SafeCharge Brokers 2025

SafeCharge is a global payment gateway providing streamlined solutions to merchants across international borders. Since 2006, the company has also been used by investors to fund retail trading activities, facilitating safe and secure deposits and withdrawals.

In this 2025 review, we explore how SafeCharge can be used by traders. We also look at how the platform works, its pricing and accessibility as well as supported countries. See our list of the best online brokers that accept SafeCharge deposits to get started today.

Note: this review has no affiliation with ECO Safe Charge.

Best SafeCharge Brokers

Our tests have revealed that these are the 2 highest-rated brokers with SafeCharge payments:

Here is a short summary of why we think each broker belongs in this top list:

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

Compare The Best SafeCharge Brokers

| Broker | Minimum Deposit | Instruments | Platforms | Leverage |

|---|---|---|---|---|

| IC Markets | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| RoboForex | $10 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | R StocksTrader, MT4, MT5, TradingView | 1:2000 |

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, FSA, CMA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

Cons

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Bonus Offer | $30 No Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

Cons

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

How Did We Choose The Best SafeCharge Brokers?

To find the top SafeCharge brokers, we:

- Pinpointed all the firms that offer SafeCharge payments from our 500-strong database of online brokers

- Verified that they support SafeCharge deposits and withdrawals for online trading

- Listed them by their rating, based on over 100+ data points and results from our hands-on tests

What Is SafeCharge?

SafeCharge is a payments technology company. It provides online payment pages, point of sale solutions and global eKYC document verification. The firm was acquired by Canadian electronic payments processor, Nuvei, in 2019. Before the takeover, SafeCharge had been supporting businesses and clients since 2006, when it was co-founded by Teddy Sagi and David Avgi.

Today, SafeCharge, via Nuvei, caters to 50,000 customers across 200+ global markets. The platform supports 150 currencies including cryptos, plus 700 payment methods. Its processing services are offered across industries, including financial services, banks and Bloomberg, as well as gaming and online trading.

The company headquarters are located in Montreal, Canada. Head to the official website for investor relations information, plus annual revenue details.

Company History

In 2014, SafeCharge Financial Services Limited had an IPO and was subsequently listed on the London Stock Exchange (LSE) with ticker, SCH. In more recent news, Nuvei joined the Toronto Stock Exchange in 2020 raising a record-breaking $700 million to become the largest ever technology company offering on the Toronto Stock Exchange.

A year later, the firm filed for a US IPO. Shares are listed on Nasdaq under the symbol NVEI.

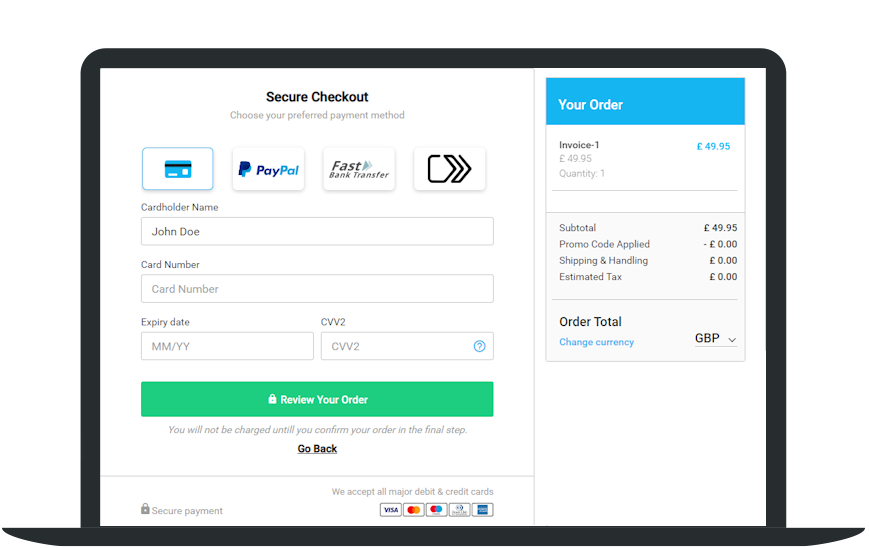

How To Deposit Using SafeCharge

SafeCharge supports a range of payment methods including debit/credit cards, mobile app payments, bank transfers, and e-wallets.

The process is very similar at most brokers. For example, at RoboForex, simply log into your trading account, and click on ‘Deposit Funds’. Then select SafeCharge from the list of payments and follow the deposit instructions.

For any questions or issues with payouts, speak to the customer support team.

Fees

The brand provides a transparent breakdown of fees on its website with fixed processing rates per transaction. The pricing charged to brokers will depend on whether they hold an Express or Enterprise account. Typical charges for card payments vary from 1.2% to 2.5% per transaction. How these costs are split between brokers and traders may vary. With that said, the top trading platforms offer free deposits.

Regulation

SafeCharge is an affiliated company of the Nuvei corporation which holds several global licenses. Nuvei Limited is authorized and regulated by the Central Bank of Cyprus with license number 115.3.9/2018.

Nuvei Financial Services Limited and Nuvei (UK) Limited, is authorized and regulated by the Financial Conduct Authority (FCA). The registered company number is 10873175.

The brand also holds licensing agreements with Visa and MasterCard in Europe.

Pros Of Trading With SafeCharge

International Availability

SafeCharge services are available globally for small and large businesses and are integrated with brokers including Trade360 and IronFX. As the merger arrangement continues, we expect more brokers to start offering the company’s payment services.

Various Payments

The transaction engine facilitates 550+ popular payment methods, including recognized platforms like PayPal, Apple Pay, and WeChat Pay. This means traders have a choice of deposit and withdrawal options when funding forex trading accounts.

Major Cards Accepted

SafeCharge accepts over 150 currencies on all major debit/credit cards such as Mastercard and Visa. Direct payments can be made via a broker’s deposit section. Again, this means traders benefit from the company’s security and ease of use while choosing between multiple payment options.

Note, recent UK compliance entails SafeCharge merchants cannot accept credit card payments for gambling, this excludes Ireland.

Security Management

The company is PCI complaint reducing the risk of security breaches and provides fraud protection with KYC checks. The company also supports merchants with 3D secure API integration. Safecharge operates in compliance with local regulations – more detail on the licenses held can be found under Regulation.

Fees

Fees are integrated through the broker’s website for traders. Traders do not directly deal with SafeCharge, instead they may utilize a payment method supported by the processor. Visit your broker’s deposit section for more information as fees vary between providers.

Speed

Payment confirmation with SafeCharge is processed instantly but receipting times vary by method. Principle membership from major card providers Visa and Mastercard guarantees faster transaction times. Online brokers also have their own processing times which may cause delays in funds reaching your trading account.

Cryptocurrencies

For traders looking to process payments in cryptocurrencies as well as traditional fiat options, SafeCharge does now support digital assets. Most big-name cryptocurrencies are available including Bitcoin, Litecoin, Ripple and Ethereum. Traders will, however, need to ensure that they are also supported by the broker. Although the integration of crypto has grown in recent years, it is not yet offered as standard across the industry.

Customer Service

Customer support is provided through Nuvei. For digital payments gateway support, call:

- North America: 1-855-264-1775

- Rest of the world: +44 20 3051 3031 ext 1

Customer service and technical support can be accessed at:

- United States: 1 877-772-3346

- Canada: 1866-687-3722

General support is available between 8:00am – 7:00pm EST, Monday to Friday. Technical support is available 24/7. Clients can also submit an inquiry ticket to the team via the Nuvei.com website. Visit Customer Support.

Nuvei has several global offices which include Tel Aviv, Israel, Singapore, the UK, Mexico and Bulgaria.

Mobile Payments

SafeCharge fully supports mobile payments. MasterCard and Visa transactions are available as well as Apple Pay, PayPal, Alipay and more. To make deposits or withdrawals to your trading account, from your mobile device, the broker will need to support mobile payments.

Mobile payment processing is becoming increasingly popular and more and more brokers are supporting it with bespoke mobile apps. However, it is worth checking to avoid disappointment.

Is SafeCharge Good For Day Trading?

SafeCharge is a secure online payment processor with a history of credible transaction services. Its merger with Nuvei has facilitated global growth and may pave the way to increased integration of its technology by brokers in the future. The brand is safe, secure and fully regulated. The technology facilitates a range of popular funding methods including PayPal, e-wallets and prepaid cards meaning that traders can make fast bank transfers to trading accounts when needed.

FAQ

How Does SafeCharge Work With My Trading Account?

SafeCharge is a payment processing provider. The platform offers 550 payment methods, direct connectivity to major payment card schemes, and flexible integrated solutions. To deposit to your live trading account, simply head to your broker’s client area, select the payment method and follow the payment instructions.

Are Trading Deposits With SafeCharge Secure?

SafeCharge is a secure payment processor. The platform has a number of measures in place to protect against the loss and misuse of customer information. The firm is PCI compliant and provides fraud protection with KYC checks. Should you have any concerns, submit a ticket to the team via the Contact Us tab on the website.

Does SafeCharge Support Mobile Payments?

SafeCharge does support mobile payments. Apple Pay, PayPal, Visa, and MasterCard transactions can be accessed via an e-wallet held on a mobile device. To utilize mobile payments, the broker will also need to support them. Check this before opening a live account.