Elasticity and Inelasticity of Demand & Supply

The elasticity of demand refers to the degree of responsiveness of the demand for a product or service to changes in its price.

A good is considered to be elastic if an increase in its price results in a significant decrease in the quantity demanded, and vice versa. It is also referred to as “price elasticity.”

On the other hand, an inelastic good does not have much of a response when it comes to changes in the price, meaning that people would still buy it even if its price increases.

In order to calculate the elasticity of demand, economists use various mathematical equations based on how much change occurs with any given shift in prices.

By doing so, they can determine whether demand is more responsive (elastic) or less responsive (inelastic).

Key Takeaways – Elasticity and Inelasticity of Demand & Supply

- Elastic Demand

- Small price changes lead to large quantity changes.

- Traders should be cautious of elastic demand in markets with many substitutes, as small price movements can trigger significant buying or selling activity.

- Inelastic Supply

- Quantity supplied remains relatively constant despite price changes.

- Traders should be aware of inelastic supply in markets with limited production capacity, as price movements may not significantly impact supply.

- Elasticity Imbalance

- When demand is elastic and supply is inelastic, price movements can be extreme.

- For other combinations, the price movements may be less so.

- Advanced traders commonly monitor elasticity imbalances in their markets to anticipate potential market volatility and adjust their strategies accordingly.

Why Traders Should Consider Elasticity

Elasticity considers, for example, the type of demand associated with the products of the company/companies they’re trading, as well as the availability of substitutes.

Therefore, it is important for traders to understand the elasticity of demand and supply in order to determine how their pricing strategy should be adjusted accordingly.

For example, if a trader knows that the company he’s trading has a revenue base with largely inelastic demand, he knows the company can set higher prices without worrying that it will significantly affect its sales volume.

Similarly, if a trader recognizes a company largely sells goods and services with elastic demand, he knows they can lower the price slightly to attract more customers without experiencing any radical changes in revenue.

Understanding the elasticity of demand and supply can therefore help businesses make better decisions regarding pricing strategies and maximize their profits efficiently.

How do you determine whether demand is elastic or inelastic?

In order to determine whether demand is elastic or inelastic, you need to consider several factors including the number of competitors, the availability of substitutes, and the price sensitivity of buyers.

If there are numerous substitutes available for a product and customers are very sensitive to price changes then it is likely that demand will be more elastic.

On the other hand, if there are not many substitutes and/or customers are less sensitive to price changes then it is likely that demand will be more inelastic.

The level of elasticity also depends on how much extra income consumers have available; if they have higher disposable incomes then they may be more willing to purchase goods with higher prices than those with lower incomes.

What is elastic supply?

Elastic supply is the responsiveness of the quantity supplied to any changes in price.

A good is considered to be elastic if an increase in its price results in a significant increase in the quantity supplied, and vice versa.

Similarly to demand, economists use mathematical equations to measure the elasticity of supply.

By doing so, they can determine whether supply is more responsive (elastic) or less responsive (inelastic).

What is inelastic supply?

Inelastic supply occurs when there is not much of a response when it comes to changes in prices; meaning that firms will still produce a product even if its price increases.

This happens when there are few substitutes available and/or producers do not have enough resources to respond to any price changes.

Inelastic supply is usually associated with goods that are essential to people’s lives such as food, clothes, and medicine.

Therefore, producers of inelastic goods are not able to adjust their production levels easily in response to price changes.

Elastic vs Inelastic Demand

Examples of Elastic Goods and Services

Examples of elastic goods and services include luxury items such as cars, jewelry, and expensive vacation packages.

These goods have a high degree of elasticity because people are willing to pay more for them when their incomes increase and less when their incomes decrease.

Another example is electronic devices like computers and smartphones, which tend to be very sensitive to price changes; if the prices go down then people will buy more of these items than they normally would.

Finally, services such as haircuts or car rides also tend to be highly elastic in nature as customers are willing to spend more on them when their budgets allow it.

In terms of market sectors, companies that sell mostly elastic goods and services are often called consumer discretionary.

Examples of Inelastic Goods and Services

Examples of inelastic goods and services include essential items such as groceries, medication, and utilities.

These goods tend to be less affected by changes in prices because people are more willing to purchase them regardless of their financial situation.

Another example is consumer staples like toiletries or cleaning supplies; these products have relatively high demand across different income levels so price changes are not likely to affect their sales volume dramatically.

Services such as child care or professional accounting also tend to be highly inelastic due to their importance for certain individuals and businesses.

Supermarket food tends to be inelastic – people need it to physically live.

Restaurant food tends to more elastic – it’s more discretionary as people can cut down on their food spending by dining at home.

Elasticity and Inelasticity of Demand for Labor

The pricing of labor occurs in the same way as the pricing of all other markets.

When it comes to the elasticity and inelasticity of labor, economists consider whether or not an employer can easily replace one worker with another.

If workers are highly specialized or have unique skills then their demand tends to be more inelastic; this means that employers will still require their services regardless of any changes in wages.

On the other hand, if new employees can easily be trained for a job where there is high competition then the demand for labor will tend to be more elastic since employers could opt for lower wages when necessary.

How to Calculate the Elasticity of Demand

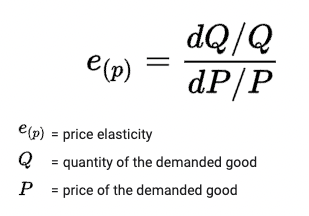

Economists use the following formula to calculate the elasticity of demand:

The result will usually range from 0 to infinity; if it is 1 or above then economists consider that demand is elastic, and if it is below 1 then they consider it to be inelastic.

To understand whether a good or service has an elastic or inelastic demand, economists look at how much the amount purchased changes when its price changes.

If there are large increases in quantity demanded for small decreases in price, then the good is considered to be elastic.

On the other hand, if there are small increases in quantity demanded for large decreases in price, then the good is considered to be inelastic.

What is the cross elasticity of demand?

The cross elasticity of demand is an economic measure used to determine the responsiveness of demand for one good or service when there is a change in the price of another.

It measures how much the quantity demanded of one product changes, given a certain percentage change in the price of another related product.

The coefficient can be positive, negative, or zero depending on if there is a substitution effect or complementary effect between these two goods.

For example, if the price of apples increases and this leads to an increase in demand for oranges, then we say that oranges and apples have a positive cross-elasticity of demand.

On the other hand, if apples and oranges are substitutes then a decrease in price of apples will lead to decrease in demand for oranges, then we say that oranges and apples have a negative cross-elasticity of demand.

Cross elasticity of demand is an important concept in economics as it reveals how changes in the prices of related goods affect the demand for other goods.

It also helps businesses understand how their pricing strategy can affect the demand for their product.

Knowing this information allows firms to make better decisions when it comes to pricing and marketing strategies, thus increasing profits.

It is also important for governments as they use cross-elasticity of demand data to measure the impact of price changes on causes such as poverty or inequality.

This information can guide policymakers in creating measures that will benefit society as a whole.

Arc elasticity

Arc elasticity is a useful concept that allows economists to determine the responsiveness of one variable against another, allowing them to predict how demand or supply will change in response to changes in price.

This is especially helpful when analyzing markets that are highly competitive and where prices constantly fluctuate.

Arc elasticity can also help identify areas of potential market failure, as well as provide insight into strategic decisions made by firms.

By using arc elasticity, economists can better understand the relationship between different variables and make more informed decisions.

In addition, it can be used to assess long-term trends and implications of policy changes for businesses and consumers alike.

Furthermore, it can be used to calculate optimal price points for goods or services based on their demand curves.

Overall, arc elasticity is an invaluable tool for economists and businesses alike, as it allows for an in-depth analysis of market forces, giving them the power to make sound decisions that will ultimately benefit their businesses.

Example: Elasticity in Housing

Elasticity can be calculated for any type of market. Financial assets, goods and services, etc.

Elasticity in housing markets refers to the responsiveness of housing supply and demand to changes in market conditions, interest rates, personal income, and savings.

Favorable elasticity dynamics in housing markets are characterized by:

1. High Supply Elasticity

A high supply elasticity means that builders and developers can quickly respond to changes in demand by increasing or decreasing the supply of housing units. This helps to:

- Reduce price volatility

- Increase affordability

- Encourage competition among builders

2. Low Demand Elasticity

A low demand elasticity means that changes in prices or interest rates have a relatively small impact on the quantity of housing demanded. This helps:

- Encourage stable and predictable demand

- Support long-term investment in housing

3. Price Elasticity of Supply

A high price elasticity of supply means that builders respond quickly to changes in prices by increasing or decreasing production, which helps:

- Reduce price bubbles

- Increase market efficiency

- Encourage competition among builders

4. Income Elasticity of Demand

A high income elasticity of demand means that changes in income have a large impact on the quantity of housing demanded. This helps to:

- Support economic growth

- Encourage housing market activity

- Increase affordability for low- and moderate-income households

5. Cross-Price Elasticity

A high cross-price elasticity means that changes in the price of one type of housing (e.g., single-family homes) have a large effect on the demand for another type of housing (e.g., apartments). This helps:

- Better encourage a diverse range of housing options

- Support mixed-use development

6. Spatial Elasticity

A high spatial elasticity means that changes in housing market conditions in one area have a high impact on nearby areas, which helps:

- Encourage regional coordination and planning

- Support transit-oriented development

7. Temporal Elasticity

A high temporal elasticity means that changes in housing market conditions have a significant impact on the timing of housing decisions (e.g., buying or selling a home). This helps:

- Reduce market instability

- Encourage long-term planning

- Support market efficiency

8. Expectations Elasticity

A high expectations elasticity means that changes in market expectations (e.g., expected price changes) have a large effect on housing decisions, which helps:

- Encourage informed decision-making

Favorable elasticity dynamics in housing markets can be achieved through policies and regulations that:

- Encourage competition among builders and developers

- Support affordable housing options without creating unintended distortions elsewhere

- Promote mixed-use development and transit-oriented development

- Foster regional coordination and planning

- Provide timely and accurate market information

FAQs – Elasticity and Inelasticity of Demand & Supply

Why should those in financial markets understand the concept of elasticity?

Understanding the concept of elasticity is important for those in financial markets as it can help them better understand how different factors can affect demand and supply for specific products or services.

Elasticity measures the responsiveness of a market to changes in price, income, and other variables, which helps investors identify opportunities to capitalize on shifts in the financial environment.

By understanding how the market will respond to changes in the cost of goods or services, traders and investors are better equipped to make informed decisions about when and where to allocate their money.

Furthermore, having an understanding of elasticity allows investors to accurately predict how different economic policies, such as changes in tax rates or interest rates, may impact demand and supply levels in a particular sector.

This knowledge is extremely valuable for any investor looking to maximize their returns while minimizing their risks.

By becoming familiar with how different factors influence demand and supply levels, they can better position themselves to capitalize on market fluctuations.

What is an example of a product or service with inelastic demand?

A good or service that has an inelastic demand means that its demand does not change significantly even when there are changes in prices or other external factors such as income levels.

An example of a product with inelastic demand would be basic necessities like food, water, electricity etc., which people need regardless of price fluctuations.

These types of products are known as necessities and are typically unaffected by changes in price due to the fact that consumers still need them, regardless of their cost.

On the other hand, luxury items like jewelry or designer clothing would be considered elastic because demand for these items is more sensitive to price changes.

Knowing how different factors affect demand and supply levels is invaluable knowledge that can help businesses and those investing in them and trading the price movements in their securities.

What is the difference between the elasticity of demand and elasticity of supply?

The elasticity of demand measures the responsiveness of consumers to changes in price, while the elasticity of supply measures the responsiveness of producers to changes in price.

In general, when prices are high and demand is low, the elasticity of demand will be higher than the elasticity of supply. This means that with a small increase in price, there will be a large decrease in the quantity demanded.

On the other hand, when prices are low and demand is high, the elasticity of supply will be higher than that of demand.

This means that even with a large increase in price, there will only be a small decrease in the quantity supplied.

Elastic vs. Inelastic – What is the difference?

The difference between elastic and inelastic refers to the responsiveness of demand and supply to changes in price.

A good or service is said to be elastic when even a small change in price causes a significant shift in either demand or supply, while a good or service is said to be inelastic when only a large price change causes a significant shift.

Essentially, if the quantity sold changes significantly with even small changes in price then it is considered elastic; however, if it remains relatively unchanged even with large changes in cost then it is considered inelastic.

Understanding how different factors influence demand and supply levels can help investors make more informed decisions about when and where to invest their money.

Is it better to invest in things that have more inelastic demand because people always need them?

It is not necessarily better to invest in things with more inelastic demand, as there are many other factors that need to be taken into consideration.

For example, if a product or service has an inelastic demand but is no longer needed by the consumer, then investing in it may not be a wise decision.

Certain products and services may also have high levels of competition, which can drive down prices and reduce profits.

It is important to carefully evaluate all aspects before investing your money in any particular good or service.

What is the formula for the elasticity of demand?

Elasticity = (Percentage Change in Quantity Demanded/Percentage Change in Price)

Conclusion – Elasticity and Inelasticity of Demand & Supply

Elasticity and inelasticity play an important role when it comes to pricing goods and services.

The degree of elasticity or inelasticity will determine whether a producer is able to adjust their prices according to the changes in demand or not.

It is also important for economists to understand the factors that affect the elasticity and inelasticity of demand so they can better forecast how different markets will react to price changes.

Understanding these concepts can help businesses set more strategic pricing strategies.

For traders and investors, it is important to understand the differences between elastic and inelastic demand as this can help them make more informed decisions about when and where to invest their money.