Kraken Review 2025

Pros

- NFT marketplace and crypto staking available

- Excellent range of 220+ more established cryptocurrencies

- Very good security track record with no hacks in a decade since launch

Cons

- Does not support many newer altcoins

- Low leverage on spot trading

- Slow verification process on Pro account

Kraken Review

Established in 2013, Kraken is a top-rated cryptocurrency trading platform. In fact, it is the fourth-largest digital currency exchange globally by trading volume. This 2025 review covers supported crypto coins, trading terminals, withdrawal fees, and more. Find out whether to start trading Bitcoin at Kraken.

Kraken Headlines

Kraken is a San Francisco-based cryptocurrency exchange. Its origin dates back to 2011 when CEO and founder, Jesse Powell, visited the offices of Mt. Gox, a crypto exchange company. Mt. Gox suffered a major security breach and was hacked losing millions in client funds. This experience motivated Powell to build a crypto investing platform that was organized, secure, and trusted by customers. Eventually, Kraken was established in 2013.

The company currently serves over 6 million traders and is looking to launch an initial public offering (IPO) in the future. Its straight-talking trading platform essentially allows participants to buy and sell cryptos with various fiat currencies.

Trading Platforms

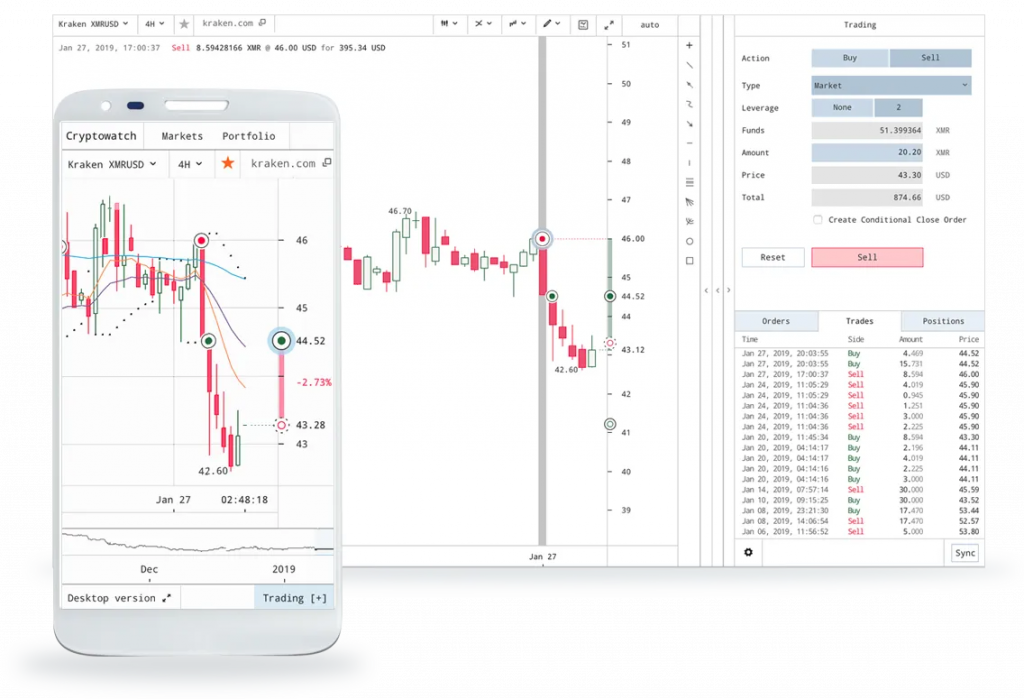

Kraken Terminal

The Kraken Terminal is a professional charting and trading interface, which is free and available to all clients. Its software is based on Kraken’s premium trading terminal, Cryptowatch.

The platform offers:

- Order book and depth chart which visualizes market sentiment i.e. volume of orders with bids and asks

- Toolbar with markets menu, time period selector, analysis, and drawing tools

- History scrollbar which scans through the current asset’s price history

- The trading form allows users to submit orders from the terminal

- A watchlist that displays selected financial markets

- Indicator panels i.e, volume and MACD

- Real-time customizable charts

Cryptowatch

Cryptowatch is Kraken’s premium terminal and provides real-time crypto market data, plus charting and investing services across 25 exchanges, including Binance, Coinbase Pro, Gemini and Kraken Futures.

Live data is supplied directly from crypto exchanges through APIs and covers over 4,000 trading markets. Basic use of Cryptowatch is free, while additional premium features can be purchased with Cryptowatch credits.

Credits can be purchased with Bitcoin or a credit card at $1 = 100 credits. Each account gets 250 credits to start with but users can earn credits during onboarding and via a referral system.

Free features include:

- Advanced charting interface which visualizes price movements and analyzes market trends

- Tools and indicators i.e. Moving Averages, MACD, RSI, and Bollinger Bands

- View trade history, orders, positions, and balances across exchanges

- Trade on multiple exchanges via one terminal including on mobile

- Price, volume, and technical analysis alerts

- Make and save your favorite themes

- Trader chatbox

Premium features include:

- 24/7 price, volume, technical analysis, and order-fill alerts as text and emails

- Cryptofinance.ai plugin pulls market data into Google sheets

- Zapier integration automates orders and alerts

- Market Data WebSocket API

Tokens & Coins

The exchange allows you to trade more than 65 cryptocurrencies and 7 different fiat currencies, with plans to add new coins in the future. Kraken offers popular cryptos such as Bitcoin, Ethereum, Tether, Ripple, Monero, and Dogecoin. Users can trade with a variety of fiat-to-crypto pairs, including USD, EUR, CAD, JPY, GBP, CHF, and AUD.

Clients can also trade on a selection of crypto futures and indices that track the overall direction of the digital currency market. These are good options for investors looking to minimize the risk of one crypto falling in value.

Spreads & Commissions

Kraken offers some of the most competitive fees in the crypto market. Fees on Kraken Pro range from 0% to 0.26% vs Coinbase and Gemini, which go up to 1.49%. The broker uses a taker/maker fee schedule, where the rate decreases as your 30-day volume increases, incentivizing market liquidity.

On the Kraken Exchange, you pay a 0.9% fee for stablecoins, and 1.5% for FX pairs or on any other crypto. Traders are also required to pay 3.75% + 0.25 EUR for card processing or 0.5% for online banking. Fees are also charged on other deposits and withdrawals depending on the method and country you reside in. Generally, funding prices are cheaper with cryptocurrencies.

Kraken does not charge any fees for transferring funds with a futures wallet, staking, storing funds, account inactivity, or account maintenance.

Leverage

Leverage limits differ across spot transactions and margin and futures investing. Kraken currently has up to 5x leverage on spot trading, depending on the currency.

For example, Bitcoin vs US Dollar has a 5x maximum leverage, while Monero vs Euro has a 2x leverage limit. The conservative leverage limit comes from the high degree of risk when spot investing in cryptos. On the other hand, futures offer 50x leverage across most contracts.

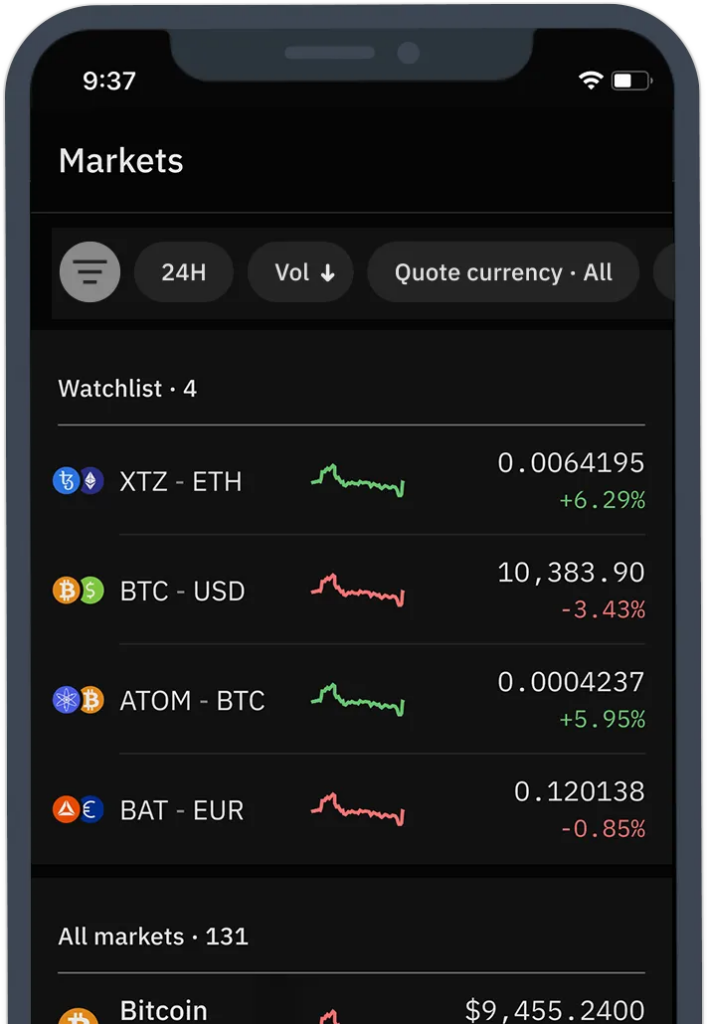

Mobile Apps

Kraken offers two proprietary mobile apps, which serve different purposes. A third option used to be available, Kraken Futures. However, it was discontinued on the 27th of January 2022. Investors must now use the official website to trade futures.

Kraken App

The beginner-friendly app allows users to buy, sell and convert crypto. You can set up and login with two-factor authentication (2FA) to monitor prices, track portfolios, save favorite cryptos, make credit and debit card purchases, plus initiate fiat withdrawals.

The app is accessible everywhere excluding Crimea, Donetsk, Luhansk, Cuba, Iran, Japan, North Korea, and Syria. You can get it on Android 8.0 and up and iOS 13 and up.

Kraken Pro

Kraken Pro provides a professional trading experience, which enables clients to place advanced orders on the go. The application offers margin trading with up to 5x leverage, candlestick price charts, crypto staking, plus order book display options. On the downside, funding is not available on the app, and can only be done through the website. 2FA does not work on the application and instead connects to your trading account using an API key.

Kraken Pro is available on Android 7.0 and up and iOS 11 and up.

Payment Methods

Deposits and withdrawals can be done with cryptos or fiat currencies. Crypto funding methods include Bitcoin, Ethereum, Litecoin, Ripple, and Tether. Credit cards can be used to buy cryptos at the Express, Intermediate, or Pro levels. Transactions have a 7-day card limit of €7,500.

Minimum orders, deposits, and withdrawals also depend on the token. The most current information on minimums can be found on the Kraken website.

Once you’ve completed the verification process, depositing and withdrawing from your account is simple:

- Head to your client area under ‘Funding’, where all limits are displayed

- Select ‘Deposit’ on the respective fiat or crypto

- For fiat currencies, select the preferred deposit method and follow the banking instructions

- For cryptos, connect to your e-wallet via the ‘deposit address’ and confirm the transaction

- Check your account balance status to ensure funds have been approved

- To withdraw earnings, select ‘Withdraw’ on the respective fiat or crypto

- For fiat currencies, select the withdrawal method, input your bank details and amount

- For cryptos, input your details and crypto address found in your e-wallet

Demo Account

The exchange doesn’t offer a demo account that you can use to test the general functionality of the platform.

However, there is an option for futures trading. To activate the free paper trading account all you need to do is to sign up in your futures dashboard and transfer the virtual funds from the holding wallet to the trading wallet.

Bonuses & Promotions

In order to comply with regulations, the exchange doesn’t offer any bonuses. However, if trading volumes exceeds $50,000 in 30 days, then investors can receive lower fees of 0.14% maker and 0.24% taker. The broker also runs referral promotions – see the website for the latest details.

Regulation & Licensing

Kraken is licensed and regulated in all jurisdictions where it operates, such as the USA (FinCEN), Canada (FINTRAC), UK (FCA), Australia (AUSTRAC), and Japan (FSA).

Client funds are held directly by users in their bank accounts at Kraken partners that are heavily regulated. The Kraken Bank itself is licensed by the Wyoming division of banking.

Additional Features

As well as basic OTC trading, Kraken also offers futures products and leverage to multiply profits while trading on Bitcoin, for example. Margin allows experienced traders to maximize gains from market swings with 5 times the earning potential vs regular spot trades.

Kraken also allows you to earn rewards by staking crypto and fiat currencies. This means users can stake assets on the blockchain i.e. ETH staking or via off-chain staking through Kraken’s internal programs. In addition, the broker offers up to 23% yield APY per year on certain cryptocurrencies.

Note, Kraken is also building an NFT marketplace that will facilitate the buying and selling of non-fungible tokens. See our guide to trading NFTs here.

Account Types

Traders need to create an account and get verified to be able to deposit and withdraw funds. Each verification level is linked to an account type. The accounts available are Starter, Express, Intermediate, and Pro, though the Express account is only available in the US.

Each verification level has different funding options and deposit/withdrawal limits. For example, the Pro account has a maximum withdrawal of $100,000,000 over a period of 30 days.

Each account requires different types of documentation with varying verification times. For example, the Starter account only requires simple personal information, which takes 1 to 2 minutes. The Pro account requires financial information and KYC verification, which can take a few days to be approved.

Benefits

If you take Kraken vs competitors like Binance, Coinbase, Coinbase Pro, and Gemini, the exchange offers the following advantages:

- Low exchange fees on Kraken Pro

- 50x leverage on futures trading

- Choice of 65+ cryptocurrencies

- Low minimum deposit of $10

- NFT marketplace plans

- Fiat currency trading

- 3D secure required

- Mobile investing

- Crypto staking

Drawbacks

- Bank cards can be used to buy and deposit crypto, but not fiat

- Slow verification process on Pro account

- Many altcoins aren’t yet supported

- Low leverage on spot trading

Trading Hours

Since cryptocurrencies are traded 24/7, the platform is available for clients to use at any time. Furthermore, some customer service contact details are also 24/7. An example is the live chatbot or the regional phone numbers provided on the official website.

Customer Support

3.8 / 5As outlined above, customer support is available around the clock and the team is able to help with any issues you encounter such as 2FA not working, login problems, or even with help to delete your account. Should you require assistance, you can notify Kraken’s support team via:

- Live chat – chatbot on the website

- Email – Submit a request form via the support center

- Phone – 24/7 numbers provided in English, Spanish, and French on the official website

Kraken mainly advises users to search for an article related to the query on the support center.

The broker’s US headquarters are registered at Payward Ventures, Inc., 237 Kearny Street #102, San Francisco, CA 94108.

Note that the support team isn’t able to offer any tax help – you may want to consider reaching out to your official tax institution. For example, in the UK this is HMRC.

Security

Kraken hasn’t been hacked and follows industry-leading safety measures. 95% of all deposits are kept in cold storage, which ensures full reserves so that users can deposit and withdraw on demand. Client information is encrypted at the system and data level, with 24/7 surveillance. Kraken also enables 2FA, 3D secure payments, SSL encryption, email confirmation for withdrawals, plus API keys.

Proof Of Reserves

Kraken is a step ahead of some of its competitors when it comes to proof of reserves. It was the first crypto exchange to offer a proof of reserves cryptographic audit. The exchange implements an audit process to prove to customers that client funds are properly held. The advanced accounting practice is conducted twice per year by trusted auditors.

The audit process involves an anonymous snapshot of all account balances held, segregating them into a Merkle-tree data structure.

Proof of reserve audits mean clients have access to balance verification at the time of audit processing. The process is relatively simple and means you can keep an eye on your assets.

To run a check:

- Log in to your Kraken account with your registered credentials

- Navigate to your account settings (Settings > Account)

- Select the ‘Audits’ tab

- Your profile will indicate recent audits that your asset balance was included in, along with the audit date, an ID, the style of evaluation and the company that organized it

- Copy the ‘Record ID’ related to your account and the specified audit

- Visit the website of the third-party auditor responsible for the proof of reserves audit

- Enter your ‘Record ID’ into the auditor’s portal

- Verify your balance at the time of the audit

Fund Safety

The Kraken platform has never been hacked in its nine-year history. Nonetheless, a $100 million fund is available for user compensation in the event of a hack or security breach, meaning you can make a withdrawal immediately.

Kraken Verdict

Kraken offers a good range of cryptocurrency assets, reliable trading apps, competitive fees, and strong user security. The exchange is also licensed and regulated by several reputable bodies. While Kraken could improve its verification times, it is still an excellent platform for crypto traders in 2025.

FAQ

Who Is Kraken Best For?

Kraken’s fees favor professional investors who trade in high volumes, with additional incentives when you reach a monthly trading volume of $50,000. Kraken also offers advanced features like margin trading, staking, and futures products. With that said, the exchange is still beginner-friendly, offering a simple UI and learning resources for new traders.

What Do I Need To Know As A UK Trader Using Kraken?

The UK is one of Kraken’s most active client bases for cryptocurrency investing and staking. However, under FCA regulation, retail traders are not eligible to trade on Kraken Futures. Clients can, however, buy, sell and hold cryptos for long-term investment purposes.

Why Is My Deposit Or Withdrawal On Hold At Kraken?

Your deposit may have been flagged for a few reasons. It may have been above the funding limit based on your verification level. There might also be a name mismatch on your Kraken and bank accounts. In addition, your bank may have asked to put the deposit on hold due to irregular activities. On withdrawals, you may encounter an invalid amount error if your account balance is below the requested amount. Speak to the broker’s customer support team to resolve any issues.

How Do I Set Up An Account With Kraken?

You can create an account on the Kraken website, using an email and password. You can only start trading and funding your account once you complete their verification process. Each verification level is associated with a particular account type: Starter, Express, Intermediate, and Pro. Each option has different deposit and withdrawal fees, funding options, and limits.

Can I Deposit Or Withdraw At Kraken Using Debit/Credit Cards?

Kraken does not typically accept cash, debit and credit cards, PayPal, or similar services for fiat currency deposits. This is because accepting cash makes it difficult to comply with financial regulations. With that said, cash and cards are accepted in CAD and the ‘Buy Crypto’ feature means you can purchase a range of cryptos with cards. Other regions can also use a bank card to purchase cryptocurrencies in order to make deposits.

Top 3 Alternatives to Kraken

Compare Kraken with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Gemini – Gemini is a cryptocurrency exchange set up in 2014 by the Winklevoss brothers, known for their early involvement in Facebook. The exchange is among the world’s 20 largest and most popular. Gemini clients can trade and stake 110+ cryptocurrencies, with derivatives trading available in some jurisdictions, an advanced proprietary platform and additional features including an NFT marketplace.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Kraken Comparison Table

| Kraken | Interactive Brokers | Gemini | FOREX.com | |

|---|---|---|---|---|

| Rating | 3.9 | 4.3 | 3.8 | 4.5 |

| Markets | Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Cryptos | Forex, Stocks, Futures, Futures Options |

| Demo Account | Yes | Yes | No | Yes |

| Minimum Deposit | $10 | $0 | $0 | $100 |

| Minimum Trade | Variable | $100 | 0.00001 BTC | 0.01 Lots |

| Regulators | FCA, FinCEN, FINTRAC, AUSTRAC, FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NYDFS, MAS, FCA | NFA, CFTC |

| Bonus | Lower fees when trading volume exceeds $50,000 in 30 days | – | – | Active Trader Program With A 15% Reduction In Costs |

| Education | Yes | Yes | Yes | Yes |

| Platforms | AlgoTrader, Quantower | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | ActiveTrader, AlgoTrader, TradingView | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | – | 1:50 | – | 1:50 |

| Payment Methods | 6 | 6 | 10 | 8 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Gemini Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Kraken and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Kraken | Interactive Brokers | Gemini | FOREX.com | |

|---|---|---|---|---|

| CFD | No | Yes | No | No |

| Forex | No | Yes | No | Yes |

| Stocks | No | Yes | No | Yes |

| Commodities | No | Yes | No | Yes |

| Oil | No | No | No | Yes |

| Gold | No | Yes | No | Yes |

| Copper | No | No | No | No |

| Silver | No | No | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | No | No |

| Bonds | No | Yes | No | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | No |

Kraken vs Other Brokers

Compare Kraken with any other broker by selecting the other broker below.

The most popular Kraken comparisons:

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Kraken yet, will you be the first to help fellow traders decide if they should trade with Kraken or not?