Uniswap Trading – Tutorial and Brokers

Uniswap is a crypto token with the ticker symbol UNI. In this article, we’ve explained what the coin is, how it relates to the Uniswap exchange, and the risks and potential rewards in trading the token. This review aims to give you all the information you need to join the UNI community, including strategies and a how-to guide for getting started trading Uniswap.

Uniswap Brokers & Exchanges

-

1

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

2

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

3

Dukascopy

Dukascopy -

4

Videforex

Videforex -

5

CEX.IO

CEX.IO -

6

UpholdTerms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

UpholdTerms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Here is a short overview of each broker's pros and cons

- eToro USA - eToro US offers 24 tradeable cryptoassets, with just a 1% buying/selling fee added to the spread. Additionally, there are 80 different coins available through the broker’s proprietary wallet service. You can also practice your crypto strategies easily by switching between live and demo mode. Crypto asset investing is highly volatile and unregulated. No consumer protection. Tax on profits may apply.

- OANDA US - Cryptocurrency trading is offered via Paxos, a separate entity from Oanda. You can speculate on the world’s biggest cryptos by market cap. Commissions are lower than many peers starting at 0.25%. Through the broker’s partnership with Paxos, clients can spot trade cryptocurrencies on the itBit exchange through the OANDA native platform.

- Dukascopy - Dukascopy facilitates day trading on popular cryptos like Bitcoin against the US Dollar. You can go long or short with leverage up to 1:5. Unusually, clients of Dukascopy are also protected to the tune of CHF 100'000 in the event of brokerage insolvency.

- Videforex - Traders can speculate on crypto prices in pairs with USD and CNY through binary options and CFDs. The range of digital currencies is fairly narrow vs alternatives but major tokens like Bitcoin are available.

- CEX.IO - CEX.IO offers hundreds of popular cryptocurrencies including big names like Bitcoin, Ethereum and Litecoin. The trading platform is well-designed with sophisticated charting and analysis tools, including 50+ in-built indicators. Traders can also reduce their monthly volumes through the tiered pricing structure.

- Uphold - You can buy and sell 250+ crypto assets with fiat currencies or in crypto pairs using the straightforward mobile app or through Uphold's browser-based account homepage. This is significantly more than many rivals. You can also earn up to 16% APY by staking one or more out of 32 valid tokens, or send tokens to an external wallet.

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Bonus Offer | Invest $100 and get $10 |

|---|---|

| Coins | BTC, ETH, BCH, DASH, LTC, ETC, MIOTA, XLM, EOS, NEO, ZEC, XTZ, MKR, COMP, LINK, UNI, YFI, DOGE, AAVE, ALGO, MANA, ENJ, BAT, MATIC, FLR, SHIBxM |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | BTC 0.75% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Regulator | SEC, FINRA |

| Account Currencies | USD |

Pros

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

- A free demo account means new users and prospective day traders can try the broker risk-free

Cons

- Average fees may cut into the profit margins of day traders

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Coins | BTC, ETH, LTC, BCH, PAXG, LINK, UNI, AAVE |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | $100 |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

- Beginners can get started easily with $0 minimum initial deposit

- The proprietary OANDA web platform continues to deliver a highly competitive charting environment, including 65+ technical indicators powered by TradingView

Cons

- It's a shame that customer support is not available on weekends

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

Dukascopy

"If you’re an experienced trader, Dukascopy provides the tools you need: JForex for algorithmic strategies, competitive spreads from 0.1 pips, leverage up to 1:200, and the peace of mind of using a Swiss-regulated bank and broker."

Christian Harris, Reviewer

Dukascopy Quick Facts

| Bonus Offer | 10% Equity Bonus |

|---|---|

| Coins | ADA, AVE, BAT, BCH, BTC, CMP, DSH, ENJ, EOS, ETH, LNK, LTC, MAT, MKR, TRX, UNI, XLM, YFI |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.1 |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | JForex, MT4, MT5 |

| Minimum Deposit | $100 |

| Regulator | FINMA, JFSA, FCMC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, PLN, CZK, AED, SAR, HUF, MXN |

Pros

- Dukascopy features some of the best research we’ve seen, even a professional TV studio in Geneva covering financial news, market analysis, and daily insights from professionals.

- Dukascopy offers tight spreads starting from 0.1 pips, leverage up to 1:200 (depending on the jurisdiction), and volume-based commissions that reward high-frequency traders.

- The proprietary JForex platform is highly advanced, offering tools for algorithmic trading, extensive charting, and access to deep liquidity for short-term traders.

Cons

- While JForex is feature-rich, it has a steep learning curve, making it less suitable for beginner traders who might prefer simpler platforms.

- Dukascopy's withdrawal fees are higher than most competitors we’ve tested, particularly for bank wire transfers, which may deter traders who require frequent access to their funds.

- Some account types, such as the MT4/MT5 accounts, require a higher minimum deposit of $1,000, which may not be ideal for traders with smaller budgets.

Videforex

"Videforex will serve traders looking for a no-frills, easy-to-use platform to speculate on the direction of popular financial markets through binaries. With a sign-up process that takes a matter of minutes and a web-accessible platform, getting started is a breeze. "

William Berg, Reviewer

Videforex Quick Facts

| Bonus Offer | 20% to 200% Deposit Bonus |

|---|---|

| Coins | BTC, ETH, QUANT, UNI, SOL, BNB, DOGE, XRP, XMR, MATIC, USDT |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Floating |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | TradingView |

| Minimum Deposit | $250 |

| Account Currencies | USD, EUR, GBP, AUD, RUB |

Pros

- Videforex regularly runs trading contests, offering practice opportunities and cash prizes to beginners and experienced traders, with position sizes from just ¢0.01.

- Traders can earn up to 98% payouts on 100+ assets with the broker’s binary options, bringing it in line with competitors like IQCent.

- Videforex is one of the few brokers with 24/7 multilingual video support, providing comprehensive assistance for active traders.

Cons

- Videforex lacks authorization from a trusted regulator, meaning traders may receive little to zero safeguards like segregated client accounts.

- The absence of any educational tools is a serious drawback for newer traders who can find blogs, videos and live trading sessions at category leaders.

- The client terminal needs improvements based on our latest tests, sporting sometimes slow and unresponsive widgets which could dampen the experience for day traders.

CEX.IO

"CEX.IO continues to serve a range of crypto investors looking to buy, sell, trade, hold and earn with low fees. The tiered pricing structure will appeal to active traders while rookie investors will enjoy the straightforward platform interface and excellent education."

Tobias Robinson, Reviewer

CEX.IO Quick Facts

| Coins | ZRX, 1INCH, AAVE, BTC, BCH, ADA, LINK, COMP, ATOM, DAI, DOGE, ETH, GUSD, ICP, LTC, LRC, MATIC, MKR, DOT, SHIB, SOL, XLM, SUSHI, SNX, USDT, XTZ, USDC, UNI, WBTC, ZIL |

|---|---|

| Crypto Mining | Yes |

| Auto Market Maker | No |

| Crypto Spread | 0.15% maker & 0.25% taker (Standard) |

| Crypto Lending | Yes |

| Crypto Staking | Yes |

| Platforms | TradingView |

| Minimum Deposit | $20 |

| Regulator | GFSC |

| Account Currencies | USD, EUR, GBP |

Pros

- The $20 minimum deposit makes the broker accessible for beginners

- There's a wide range of global payment methods available including PayPal

- The proprietary terminal features an advanced charting package from TradingView, including 50+ technical indicators

Cons

- The broker has limited regulatory oversight

- Deposit and withdrawal fees are relatively high, including 0.3% + $25 for SWIFT withdrawals

- The Exchange Plus platform delivers a cluttered interface compared to competitor platforms

Uphold

"Uphold remains a top choice for crypto investors looking for a one-stop-shop solution to accessing the markets. There are over 250 tokens to buy, sell and trade through flexible platform options."

William Berg, Reviewer

Uphold Quick Facts

| Coins | BTC, BTCO, AAVE, ALCX, DYDX, INH, XYO, API3, GHST, LSK, AUDIO, GLMR, NMR, CAKE, GODS, REQ, CHR, TRB, DAO, ROOK, XRP, ETH, BAT, ADA, ALGO, ATOM, AVAX, AXS, BCH, BAL, BTG, CSPR, COMP, CRV, DASH, DCR, DGB, DOGE, DOT, EGLD and many more |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Up to 1.5% |

| Crypto Lending | No |

| Crypto Staking | Yes |

| Platforms | Desktop Platform, Mobile App |

| Minimum Deposit | $0 |

| Account Currencies | USD, EUR, GBP |

Pros

- Two-step authentication bolsters user security

- Uphold is 100% reserved which helps to protect client funds

- The proprietary app is extremely easy to use with a slick design and navigation

Cons

- There is a 2.49% fee if you want to use debit or credit cards

- The charting analysis features on the platform trail specialist exchanges

- Customer service is slow based on tests, with limited contact options

What Is Uniswap (UNI)?

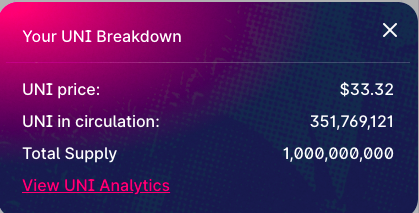

Uniswap (UNI) is a top ten cryptocurrency with a market cap of nearly $20bn. It is an Ethereum blockchain token that powers the Uniswap Exchange, a decentralised liquidity provider (or a DEX as they are sometimes known). The Uniswap token is a governance token. This means it allows holders to vote on development work and decisions such as new fee structures.

Unlike cryptos such as Bitcoin and Dogecoin, Uniswap does not use an order book to match buyers and sellers or determine the token price. Instead, holders of Uniswap create market liquidity by adding their coins to a liquidity pool (LP).

Whenever liquidity is added, new liquidity tokens are minted that represent the value of the coin deposited. This allows Uniswap to be bought and sold by other traders while the owner holds onto the liquidity token. When any transaction occurs with the lent out Uniswap, the liquidity pool receives 0.3% of the transaction in return for lending their holdings. This is distributed proportionately among the pool. This is a form of decentralised finance (or DeFi), allowing users to create their own market liquidity rather than relying on banking institutions.

Uniswap liquidity providing is similar to staking and mining in that holders lend their coins to pools in exchange for interest. However, there are fundamental differences in the aim. Mining and staking aim to validate the network whereas liquidity pools replace the requirement for an order book. Staking is fairly risk free, but LPs have the potential for impermanent loss.

History Of Uniswap

Uniswap was created in September 2020 to prevent exchange users from using rival DEXs such as SushiSwap. At its initial coin offering (ICO), Uniswap handed out 400 governance tokens to everyone who had ever used the platform. At the time, these tokens were worth around $1000, the current value is nearly $15,000. The price more than tripled in the first quarter of 2021, the height of the latest cryptocurrency bull run.

Uniswap’s founder, Hayden Adams started the company in 2018, having received the backing of various venture capital funds.

In April 2020, over $25m of cryptocurrency was stolen during a hack of the Uniswap exchange and Lendf.me (a DeFi lending platform). Uniswap was affected to a much lesser degree than Lendf.me, but the website was taken offline for a short time while developers fixed the vulnerability. In general, Uniswap is safe from hackers because of its decentralized nature. While centralized exchanges such as Coinbase look after the crypto-wallet on behalf of owners, Uniswap operates on a system of self-custody, meaning individuals hold their own crypto. This makes it much harder to hack on any large scale.

The 2020 Uniswap white paper set out the intentions for the Uniswap version 2 (v2) core contracts, in particular, the development of a hardened price oracle, flash swaps and the introduction of a protocol fee. In 2021, the version 3 (v3) whitepaper was released, introducing concentrated liquidity and multiple fee tiers allowing LPs to be compensated appropriately for risk.

Uniswap Trading Chart

Why Trade Uniswap?

There are many reasons why Uniswap is a good buy. Ultimately, investors should consider whether they believe the technology that underpins Uniswap will be the future.

- A good deal for liquidity providers – Uniswap is based on the emerging concept of DeFi (decentralized finance). This concept aims to revolutionize the finance industry, taking the power of credit from institutional banks and putting it into the hands of anyone with capital. By contributing to a liquidity pool, UNI holders lend their share to others and receive interest in return. This is likely to be a better return on investment than banks are offering.

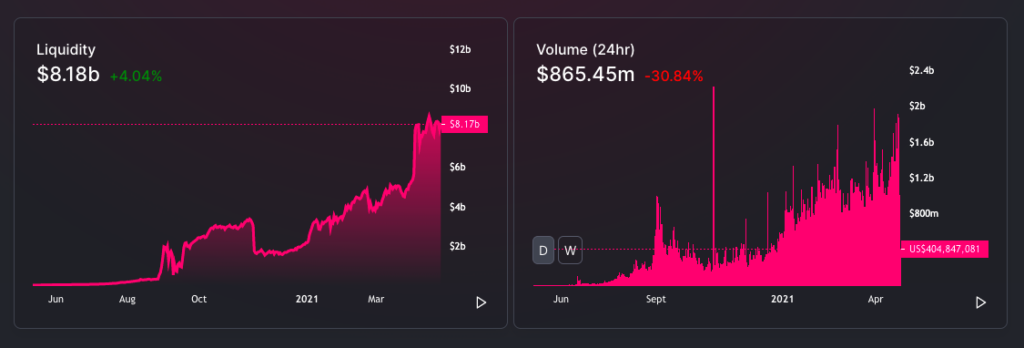

- DEX growth – In March 2021, the daily trading volume of Uniswap reached $7 billion, having increased 450% in 24 hours. This was partly due to a brand new ERC-20 coin called Delta, which aims to reduce volatility issues in options trading. To buy Delta you have to use Uniswap, and so the DEX saw a huge jump in trading volume. Growth in the exchange means that the price of UNI is likely to hold its value, or rise.

- Future coin distribution – When UNI was created in 2020, users of the DEX received free UNI tokens in what is known as an airdrop. An airdrop is when crypto coins are distributed for free as a way of gaining attention for the token. Since this initial distribution, users have been speculating on when the next airdrop will be. Holders of UNI or ETH on the exchange could profit hugely. However, no further airdrops have been confirmed yet.

Risks Of Trading Uniswap

Investors should be aware that there are risks involved with trading on this relatively new asset.

- Extremely high gas fees – Uniswap’s liquidity pool system means that gas fees increase as Ethereum usage rises. Gas fees are paid by users to compensate for the energy usage required to complete a transaction on the Ether network. Currently, investors are finding that the price of gas fees, which can reach into the hundreds of dollars, are just too high. If this continues, it will impact the long term viability of the DeFi system Uniswap is built on, and therefore the value of the token itself.

- Risky tokens on the DEX – Anyone can create an ERC20 cryptocurrency on the Uniswap exchange and therefore new token listings, such as Hoge, Unistake and Ecomi, are added regularly. But, it’s vital that investors research an upcoming token thoroughly before investing. There has been news of fake versions of existing tokens popping up on Uniswap. Plus there’s no guarantee that a cryptocurrency will increase in value. If trust in the system fails, this could have an impact on the value of UNI.

- Uncertainty of price predictions – The Uniswap token saw growth of over 250% in the first quarter of 2021, causing optimism within the UNI community. Some coin commentators forecast that $100 is achievable by 2025. But investors should be cautious. Past performance is not an indication of future gain and there is no guarantee of ROI. Any price prediction should be fully researched and the risks taken into account.

Uniswap Trading Strategies

Arbitrage

Arbitrage is one of the best strategies to use with Uniswap because it utilises the automated market maker (AMM) system that bases coin prices on demand and supply within the pool. AMM means that there is often a difference in a coin price on Uniswap vs other centralized exchanges, such as Coinbase or Binance. Arbitrage involves taking advantage of this price discrepancy. For example, if Kraken is offering Bitcoin at $50,000 and Coinbase at $50,500, you can buy BTC on Kraken and sell on Coinbase, pocketing the difference. Arbitrage is a vital part of the AMM system on Uniswap, as traders will continue to buy until the price is in line with the market.

Flash Swaps

Whilst arbitrage is a strategy reserved for those with capital in their back pocket (not everyone has 1 BTC lying around), flash swaps allow traders to take advantage of the risk-free strategy without the capital. Traders can withdraw up to the full amount of their ERC-20 holdings in any token to arbitrage providing that after the transaction, they pay for the withdrawn ERC20 tokens with the corresponding pair tokens or return the withdrawn ERC20 tokens along with a small fee. Traders can optimistically withdraw their coins using a flash swap, purchase the coin on the other end of the pair through another exchange, and then pay Uniswap back the original amount that was borrowed, keeping what’s leftover for themselves. This strategy is fairly risk-free, profitable, and actively encouraged by Uniswap to keep the price in line with the market.

How To Start Trading Uniswap

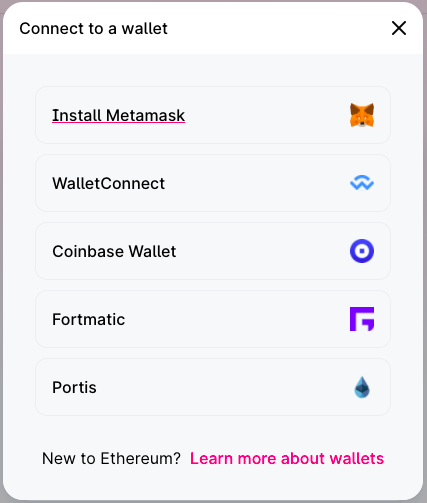

Uniswap is available to trade with a number of brokers, including Gemini and Coinbase. You can also swap tokens for UNI directly on the Uniswap exchange. To do this, you’ll firstly need to sign up to an ERC-20 compatible wallet service, such as WalletConnect, MetaMask or Portis and make sure you load it with ETH. Then, create a Uniswap account and login. Since Uniswap is decentralised, there are no KYC (know your customer) identity checks.

Login to your wallet and allow it to connect to Uniswap.5. You’ll then be able to swap ‘from’ one token ‘to’ another. Uniswap will provide you with a non-negotiable quote. Confirm the transaction and wait for it to be added to the blockchain. You can track its progress using Etherscan. The Uniswap exchange app is also available on mobile on both iPhone and Android.

If you’ve been waiting for confirmation of the transaction for a while, you might need to adjust your allowed slippage in the settings to account for the fee taken in the swap. Alternatively, you may not have enough gas for the fee. Top up your wallet with Ether and try again. If your transaction keeps failing or something else is not working, help and support for your query is available through the Uniswap community on Reddit, Discord and Twitter. Users can also keep up-to-date with announcements via the Uniswap blog.

Final Word On Uniswap

Uniswap is one of the biggest cryptocurrencies by market cap and has seen a huge jump in value since its creation. As a governance token for the Uniswap exchange, its price is determined by the success of the DEX technology it is built on. Investors should consider whether they believe in the concept of decentralised finance before investing. However, all indications so far suggest that rerouting power from institutional banks into the hands of the people could be the future of finance.

FAQ

What Is Uniswap (UNI)?

Uniswap (UNI) is an ERC-20 token that powers the Uniswap exchange. It is a governance token, which allows holders to vote on major decisions regarding the future of the exchange.

How Do I Use Uniswap (UNI) To Vote?

To vote on Uniswap exchange governance, visit the ‘Vote’ page of the Uniswap website. Here you’ll see a list of proposals that you can vote on. Create an account on gov.uniswap.org to participate in discussions and debates around the votes. Any holder can cast a vote, but you’ll need a minimum of 1% supply to submit a proposal.

How Do I Buy Uniswap?

Uniswap is available to purchase from some of the largest cryptocurrency exchanges, including Binance and Gemini. However, it can also be obtained on the Uniswap exchange by loading your ERC-20 compatible wallet with ETH and then swapping to UNI.

Can I Make Money From Uniswap?

Yes, Uniswap is a decentralised exchange that does not use an order book to determine the price of assets. Instead, it uses liquidity pools. Users that add their assets to a liquidity pool can earn a transaction fee for lending their liquidity to the market. As long as the value of the crypto increases, this will translate into real-world earnings. However, users should understand the risks involved as impermanent loss can occur.

Is Uniswap A Popular Cryptocurrency?

Uniswap is a top ten cryptocurrency by market cap, with a current valuation of nearly $20 billion. As a result, it’s a hugely popular option in the crypto space.