Wealthsimple Review 2025

Awards

- Best Financial Services Website - Webby Awards

- Top 100 Global Financial Technology Companies - Fintech 100

Pros

- Simple and secure onboarding process through an intuitive and well-reviewed mobile app - start investing in 5 minutes

- Attractive perks available for Premium and Generation clients, including airport lounge access, 15% off your will, and health plans

- Trade stocks from as little as $1 with zero commissions, plus Canadian fractional shares including Shopify and Royal Bank of Canada

Cons

- Limited to investing only in stocks, ETFs and cryptos

- High management fees compared to competition

- Only Canadian residents can join after operations ceased in the USA and the UK

Wealthsimple Review

Wealthsimple is a prominent robo-advisor and trading brokerage. The many different types of TFSAs and HISAs help clients to generate a passive income whether they are saving for business or the future. This 2025 review will discuss how to trade with Wealthsimple, the investing accounts on offer, pros and cons, trading fees and more. Find out whether to sign up with Wealthsimple today.

What Is Wealthsimple?

About

Wealthsimple is a Canadian investment management company that creates customized portfolios suited to a client’s financial goals and risk tolerance. The brand is a good option for traders who have little or no experience in managing their own portfolio due to its ease of use and high-quality support.

The company’s head office is in Toronto, Canada. Wealthsimple used to operate in the UK and the USA, however, it has since stopped accepting new users from these countries and transferred current accounts to other firms.

History

Wealthsimple was launched in 2014 by founder and current CEO, Michael Katchen. Since then, it has seen rapid growth and now there are more than 2 million people with investment accounts and over $15 billion worth of assets under management (AUM).

The current majority owner is Power Corporation which has led Wealthsimple to be considered among the top 100 global fintech companies.

Markets & Assets

Through the Wealthsimple investing service, clients have the opportunity to buy and sell stocks, ETFs and cryptocurrency.

Wealthsimple does not support options trading, forex, or mutual funds.

Stocks & ETFs

The stocks and ETFs available are listed on US and Canadian stock exchanges, such as the Toronto Stock Exchange and NASDAQ, amongst others. Example ETFs include the BMO ZFL and the TD Canadian Index fund.

There is no complete list of the best Wealthsimple stocks and ETFs, however, you can search for specific assets on my.wealthsimple.com or by using the mobile app.

If there is a stock or ETF you want to invest in but it is not listed, you can make a request through the official website. Note, however, that it is not guaranteed and only stocks and ETFs that meet certain requirements are permitted.

There are no fees charged for investing in stocks and ETFs unless you need to convert currency between USD and CAD. In this case, the fee is 1.5% x the current exchange rate.

IPOs

In 2022, the Wealthsimple Venture Fund I was launched which allows clients to invest in pre-IPO companies with a minimum investment of $5,000. This account has the potential for high returns with venture capital having outgrown both the S&P 500 and TSX since 2000.

If you are interested in private equity, you need to complete a survey on the Wealthsimple website.

Cryptocurrency

When the Wealthsimple crypto trading service first started, the only options were buying and selling Bitcoin or Ethereum. Since then, however, the broker has expanded its offering such that clients can now invest in 56 different new coins. This includes tokens such as Terra (LUNA), Shiba Inu (SHIB), Dogecoin (DOGE), Loopring (LRC) and the stablecoin USD Coin (USDC), which is similar to Tether (USDT) and Paxos Gold (PAXG).

For Wealthsimple crypto trading accounts, there is an investment fee of 1.5 – 2%.

Products & Accounts

Managed Investing Accounts

The brokerage offers a range of different managed savings accounts. The interest rate across all accounts at the time of writing is 1% but this is subject to change.

- Registered Retirement Savings Plan – This is for clients who are saving for retirement. Customers do not pay tax on interest, dividends or capital gains accrued. The RRSP is available as a personal, joint spousal or group account.

- Registered Educations Savings Plan – The purpose of an RESP is to allow clients to make use of the Canadian Learning Bond government scheme that helps parents to save for their children’s education. The government offers a fifth of your annual contributions to the plan up to $500 per year with an overall maximum of $7,200.

- Tax-Free Savings Account – A managed TFSA works akin to the RRSP as clients do not pay tax on interest, dividends or capital gains up to a limit. In 2022, this limit is $6,000.

- Locked-In Retirement Account – This is useful if you have a pension contract with a previous employer but have not yet retired. While you are not permitted to withdraw the pension yet, you can invest the capital through the Wealthsimple LIRA.

Portfolios

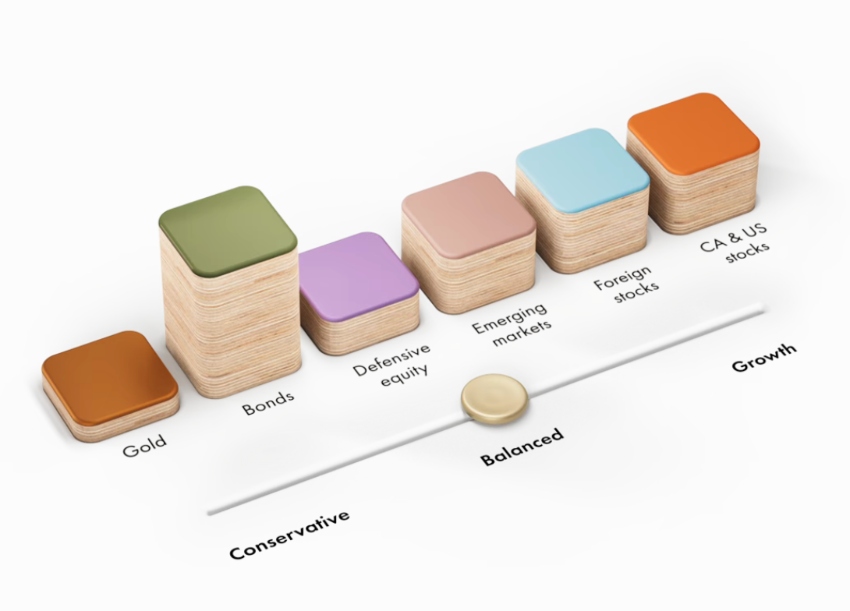

Wealthsimple requires that users complete a risk assessment questionnaire to determine their risk appetite. This is used to help curate a suitable investment portfolio.

In general, portfolios fit into one of three categories:

- Growth – The portfolio is characterized by high risk and high revenue with 75% to 90% equity allocation. It is made for clients who can accept periods of short-term loss in pursuit of the greatest earnings. Wealthsimple created a model portfolio launched in 2014 with an initial valuation of $10,000. If it had an equity allocation of 80%, the portfolio’s value would yield an increase of $5,137 by August 2022.

- Balanced – Wealthsimple provides this portfolio for clients with medium risk tolerance who still seek reasonable returns. The equity allocation is between 50% and 65%. Using the aforementioned model but with an equity allocation of 50%, the portfolio’s value would yield an increase of $2,670 by August 2022.

- Conservative – This is the firm’s lowest risk portfolio made for customers who prioritize stability. Equity allocation ranges from 30% to 40%. Using the portfolio model with an equity allocation of 35%, the portfolio’s value would yield an increase of $1,713 by August 2022.

Wealthsimple also offers investing solutions across:

- ESG – The broker has created a portfolio for clients who want to invest in companies that are aligned with socially and environmentally responsible values. This is a good way to invest in stocks and ETFs that take into account factors such as a company’s staff turnover, greenhouse gas emissions and corruption.

- Halal – All aforementioned portfolios can be opened in accordance with Sharia law. Wealthsimple allows Muslim clients to construct Halal portfolios made up of compliant investments. For example, no stocks relating to alcohol or tobacco.

Plans

There are three different plans for Wealthsimple accounts and portfolios. The plan is dependent on the funds deposited in the account.

As soon as your deposited funds with Wealthsimple reach $100,000, your plan automatically switches from Basic to Black. If your account grows to $500,000, you upgrade to the Generation plan.

Note that you must always have at least the plan’s minimum limit in your account to qualify for the benefits.

Basic

This is the simplest Wealthsimple plan with the lowest entry of just a $1 deposit. Clients with a Basic plan are charged a 0.5% management fee and get benefits such as expert advice alongside their personalized portfolio.

Black

The Black plan is available to clients who have at least $100,000 deposited in their Wealthsimple account. The benefits compared to a Basic plan include a 0.4% managed account fee, tax-loss harvesting, tax-efficient funds, plus health and estate advice as area-specific perks. For instance, Ontario residents can get six months of free medical services.

Generation

The Generation plan is the most advanced Wealthsimple solution with a minimum deposit of $500,000. In addition to all the benefits of a Black plan, Generation customers also have access to portfolio managers. These managers will build a portfolio according to your financial goals and optimize your investments for tax savings.

Other benefits include a 50% discount from a Medcan Comprehensive health plan in addition to the free first six months.

Calculators

There are several different calculators available to clients. For example, there are calculators for retirement, income tax, RRSP and TFSA. These are useful, particularly when it is time to file your tax return.

Note that you will need to log into your account to access this free service.

Wealthsimple has also acquired SimpleTax and NETFILE to help clients prepare and file their tax returns in addition to Koinly for crypto-specific taxes.

Getting Started With Wealthsimple

How To Set Up An Account

You can switch from other investment management services easily. If you transfer over at least $5,000, then Wealthsimple will pay the switch fees on your behalf.

- On the Wealthsimple website, click on the ‘Get Started’ button and type your email and desired password

- Select the product you are interested in from the drop-down list

- Input your personal details (you may be asked to provide identification documents)

- Click the option to add or transfer a new account

- Select the account type from the list and input responses to the on-screen prompts

Requirements

- You currently reside in Canada either as a citizen or with a valid Visa. Canadian citizens living in other countries are not permitted to sign up for an account

- You have a valid Social Insurance Number (SIN)

- Complete a KYC process by verifying your identity if you open a non-registered account

How Old Do You Have To Be To Use Wealthsimple?

You need to satisfy the age requirements in your province. In Alberta, Manitoba, Ontario, Prince Edward Island, Quebec and Saskatchewan the minimum age is 18. In all other provinces, the age limit is 19.

If you are under 18, you cannot open a Wealthsimple account.

How To Delete Your Wealthsimple Account

You can close your account by following these steps:

- Login at my.wealthsimple.com

- Go to the ‘Settings’ section on the dashboard

- Click ‘deactivate my profit’

- Confirm

Deposits & Withdrawals

Deposits

Wealthsimple clients are permitted to make instant direct deposits up to a certain limit across a three-day period. Our experts found the limit varies depending on the amount held in your accounts and whether you are a Basic or Plus subscriber.

A Wealthsimple Plus subscription costs $10 per month. The absolute maximum is $25,000, which is available for Plus subscribers with $50,000 or more deposited in their accounts. Once you have used all the allocated quick deposit limit, you need to wait for the next three-day cycle before you can make another instant deposit.

After the instant deposit allocation is used up, any deposits under $50,000 take three business days. All deposits greater than $50,000 take five business days.

Currently, Wealthsimple only permits deposits in CAD if you use Visa and Mastercard debit and credit cards or a transfer from a Canadian bank such as BMO and RBC.

If you want to make a deposit using USD, you need to set up a wire transfer or move funds via another institution or broker.

Roundup

If you connect your debit or credit card to your account, you can use the ‘Roundup’ feature. This service helps to further fund your savings accounts such that whenever you make everyday purchases, the amount is rounded up to the next whole number. The money used to round up is then sent directly to your Wealthsimple account. For example, if you were to buy a magazine for $3.75, Wealthsimple would deposit $0.25 into your account to round up the purchase to $4.00.

Withdrawals

Wealthsimple does not impose any fees for withdrawals.

The time taken to process the withdrawal varies depending on the type of account:

- Managed accounts take up to 7 business days

- Stock trading accounts take one or two business days

- Crypto trading accounts take two or three business days. Withdrawals made in cryptocurrency to your wallet rather than fiat are much quicker and often take less than 30 minutes

- Spend trading accounts take one or two business days

Security

Wealthsimple has taken several measures to help protect clients’ accounts. Firstly, all financial information is encrypted and accounts can enable two-factor authentication (2FA) at sign-in.

Additionally, the Canadian Investor Protection Fund keeps customers safe as the company is regulated by the Canadian Investment Regulatory Organization (CIRO).

Finally, while Wealthsimple manages your investments, the accounts are still kept in your name meaning if Wealthsimple were to default, you would still have ownership of your capital.

Customer Support

If you are having problems such as Wealthsimple is not working, keeps logging out, asking for code, crashing, real-time quotes are not available or you encounter a glitch, there are several ways of finding a solution. If Wealthsimple is down then check third-party sites such as DownDetector to see if the issue is your online connection or if there is an outage.

Upon testing, we found you can also seek support through the following channels:

- The detailed FAQs and Help section on the Wealthsimple website

- Email address that is contactable 24/7

- Live chat. Contact a member of the team 8 AM – 8 PM (EST) on weekdays and 9 AM – 6 PM (EST) on weekends. Alternatively, you can use the virtual assistant 24/7

- Over the phone at 1-855-255-9038. Open the same hours as the live chat team

- Message one of the social media accounts on Instagram, Facebook, Twitter, YouTube or LinkedIn

Note, if you have a complaint or need to resolve an outstanding balance, there are specific email addresses and phone numbers to contact.

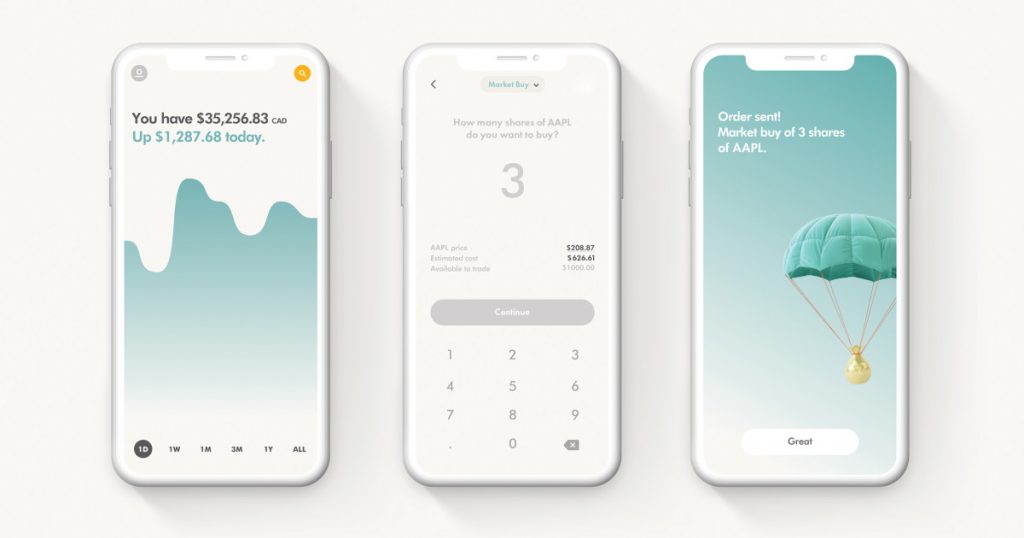

Apps

Clients can access their trading accounts either via their mobile device or through a desktop browser. You can use the app for checking your portfolio’s current performance, reading the newsletter and making a trade.

You can download the app on iOS and Android mobiles via the Apple App Store and Google Play Store, respectively.

Whether you run Windows, macOS or Linux, you can access your accounts via a web browser.

Promotions

Wealthsimple runs a partner referral scheme where you can earn for each person who uses your unique link or scans your QR code when they join up.

If your colleague forgot to use your cash promo code when they signed up, you can still claim the bonus if they input the code within the following 30 days.

Wealthsimple Verdict

If you are new to trading then Wealthsimple is a great option as the low account minimums make it highly accessible. The many different plans and the portfolio customization means there is something for all investors, regardless of their risk tolerance.

If you are interested in launching an account, it is worth contacting a team member to find the best way to make money according to your interests and financial goals. Whether it is through the cheapest penny stocks or the best cryptos, Wealthsimple can help you to build a foundation for future financial freedom.

FAQs

Is Wealthsimple Canadian?

Yes, Wealthsimple is based in Canada. Currently, only Canadian residents can open an account. In the past, investors from the UK and the USA could open an account but this is no longer an option.

Does Wealthsimple Have Fees?

Yes, Wealthsimple does charge fees. There is a management fee of 0.5% for accounts under $100,000. All accounts with deposits totalling $100,00 or more are charged 0.4%. There is zero trade commission on stocks and ETFs but there is a fee for crypto trading.

Can You Buy Ripple (XRP), Bitcoin (BTC) and Dogecoin (DOGE) On Wealthsimple?

Unfortunately, Wealthsimple does not support Ripple (XRP) trading. If you want to buy and sell XRP you will need to find a different crypto broker. The brand does, however, support BTC and DOGE, amongst other tokens. If you are interested in buying cryptocurrencies with Wealthsimple, you can find the full list of supported tokens as well as any associated fees on the official website.

Where Can I Learn How To Make Money On Wealthsimple?

Wealthsimple has an extensive learning section on its website to help clients to boost their understanding of markets and investing. This is useful if you need concepts or a definition explained, for example, order types such as limit buy, limit sell, stop loss or how auto invest works. You can also subscribe to the Wealthsimple Medium blog and weekly newsletter to stay updated on news and financial statements.

If you want specific information about the company, then websites such as Wiki and Zoominfo are good resources.

Is Wealthsimple Profitable?

Yes, it can be profitable but returns are not guaranteed. As with all investments, you must accept that you can lose money with Wealthsimple.

Is My Wealthsimple Safe And Legit?

Yes, my.wealthsimple.com is legitimate and can be trusted. You do not need to worry if it is safe enough to give Wealthsimple your SIN as it is regulated by the CIRO, Canada’s financial regulatory authority.

Can You Trade Options On Wealthsimple?

Wealthsimple does not have options trading as derivatives are not supported. You can only spot trade stocks, ETFs and crypto.

Should I Use Wealthsimple?

Only you can determine if signing up for an account with Wealthsimple is worth it. You should take the time to evaluate the benefits and drawbacks of using the managed investment services on offer. It can be helpful to read customer reviews and opinions on websites such as Reddit and Facebook before you invest. Alternatively, read our comprehensive review based on our experts’ findings while using Wealthsimple.

Who Owns Wealthsimple?

Wealthsimple is principally owned by Power Corp, a financial services company based in Montreal, Canada.

Top 3 Alternatives to Wealthsimple

Compare Wealthsimple with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Wealthsimple Comparison Table

| Wealthsimple | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 3.1 | 4.3 | 3.6 | 4.5 |

| Markets | Stocks, ETFs, Cryptocurrencies | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stocks, Futures, Futures Options |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $1 | $0 | $100 | $100 |

| Minimum Trade | $1 | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | CIRO | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | – | – | 10% Equity Bonus | Active Trader Program With A 15% Reduction In Costs |

| Education | Yes | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | – | 1:50 | 1:200 | 1:50 |

| Payment Methods | 5 | 6 | 11 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Wealthsimple and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Wealthsimple | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Wealthsimple vs Other Brokers

Compare Wealthsimple with any other broker by selecting the other broker below.

The most popular Wealthsimple comparisons:

Customer Reviews

There are no customer reviews of Wealthsimple yet, will you be the first to help fellow traders decide if they should trade with Wealthsimple or not?