Dukascopy Introduces Crypto CFDs On MetaTrader 4

Following a rise in demand among retail traders, Dukascopy has introduced Bitcoin, Ethereum and Litecoin on its MT4 terminal. Clients can trade the digital currencies against the US Dollar with competitive rates.

New Cryptos At Dukascopy

Previously clients could only trade digital currencies on the jForex platform, however, users will now be able to take positions on three of the top cryptos by market capitalisation on MetaTrader 4. The new currencies will be available on the broker’s live account and demo solution. Both long and short positions can be taken on the latest products.

Leveraged trading is available on Dukascopy’s new assets. Clients of Dukascopy Bank will be able to access leverage rates up to 1:5 while the broker’s European traders can access leverage up to 1:2.

Dukascopy added “Unlike traditional purchase of cryptocurrencies trading cryptocurrency CFDs allow speculative operations without having a digital wallet. There is no need to own cryptocurrency coins eliminating cybersecurity risks.”

MetaTrader 4

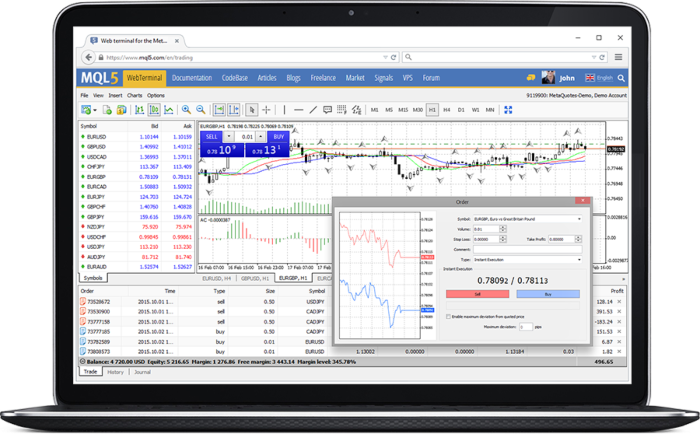

MetaTrader 4 is an ideal platform for analysing volatile digital currencies. MT4 has 30 technical indicators, 24 analytical objects and 2,000 free custom indicators. Available on both desktop and mobile, MT4 also offers automated trading through Expert Advisors (EAs) alongside 3 execution modes, 2 market orders and 4 pending orders.

Crypto Demand Rises

The volatile nature of this new asset class has attracted retail traders from around the world. Many leading brokers have introduced CFDs on major cryptocurrencies in recent months.

The market has taken a plunge recently as China has cracked down on crypto mining leading to a fall in the value of some of the biggest coins. And whilst this is arguably good news for savvy investors, it does highlight the risks associated with trading these digital currencies.

Dukascopy has had a strong 12 months or so, attracting thousands of new customers in 2020 leading to a boost in operating income. Its latest move to bring Bitcoin, Litecoin and Ethereum CFDs to its MT4 platform is likely to help fuel its growth plan.