Alternatives To Coinbase

Coinbase was founded in 2012 and is a platform for buying, selling, storing, and trading cryptocurrency. It supports over 150 cryptocurrencies and is designed for traders new and advanced. But while a popular platform, there are some excellent alternatives to Coinbase.

Read on to review and compare Coinbase vs. Binance, Kraken, BitMEX, Crypto.com, and Gemini. We wrap up by answering what broker to use instead of Coinbase for those ready for a change.

Alternative Crypto Brokers

-

1

Plus500 USTrading with leverage involves risk.

Plus500 USTrading with leverage involves risk. -

2

NinjaTrader

NinjaTrader -

3

Interactive Brokers

Interactive Brokers -

4

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

UpholdTerms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

UpholdTerms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

This is why we think these brokers are the best in this category in 2025:

- Plus500 US - Plus500’s Micro-Bitcoin and Micro-Ethereum futures only allow traders to scratch the surface of crypto trading with bets on the two most popular digital assets. Importantly, you cannot buy and own the cryptos with these derivative contracts - you are speculating on their price.

- NinjaTrader - You can get exposure to micro Bitcoin futures through the CME Group’s centralized exchange, which is highly regulated by the US CFTC. Micro contracts allow you to trade a fractional size of one Bitcoin, giving you more risk control and order flexibility.

- Interactive Brokers - IBKR lets you purchase and hold Bitcoin, Bitcoin Cash, Ethereum, and Litecoin at competitive commission rates and without needing a crypto wallet. Additionally, there is a range of other diverse assets to explore, such as crypto indices like the NYSE Bitcoin Index, as well as futures contracts like the BAKKT Bitcoin Futures.

- eToro USA - eToro US offers 24 tradeable cryptoassets, with just a 1% buying/selling fee added to the spread. Additionally, there are 80 different coins available through the broker’s proprietary wallet service. You can also practice your crypto strategies easily by switching between live and demo mode. Crypto asset investing is highly volatile and unregulated. No consumer protection. Tax on profits may apply.

- OANDA US - Cryptocurrency trading is offered via Paxos, a separate entity from Oanda. You can speculate on the world’s biggest cryptos by market cap. Commissions are lower than many peers starting at 0.25%. Through the broker’s partnership with Paxos, clients can spot trade cryptocurrencies on the itBit exchange through the OANDA native platform.

- Uphold - You can buy and sell 250+ crypto assets with fiat currencies or in crypto pairs using the straightforward mobile app or through Uphold's browser-based account homepage. This is significantly more than many rivals. You can also earn up to 16% APY by staking one or more out of 32 valid tokens, or send tokens to an external wallet.

Plus500 US

"Plus500 US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500 US Quick Facts

| Bonus Offer | Welcome Deposit Bonus up to $200 |

|---|---|

| Coins | MicroBitcoin, MicroEthereum |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Regulator | CFTC, NFA |

| Account Currencies | USD |

Pros

- The Futures Academy is an excellent resource for new traders with engaging videos and easy-to-follow articles, while the unlimited demo account is great for testing strategies

- The trading app provides a terrific user experience with a modern design, a clean layout and mobile-optimized charts

- Plus500 US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

Cons

- Although support response times were fast during tests, there is no telephone assistance

- Plus500 US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

- While Plus500 US continues to broaden its investment offering, it's currently restricted to around 50+ futures with no stocks

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Coins | BTC |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Floating |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Account Currencies | USD |

Pros

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

Cons

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

- There is a withdrawal fee on some funding methods

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Coins | BTC, LTC, ETH, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.12%-0.18% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Bonus Offer | Invest $100 and get $10 |

|---|---|

| Coins | BTC, ETH, BCH, DASH, LTC, ETC, MIOTA, XLM, EOS, NEO, ZEC, XTZ, MKR, COMP, LINK, UNI, YFI, DOGE, AAVE, ALGO, MANA, ENJ, BAT, MATIC, FLR, SHIBxM |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | BTC 0.75% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Regulator | SEC, FINRA |

| Account Currencies | USD |

Pros

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

- The online broker offers an intuitive social investment network with straightforward copy trading on cryptos

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

Cons

- Average fees may cut into the profit margins of day traders

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Coins | BTC, ETH, LTC, BCH, PAXG, LINK, UNI, AAVE |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | $100 |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- The broker offers a transparent pricing structure with no hidden charges

- The proprietary OANDA web platform continues to deliver a highly competitive charting environment, including 65+ technical indicators powered by TradingView

- Day traders can enjoy fast and reliable order execution

Cons

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

Uphold

"Uphold remains a top choice for crypto investors looking for a one-stop-shop solution to accessing the markets. There are over 250 tokens to buy, sell and trade through flexible platform options."

William Berg, Reviewer

Uphold Quick Facts

| Coins | BTC, BTCO, AAVE, ALCX, DYDX, INH, XYO, API3, GHST, LSK, AUDIO, GLMR, NMR, CAKE, GODS, REQ, CHR, TRB, DAO, ROOK, XRP, ETH, BAT, ADA, ALGO, ATOM, AVAX, AXS, BCH, BAL, BTG, CSPR, COMP, CRV, DASH, DCR, DGB, DOGE, DOT, EGLD and many more |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Up to 1.5% |

| Crypto Lending | No |

| Crypto Staking | Yes |

| Platforms | Desktop Platform, Mobile App |

| Minimum Deposit | $0 |

| Account Currencies | USD, EUR, GBP |

Pros

- Fees are competitive based on tests, with 26 underlying platforms helping to source the best prices

- UK users can get the Uphold card with up to 2% cashback in XRP

- Two-step authentication bolsters user security

Cons

- Customer service is slow based on tests, with limited contact options

- There is a 2.49% fee if you want to use debit or credit cards

- The charting analysis features on the platform trail specialist exchanges

About Coinbase

The firm is based in San Francisco and is a fully licensed and regulated cryptocurrency exchange in 45 US states. Its services are also available globally, including to investors in Australia, the UK, Europe, South America, and Africa. In fact, the crypto exchange boasts over 98 million verified users across more than 100 countries. And while our best alternatives to Coinbase have a lot to offer in terms of tools, features, and fees, few can match the global reach of the crypto exchange.

Products

Coinbase offers a wide range of products to suit beginners and professionals:

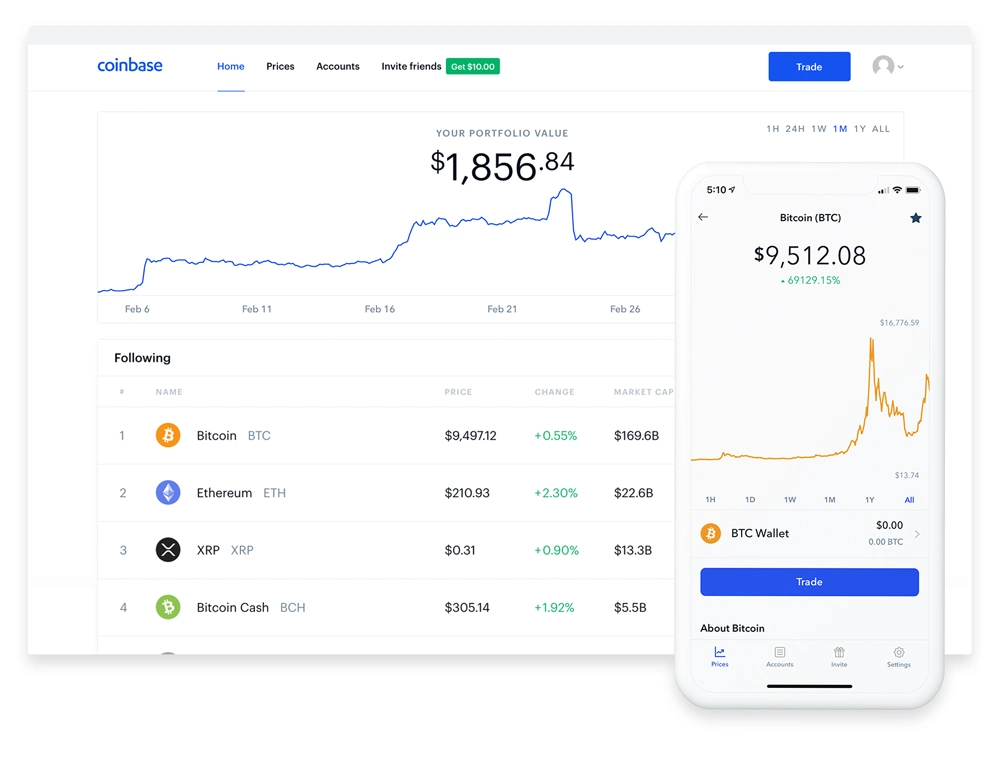

- Coinbase – Buy, sell, trade, and store over 150 tradable cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin.

- Wallet – Retail investors can manage and store their crypto assets without a centralized brokerage or exchange. There are options to use US dollars or other fiat currencies. Protect your digital assets with industry-leading security.

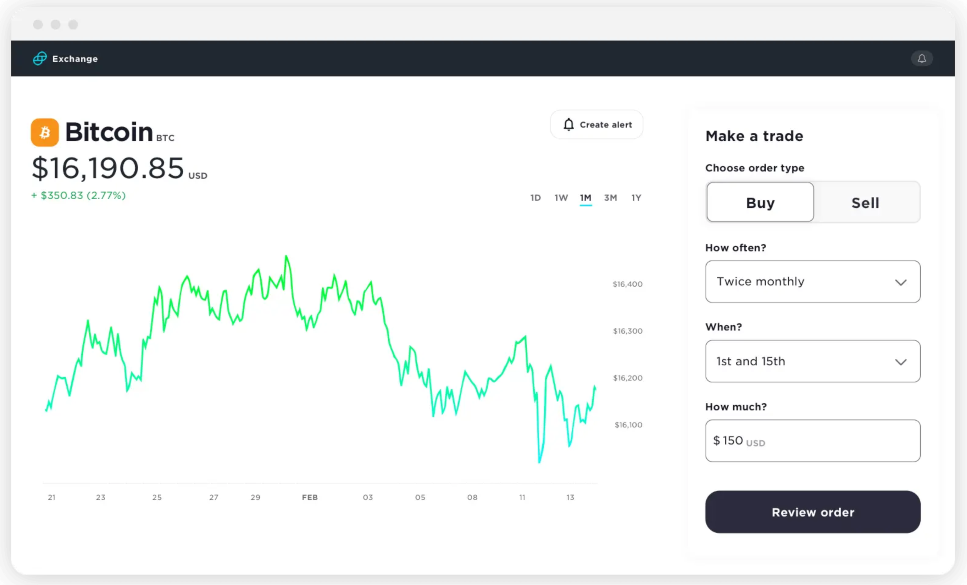

- Coinbase Pro – Formerly GDAX, Coinbase Pro is a premium service with an intuitive interface including real-time order books, charting tools, trade history, and a simple order process so you can trade from day one.

- USD Coin (USDC) – A digital stablecoin that is pegged to the United States dollar.

Platforms

Coinbase

Coinbase is a secure online trading platform that utilizes the US dollar to purchase a growing list of over 150 cryptocurrencies. Geared towards beginners, it has a straightforward, user-friendly interface with options to ‘buy’, ‘sell’ or ‘convert’ when placing a trade.

Note, the mobile app can be accessed on Android and iOS devices.

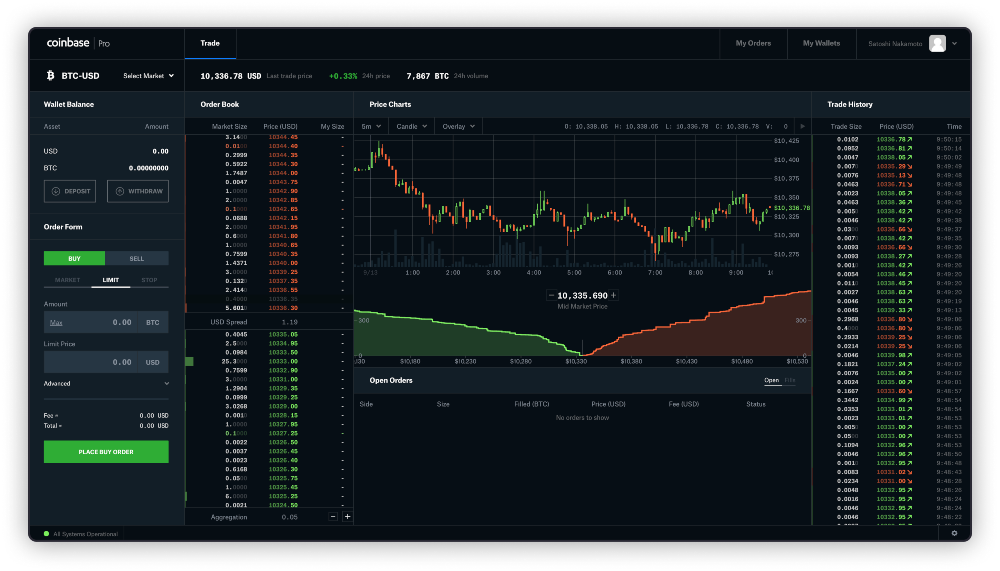

Coinbase Pro

As outlined above, Coinbase Pro was formerly known as Global Digital Asset Exchange (GDAX). It is an in-depth platform that caters to more advanced traders. On top of the same functionalities as the original platform, it offers advanced charting functions and the ability to place market limits, stop orders, an easy order process, and detailed trade history. Investors can specify an order type or default to market.

Fees

With the exception of Coinbase Pro, fees are expensive compared to competitors. They vary between 0.5% and 4.5% and between payment methods, cryptocurrency type, transaction size, and platform used.

There is a 1% fee to convert and withdraw your crypto to cash in addition to standard network fees. A network fee is necessary to have your transaction processed by the decentralized cryptocurrency network.

If you stake your assets with Coinbase, your reward will be determined by the protocols of the applicable network. The firm will distribute this reward after receipt, minus a 25% commission.

The exchange charges spreads of 0.5% for crypto purchases and sales. Depending on market fluctuation, rates may be higher or lower. On top of that, they also take a flat fee or variable percentage, depending on region, amount purchased, product feature, and payment type. For example, a $100 purchase of Bitcoin with a USD bank account will come with a flat fee of 1%.

Suppose you borrow USD from Coinbase or an affiliate. The brand has to sell your BTC collateral (as they are authorized to do under an applicable loan agreement). In that case, there is a flat fee of 2% of the total transaction.

On the other hand, Coinbase Pro’s fee schedule is straightforward and less expensive. It is based on monthly trading volume and a taker-maker model, which depends on the liquidity of the asset at the time of purchase. Varying between pricing tiers, taker fees are between 0.05% to 0.6%, while maker fees are between 0.00% to 0.4%.

On the basic Coinbase platform, deposits on wire transfers are $10 and $25 to withdraw. The exchange also requires a minimum of $2 to purchase and sell and is capped at $25,000 a day. Trade and balance levels are unlimited on Coinbase Pro. However, withdrawals are limited to $25,000 by default, which can be increased by request.

Best Alternatives To Coinbase

While the crypto exchange has a lot to offer, there are several strong alternatives to Coinbase. See our comparison below:

Binance

Founded in 2017, Binance’s broker terminal is a good alternative to Coinbase for those looking to buy and sell crypto instantly.

Compared to Coinbase, Binance offers a wider range of modes that suit all skill levels. They offer Classic, Advanced, Margin, Convert, and P2P. Classic provides a more traditional platform with charts and options to trade with stop loss, by market, or limit order. Advanced offers all the Classic features but with full access to trading tools. Margin allows traders to increase profits with leverage. Convert is an OTC trading platform that offers quick settlements for larger buy or sell trades. Lastly, P2P will enable you to buy and sell cryptocurrencies among fellow Binance users with zero fees.

It is also worth pointing out that Binance offers a greater range of over 600 crypto coins. Additionally, it has among the best apps for crypto trading.

Binance’s fee structure is less complicated and cheaper compared to Coinbase. It offers a tiered fee structure based on 30-day cumulative trading volumes. It charges 0.1% for all trades and offers a 25% discount on fees that use Binance Coin. Unlike Coinbase, Binance does not charge any deposit fees but withdrawal fees change based on the market.

Together, this makes Binance one of the best alternatives to Coinbase.

Kraken

While Kraken offers advanced trader services, it is also considered beginner-friendly. Moreover, it is a great alternative for advanced traders compared to Coinbase Pro.

Established in 2014, Kraken is a hassle-free cryptocurrency exchange. It has margin and OTC trading with over 120 coins. Unlike Coinbase, it does not offer a wallet or its own crypto coin.

Platforms include the Kraken Terminal and Cryptowatch. The Kraken terminal allows you to view markets in real-time and access customizable price charts with a live trade feed, order book, and a depth chart to help you visualize market sentiment.

Advanced features on Cryptowatch include an additional 25 crypto exchange services, automated orders, technical analysis features, and more.

Fees on Kraken Pro are significantly cheaper than Coinbase and Coinbase Pro. The fee schedule depends on your last 30-day trading volume and is based on a taker-maker model. For example, an account with a 30-day volume of $0 to $50,000 will pay a 0.16% maker fee or 0.26% taker fee. A detailed fee schedule is available on the Kraken website.

Overall, Kraken is among the strongest alternatives to Coinbase.

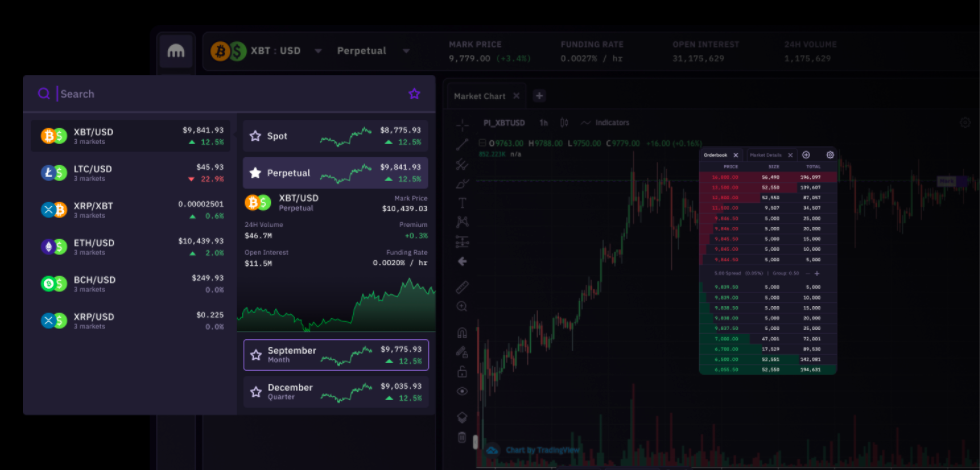

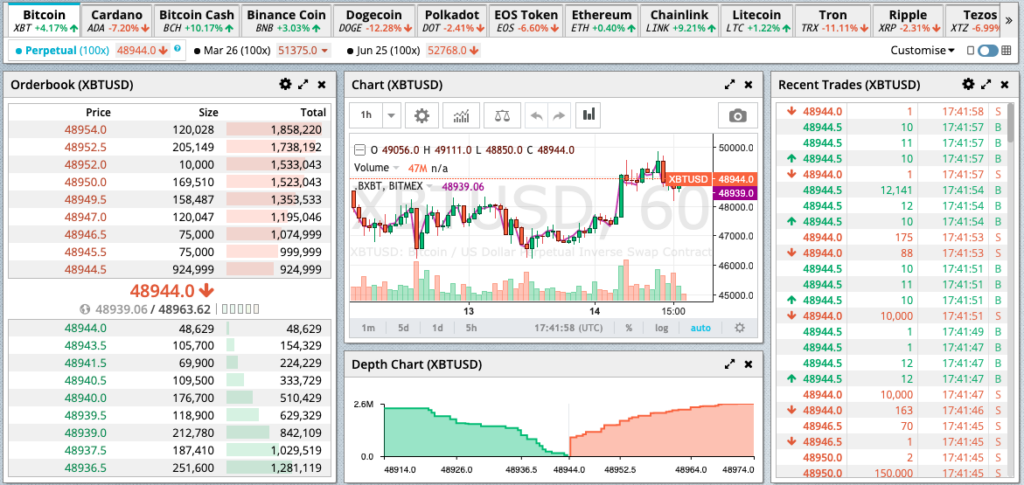

BitMEX

BitMEX is a peer-to-peer (P2P) crypto trading platform that offers leveraged contracts bought and sold in Bitcoin.

Unlike Coinbase, BitMEX does not handle fiat currency but offers up to 1:100 leverage. As Coinbase has disabled margin trading due to regulatory changes (and is now only available on Coinbase Pro), BitMEX is a great alternative.

BitMEX only offers three Bitcoin products; XBT Perpetual, XBT Quarterly Future, and XBT Biquarterly Future. Instead of investing in currency directly, users simply trade contracts, which can be more volatile than traditional investing. As a result, this platform is more suited to advanced crypto traders.

Since BitMEX only exchanges cryptos, it does not incur added fees for buying crypto with cash. Thus, fees are as low as 0.01% to 0.075%. It also does not charge fees on deposits or withdrawals. However, a minimum Bitcoin Network Fee is paid to the Bitcoin miner who processes your transaction (this fee does not go to BitMEX).

Ultimately, BitMEX is one of the best alternatives to Coinbase for users looking to cut costs and advanced investors.

Gemini

Gemini is more suited to advanced traders. It has similarities to Coinbase, such as the ability to buy and sell using fiat and cryptocurrencies. However, Gemini offers different buy and sell orders. On top of that, it has a wider range of platforms that suit all levels, such as a simple web interface or a more advanced ActiveTrader platform. On the downside, Gemini currently only offers around 50 cryptocurrencies.

Importantly, investors are more likely to save on Gemini as it does not charge for deposits and only up to 3.64% when trading. With that said, the fee schedule on Gemini vastly differs depending on the products used and trades made in a 30-day period. For example, a trading volume of up to $100,000 on the ActiveTrader platform charges a 0.2% taker and 0.08% maker fee, which is cheaper than Coinbase Pro.

Overall, Gemini is one of the top alternatives to Coinbase for those looking for a wider range of cost-efficient trading platforms and tools.

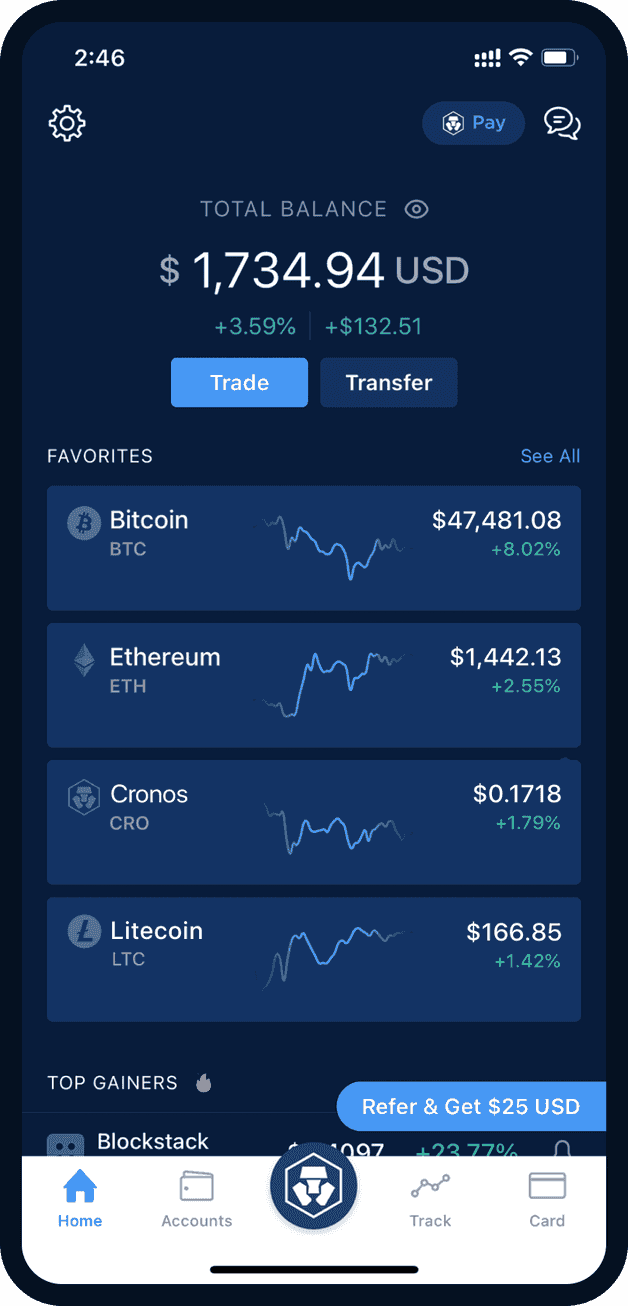

Crypto.com

Monaco Technologies GmBH was the initial trade name for Crypto.com, which was founded in 2016. The owner’s goal was to accelerate the world’s adoption of cryptocurrencies. Today, the firm is headquartered in Hong Kong and has over 4,000 employees in countries such as China, Russia, the United States, and the United Kingdom.

Various financial institutions regulate the firm in each of its operating nations, ensuring that it complies with monetary and risk-prevention laws, such as the FCA in the United Kingdom. And with over 50 million users across 90+ supported countries, the exchange is continually growing.

Crypto.com became the first-ever official global partner of UFC in 2021, and the total number of CRO coins available is capped at 30 billion. This follows the burning of 70 billion CRO tokens, the greatest such burn in crypto history.

The trading costs on Crypto.com are both competitive and clear. Trading fees are dependent on volume, so the more you trade, the more discounts you get. And importantly, there are no hidden fees. But because the trading volumes necessary for the lower costs are so high, inexperienced investors may not be able to take advantage of this benefit.

Fortunately, staking and paying fees with CRO might help you save money. On CRO stakes, you can get a 10% p.a. bonus.

The following is a fee tier guide for trading and selling:

- Level 1: 30-day trading volume of $0-$25,000, 0.4% maker and 0.4% taker charges

- Level 2: 30-day trading volume of $25,001-$50,000 0.35% maker and 0.35% taker charges

- Level 3: 30-day trading volume of $50,001-$100,000, 0.15% maker and 0.25% taker charges

- Level 4: 30-day trading volume of $100,001-$250,000, 0.1% maker and 0.16% taker charges

- Level 5: 30-day trading volume of $250,001-$1,000,000, 0.09% maker and 0.15% taker charges

- Level 6: 30-day trading volume of $1,000,001-$20,000,000, 0.08% maker and 0.14% taker charges

- Level 7: 30-day trading volume of $20,000,001-$100,000,000, 0.07% maker and 0.13% taker charges

- Level 8: 30-day trading volume of $100,000,001-$200,000,000, 0.06% maker and 0.12% taker charges

- Level 9: 30-day trading volume of $200,000,001+, 0.04% maker and 0.1% taker charges

Because Crypto.com has over 250 tokens available, the exchange makes for a good alternative to Coinbase. Similar to Coinbse Earn, you can also complete missions. In exchange, you get diamonds which can be converted into prizes.

Pros Of Coinbase

- Trading on more than 150 cryptocurrencies

- Simple interface for new crypto investors

- Cryptocurrencies are insured

- Low minimum deposit

- High liquidity

Cons Of Coinbase

- Complicated and expensive fee structure on original Coinbase platform

- Growing list of reliable alternatives to Coinbase broker

- Lack of autonomous control on wallet keys

Final Word On Alternatives To Coinbase

Considered one of the top cryptocurrency exchanges in the industry, Coinbase is well-positioned to meet various investment goals and skill levels. Coinbase Pro also provides a good all-around platform for advanced traders with decent fees, while the standard solution has a simple and user-friendly interface for new traders. Unfortunately though, costs on Coinbase are quite expensive in general.

Overall, when comparing alternatives to Coinbase, Binance is one of the best options. It is cheaper to trade with and offers a wider range of platforms and over 600 coins. It also provides one of the best mobile app alternatives to Coinbase.

FAQs

What Is A Similar And Better Alternative To Coinbase?

Out of Binance, Kraken, BitMEX, Crypto.com, and Gemini, Binance offers the most similar service to Coinbase. It has competitive products such as a crypto wallet and fiat currencies. Its trading platforms also suit both new and advanced traders while offering services that Coinbase doesn’t, such as P2P and margin trading.

What Are Cheaper Alternatives To Coinbase?

Coinbase’s original trading platform has the highest and most complicated fees of all alternatives mentioned in our review. However, when comparing Coinbase Pro, the brand provides similar and competitive rates. As BitMEX only exchanges cryptocurrencies via contracts, it has the cheapest fees amongst all alternatives mentioned, with a range of 0.01% to 0.075%.

Is Coinbase Legal In The UK?

Yes – Coinbase does operate legally in the UK. It is also available in Australia, Canada, Singapore, the United States, and a number of European countries based on regulation. With that said, the UK’s Financial Conduct Authority (FCA) banned the sale of crypto derivatives in 2021 because of the risk to retail consumers. Coinbase is only regulated in 45 states in the US.

How Do I Buy And Sell On Coinbase Without Fees?

While it is not widely popular and known, it is possible to buy Bitcoin without fees on Coinbase Pro. This can be done as a maker or taker. To find out how, head to the official website.

Does Coinbase Sell Instantly Vs. Alternatives?

Whether you can sell instantly will depend on which region you are from. It typically takes one to two business days to complete for US customers after initiating a sell or withdrawal. However, buying and selling occur instantly for the UK and European customers as the local currency is stored within your Coinbase account. Coinbase is, therefore, in line with many alternatives.