exposure with lower cash outlay.

- Leaves more that can be traded/invested in core parts of the portfolio.

- Options and Derivatives

- Options, swaps, and other derivatives to hedge risks, enhance yields, and exploit market volatility, such as selling covered calls to generate premium income.

Key Concepts

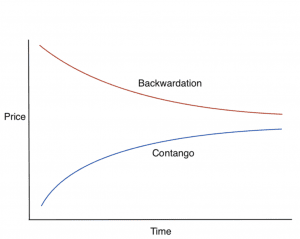

1. Contango and Backwardation

- Contango – A market condition where futures prices are higher than the spot prices. This situation often leads to negative roll yields when futures contracts are rolled over. This means buying at a higher price as you “roll” the current contract into the next one.

- Backwardation – A market condition where futures prices are lower than the spot prices, resulting in positive roll yields during contract rollovers.

2. Roll Yield

The yield generated from rolling a futures contract over time.

Positive roll yield is typically obtained in backwardated markets, while negative roll yield is common in contango markets.

The difference can be seen below.

3. Storage Costs and Convenience Yield

- Storage Costs – The costs associated with storing physical commodities. These are factored into futures prices.

- Convenience Yield – The non-monetary benefits of holding physical commodities, such as ensuring supply for production processes, which can affect futures pricing dynamics.

Strategies for Commodity Yield Enhancement

1. Strategic Roll Timing

Rolling futures contracts at optimal times to capture positive roll yields and minimize negative roll yields.

This strategy requires analyzing market conditions to identify periods of backwardation or contango.

2. Enhanced Indexing

Using commodity indices that employ smart roll strategies, such as rolling into contracts with the most favorable pricing structures, to enhance returns compared to traditional passive indices.

For example, for a long-term trade, they might roll into a longer-dated contract in a backwardated curve, assuming sufficient liquidity.

3. Active Management

Engaging in active trading strategies, including speculation on commodity price movements and tactical asset allocation, to exploit market inefficiencies and generate alpha.

4. Collateral Management

Efficiently managing the collateral underlying futures contracts, often by investing in high-yielding short-term securities, to generate additional returns.

Futures can generate a substantial amount of exposure for little cash outlay, leaving more for other trades/investments.

5. Options and Derivatives

Using options, swaps, and other derivatives to hedge risks, enhance yield, and exploit market volatility.

For example, selling covered calls can generate premium income while holding commodity positions. (In exchange, the upside return above the strike price is foregone.)

Practical Applications

1. Institutional Investment

Institutions, such as pension funds and endowments, use CYE strategies to diversify portfolios and improve risk-adjusted returns.

These strategies are often implemented through managed futures funds or specialized commodity funds.

2. Risk Parity Portfolios

CYE strategies can be integrated into risk parity and other balanced beta portfolios to balance risk contributions across asset classes or economic environments.

This way commodities contribute positively to the overall portfolio performance.

3. Commodity Producers

Producers of commodities, such as oil companies or agricultural firms, use CYE strategies to hedge against price fluctuations and stabilize revenues.

This often involves using futures and options markets to lock in favorable prices.

Example

A grain producer, such as a farmer, faces the risk that the price of corn may fall by the time of harvest.

To hedge against this price risk, the producer can use corn futures contracts.

Here’s how the process works:

1. Understanding the Position

- Long in the Underlying Market – The grain producer is already considered “long” in the corn market because they own (or will produce) the physical corn.

- Hedging Objective – The goal is to lock in a favorable price for the future sale of the corn, reducing the risk of price fluctuations.

2. Selling Corn Futures Contracts

- Futures Contracts – Futures are standardized contracts traded on exchanges, where the seller agrees to deliver a specified quantity of corn at a future date for a predetermined price.

- Action – The producer sells corn futures contracts. This action is known as taking a short position in the futures market, which offsets their “long” position in the physical market.

3. Hedging Mechanism

- Locking in Price – By selling futures contracts, the producer locks in a price for their corn at the time of the contract sale, even if the actual market price falls by the harvest time.

- Price Risk Hedging – Any losses in the physical market due to a price drop are offset by gains in the futures market, thereby stabilizing the revenue.

4. Example Scenario

Scenario Assumptions:

- Current Spot Price of Corn = $4.00 per bushel

- Futures Price (for delivery at harvest) = $4.20 per bushel

- Expected Harvest = 10,000 bushels of corn

Actions Taken:

- Selling Futures – The producer sells 10 futures contracts, each representing 1,000 bushels of corn, at $4.20 per bushel.

- Harvest Time – When the harvest occurs, the market price of corn has fallen to $3.80 per bushel.

- Market Transactions:

- Physical Sale – The producer sells the harvested corn in the spot market at $3.80 per bushel.

- Futures Market – The futures contracts sold at $4.20 per bushel are now worth $3.80 per bushel in the market, resulting in a gain of $0.40 per bushel in the futures market.

Financial Outcome:

- Spot Market Revenue: 10,000 bushels * $3.80/bushel = $38,000

- Futures Market Gain: 10,000 bushels * $0.40/bushel = $4,000

- Total Effective Revenue: $38,000 (spot) + $4,000 (futures) = $42,000

That $42,000 is their 10,000 bushels multiplied by the futures price they locked in ($4.20/bushel).

5. Benefits of Hedging

- Price Stability – The producer effectively secures a price of $4.20 per bushel, despite the spot price falling to $3.80.

- Focus on Volume – With price risk hedged, the producer can focus on maximizing production volume and efficiency without worrying about market price volatility.

- Risk Management – This strategy transforms the producer’s business model from being price-sensitive to volume-focused. This reduces financial uncertainty and allows for better planning and investment.