Diagonal Spread Strategy

A diagonal spread in options trading is a strategy that involves simultaneously buying and selling options of the same type (either calls or puts) on the same underlying asset, but with different strike prices and expiration dates.

It’s a form of spread trading.

The option purchased has a longer expiration date than the option sold.

Key Takeaways – Diagonal Spread

- What it is – An options strategy that combines different strikes and expirations for potential profit from time decay and price shifts.

- Objective – The trader is looking to capitalize on the difference in time decay (theta) and possibly the price movement of the underlying asset.

- When to use it – Use a diagonal spread to profit from varying time decay in the options and directional moves in the underlying asset.

Diagonal Spread Explained

A diagonal spread is an options trading strategy that combines elements of both vertical and calendar spreads.

It involves simultaneously buying and selling options of the same type (calls or puts) on the same underlying asset, where the options have different strike prices and expiration dates.

Typically, the trade involves buying a longer-term option and selling a shorter-term option, though some generalize a diagonal spread to mean any options trade with different strikes and expirations.

It tries to profit from the difference in:

- time decay (shorter options decay faster) and

- (possibly) the movement in the underlying asset’s price

Mechanism

The long call option will typically have a shorter rate of time decay as it approaches expiration.

The short call option with a shorter expiration will decay at a faster rate, providing some premium to offset the cost of the long call.

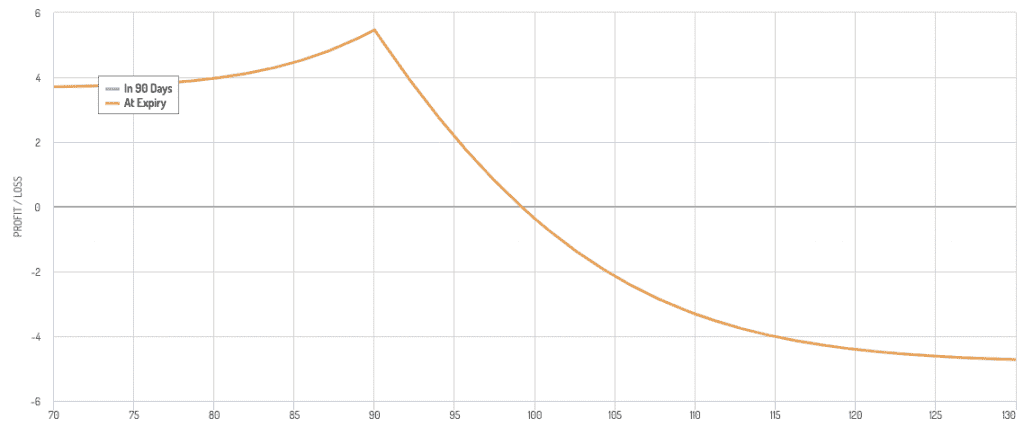

Diagonal Call Spread Example (Bearish Diagonal Spread)

An example of a diagonal spread would be the following:

- Long 12-month 100 Call

- Short 3-month 90 Call

Payoff Diagram

This would produce the following payoff diagram.

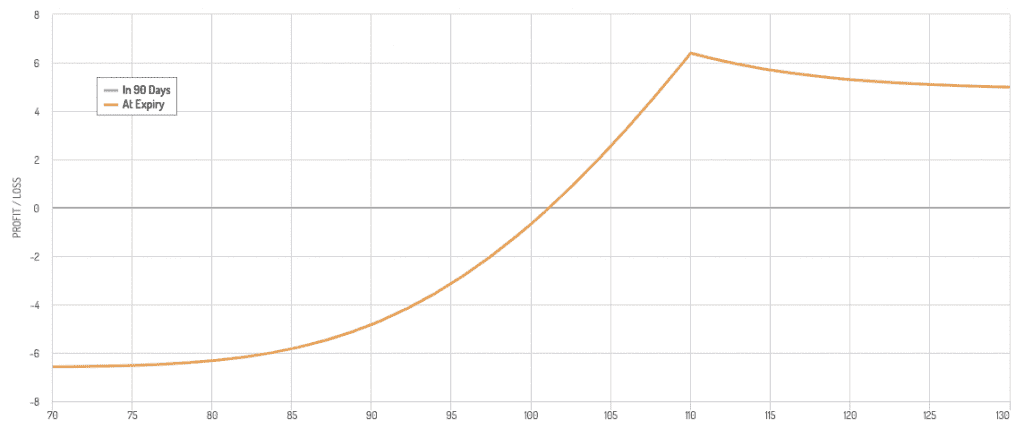

Diagonal Put Spread Example (Bullish Diagonal Spread)

An example of a diagonal spread would be the following:

- Long 12-month 100 Put

- Short 3-month 110 Put

Payoff Diagram

Risk/Reward Profile of a Diagonal Spread

This strategy limits both potential gains and losses:

- The maximum gain is capped by the strike price of the short call option.

- The maximum loss is limited to the net premium paid for the spread.

Market Outlook

A diagonal put spread as shown above is typically used when the trader expects a moderate increase in the price of the underlying asset over the near term but believes there will be limited upside potential over the longer term.

And vice versa for the diagonal call spread.

Volatility Impact

The strategy can benefit from an increase in implied volatility for the near-term option more than the long-term option, but it can also be used when expecting stable or declining volatility.

Time Decay (Theta)

- Time decay is the trader’s friend for the sold option and an enemy for the bought option.

- The strategy tries to balance the time decay in favor of the trader.

Breakeven Point

Determined by the strike price of the long call plus the net premium paid, adjusted by the amount the short call is in or out of the money at expiration.

Advantages of a Diagonal Spread

Dual Source of Profit

Can profit from both the time decay (theta) and the directional movement of the underlying asset.

Flexibility

Offers the ability to adjust strikes and expirations for different market conditions and views.

Reduced Cost of Entry

Selling the short-term option helps offset the cost of the long-term option.

This reduces the net investment.

Risk Management

Defined risk strategy, where the maximum loss is known at the time of trade setup.

Disadvantages of a Diagonal Spread

Complexity

Requires a good understanding of options trading, including managing multiple expiration dates and strike prices.

Options Greeks to have a handle on include:

- theta

- vega

- delta

Adjustment Costs

While adjustments are possible, they can incur additional transaction costs and complexity.

Limited Profit Potential

Profit is often capped at the strike price of the short option, unless adjustments are made.

Time Decay Mismatch

The sold short-term option can experience rapid time decay, which is beneficial, but this must outweigh the slower time decay of the longer-term bought option to be profitable.

Diagonal Spread vs. Calendar Spread

Strike Prices

- Diagonal Spread: Different strike prices.

- Calendar Spread: Same strike price.

Expiration Dates

Both strategies involve different expiration dates, with the near-term option sold and the longer-term option bought.

Objective

- Diagonal Spread: Targets both time decay and price movement.

- Calendar Spread: Primarily exploits time decay.

Directional Bias

- Diagonal Spread: Can have a directional bias due to different strikes.

- Calendar Spread: Generally neutral, focusing on time decay.

Profit and Risk

Both strategies have defined risk, but diagonal spreads offer a chance to adjust for directional moves, while the calendar spread is focused on time decay.

Conclusion

This type of spread takes advantage of the time decay differential between contracts with different expiration dates and the leverage provided by options to control more of the underlying asset with less capital.

It’s a more advanced strategy that requires a good understanding of options trading principles, including how time decay, volatility, and price changes in the underlying (i.e., theta, vega, and delta) affect the price of options contracts.