Barclays Options Trading Strategy that Outperforms the Market

The Barclays options trading strategy, popularized on YouTube (bottom of this article) and a 30-page report from the bank itself, capitalizes on the volatility mispricing of single stock call options.

This strategy tries to outperform the market by exploiting the gap between implied volatility (IV) and historical volatility (HV) – i.e., which often tends to approximate realized volatility (RV).

This opportunity is exploitable due to retail traders bidding up the price of options beyond their intrinsic value, which lets institutional traders capitalize by selling short volatility positions against them (e.g., selling straddles).

Key Takeaways – Barclays Options Trading Strategy that Outperforms the Market

- Exploitation of Volatility Mispricing

- The Barclays options trading strategy leverages volatility mispricing between implied and historical volatility by selling straddles on overvalued options (among other potential trade structures).

- It capitalizes on retail traders’ general tendencies to overprice options, allowing institutional traders to profit from the gap.

- Adaptability and Risk Management

- The strategy includes adaptable tactics like day trading and long call spreads for risk management and to exploit directional moves with lower risk.

Best Brokers for Trading Options

Following our hands-on tests, these are the top 4 platforms for trading options:

Understanding the Basics of Volatility

Barclays’ strategy is based on volatility – a major variable in the options market, where prices hinge on the anticipated future volatility of an underlying asset.

High expected volatility equates to pricier options.

The distinction between IV, a forward-looking expected value metric, and RV, which captures a stock’s actual volatility by expiration, is the basis of volatility strategies.

Barclays’ report draws attention to two key observations:

- A change in the volatility risk premium for certain stocks, indicating a gap between expected and actual volatility.

- An increase in hedging share volume, with market makers buying shares to hedge options positions, which impacts stock prices (“gamma squeeze“).

Barclays’ Strategy in Monetizing Volatility

Monetizing Elevated Volatility with Short Delta Hedge Straddles

Barclays suggests capitalizing on mispriced volatility by selling straddles or shorting the volatility of stocks where IV is notably higher than historical volatility or expected volatility.

This approach doesn’t bet on the stock’s direction but on its movement intensity.

Essentially, Barclays bets against the market’s expectations of future volatility.

Accordingly, they look to profit from scenarios where the market has overestimated this volatility.

Example

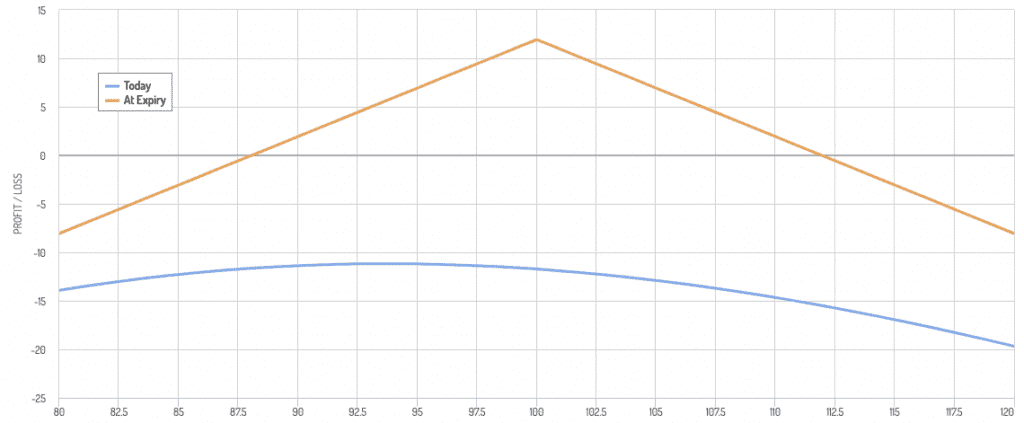

A straddle’s payoff diagram look like this (as an example).

A trader would profit as long as the price at expiration doesn’t move outside the profitability range.

There are other strategies that can also be pursued, such as day trading (not waiting for expiration) to capture P/L early or manually readjusting the straddle.

Buying Long Call Spreads on Stocks with Converging IV and HV

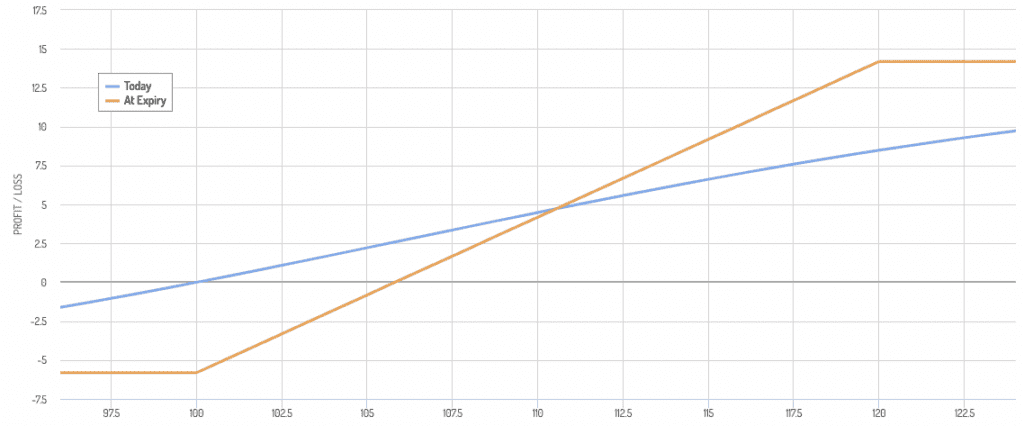

Another strategy involves buying a call option while selling a deeper out-of-the-money call option on stocks where IV and HV are converging.

This strategy is a calculated bet on the stock’s direction, exploiting the overpricing of volatility in the options market.

It can be a less risky play with more prominent directional exposure.

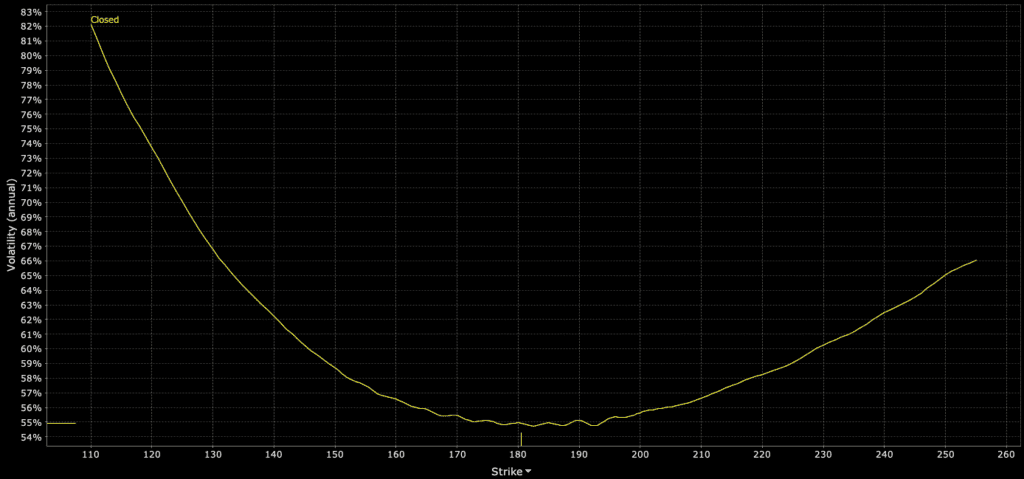

Volatility – when priced from an implied volatility perspective – tends to be cheaper at-the-money than it does OTM (though naturally the ATM option will cost more than the OTM one due to the delta effect – i.e., greater probability of landing ITM).

This is graphically represented via volatility skew (volatility smile).

Example

An example payoff diagram of a call spread:

Selling a Deep ITM Call

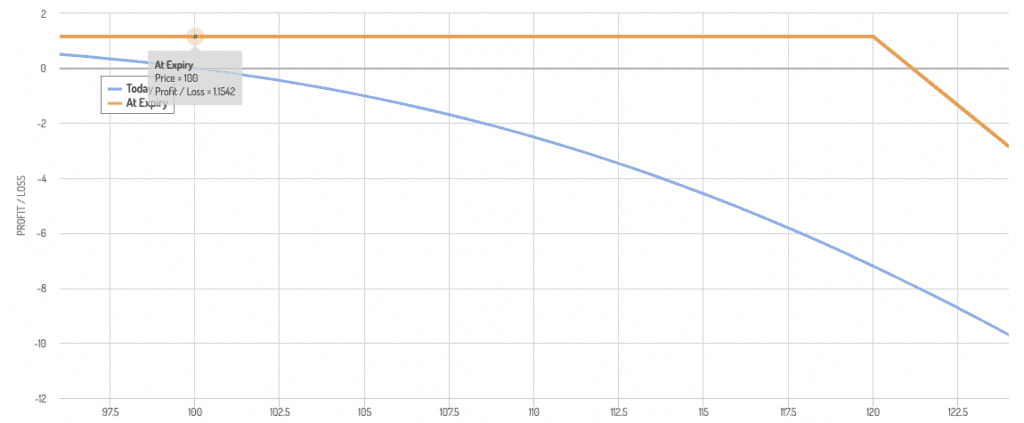

Below we have an example payoff diagram, where selling overpriced volatility via selling a 20% ITM call can be profitable as long as the stock doesn’t rise by more than around 21%.

Impact on Retail Traders

Retail traders are now more empowered by a wide selection of options brokers and commission-free trading platforms, and have influenced the dynamics of options pricing through their speculative bets.

These strategies pose certain implications for these traders:

- By selling straddles on overvalued volatility, institutional investors could be seen as capitalizing at the expense of retail traders. Such is the nature of any market inefficiency.

- The increased trading volume from market makers’ hedging actions might further affect stock prices. This illustrates the complex, nth-order ripple effects of trading activities.

Insight & Caution for the Retail Investor

The strategies outlined by Barclays offer a means to profit from volatility mispricing, and show the relationship between IV and HV/RV, along with the influence of retail trading activity.

For retail traders, this report provides a glimpse into institutional trading tactics and also serves as a reminder of the complexities and risks associated with options trading.

Execution timing, risk management, and an understanding of volatility dynamics are essential for anyone looking to profitably trade volatility or any strategy.

See DayTrading.com’s selection of the best brokers for trading options.