Why Leveraged ETFs Target Daily Returns

Leveraged ETFs target daily returns to maintain a consistent leverage factor, such as 2x or 3x, of the underlying index’s performance.

This daily reset ensures predictable amplification of returns for short-term traders.

But it can lead to significant deviations from expected performance over longer periods due to compounding effects.

Key Takeaways – Why Leveraged ETFs Target Daily Returns

- Purpose and Structure

- Leveraged ETFs aim to deliver multiples (e.g., 2x, 3x) of the daily returns of a benchmark index using financial derivatives and borrowing.

- Daily Reset Mechanism

- They reset daily to maintain their leverage ratio.

- Benefits short-term traders by magnifying gains, but potentially leads to significant deviations from the index over longer periods due to compounding effects.

- Compounding and Volatility

- The daily compounding can cause “return decay” during volatile market periods.

- They’re generally unsuitable for long-term investment.

- Target Audience

- These ETFs are designed for sophisticated day traders due to their short-term nature and risk level.

- Risk and Expense

- Leveraged ETFs carry higher risks and expenses compared to traditional ETFs, which can erode returns over time.

Overview of Leveraged ETFs

What they are

Leveraged ETFs are like turbocharged versions of regular ETFs.

They aim to deliver a multiple of the daily return of whatever they track – usually a market index like the S&P 500.

So, a 3x leveraged ETF would try to return three times the daily gain (or loss) of that index.

There are also different varieties, such as 1.25x, 1.5x, 1.75x, 2x, and 3x leverage.

How they work

To achieve this amplified return, they use a combination of financial derivatives (e.g., options and futures) and borrowed money (credit lines).

This leverage is double-edged: it magnifies gains, but also magnifies losses.

The daily reset

Leveraged ETFs rebalance their holdings daily to maintain that target multiple.

This is great for day traders who are in and out of positions quickly.

But for long-term holders, it can cause a phenomenon called “return lag.”

This is because the daily compounding of returns can lead to your ETF’s performance diverging from a simple multiple of the index over longer periods.

Who they’re for

Leveraged ETFs are primarily tools for sophisticated traders.

They can be used for short-term speculation, hedging, or as part of more complex strategies.

They’re not recommended as buy-and-hold investments or for long-term trades.

Important to remember

These ETFs are complex and carry significant risk.

It’s important to fully understand how they work before using them.

Don’t get seduced by the promise of outsized gains – the potential for losses is just as large.

Leveraged ETF Return Decay Example

As we mentioned, leveraged ETFs are especially bad for any timeframe beyond one day because of the time decay or tracking error element.

They need to be handled carefully if used for anything beyond day trading purposes.

This is because their values are recalculated every trading day.

Percentages matter rather than the value of the index.

If the value of something falls 20 percent, a 25 percent gain is needed to make back the losses and leveraged ETFs reflect this.

Example

For example, if an index drops from 100 to 99 it loses 1% of its value.

If the index rallies back to 100 the next day that would be a gain of 1.01%.

A 2x leveraged ETF of the underlying index would drop 2% from 100 to 98.

The next day, the ETF would need to rally 2.02% to follow the index (2 multiplied by the 1.01 percent gain).

However, following the daily reset, doing the calculation, taking 98 multiplied by 2.02 percent gives us only 99.98.

Further price movement compounds this tracking error.

Higher volatility causes a higher resulting discrepancy.

Because of this, there’s a natural decay pattern in these leveraged ETFs that distorts how effectively they’ll mirror what they’re supposed to be tracking over the long-term – i.e., anything longer than one day. Or whatever the reset period is.

If the market does decrease and you’re long a 2x or 3x leveraged short ETF, you’ll make money in excess of simply being short a straight 3x short S&P 500 ETF like SPXU.

But it won’t be the 3x many might assume they’ll be getting unless limiting the holding period to within just a single day.

The advantage of these securities, however, is that they can be traded in a regular stock trading account for those who lack futures and options accounts.

Nonetheless, the leveraged varieties should ideally be avoided for those who have holding periods beyond one day due to the tracking error that results from them.

The basic 1x ETFs like SPY or VOO also tend to be cheap in terms of the expense ratio.

Leveraged ETFs tend to be expensive with a higher expense ratio.

SPY vs. SSO

SPY is a standard 1x ETF that tracks the S&P 500.

SSO is a daily leveraged 2x ETF.

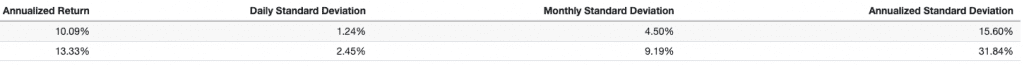

If we look at the annualized return, SSO has beaten the SPY over time (these returns go through the 2008 financial crisis).

However, you can see that the standard deviation is about 2x higher, but the returns aren’t. They’re only about 30% better (13.33% vs. 10.09%).

SPY (top) vs. SSO (bottom): Returns & Volatility

So, for those with multi-day holding periods, these aren’t recommended because you aren’t getting compensated for this extra risk you’re taking on.

The takeaway

Leveraged ETFs are engineered for daily performance.

If you’re not actively managing them, you’re essentially leaving your money in something that resets every day.

So, it’s important to know what you’re getting into.

Benefits of Daily Return Targeting

Consistency

The daily reset is like a promise.

You know that each day, the ETF aims to deliver a specific multiple of the underlying index’s return.

This creates a level of predictability.

Short-term trading advantage

If you’re in and out within a day or a few days, the longer-term compounding effects become less relevant.

Precise hedging tool

Leveraged ETFs can be used to hedge other holdings in your portfolio.

For example, if you own a large-cap stock ETF and are worried about a short-term market dip, you could buy a small amount of an inverse leveraged ETF to offset potential losses.

Not for everyone

Even in a favorable market, the compounding effect can be unpredictable over longer periods.

Daily Leverage Resets vs. Monthly Leverage Resets

Some leveraged funds – mostly in the mutual fund space – use monthly leverage resets instead of daily ones to reduce the adverse effects of daily compounding on traders’ returns over longer periods.

Daily resetting is typical so that the leverage factor (e.g., 2x or 3x) is maintained on a day-to-day basis, which is ideal for short-term day traders looking to capitalize on short-term market movements.

But for traders and investors holding positions over extended periods, daily resetting gives “volatility decay” or “volatility drag.”

As noted, this occurs because the ETF’s or ETN’s performance can deviate significantly from the expected leverage multiple of the underlying index due to the effects of daily compounding in volatile markets.

By resetting leverage on a monthly basis, these financial instruments try to reduce the impact of daily market fluctuations and provide a return profile that is more closely aligned with the intended leverage multiple over a longer term.

This approach is good for traders/investors with a medium-term horizon who want leveraged exposure but are concerned about the potential erosion of returns due to frequent resetting.

Nonetheless, they still suffer the same kind of decay.

Example

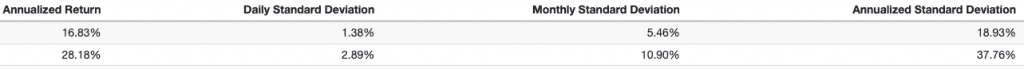

We can look at QQQ (Nasdaq ETF) vs. RMQAX, a 2x leveraged monthly rebalance Nasdaq mutual fund from Guggenheim.

QQQ (top) vs. RMQAX (bottom): Returns & Volatility

You can see that the returns relative to the risk are close-ish (67% higher returns for double the risk) at least compared to our daily reset example above.

But:

- The return history is only half as long as SPY vs. SSO for the period we looked at.

- While the monthly reset reduces the lag, it’s still there.

Risks Associated with Leveraged ETFs

Here are some serious risks you need to be aware of with leveraged ETFs:

Volatility is the name of the game

While the daily reset provides a level of consistency, it also amplifies volatility.

If the market swings wildly up and down, your leveraged ETF will be on that roller coaster too, just with a bigger drop on the downhills.

It can eat into your returns over time.

Decay

The dreaded “volatility drag.”

As covered, this happens when the underlying index experiences sharp ups and downs.

Even if the index ends up where it started over a period of time, the leveraged ETF can lose value due to the way the daily compounding works.

It’s like taking one step forward and two steps back over and over again.

The longer you hold, the riskier it gets

Leveraged ETFs are designed for short-term trading.

The longer you hold them, the more exposed you are to the risks of volatility and decay.

Over weeks or months, your results might look nothing like what you expected based on a simple multiple of the index return.

Don’t underestimate costs

Leveraged ETFs typically have higher expense ratios than regular ETFs.

These fees might seem small, but they can add up and eat into your returns, especially if you’re holding for longer periods.

Use Cases for Leveraged ETFs

Day trading

Speculative trading is the most common use case.

These ETFs are like rocket fuel for short-term bets.

A leveraged ETF can dramatically amplify your gains (or losses).

They’re high-risk, high-reward.

Timing the market

Because they reset daily, leveraged ETFs are well-suited for those trying to time the market.

You can buy in before an anticipated move and sell quickly to capture the amplified return.

This is not for the buy-and-hold crowd, but for active traders who thrive on volatility.

Hedging strategies

Let’s say you have a diversified portfolio, but you’re worried about a short-term dip in a particular sector.

A leveraged inverse ETF (which goes up when the index goes down) can act as a counterbalance to offset potential losses.

It’s not a recommended long-term hedge for the reasons we’ve covered ad nauseum.

Tactical Asset Allocation

Some experienced traders use leveraged ETFs for tactical asset allocation.

This means temporarily adjusting their exposure to certain asset classes based on what they expect to happen.

It’s a more nuanced approach than pure speculation, but still requires careful timing and risk management.

Caution

The compounding effect means leveraged ETFs are not suitable for long-term holding.

Unless you’re actively managing your positions and monitoring the market closely, you’re likely to end up worse off than if you’d just bought a regular ETF.

Regulatory & Structural Considerations

Watchdogs

Regulators like the SEC (Securities and Exchange Commission) keep a close eye on leveraged ETFs.

These products are subject to stringent requirements for transparency and fair dealing.

Disclosures of Leverage Factor

ETFs must clearly disclose their leverage factor (e.g., 2x or 3x) and how they achieve it.

You should be able to find detailed information on the specific financial instruments they use (like derivatives) and their daily rebalancing methodology.

This information is typically laid out in the ETF’s prospectus and fact sheet.

Regular Check-Ups

It’s not a one-time thing.

Leveraged ETFs are required to provide ongoing updates on their holdings and performance.

This helps traders monitor how closely the ETF is tracking its target multiple and assess any potential risks.

Alerts

Regulators often issue alerts to highlight the unique risks associated with leveraged ETFs.

These alerts typically emphasize that these products are not suitable for long-term holding due to the compounding effect and volatility.

Education Is Key

Before trading any leveraged ETF, it’s important to thoroughly research the product and understand its risks.

Don’t just rely on marketing materials or flashy headlines.

Read the prospectus, check independent sources, and consider consulting a financial advisor if you’re unsure.

Conclusion

- Leveraged ETFs aim for multiples of daily index returns (e.g., 2x, 3x). Most are long, but some are also short (e.g., -2x, -3x).

- They use financial derivatives and borrowed money.

- Daily resets maintain the target leverage factor.

- Suitable for short-term trading, not long-term holding.

- Risk of significant deviations due to compounding effects.