How to Trade Water Rights

Water rights trading is an increasingly important aspect of resource management in many parts of the world – particularly in areas facing water scarcity.

As populations grow and climate change impacts water availability, the ability to buy, sell, and trade water rights has become an important mechanism for allocating this vital resource efficiently.

Water rights trading involves the transfer of the legal right to use a specific amount of water from one party to another.

This can be done on a temporary or permanent basis, and it allows for more flexible and responsive water management strategies.

Water rights are increasingly of interest to capital allocators because of their potential diversification value, with valuations not typically connected with traditional asset markets.

Key Takeaways – How to Trade Water Rights

- Water rights values vary widely based on seniority, location, and scarcity.

- Senior rights are more valuable, with prices potentially reaching thousands of dollars per acre-foot in water-stressed regions.

- Trading water rights in an active, tactical way requires specialized knowledge of complex legal and regulatory frameworks that vary by state and locality.

- The popularity of passive (or actively traded) water rights is increasingly through specialized digital marketplaces.

- Water rights can offer portfolio diversification, with returns not typically correlated to traditional assets.

- Nonetheless, they come with unique risks like regulatory changes and climate impacts.

Understanding the Types of Water Rights

Before going into the trading aspects, it’s important to understand the different types of water rights that exist:

Riparian Rights

Riparian rights are tied to land ownership along a water body.

These rights allow landowners to use water from adjacent streams or lakes for reasonable purposes.

Prior Appropriation Rights

Common in the western United States, prior appropriation rights are based on the principle of “first in time, first in right.”

These rights are not tied to land ownership and can be transferred separately from the land.

Groundwater Rights

These rights pertain to the extraction of water from underground aquifers.

They can be based on various systems, including reasonable use or prior appropriation.

Seniority in Water Rights

In many systems, especially those based on prior appropriation, the concept of seniority is important in their value:

Senior Rights

Older water rights are considered senior and have priority during times of scarcity.

These rights are generally more valuable and secure.

They’re most commonly held by farmers.

Junior Rights

More recently established rights are junior and may be subject to curtailment during drought conditions.

While less secure, they can still be valuable in years of abundant water supply.

What Are Water Rights Worth?

The value of water rights can vary significantly based on several factors:

- Location and water source reliability

- Seniority of the right

- Quantity of water allocated

- Local demand and scarcity

- Legal and regulatory environment

In some areas, water rights can be worth thousands of dollars per acre-foot (the volume of water covering one acre to a depth of one foot).

Long-Term Returns in Water Rights

Trading or investing in water rights can provide long-term returns through:

- Appreciation in value as water becomes scarcer

- Leasing income from temporary transfers

- Potential for development or agricultural use

- Diversification in returns relative to traditional assets (stocks, bonds)

Returns can be volatile and influenced by factors such as climate variability and regulatory changes.

Consider:

- nominal vs. real returns

- returns against other returns streams/strategies you could pursue

- their correlation to other things in the portfolio.

Legal Framework and Regulations

Water rights trading operates within a complex legal and regulatory environment:

Federal Regulations

In the United States, federal laws such as the Clean Water Act and Endangered Species Act can impact water rights trading.

State Laws

Most water rights are governed by state laws, which can vary significantly.

Some states have well-developed frameworks for water trading, while others have more restrictions.

Local Regulations

Counties and municipalities may have additional rules affecting water rights transfers.

Assessing the Value of Water Rights

Determining the value of water rights requires specialized analysis:

Hydrological Assessment

Understanding the reliability and quantity of the water source.

Legal Due Diligence

Verifying the validity and characteristics of the water right.

Market Analysis

Researching recent transactions and local demand helps in pricing.

Future Projections

Considering potential changes in climate, population, and regulations is important for long-term valuation.

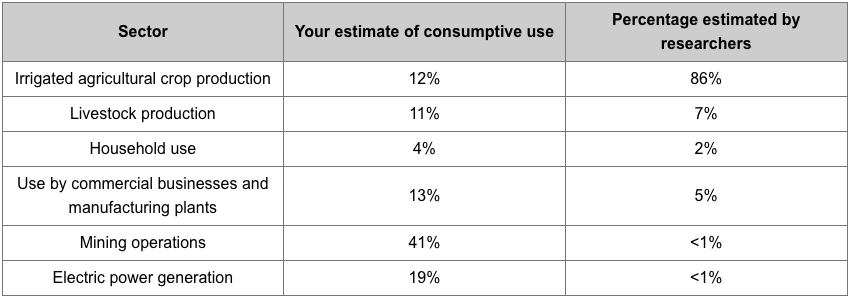

Consumptive Water Use in Supply and Demand Dynamics

Consumptive water use refers to the portion of water that isn’t returned to the original source after use.

This impacts water availability for other purposes and influences water rights trading dynamics.

For example:

Irrigated Agricultural Crop Production

With consumptive use estimated at 86%, high water demand in agriculture drives trading in water rights to for sufficient supply.

Livestock Production

At 7% consumptive use, water rights trading helps secure adequate water for livestock.

This balances agricultural and ecological needs.

Household Use

Though only 2% consumptive, trading water rights can ensure urban areas have a reliable water supply – e.g., especially in drought-prone regions (southwestern US states).

Mining Operations

Despite less than 1% consumptive use, mining operations may need to trade for water rights to meet operational demands while complying with environmental regulations.

Electric Power Generation

With consumptive use also less than 1%, power plants engage in water rights trading to maintain cooling processes and power generation without depleting local water resources.

Marketplaces for Water Rights

Water rights can be traded through various channels:

Water Banks

Some regions have established water banks that facilitate temporary transfers.

Online Platforms

Emerging digital marketplaces are making it easier to connect buyers and sellers.

These will have to be vetted individually.

Brokers and Consultants

Specialized brokers can help in finding and negotiating water rights deals.

Direct Negotiations

Many transactions occur through direct negotiations between parties.

This is especially true for larger or more complex deals.

Steps to Buying & Selling Water Rights

The process of trading water rights typically involves:

- Identifying available rights or potential buyers

- Conducting due diligence on the water right and parties involved

- Negotiating terms, including price and transfer conditions

- Obtaining necessary approvals from regulatory agencies

- Executing the transfer and updating official records

Digital marketplaces are more common these days to help with these intermediary steps, similar to how brokers function with traditional assets.

Risks and Challenges in Water Rights Trading

Trading water rights comes with several risks and challenges:

Regulatory Risk

Changes in laws or regulations can impact the value and transferability of water rights.

Environmental Concerns

Transfers may face opposition due to potential environmental impacts.

Market Volatility

Water rights values can fluctuate based on supply and demand dynamics.

Climate Change

Long-term climate trends may affect the reliability of water sources.

Transaction Costs

The complexity of water rights transfers can lead to significant legal and administrative costs.

As such, trading water rights is more of a specialized skill set.

For those who want to hold water rights as a small fixed percentage of their portfolio for diversification purposes, they will need to understand the expected return and risk profile, as well as its correlation with traditional assets.

Strategies for Successful Water Rights Investment

To navigate the complexities of water rights trading, consider these strategies:

Diversification

Trading rights from different sources and with varying priorities can help manage risk.

Long-Term Perspective

Water rights often appreciate over time – at least in nominal terms – so a patient approach may be beneficial.

Stay Informed

Keeping up with regulatory changes and market trends is important for making informed decisions.

Collaborate with Experts

Working with experienced water rights attorneys and consultants can help better understand the nature of these transactions.

Consider Alternative Structures

Exploring options like leasing or partial transfers can provide flexibility and potentially lower risk.

Conclusion

Trading water rights is a bit of a unique area of trading, investment, and resource management.

As water scarcity becomes more prevalent in some parts of the world, the importance of efficient water allocation through market mechanisms is likely to grow.

However, the complexity of water rights trading requires expert consideration of legal, environmental, and economic factors.

Those who approach this market with thorough research, expert guidance, and a long-term perspective may find significant opportunities in this essential resource.