Trade Idea: Credit Spread Widening

As a day trader, you are mostly inclined to not hold positions overnight. But having a flexible mandate to swing trade or position trade some things can provide you with more, and better quality, trading opportunities than you might have otherwise. Many trade ideas, like credit spread widening – or the spread between different yields on various credit securities (usually “safe” credit versus riskier forms) – take longer to pan out.

The Best Brokers For Credit Spread Widening

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Spread trades are often among the best because you can calculate with some degree of accuracy your reward-to-risk. If the spreads between different forms of credit compress more than what’s sustainable in the long-run (based on, for example, “expected loss given default” calculations), you will have a high reward-to-risk trade.

Examples

1) BBB-U.S. Treasury (“UST”) Spread

BBB rated credit is the tail-end of the investment grade (IG) range. U.S. Treasuries are considered among the safest financial securities available globally.

As this is being written, BBB-UST credit spreads are 154 basis points (typically abbreviated bps, with each basis point equal to 0.01%). In other words, lower-range IG credit gives you just an extra 154bps of annual returns over Treasuries.

Let’s say theoretically things go very well for risk assets and you get a tightening of 50bps in this spread, which would bring it down to 104. (This would be tighter than even 2006-07.)

But when those spreads blow out in a recession you’re likely looking at 300bps or more. In December 2008 you got 800bps.

So your reward/risk is at least close to 3/1 in that situation if you bet on that spread based on (300-154)/(154-104), or your upside minus your current spread divided by the difference of your current spread and theoretical downside. It would have been even better if you got this spread at sub-130bps. Then your upside is much better. This spread can only tighten so far based on expected loss in case of default.

Excluding the longest-duration forms, Treasuries and IG are less volatile than high-yield (HY). Accordingly, you can leverage this trade more so than betting on a UST-HY spread widening.

How do you bet on the spread widening?

Long U.S. Treasuries, short corporate credit.

What instruments?

I like doing long bonds for the carry and shorting futures for the corporate credit.

Note that you will have negative carry if you short a backwardated futures market. Always check what’s priced into the curve.

Other options include buying puts on ETFs, preferably long-dated as this idea isn’t time-sensitive. Or shorting the ETF if you don’t want volatility, time, and other elements as part of the picture, as is the case with options and what factors into their pricing. The problem with shorting ETFs or even underlying bonds is the margin requirements, which are high, and you pay the carry (e.g., the dividend or coupon).

IG corporate credit futures can be found through the symbol IBXXIBIG on CFE.

2) HY-UST Spread

– Cyclical low on B-rated credit spread over Treasuries was 328bps on October 2 this year

– Was 241bps back in June 2007

– Currently 357bps

– In a typical recession that’ll blow out to 800-1,100bps. In a bad one, 1,500-2,500bps.

Conservatively, let’s say your risk is a tightening to ~225bps and a reward of 800bps. Reward/risk is then:

(800-357)/(357-225) = 3.4x

How to Bet?

Same thing, long U.S. Treasuries or highest-grade IG, short HY credit if the spread becomes tight enough. If you are already long a variety of USTs or IG, you could probably simply short HY.

HY corporate credit futures can be found through IBXXIBHY on CFE.

The General Idea of a Credit Spread Widening Trade

Spread trades, rather than purely directional trades, can be among the most lucrative because there becomes a constraint to how much a spread can realistically compress.

For example, if the forward yield on stocks is within 150-200bps of the forward yield on a 2-year Treasury, you’re probably not making a very good reward-to-risk bet being net long equities. (I’m not saying this is true now. You’re at around ~320bps in this particular example.)

As another past example, credit defaults swaps (CDS) on 10-year European sovereign credits were trading at only 5bps toward the top of the October 2002 to December 2007 business cycle. When you buy a CDS your loss is limited to the interest rate you pay, which was that 5bps per year over the life of the bond (10 years). When the economy contracted, this spread rose to 80bps. In a normal recession, you see these expand to 40-50bps, meaning your reward/risk on this trade was probably 8/1 or better.

Moreover, this type of trade is a “risk off” bet. Or a form of insurance with a low premium and limited downside. Plus asymmetric upside that are many multiples of the units of risk in the event of relevant and material changes to the economy and markets.

One of the risks in these types of trades is that you can be too early and sit in a “dead money” or losing trade for years. That can limit your return and returns are time-sensitive.

Moreover, interest rate risk can be greater than credit risk and you can lose money. This is common in late-cycle economies where rates are increasing, but credit risk is increasing to a lesser extent.

The catalyst is a contraction in private sector credit creation brought on by a wave of defaults when debt servicing costs are in excess of cash, assets, income and new borrowing available to service it.

Important Points

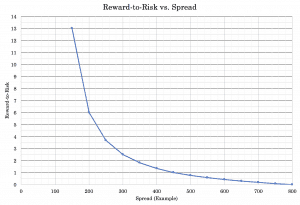

1. Note that these trades become more attractive in exponential fashion as the credit spreads tighten. This is because of the nature of the reward/risk calculation. The numerator becomes larger, while the denominator becomes smaller.

It follows in this format:

(Upside Spread – Current Spread) / (Current Spread – Downside Spread)

It is also, of course, a risk-off trade. General things going in favor of this trade are slowing global growth and the pullback of liquidity by the US Federal Reserve, making risk assets riskier.

Spreads should widen as the cycle proceeds. But the ultimate widening in the spreads won’t occur until there’s a debt problem, and we’re still at least a year off from that as of November 2018.

2. Some people say that because they have a “stop-loss” at one point in the market and a “take-profit” level in another, with the take-profit being 3x as far away from the current price as the stop-loss, this means that the reward/risk of the trade is supposedly 3x.

However, it wouldn’t be accurate to say that. It might be true theoretically, but in practice it’s not. If there isn’t an actual catalyst to lift or drop price to the targeted level, that’s not a 3x reward/risk trade at all.

For example, if someone goes long Apple stock (AAPL) at $210, sets a stop-loss at $200 and a take-profit at $240, they might view that as a “3-to-1 reward/risk” trade.

For this to be a believable claim, they would need to identify what the catalyst is with some math behind it beyond the usual beta return associated with being long equities. Naming recent headlines or some lagging metric isn’t viable. Remember that the present is already in the price.

The Curve

Based on the formula in point one of the section above, each basis point of compression in the spread has a positive non-linear effect on the reward relative to your risk.

This goes for all bets, not just what’s covered in this particular article. Understanding risk and reward is your most important thing. It’s just like poker. Know when to bet and size it appropriately when you know the odds are really in your favor. And you need to know when not to bet when the odds are against you, or neither favorable nor unfavorable.

It’s also the reason why you will tend to add in higher quantities if a position goes against you, but for reasons that don’t change your mind about the underlying asset. This improves your cost basis and reward-to-risk.

As a general reminder, a financial asset is simply the present value of the future cash flows it produces discounted back to the present. Over the long-run, assets’ cash flows are relatively predictable and stable. But their present values (i.e., their prices based on the discount rate) fluctuate. If prices or the general cost of a trade is high, this means that paying a higher price will necessarily produce lower future returns. Namely, there is an inverse mechanical relationship between realized and expected returns.

If you’re looking to be long or short something or trying express an opinion on a market in some way, you need to ask yourself, how good can it get and how bad it can get?

This involves some calculations. Don’t trade simply based on things you read or heard or based on stories. If you don’t know, then ask people who are believable and might know. If you still don’t know precisely, it’s good to estimate conservatively.

Only take the trades you really like. And you don’t need to go crazy with the number of bets.

Mathematically, if you can find 10 quality bets that are truly uncorrelated and are equally good – i.e., same return, same risk – you will improve your reward-to-risk by a factor of more than 3-to-1. In other words, you’ll remove over two-thirds the risk without compromising returns.

If you can find 15, then it comes to about 4-to-1.