Trading EURCAD

The EURCAD is one of the most-traded currency pairs by volume. However, complexity and volatility can lead to unsettled price action. This guide will analyse the trading view of the EURCAD cross-currency pair, including historical data, long-term forex forecasts, correlation calculators, investing strategies, live charts, and more.

Best EUR/CAD Brokers

We've tested hundreds of brokers and these 6 stand out as the best for trading EUR/CAD:

This is why we think these brokers are the best in this category in 2025:

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- XM - XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC and CySEC and offers a comprehensive MetaTrader experience.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- Deriv - Established in 1999, Deriv is an innovative broker now serving over 2.5 million global clients. The firm offers CFDs, multipliers and more recently accumulators, alongside its proprietary derived products which can't be found elsewhere, providing flexible short-term trading opportunities.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Bonus Offer | Active Trader Program With A 15% Reduction In Costs |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, Stocks, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

| Currency Pairs | USD/CNH, EUR/CNH, AUD/CNH, CNH/JPY, EUR/AUD, EUR/SGD, EUR/TRY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/JPY, GBP/ZAR, USD/HKD, USD/SGD, USD/THB |

Pros

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | ASIC, CySEC, DFSA, IFSC |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

| Currency Pairs | EUR/AUD, EUR/JPY, EUR/SGD, EUR/TRY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/JPY, NZD/SGD, USD/HKD, USD/SGD |

Pros

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

Cons

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- Although trusted and generally well-regulated, the XM global entity is registered with the weak IFSC regulator and UK clients are no longer accepted, reducing its market reach.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, FSA, CMA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

| Currency Pairs | USD/CNH, EUR/AUD, EUR/SGD, EUR/TRY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/JPY, USD/HKD, USD/SGD, USD/THB |

Pros

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

Cons

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Bonus Offer | $30 No Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

| Currency Pairs | EUR/AUD, EUR/JPY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/JPY |

Pros

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

Cons

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

Deriv

"Deriv is ideal for active traders seeking alternative and unique ways to speculate on global financial markets, from multipliers and accumulator options to its bespoke synthetic indices, which mimic real market movements and are available 24/7, allowing for continuous trading opportunities regardless of market hours."

Christian Harris, Reviewer

Deriv Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs |

| Regulator | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

| Platforms | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP |

| Currency Pairs | EUR/AUD, EUR/JPY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/JPY |

Pros

- Account funding is a breeze with a very low minimum deposit of $5 and a huge selection of payment options, plus Tether was added to the cashier in 2023.

- Deriv stands out with its innovative products, from multipliers and derived indices to its addition of accumulator options, providing exclusive short-term trading opportunities.

- Although response times trail alternatives in our personal experience, Deriv offers 24/7 support and is one of the few brokers to offer WhatsApp assistance.

Cons

- Apart from the MFSA in the EU, Deriv lacks top-tier regulatory credentials, reducing the level of safeguards like access to investor compensation.

- While the Academy launched in 2021 is a step in the right direction, there is limited education on advanced trading topics for seasoned traders and no live webinars to upskill new traders.

- Although there’s a basic blog, there's little in terms of technical analysis or market reports which could help active traders identify potential opportunities.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

| Currency Pairs | USD/CNH, EUR/CNH, GBP/CNH, NZD/CNH, EUR/AUD, EUR/SGD, EUR/TRY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/HUF, GBP/JPY, NZD/SGD, USD/HKD, USD/INR, USD/SGD, USD/THB |

Pros

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

- Now offering spread betting through TradingView, Pepperstone provides a seamless, tax-efficient trading experience with advanced analysis tools.

Cons

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

EURCAD Explained

The Euro (EUR) is the official currency of respective European nations, and the Canadian Dollar (CAD) is that of Canada. The exchange rate of both currencies is impacted by respective monetary policies from the European Central Bank (ECB) and the Bank of Canada. Today, the Euro is the second most traded currency in the world, while the Canadian Dollar is the sixth.

Importantly, the EURCAD exchange rate denotes the buy or sell price of the Euro to the Canadian Dollar. For example, 1 EUR to 2 CAD means to buy 1 Euro, you will pay 2 Canadian Dollars.

Exchange rate history, future prognosis, real-time news, and decisions from central banks can all help traders make predictions about the value of the currency today, tomorrow, or several months from now.

Live Chart

History

The EURCAD is a fairly new forex pairing following the introduction of the Euro. The Euro was established as a digital currency in 1999 before gaining power as a physical asset across European Union zones. Significant economic events, including Brexit, and Eurozone performance have impacted the value of the Euro over the years.

The Canadian Dollar, originally the Canadian Pound, was developed in the 1850s and renamed to strengthen trade affiliation with the US. The value of the Canadian Dollar was set at 1.1 CAD to 1 USD until 1970 when it then became a floating currency. The Canadian Dollar is a commodity-sensitive currency with exchange rate fluctuations responding to price movements of their most lucrative export asset, crude oil.

In recent history, inflation rates and the Russia-Ukraine war also destabilized the EUR, which has since been losing ground against the CAD. This is a very good example of how global political events can impact forex trading markets, even though Ukraine doesn’t directly use the Euro.

Note, the all-time high for the EUR/CAD was 1.71 in December 2008 while the all-time low was 1.21 in August 2012.

Influences On Price

Many influences can cause movements in the value of the EURCAD, lending it to various trading strategies. Fundamental and technical analysis play a key role in most strategies, helping to inform investment decisions.

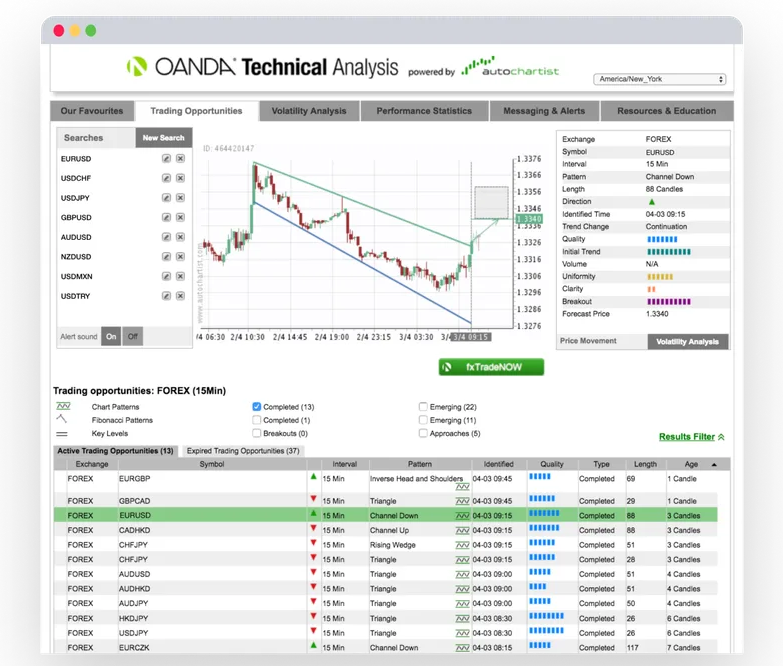

Technical Analysis

Today, technical analysis for trading forex pairs such as the EURCAD typically involves reviewing price trends and patterns on graphs. Historical 5 /10/ 20 years price data and monthly average charts are available at many top brokers, including IG. In fact, most of the best brokers offer software free downloads with a suite of charts and indicators to aid with technical analysis. Competitive forward rates are also available at top providers.

Fundamental Analysis

Fundamental analysis involves looking at economic, social, and political influences on the EURCAD. For example, investors should look at Canadian GDP growth data, plus unemployment and interest rates. Lots of the best platforms for day trading currencies offer economic calendars with upcoming events, along with the latest news bulletins.

Features Of The EURCAD

The EUR/CAD is known as a cross-currency forex pair. Cross pairs are those that do not include the US Dollar and have particular features to take into account:

- Uncorrelated pairs are highly volatile

- Reduced exposure to exchange rate fluctuations from US Dollar sensitive events

- Lower volume traded vs. major currency pairs can lead to increased price swings

- Weaker liquidity may lead to increased spreads with additional pips to enter trades

Despite this, it is important to note that the value of the US Dollar can still influence price movements in the EURCAD. A strength or weakness in the USD against other currency pairs can indirectly impact cross pairs.

Use a correlation calculator to understand the variables impacting the EURCAD versus the EURUSD and USDCAD. A positive correlation indicates a forex pair that reacts in line with movements in the EURCAD. A negative correlation suggests the currency pair will move in the opposite direction.

How To Trade The EURCAD

Currency pairs such as the EURCAD are bought and sold via a network of banks and brokers in a decentralized OTC market. Traders can use CFDs, forwards and futures, options, and more to speculate on the value of the pair.

Regardless of instrument, employment rates, political events, and demand for key commodities such as oil can all impact the EURCAD.

Trading Strategies

Many forex trading styles can be used to speculate on the price of the EURCAD:

- Swing – Holding positions for one or more days. Identify the market range and buy or sell according to support and resistance signals, pivot points, or other indicators.

- Scalping – Opening and closing positions, usually holding for just a few minutes to take advantage of small gaps between the bid and ask price. Intraday candlestick charts are a useful tool for scalpers.

- Carrying – Using a low-interest-rate currency to invest in a high-interest rate currency. EURCAD swap strategies usually involve going short. Sell the Euro to benefit from an interest rate differential between the EURCAD and your position size.

Pros Of Trading EURCAD

There are several reasons why this forex pair is popular:

- High volatility – Strong market trends means greater potential to generate revenue.

- Interest rates – Discrepancies between interest rates create opportunities for carry trade strategies.

- Information – Plenty of financial information is available on the EURCAD exchange rate online. Data includes weekly forecasts, live exchange rate charts, and currency conversion graphs. These can all help with trader outlooks and market sentiment.

Cons Of Trading EURCAD

There are some drawbacks to consider before investing money in the EURCAD:

- High risk – The volatility of the pair can create a complex environment for traders with limited experience or knowledge.

- Euro cross – The Euro links make the FX pair susceptible to intense price fluctuations from political and economic events in Europe.

Best Time To Trade

The majority of price movement occurs during the crossover between the London and New York financial market sessions, 1 pm to 4 pm GMT. Keep an eye on FX spot rate real-time charts and live graphs during this time. Most popular day trading strategies can be used during this period of increased liquidity.

Final Word On Trading EURCAD

The EURCAD offers traders both liquidity and volatility. There is a wealth of market data and trading tools available at leading forex brokers to help traders take positions on the FX pair. But before you start investing money, it is important to keep abreast of factors that can influence the exchange rate, including central bank decisions, news events, and indirect impacts from US Dollar sensitivities.

FAQs

Which Monetary Authority Regulates The Canadian Dollar?

The Central Bank of Canada is the nation’s primary bank. While intervention is rare, it is worth keeping an eye on announcements from the central banking authority as they may influence the value of the EURCAD.

How Do I Read The EURCAD Forex Pair?

In this forex pair, the Euro is the base currency and the Canadian Dollar is the quote currency. The base currency signifies how much of the quote currency is needed to buy one unit of the base currency. For example, 30 EUR versus 45 CAD means to buy 30 Euro you will pay 45 Canadian Dollars.

When Is The Best Time To Trade EURCAD?

The best time to trade the EURCAD currency pair is generally during the crossover between London and New York market sessions, 1 pm to 4 pm GMT. This is where the majority of price movement will occur creating trading opportunities.

How Much Is 1 EUR To CAD?

Exchange rates for the EUR to CAD fluctuate daily, noted in historical charts by date. Live currency exchange rate charts offered by leading forex brokers show how many Canadian Dollars are needed to buy 1 Euro.