Collar Options Trading Strategy

A collar options strategy is a protective options trading technique used by traders to limit potential losses on an existing stock position while also capping potential gains.

This strategy involves simultaneously holding shares of an underlying stock, buying an out-of-the-money put option, and selling an out-of-the-money call option on the same stock.

Key Takeaways – Collar Options Trading Strategy

- Collar options limit downside risk by buying a protective put while capping upside potential by selling a covered call.

- Can provide a safety net for stock positions in volatile markets.

- The strategy can be cost-effective, potentially creating a zero-cost collar where the call premium offsets the put cost, reducing the overall expense of portfolio protection.

- Strike price selection is important – wider spreads offer more potential gain but less protection, while tighter spreads provide stronger safeguards but limit profit opportunities.

Key Components of a Collar Strategy

There are three parts to a collar option strategy:

- Long stock position

- Long put option (protective put)

- Short call option (covered call)

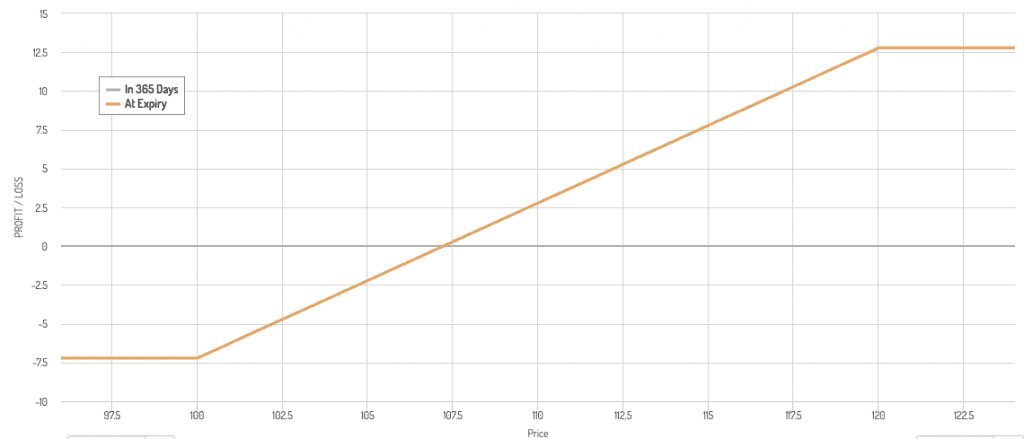

Covered Call Payoff Diagram

In normal circumstances when opening the collar trade, the stock would be positioned somewhere in the middle of the collar.

How Collar Options Work

The collar strategy is essentially a combination of two popular options strategies: a protective put and a covered call.

By using these simultaneously, traders create a “collar” around their stock position, protecting it from significant downside risk while still (if wanted) allowing for some upside potential.

Protective Put Component

The long put option acts as insurance for the stock position.

If the stock price falls below the put’s strike price, the trader can exercise the option to sell the shares at the higher strike price, limiting potential losses.

Covered Call Component

The short call option generates income through the premium received, which can offset the cost of the protective put.

But it also limits the potential upside of the stock position, as the trader is obligated to sell the shares at the call’s strike price if the stock rises above that level.

Benefits of Collar Options

Risk Mitigation

The primary advantage of a collar strategy is its ability to protect against significant downside risk.

This makes it attractive for traders who want to maintain their stock positions but are concerned about potential market volatility or downturns.

Cost Reduction

By selling a call option, traders can offset some or all of the cost of purchasing the protective put.

In some cases, it’s possible to structure a “zero-cost collar” where the premium received from selling the call exactly covers the cost of buying the put.

Flexibility

Collar options can be tailored to a trader’s specific risk tolerance and market outlook by adjusting the strike prices of the put and call options.

Drawbacks of Collar Options

Limited Upside Potential

The most significant drawback of a collar strategy is the cap it places on potential gains.

If the stock price rises above the call option’s strike price, the trader misses out on further upside.

Ongoing Management

Collar strategies require active management and periodic adjustments – i.e., when options approach expiration or if the underlying stock price moves significantly.

Opportunity Cost

While providing protection, collars may underperform in strongly bullish markets compared to simply holding the stock outright.

The cost of calls relative to puts also increases when interest rates rise.

Implementing a Collar Options Strategy

Selecting Strike Prices

The choice of strike prices for both the put and call options is important in determining the exact risk-reward profile of the collar strategy.

Put Strike Selection

Typically, traders choose a put strike price below the current stock price (out-of-the-money) to balance protection and cost.

A lower strike price offers less protection but is cheaper, while a higher strike provides more protection at a higher cost.

Call Strike Selection

The call strike price is usually set above the current stock price (out-of-the-money).

A higher strike allows for more potential upside but generates less premium income, while a lower strike caps gains more tightly but provides more income.

Some favor “zero-cost collars” where the put cost is offset by the call income.

Expiration Dates

Traders can choose to use options with the same expiration date or different dates for the put and call.

Using the same expiration simplifies management, while different dates can offer more flexibility in adjusting the strategy over time.

Advanced Collar Strategies

Rolling Collars

As options approach expiration, traders can “roll” their positions by closing out existing options and opening new ones with later expiration dates.

This allows for continual protection and income generation.

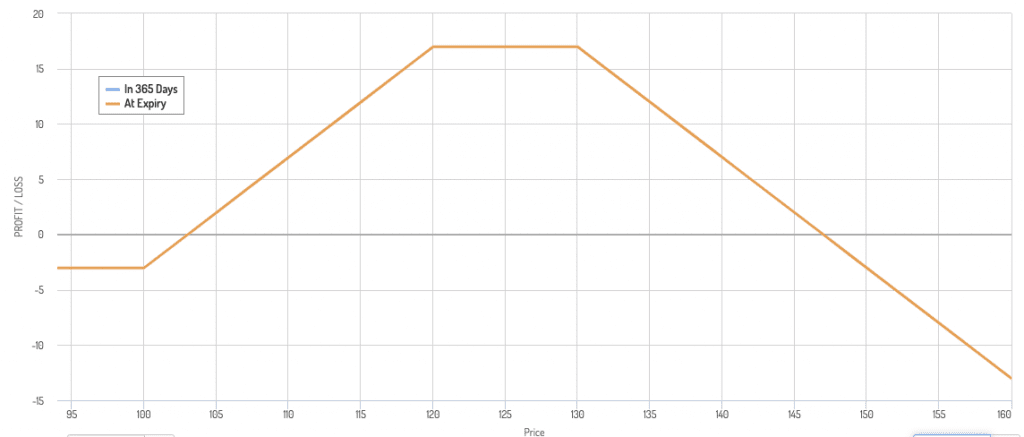

Ratio Collars

A variation on the standard collar, ratio collars involve selling multiple call options for each put option purchased.

This can generate more income but increases risk if the stock price rises a lot.

It would look like so:

This is setup with a:

- Long stock

- Long 100 put

- Short 120 call

- Short 125 call

Adjustable Collars

Some traders actively adjust their collar positions based on what the market is doing, widening or tightening the range between put and call strikes as their outlook changes.

Collar Options in Different Market Conditions

Bullish Markets

In strongly bullish markets, collar strategies may underperform due to their capped upside.

However, they can still be useful for protecting gains in positions that have already appreciated significantly.

When you sell ITM options you also have to consider assignment risk, which can call away their position.

Bearish Markets

Collars shine in bearish or volatile markets, providing downside protection that can help traders weather market downturns without liquidating their positions.

Sideways Markets

In range-bound markets, collar strategies can be most effective, allowing traders to generate income through option premiums to offset the costs of the downside protection while maintaining their stock positions.

Tax Considerations

Taxes are commonly overlooked with all strategies.

Implementing a collar strategy can have tax implications, particularly regarding holding periods and the treatment of options premiums.

Traders should consult with a tax professional to understand how collar options might affect their tax situation.

Qualified Covered Calls

For US traders, the IRS has specific rules regarding “qualified covered calls” that can impact the holding period of the underlying stock.

Understanding these rules is important for managing the tax efficiency of collar strategies.

Conclusion

Collar options strategies offer a particular kind of approach to risk management for stock traders/investors.

By combining downside protection with income generation, collars provide a middle ground between the potential for unlimited gains and the desire for capital preservation.

While they require more active management than simply holding stocks, collar options can be useful for traders looking to navigate bumpy markets or protect significant gains in their portfolios.

As with any trading or investment strategy, it’s important to thoroughly understand the mechanics, risks, and potential outcomes of collar options before implementing them.

When used appropriately, collar strategies can help traders balance their desire for growth with their need for protection.