Rarible Review 2025

Rarible is one of the top-rated platforms where non-fungible tokens (NFTs) can be bought and sold. Users can create and mint their own NFTs without any coding skills while traders can buy innovative digital tokens. The platform is also the first to launch a governance crypto token in the NFT space. See our guide below to understand how Rarible works. We also review the NFT trading platform’s fees, available tokens, compatible wallets and more.

About Rarible

Rarible Inc was launched in 2020 by owners and co-founders Alexei Falin and Alexander Salnikov. It is an open-source NFT marketplace where any user can buy, mint and sell digital items. The ownership of these items is exchanged on the company’s online platform using Ethereum blockchain technology.

Rarible has a particular focus on art assets and virtual collectables. The platform also stands out for its simple NFT minting process, which is particularly attractive to those with no coding skills. This has allowed artists and creatives to sell their digital art with low barriers to entry.

In July 2020, Rarible launched the first-ever governance token in the NFT space called RARI. Since then, its token price has increased tenfold. RARI was created to give the Rarible community the power to vote on platform upgrades and to participate in content curation.

The exchange’s token can’t be purchased and instead has to be earned by active participation on the platform. This is a move towards becoming a fully Decentralized Autonomous Organization (DAO), where decision rights belong to platform users. Voting requires staking your RARI for a specific period, mitigating potential short-term opportunistic governance attacks.

In February 2021, Rarible raised $1.75 million in a successful seed funding round. Notable investors included Coinbase Ventures, Bollinger Investment Group, MetaCartel Ventures and CoinFund. The NFT trading platform has since seen a further spike in investing activity reaching a market capitalisation of over $30 million.

What Is NFT Trading?

NFTs are unique digital assets, which can encompass collectables, game items, virtual art, event tickets, domain names, and more. Ownership of NFTs can be tracked and verified on the blockchain.

The decentralised finance (DeFi) space has seen a surge in NFT trading, which follows the booming popularity of cryptos. In 2020, the NFT market grew into a $250 million industry. The new crypto-mania has led to the creation of several online platforms like Rarible, including OpenSea and Nifty Gateway.

Of course, NFTs have also been met with controversy, particularly around their environmental impact. NFTs on the Ethereum blockchain come with a large carbon footprint due to the electrical energy consumption needed to mint tokens. This is because a network of computers is required to run millions of mathematical values until it finds the right combination of numbers to mint a transaction.

How Rarible Works

Rarible is a marketplace that connects sellers, such as content creators or digital artists, with buyers who can purchase ownership over pieces, without a middleman. As a decentralised marketplace, Rarible trades happen through a smart contract and are logged on a blockchain ledger, which offers transparency and security for market participants.

When creators upload and mint their files on Rarible, this generates an NFT on the blockchain. Each NFT is unique and not interchangeable. Similar to other tokens on Ethereum, this allows NFTs to be transferred between wallets.

Rarible users are able to program royalties or the rights to future cash flows on the assets they create. Creators can set a percentage of future sales and a portion of consequential sales will automatically be withdrawn to the creator’s digital wallet. This feature has drawn many creators to the platform, which stands out from traditional content platforms.

On top of the ability to integrate collectables from OpenSea to Rarible, the company is working on a cross-platform royalties implementation.

You can stay tuned for any Rarible updates or news on their Twitter, Discord Server, Telegram and Instagram.

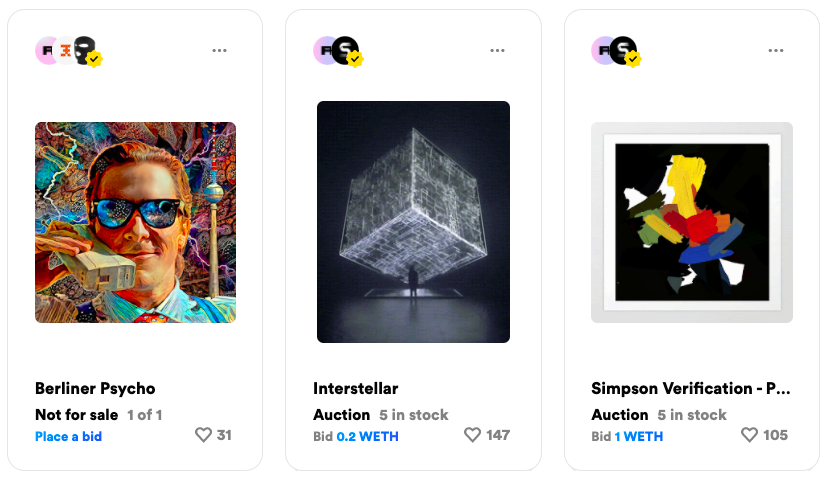

Tradable NFTs

- Art & photography – Digital art was a suitable fit for NFTs as much of what makes art valuable is its scarcity and ability to prove ownership. Art and photography content can include anything from a 3D model to a logo png. Notably, artist Beeple sold their work for $69 million, which smashed existing digital art records. Other popular artists on Rarible include Murat Pak and Pest Supply.

- Games – Digital assets can be bought within a game belonging to a participating company. Gamers would buy the item, which would be temporarily used while playing the game. However, NFTs have shifted the ownership of game items to the actual buyer. Assets can include unique swords, skins or avatars. Rarible is tapping further into the NFT gaming industry by partnering with MyCryptoHeroes. Those who play the game are rewarded with potential access to a RARI airdrop too.

- Music – Music and audio files can be uploaded and minted on Rarible. Musicians have turned to NFTs as a way to control how many editions can be made available on the marketplace. Instead of being paid per stream, they may earn more by being paid per edition. These online music files become collectables that can appreciate in value over time, unlike traditional forms of streaming.

- Metaverses – This is a shared virtual space, which spans and operates across platforms and in the real world. NFTs on the metaverse allow for assets to be moved seamlessly from one virtual world to another as they exist on the blockchain.

- Memes & punks – A one-of-a-kind digital rendition of the Nyan cat meme made headlines for being sold for 300 ETH, which was equivalent to $590,000. On the other hand, computer-generated avatars called CryptoPunks have sold for $2 million. The value of both pieces comes from their scarcity and limited supply.

- Domains – Domain names can also be purchased on Rarible. For example, the purchase of the Binance smart chain domain is available on the platform.

- DeFi – Users can trade a number of cryptocurrencies like DAI, ETH and Bitcoin. Call options on crypto are also being sold on Rarible.

Fees

Rarible charges a service fee of 2.5% per sale on both ends of the transaction, which acts as a listing fee. However, the seller can choose to take on the fee, which will cost 5% of the final sale price. This is standard for the market vs OpenSea, which only charges 2.5% in commission. On top of that, a transaction fee to mint a token is passed on to the buyer. When it goes through Rarible’s call contract method, it automatically connects to your crypto wallet.

Note, Rarible only accepts ETH for all transactions. If your online wallets don’t hold ETH, you may be charged conversion fees to transfer crypto tokens.

Like most NFT marketplaces, you will have to pay a gas price, which acts as an upload fee. These are usually priced in ETH. A gas fee is the cost of the computing energy required to process and validate transactions on the Ethereum blockchain. The price of the gas fee fluctuates throughout the day depending on the supply and demand of processing power at that point in time. Miner fees are also based on the size of the transaction. There are websites that offer gas price predictions based on your time zone, thus, you can choose an optimal time to upload your NFT before committing to payment.

Gas fees can be expensive for creators. However, other alternatives to Rarible have tried to combat high gas fees. For example, Mintable launched gasless minting, where you can make your item on the blockchain without having to submit anything on the ledger. A transaction only occurs when someone buys it. Similarly, OpenSea introduced lazy minting, where creators can make NFTs without any upfront gas cost. This means the NFT won’t be transferred on-chain until a first purchase is made. This offloads some of the unnecessary energy needed to mint an NFT token that might not even be bought.

Deposits & Withdrawals

Rarible only accepts deposits and withdrawals via an ETH crypto wallet. Therefore, if you want to interact on the marketplace you have to sign up and login with a digital wallet provider. You can purchase Ether via your wallet using a credit or debit card.

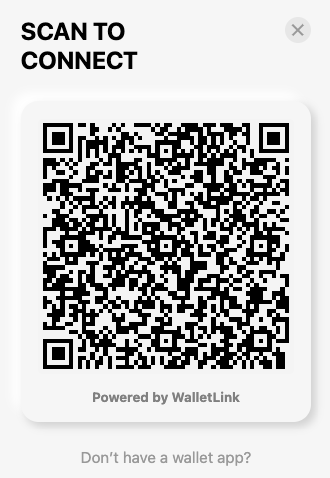

Afterwards, you have to select ‘Connect Wallet’ on the Rarible website. Approved wallets include Fortmatic, Coinbase Wallet, MyEtherWallet or Torus. However, if you own other solutions like a Metamask or Exodus wallet, you can use WalletConnect. You don’t need to go through a KYC verification process on Rarible.

Once connected, you can instantly buy and sell NFTs on the marketplace. If any of your tokens get sold, the funds will automatically be transferred to your crypto wallet. The tokens can be used to buy other NFTs on the platform or you can cash out using services like Coinbase or Binance.

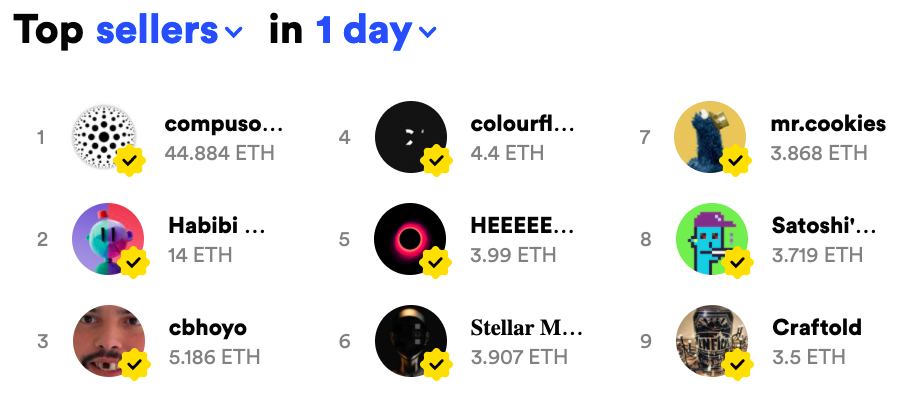

Rarible Offers

Rarible did not issue any promotional offers at the time of writing. With that said, alongside the RARI governance model is their unique liquidity mining scheme. This rewards active buyers and sellers with RARI tokens, which can be used to govern the marketplace. Rarible also hosted RARI airdrops to reward new and existing users for supporting the platform.

How To Open A Rarible Account

To open a Rarible account, you need to connect a compatible crypto wallet. Once connected, Rarible will auto-generate an account, which can be immediately used to access the marketplace.

To personalise your account profile, head to ‘My Account’. From there, you can set up a display name and profile picture, edit your account bio and custom URL. Then, confirm changes by clicking ‘Update Profile’.

You may wish to have a verified badge associated with your account. Rarible stresses that verified badges are only awarded to creators and collectors that can prove authenticity and dedication to the marketplace. Users will have to fill out a Typeform found in the website’s FAQs.

Rarible’s verification process has been met with criticism. Users have been subject to fraud from a verified account called Kaws. After purchasing their fraudulent token, clients were not compensated with a refund. Instead, the company’s support team simply burned the token from the platform. Since then, the Rarible team has been much stricter with the verification process.

How To Sell & Create NFTs

The following is a tutorial on how to sell and create NFTs on Rarible:

- On the Rarible homepage, click ‘Create’. You will be led to a creator screen where you can connect to your digital wallet

- Choose whether to sell single or multiple copies of your NFT

- Upload your file. Accepted file types include PNG, GIF, WEBP, MP4 and MP3. The file size limit is 30MB

- You can either create a new collection or keep it in the Rarible collection. Choose a name for your collectable and edit the description

- You can choose to set up royalties, where you get a percentage of consequential sales i.e. 10%, 20% or 30%

- Input the properties of your file, i.e file size, format or metadata

- Consider the optional ‘unlock once purchased’ feature. This allows the creator to share secure content such as discount codes, digital keys or a URL exclusively to owners of the NFT

- If you choose to put the item up for sale, you can decide on the price. Without an instant sales price, the content will go into an auction where bidding can take place

- You will then be asked to confirm the transaction. Once the token is minted, you have to sign the sell order

- You should then find your minted NFT token under ‘Collectables’. Minting times can vary so it may be a while before the item appears. You can choose to remove your token at any point.

Pros Of Rarible

If you take Rarible vs Nifty Gateway, SuperRare, or Foundation, the platform has the following advantages:

- Community governance scheme to become a DAO

- Open source and non-custodial marketplace

- Strong investor backing

- RARI governance token

- User-friendly experience

- No coding skills required

- Digital art specialism

Cons Of Rarible

When comparing Rarible vs Mintable and OpenSea, the platform has some downsides:

- Limited customer support, contact details & FAQs

- No official roadmap or whitepaper

- Adverse environmental impacts

- No API or IPFS storage

- No mobile app

- High gas fees

Final Word On Rarible

Rarible has emerged as one of the leading NFT marketplaces. The exchange’s accessibility has opened up NFT trading to all types of creators with little to no experience of digital tokens. Its community governance model and RARI token is also a game-changer in the DeFi industry and the company has strong investor backing. On the downside, Rarible has some way to go to combat the high gas fees not seen at competitors like OpenSea.

FAQ

How Do I Get Verified On Rarible?

Users have to prove authenticity and active dedication to the Rarible platform. To submit a request for a verified badge, you have to visit a link to a Typeform, which can be found on the broker’s FAQ page. The exchange also provides a comprehensive guide to getting verified too. The verification process can take up to 2 weeks and you can submit a request again if your application is rejected.

How Much Does It Cost To Mint An NFT Token On Rarible?

The cost of minting will differ on every NFT platform. This is the process of registering an item on the Ethereum blockchain. Rarible has its own call contract method, where the transaction fee is passed on to the buyer. This charge varies with each transaction. Note, the user can always confirm or back out of the transaction via their crypto wallet.

Where Do I Buy NFTs On Rarible?

Head to the ‘Explore’ page on the Rarible website to buy NFTs. Here, you can browse the array of art, music, domain names and meme tokens. When you click on an NFT, you have the option to ‘Buy Now’ or ‘Bid’. A service fee of 2.5% is charged on each transaction and is priced in ETH.

How Do I Sell And Mint NFTs On Rarible?

Firstly, you need to click ‘Create’ on the Rarible homepage. Here, you can choose to sell a single copy of your NFT or multiple copies. Then you will need to upload a file no larger than 30MB in the following formats; PNG, GIF, WEBP, MP4 or MP3. You will need to input some details and confirm the transaction via your digital wallet browser extension. Once that’s done, the minted token will appear in your collectables. If someone purchases your NFT, the ETH tokens will automatically be transferred to your crypto wallet.

Which Blockchain Does Rarible Use?

Rarible uses the Ethereum blockchain. This is a widely used blockchain platform in the NFT marketplace, though there has been some negative news stories about its impact on the environment.

What Are The Best Digital Wallets?

Rarible only accepts ETH digital wallets, such as Fortmatic, Coinbase Wallet, MyEtherWallet and Torus. With that said, other popular wallets, such as Metamask and Exodus can be connected to the exchange using WalletConnect.