What Would Happen if the US Defaulted on Its Debt?

The US can always pay its bills because it has the power to “print” money. The Federal Reserve controls money creation in the US.

So even if the US has bad finances, as it does – i.e., it spends more than it earns and has more liabilities than assets – the country can always satisfy its debt and obligations in nominal terms.

This has trade-offs, such as inflation and currency depreciation, especially in the long-run, but a default is not on the table.

The debt ceiling

There is a technical aspect to the US debt situation, however, known as the debt ceiling.

If the debt ceiling isn’t raised, then the US federal government isn’t allowed to issue debt to fund its spending. It effectively runs out of money.

We can look at a chart of what this looks like from any random point in time.

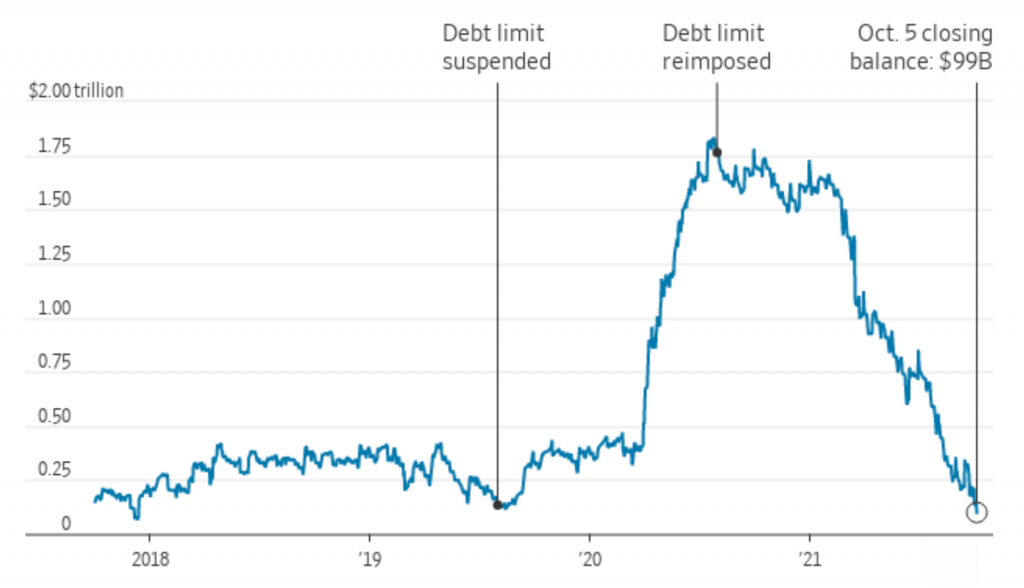

The Treasury operating cash balance looks like the following when there’s the process of a debt limit being suspended, then reimposed, then dangerously close to not being suspended:

US Treasury operating cash balance

(Source: US Treasury)

If this goes to zero and the debt ceiling isn’t raised, then there’s a default on the debt.

What would be the consequences if the US defaulted?

If the US were to default, financial markets would lose faith in the US.

The US has the world’s primary reserve currency in the dollar. It accounts for the majority of debt, savings, and invoicing around the world.

That the US will continue to make good on its obligations is the largest pillar of trust underpinning global financial markets.

If, for any reason, the US were to default, the dollar would weaken and equities would decline globally.

The US would have its credit rating downgraded. This previously happened on August 5, 2011, by Standard & Poor’s, reducing it from AAA (the highest rating possible) to AA+.

Interest rates would rise throughout the economy. Consumer loans – e.g., mortgages, autos – would see increased interest costs. Debt servicing payments would go up, putting more of a strain on borrowers.

This could trigger a recession. The financial economy leads the real economy. It could also create a freeze in the credit markets that could compromise the ability of US companies to operate.

In the 2021 debt ceiling scenario, if the US would have ceased being able to borrow (what Janet Yellen called “staring into a catastrophe”), a resulting cut in government revenue would have been around 7 percent of GDP.

That’s enough to produce an economic downturn, if prolonged. The economy would have lost around 5 million jobs and pushed the unemployment rate up to around 8 percent.