Can The US Increase Oil Production?

With more geopolitical conflict there are more calls for the US to increase oil production.

How can the US increase oil production?

Besides shale, it can easily take more than two years for an oil production company to make a final investment decision and start production.

Many have used the argument that higher prices will – or at least should – incentivize more oil production in the US.

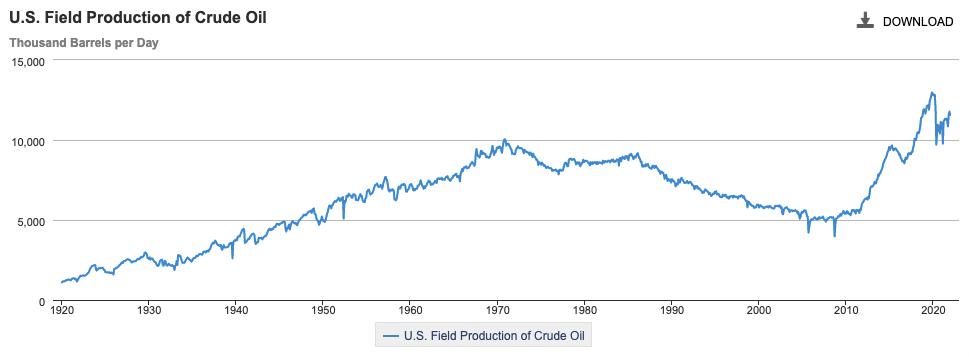

The US has traditionally had a strong energy sector fueled by private companies – enough to produce 16-17 million barrels of oil equivalent per day. (Global oil consumption is around 100 million barrels of oil equivalent per day.) This makes the US the world’s top oil producer.

This comes in the form of 11-12 million barrels of oil in terms of field production.

(Source: EIA)

Another 5-6 million or so barrels of oil equivalent come from natural gas liquids.

What matters most are incentives.

Term pricing is more important than spot pricing

In terms of what drives investment, term pricing is more important than spot.

The spot pricing is what we see reported and matters a lot for the prices of various goods and input costs in the near term.

However, despite the new geopolitical realities, term crude prices haven’t budged much.

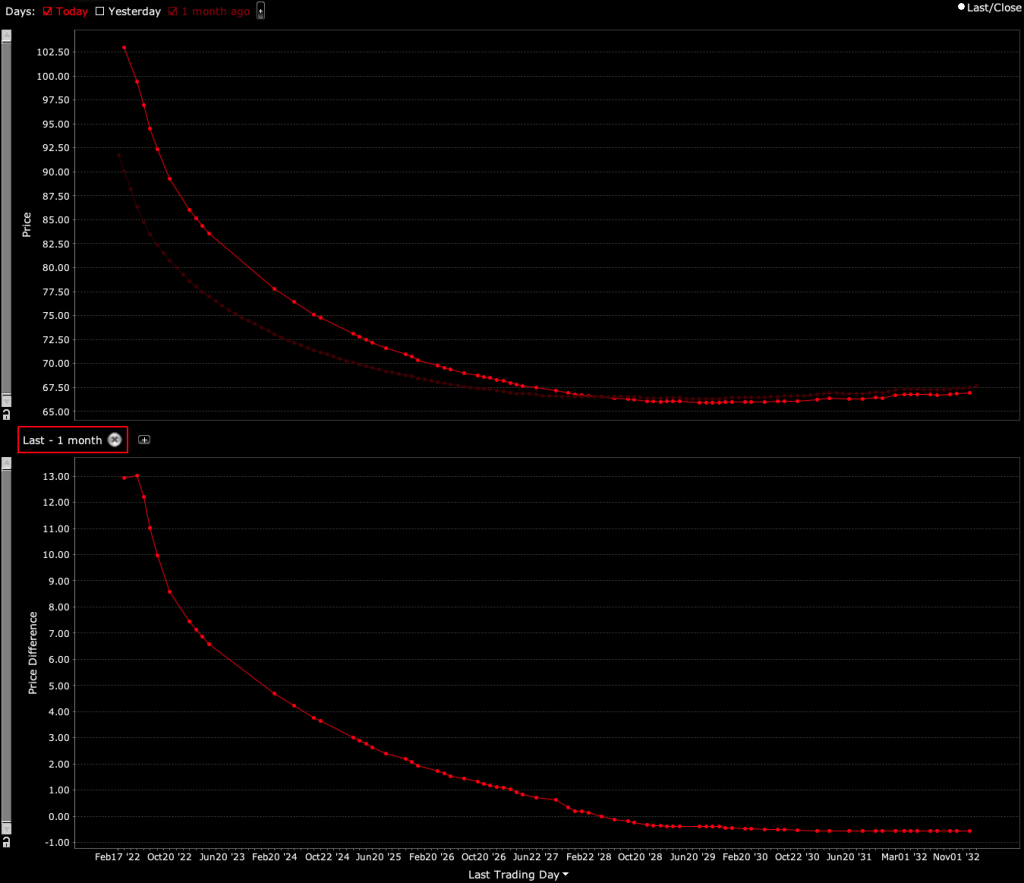

The top graph below shows the oil pricing curve through 2032. The strong red line shows the oil curve after Russia’s invasion of Ukraine. The faint red line shows where it was before the invasion.

There’s a one-month difference between the two readings. The curve became more pointy and backwardated, suggesting a shortfall in supply.

The bottom graph shows the price differential between the two months.

WTI Crude Oil Futures (CL) Price Curve

(Source: Interactive Brokers)

In other words, there’s a big difference in spot pricing but not term pricing.

In fact, term crude prices the furthest out settled lower than before the invasion. Even a couple of years out, it was only a matter of a few dollars per barrel.

The market is saying that the energy dynamics going on today will have structural supply and demand impacts, which will eventually result in somewhat lower prices going forward, starting some six years after Russia’s initial invasion into Ukraine.

This is not the signal that producers are looking for in order to increase investment in new oil capacity.

The difference with shale

Of course, shale is different.

With shale, production can start in around 8-10 months from when the investment decision is made and it’s more heavily front-loaded.

But shale was already ramping up and priced into energy forecasts before the spike in crude spot pricing. The question is how much faster can it be scaled on top of previous plans.

At the same time, shale growth will hit constraints. The upstream oil and gas industry was heavily stressed in the US from 2014 forward.

And oil field services was the hardest hit, with a lot of investment drying up completely.

There has been virtually no growth capex in years as a result of several price scares (e.g., 2015-16, 2020) and changes in public policy to help address environmental and climate change concerns.

This has forced a lot of these companies to restructure their business models.

Equipment has deteriorated and employees have departed to other industries.

How to bring shale oil online

There is a long chain of steps that are necessary in order to bring new shale oil online: drilling rigs, fracking, sand, pipeline takeaway capacity, etc.

Any weak spots in that chain inhibit growth.

For example, if takeaway capacity isn’t increased, then the whole process of bringing new shale oil to market becomes constrained by that. If drilling rigs don’t grow, the same thing.

And labor is also very difficult to find.

So, increasing oil production is not as simple as oil companies making an immediate decision about existing operations and the new oil is there immediately to meet demand and bring prices down.

How to lower domestic prices for consumers

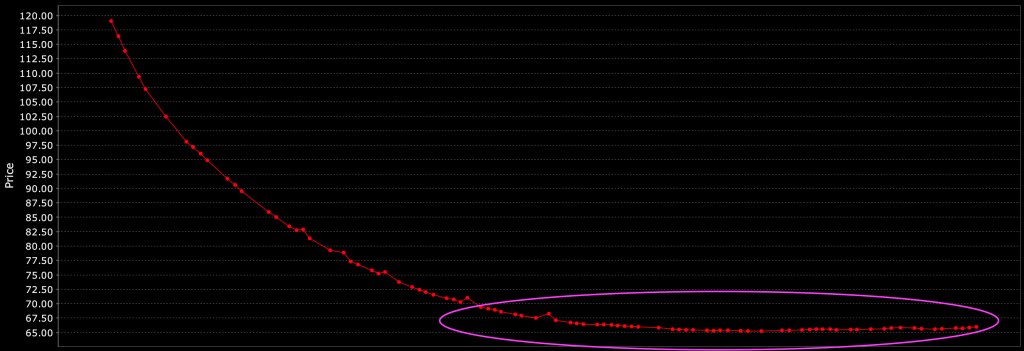

Lowering domestic prices for consumers would involve finding ways to flatten the oil curve.

That involves reducing spot and/or bringing up term pricing.

Spot can be lowered by releasing oil from the SPR (strategic petroleum reserves). How much spot pricing would be lowered by would depend on how much is released.

At the same time, it could be mandated that the SPR would be restocked fully (or even expanding the SPR) starting in, for example, 18-36 months.

That would incentivize new supply to be produced because there would an explicit demand for it.

Spot would fall and term pricing would rise and help provide more confidence to the industry.

The chart below shows the discrepancy between spot pricing and term pricing.

Spot pricing vs. Term pricing

The US SPR release

In late March 2022, the White House said it would start releasing 1 million barrels a day (roughly 1 percent of global demand) from the Strategic Petroleum Reserve over six months, which comes to 180 million barrels in total.

This was the largest SPR release in its history.

The Biden administration’s definitive wording nonetheless left something to be desired.

It could have asserted, for example, that it will authorize a release of 1 million barrels a day over 30 days with an option to repeat it in 30-day chunks up to five more times.

However, just the possibility of an SPR release can be enough to drop prices, so it could have left itself more optionality for the future. (Even Trump tweeting “Lots of oil!” was enough to drop prices after the Abqaiq attack in 2019.)

That said, the Biden administration also has to focus on midterm elections, so there is a lot of political motivation in it. This is especially true given inflation is a top concern in the US economy and will be a decisive political issue.

Moreover, the capacity of the US SPR is 714 million barrels.

All considered, it’s not that deep, especially given the US consumes about 20 million barrels per day. So if it had to meet the entire US demand, it would hold up for only 35 days if it were at full capacity.

Taking another 180 million barrels out of the SPR would deplete it further given there were previous depletions of it in late-2021 and early-2022.

It would leave only about 300 million barrels in reserve, or just over 40 percent of its total capacity. So, there’s not much of a cushion, especially without a promise of an aggressive restocking of the SPR 2+ years down the line.

International Energy Agency (IEA) member countries are required to hold 90 days of net import cover in reserves.

The US must hold 315 million barrels in the SPR.

Accordingly, an obvious concern is that such a large drawdown means the market could focus on the consequences of the loss of this shock absorber.

OPEC itself only has about 2 to 2.5 million barrels a day of additional spare capacity.

Other dynamics in the oil and energy market

Replacing Russian gas and oil will take time

Replacing Russian oil and gas is a difficult thing to do in the near term because of the scale of that exposure to Russian oil and gas, especially in Europe.

This is a situation where the high-price environment is unlikely to go away soon because there’s been a shock and underinvestment into new capacity.

Because of how long it takes for new oil capacity to come online, it can take a few years before one can see additional supply globally to replace what Russia brings to the market.

The conflict is likely to reverse a multiyear decline in energy capex

This Russia-Ukraine conflict is that catalyst that changes the perception of the importance of energy availability and diversification of energy sources.

Capex in the energy industry is expected to climb as the Russia-Ukraine conflict causes a global reset in how the world produces energy.

While investment in the sector has dropped in recent years, we should expect capex in primary energy (hydrocarbon, nuclear and renewable power) to grow significantly.

The new focus on energy security, resilience, and the need to avoid dependence on any one source will drive a new era for energy investments.

US shale and offshore oil projects (increasingly shunned due to climate concerns) are likely to see increased funding

However, the drive for decarbonization will stick, pushing more investment in liquefied natural gas (LNG), renewables, bioenergy, and hydrogen to new highs as well.

Renewables have a key role to play

Renewables have been a very important influence in achieving climate goals over the past 20 years in the European Union and now they’re becoming probably even more central.

Essentially, every megawatt hour of electricity that you generate from wind and solar is energy that you don’t have to get from Russia.

Oil production – FAQ

What is the Strategic Petrolum Reserve (SPR)?

The Strategic Petroleum Reserve (SPR) is the world’s largest emergency oil stockpile.

It was created in 1975 in response to the oil embargo imposed by OPEC.

What is the purpose of the SPR?

The SPR is intended to be used in cases of oil supply disruptions.

It can also be used to stabilize oil prices in times of market turmoil.

How much oil does the SPR hold?

The SPR currently holds about 714 million barrels of oil, enough to cover approximately 140 days of imports.

Who manages the SPR?

The Department of Energy (DOE) is responsible for managing the SPR.

What are the rules for using the SPR?

Under law, the president can only tap into the SPR in the event of a “severe energy supply interruption.”

This generally means a disruption that causes oil prices to spike.

How has the SPR been used in the past?

The SPR has been used a handful of times since it was created. A prominent example was in 2005, when Hurricane Katrina disrupted oil production in the Gulf of Mexico.

Another came in 2022 due to the Russian invasion of Ukraine and higher domestic monetary inflation.

What is the future of the SPR?

The future of the SPR is uncertain.

Some lawmakers have proposed selling off some of the oil to help reduce the federal budget deficit.

Others have suggested expanding the reserve to maintain its strategic purpose.

What is oil production?

Oil production is the process of extracting oil from the ground.

This can be done through traditional methods, such as drilling, or through newer techniques, such as fracking.

What could the US do to increase oil production?

The US private sector could invest in new drilling and new technologies to extract oil from unconventional sources, such as oil sands and shale formations.

The government could also work to reduce regulations that impede oil production.

Alternatively, it could invest in alternative energy sources to reduce reliance on carbon-heavy sources of energy.

What are the benefits of oil production?

Oil production provides many economic benefits, including jobs and revenue for governments.

It can also help to reduce dependence on imported oil.

What are the risks of oil production?

Oil production can have negative environmental impacts, such as air pollution and water contamination.

There is also the risk of oil spills, which can cause significant damage to ecosystems.

How can oil production be made safer?

There are a number of ways to make oil production safer, including improved regulation and better technology.

For example, oil companies can use horizontal drilling and fracking to extract oil from shale formations with less risk of contamination.

What is the future of oil production?

The future of oil production is uncertain. The world’s oil reserves are finite, and eventually there will be lower supply if more is not brought online.

Additionally, oil prices are volatile and subject to market forces beyond the control of producers.

Alternatives to oil, such as renewables, could eventually supplant it as the world’s primary source of energy.

How many years of oil does the US have left?

The US has proven oil reserves equivalent to about 4.9 times its annual consumption.

This means that, without imports, there’d be around 5 years of oil left at current consumption levels (excluding unproven reserves).

Does oil regenerate in the earth?

Oil, like coal and natural gas, is a non-renewable source of energy. This means that it cannot be replenished once it is used up.

However, oil companies are constantly looking for new ways to extract oil from the ground, which can help to offset declining reserves.

Some also have renewables units to help this problem and attend to climate concerns.

Conclusion

It is possible for the US to increase oil production, but it’s not as simple as just making a decision to do so.

There are various constraints that need to be considered, such as labor, equipment, new drilling rigs, sand, pipe, fracking, takeaway capacity, and so on.

In addition, term pricing is more important than spot pricing when it comes to investment decisions by oil companies. Pricing further out on the curve needs to rise.

Finally, releasing oil from the strategic petroleum reserve could help lower domestic prices for consumers today. Mandating a full restocking (or expanding the SPR) would incentivize new supply and flatten the oil price curve.