Spread Option Trading Strategies

Spread trading in options is an approach to trading that involves simultaneously buying and selling multiple options contracts.

These strategies are designed to help traders manage risk, capitalize on specific market conditions, and potentially profit from various scenarios while often limiting potential losses.

Key Takeaways – Spread Option Trading Strategies

- Risk-Reward Balance – Spreads often limit both potential losses and gains. They can offer a more controlled risk profile than single options positions.

- Market Outlook Alignment – Choose spreads that match your market view – bullish, bearish, or neutral strategies exist for various scenarios.

- Time Decay Opportunities – Some spreads, e.g., calendar spreads, can profit from the natural erosion of option value over time.

- 20+ strategies covered.

Purposes of Spread Options Trading Strategies

The primary purposes of spread trading options strategies include:

Risk management

By combining multiple options positions, traders can often limit their potential losses and improve their risk/reward compared to holding a single option or the underlying asset directly.

In many forms of spread trading, max loss and max gain can be known ahead of time.

Profit from specific market outlooks

Different spreads are tailored to benefit from various market conditions, such as bullish, bearish, or neutral outlooks.

Leverage

Spreads can provide leveraged exposure to price movements while often requiring less capital than outright positions in the underlying asset.

Volatility trading

Some spreads allow traders to profit from changes in implied volatility rather than just directional price movements.

Time decay exploitation

Certain spreads take advantage of the natural time decay of options to generate profits.

Reduced costs

By selling options as part of a spread, traders can offset some of the costs of purchasing options.

This can potentially improve the overall risk-reward profile of the trade.

Flexibility

Spread strategies can be adapted to various market environments and trader objectives, offering a wide range of possibilities for different scenarios.

Arbitrage opportunities

Some complex spreads allow traders to capitalize on pricing inefficiencies between related options or markets.

These are generally taken advantage of by systematic traders.

Structure of Spread Options Strategies

These strategies range from relatively simple two-legged spreads like bull call spreads or bear put spreads to more complex multi-legged strategies like butterflies, condors, and calendar spreads.

Each strategy has its own risk-reward profile and is suited to specific market outlooks and trader goals.

Risks of Spread Options Strategies

Spread trading can offer advantages, but these strategies can also be complex and involve risks.

Traders need to thoroughly understand the mechanics, risks, and potential outcomes of any spread strategy before implementing it in their trading.

Options are less liquid than the underlying assets, so transaction costs need to be factored in.

Spread Options Trading Strategies

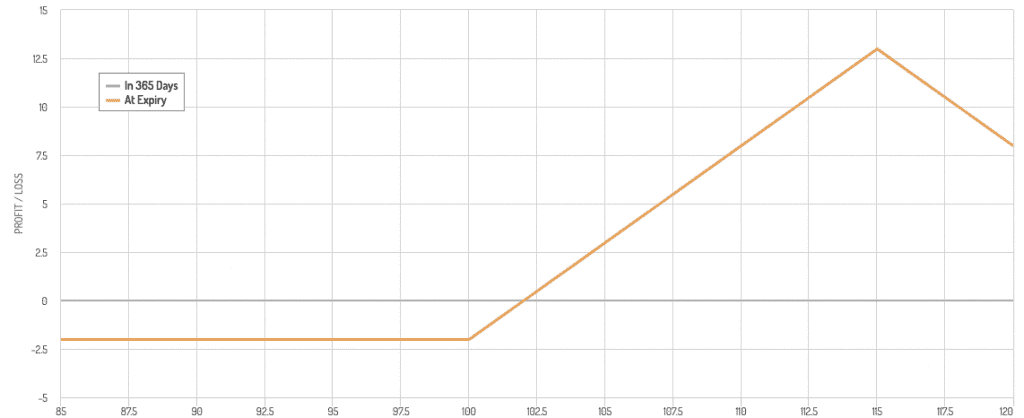

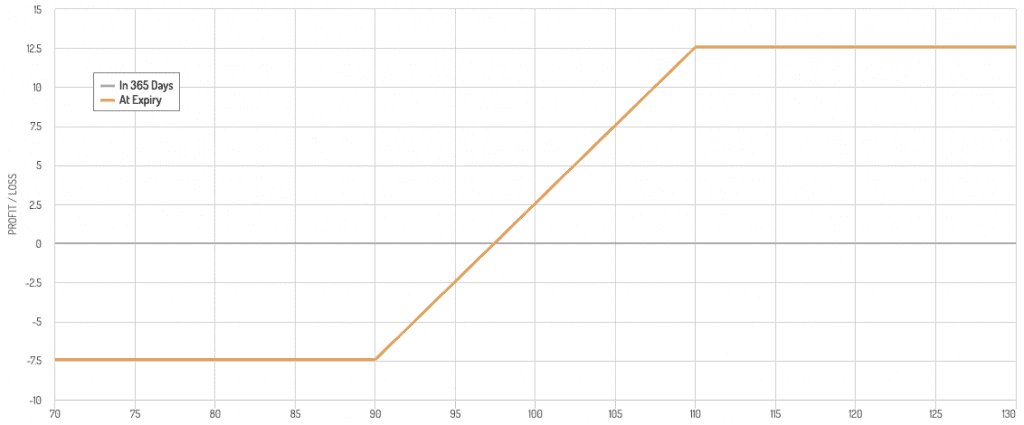

Bull Call Spread

- Buy a call option with a lower strike price

- Sell a call option with a higher strike price

- Profit from a rise in the underlying asset’s price

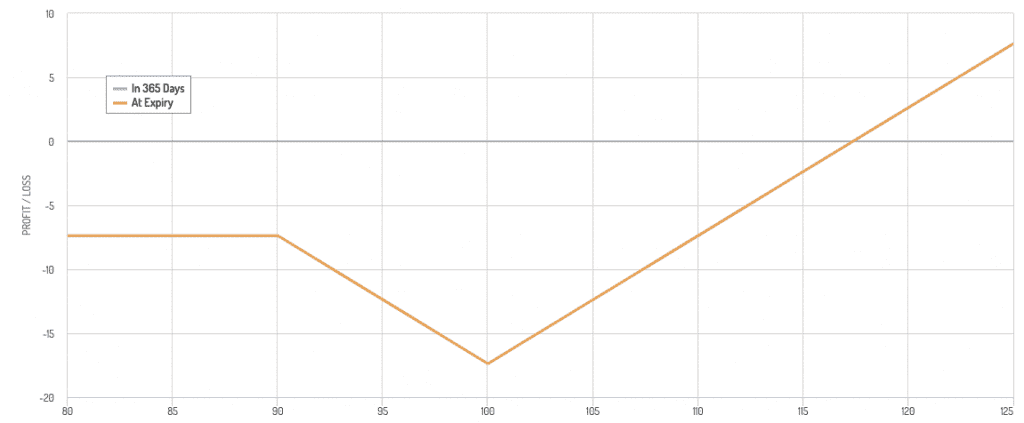

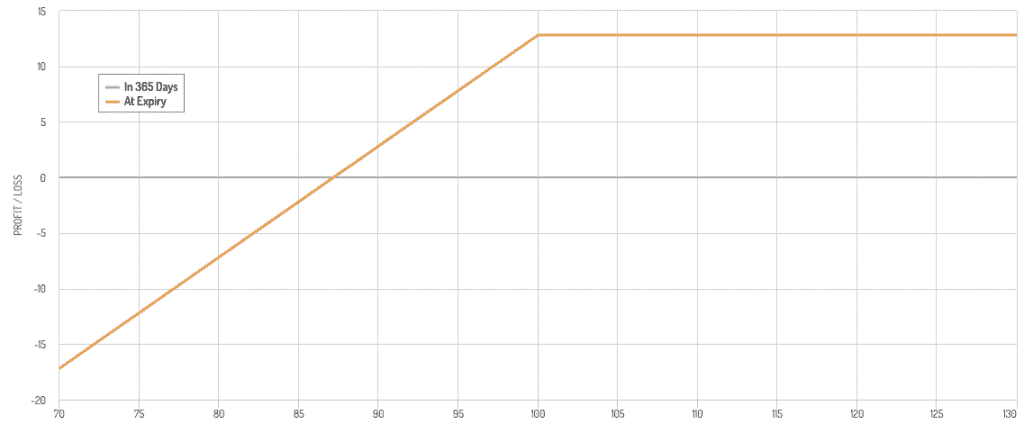

Bear Put Spread

- Buy a put option with a higher strike price

- Sell a put option with a lower strike price

- Profit from a fall in the underlying asset’s price

Calendar Spread

- Buy a call or put option with a longer expiration date

- Sell a call or put option with a shorter expiration date

- Profit from time decay and volatility differences

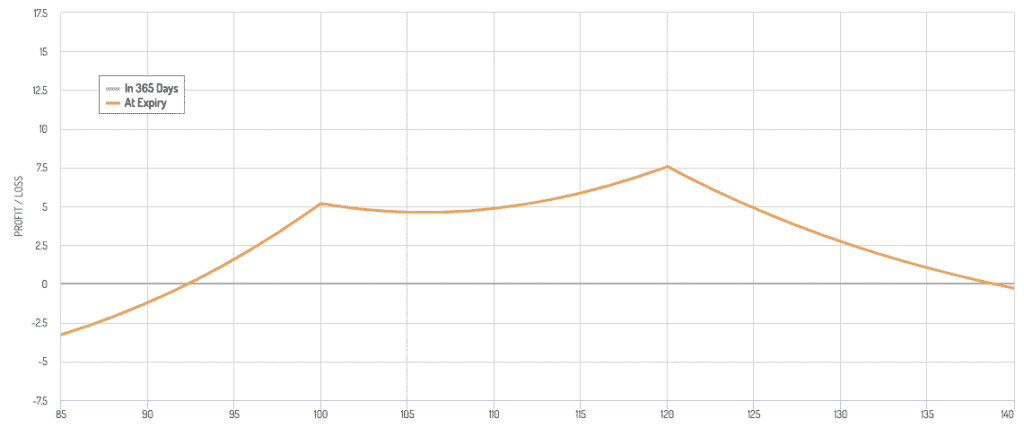

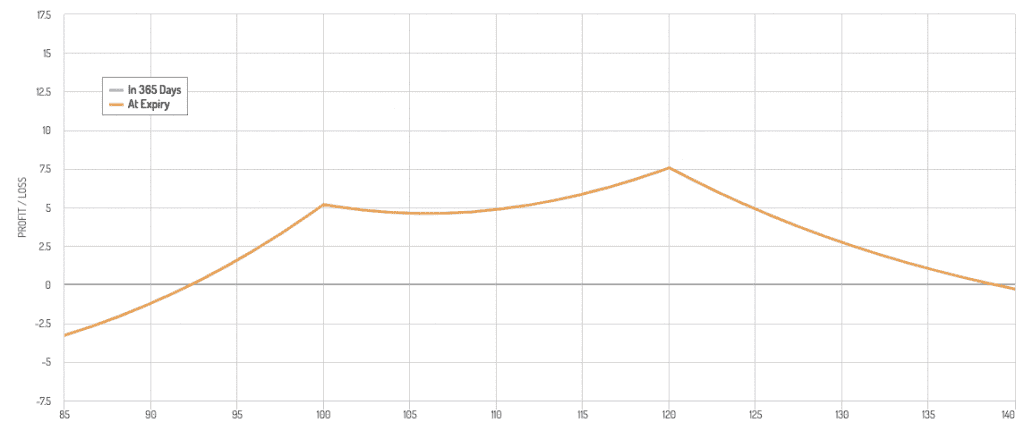

Whenever different expirations are at play, you’ll see more of a curved payoff diagram.

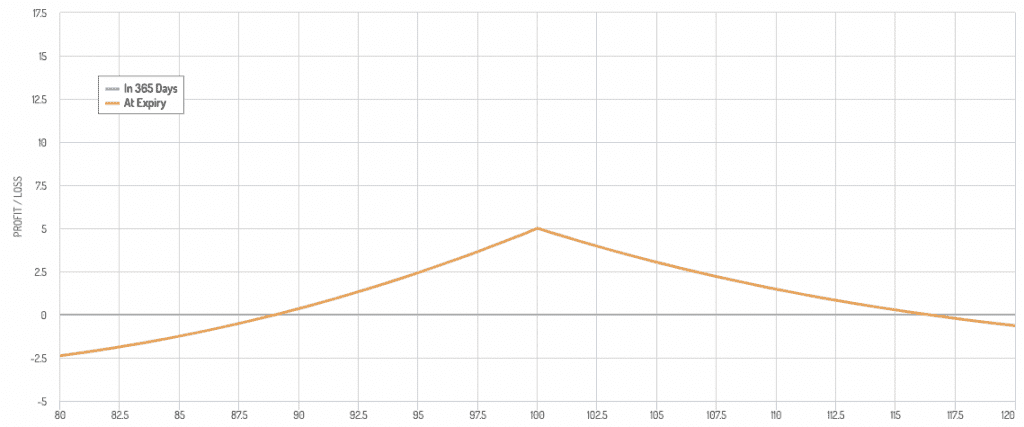

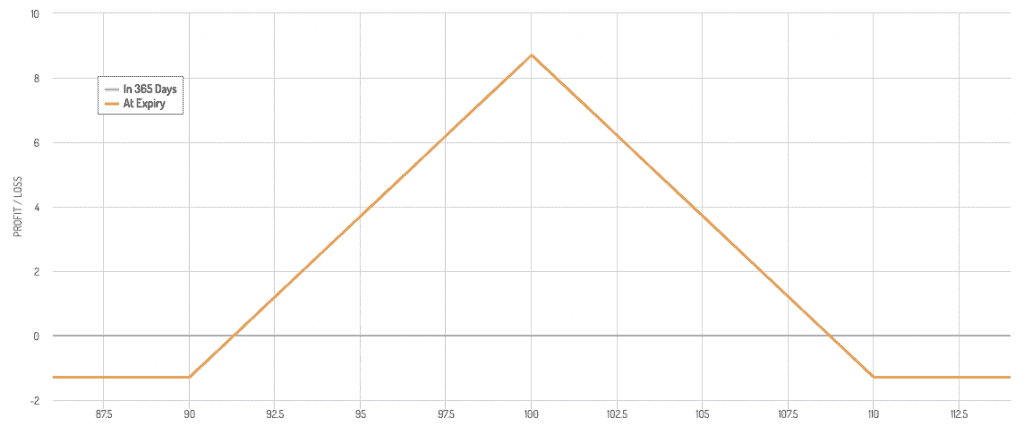

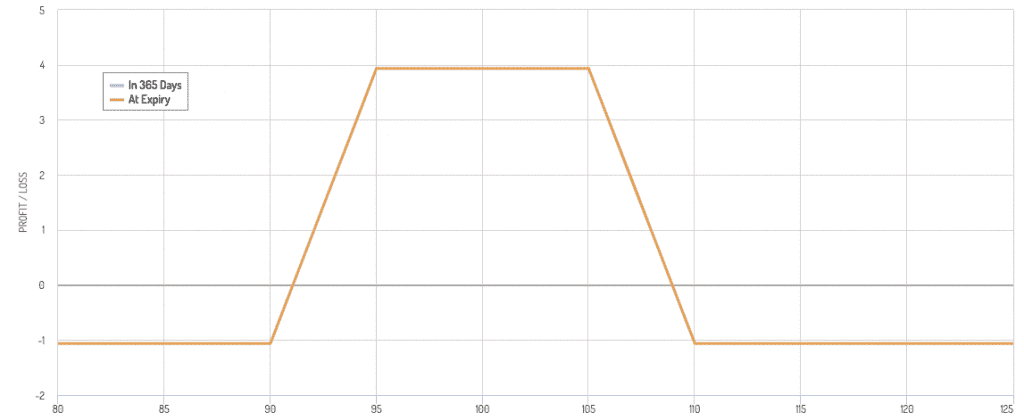

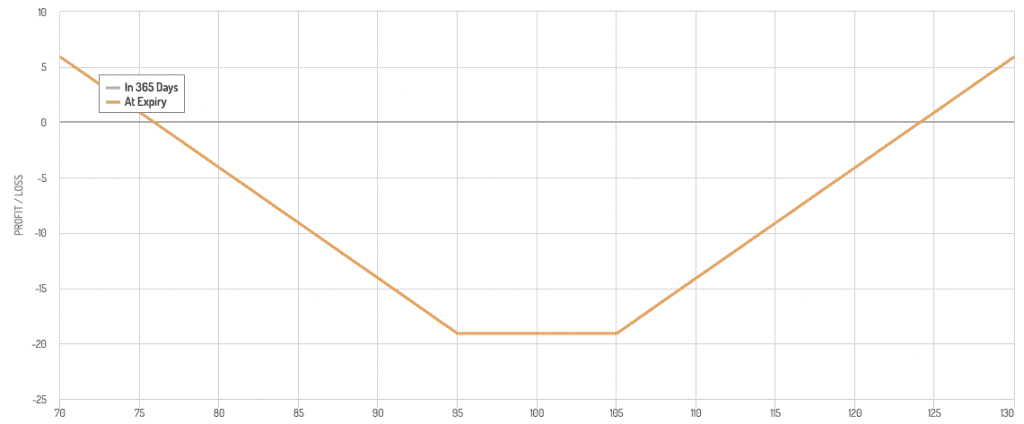

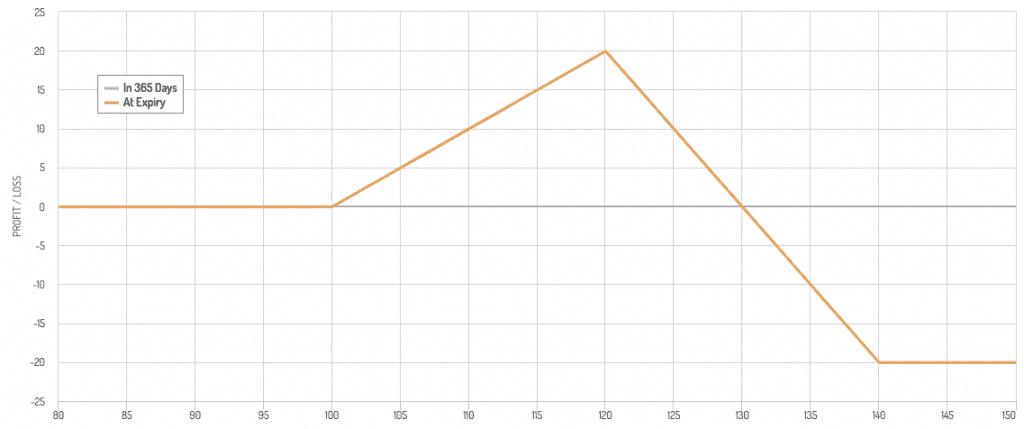

Butterfly Spread

- Buy a call option with a lower strike price

- Sell two call options with a middle strike price

- Buy a call option with a higher strike price

- Profit from a stable underlying asset’s price

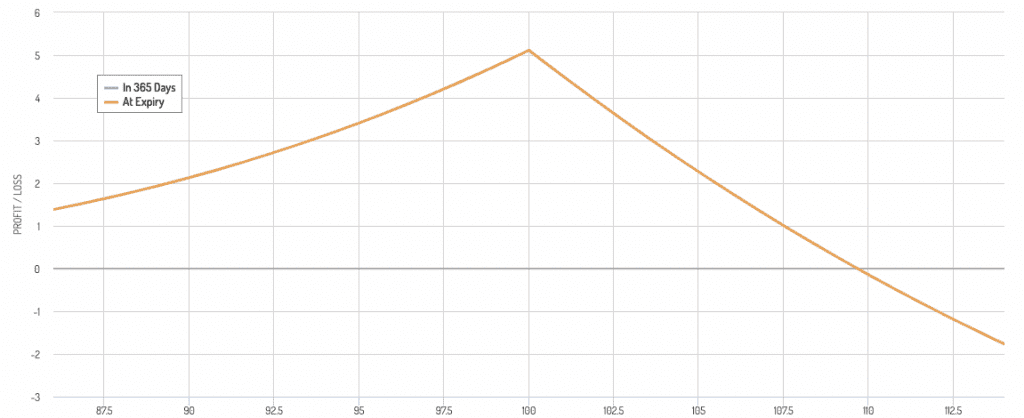

Diagonal Spread

- Buy a call or put option with a longer expiration date and a different strike price

- Sell a call or put option with a shorter expiration date and a different strike price

- Profit from time decay and differences in volatility between the two options

Ratio Spread

- Buy a call or put option with a certain strike price

- Sell multiple call or put options with a different strike price

- Profit from a rise or fall in the underlying asset’s price

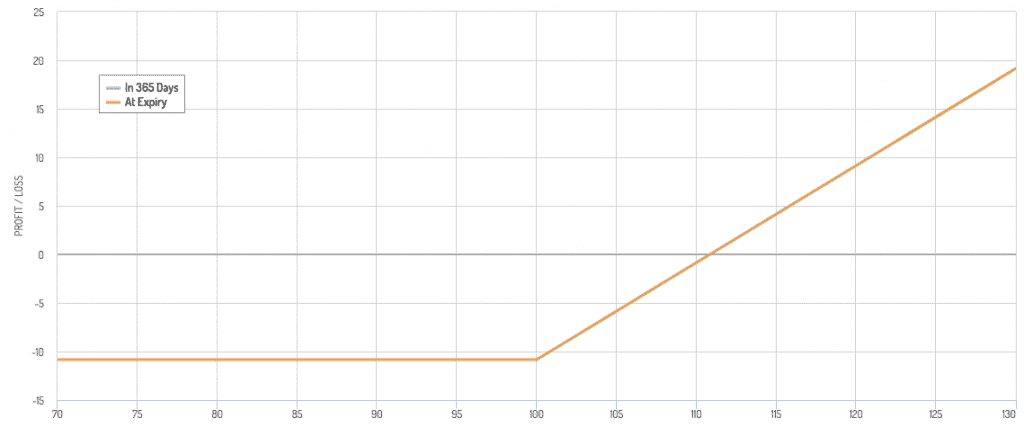

Backspread

- Sell a call or put option with a certain strike price

- Buy multiple call or put options with a different strike price

- Profit from a rise or fall in the underlying asset’s price

Iron Condor Spread

- Buy a call option with a higher strike price

- Sell a call option with a middle strike price

- Sell a put option with a middle strike price (for the condor, has to be different from the one above, or else it’ll be a butterfly spread)

- Buy a put option with a lower strike price

- Profit from a stable underlying asset’s price

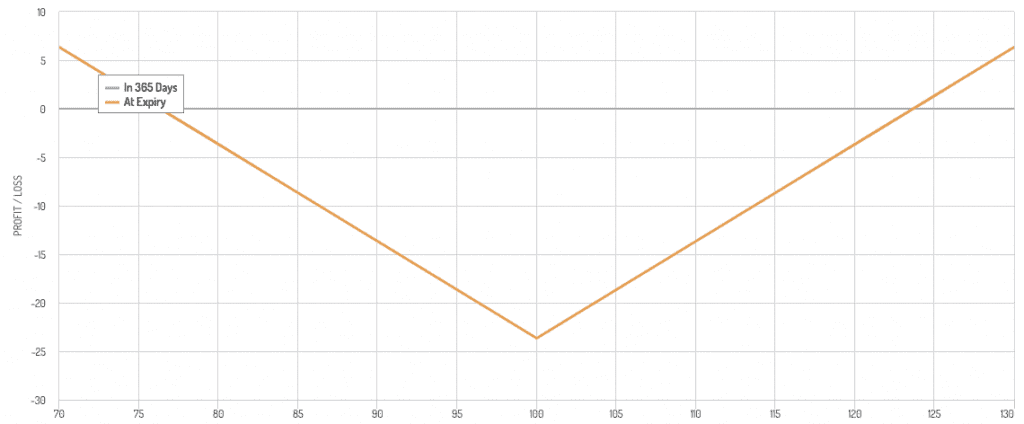

Straddle Spread

- Buy a call option and a put option with the same strike price and expiration date

- Profit from significant movement in the underlying asset’s price in either direction

Strangle Spread

- Buy a call option with a higher strike price

- Buy a put option with a lower strike price

- Profit from significant movement in the underlying asset’s price in either direction

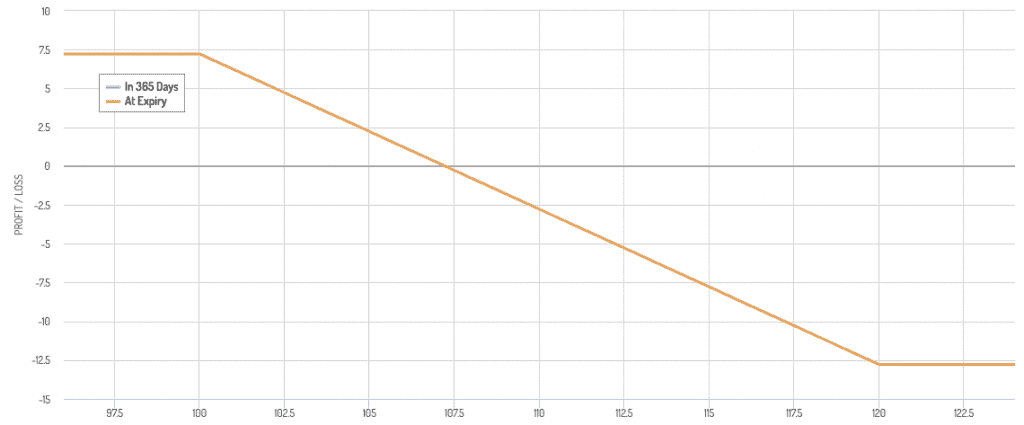

Covered Call Spread

- Own the underlying asset

- Sell a call option with a higher strike price

- Profit from collecting the premium and potential slight rise in the underlying asset’s price

Protective Put Spread

- Own the underlying asset

- Buy a put option with a lower strike price

- Protect against a decline in the underlying asset’s price

Box Spread

- Create a combination of a bull call spread and a bear put spread

- Profit from arbitrage opportunities

Collar Spread

- Own the underlying asset

- Buy a protective put option

- Sell a covered call option

- Profit from limited risk and limited profit potential

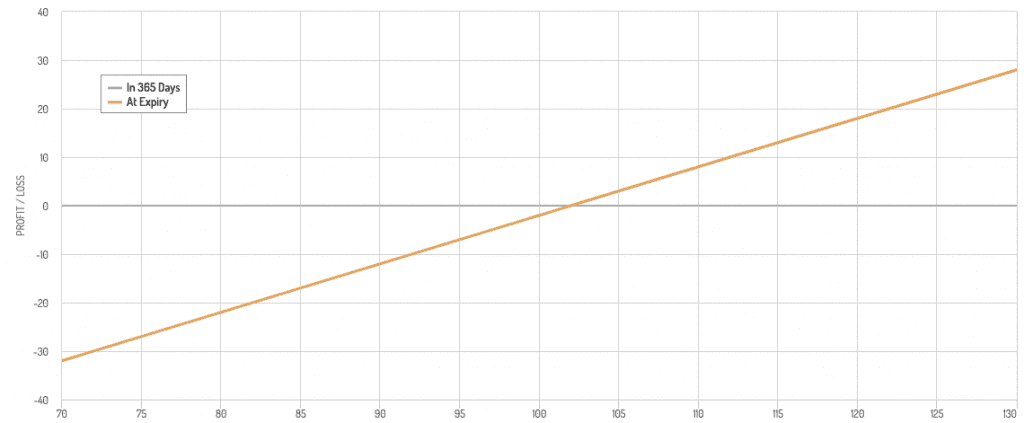

Synthetic Long Spread

- Buy a call option with a lower strike price

- Sell a put option with a higher strike price

- Profit from a rise in the underlying asset’s price

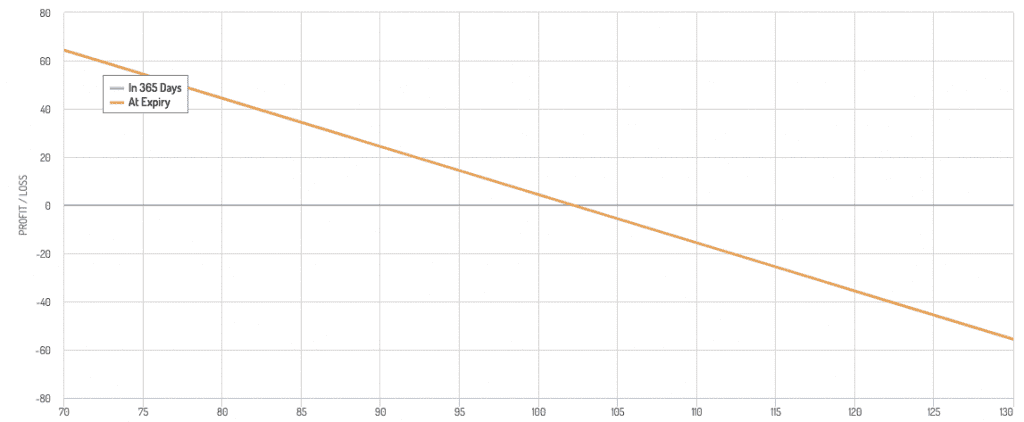

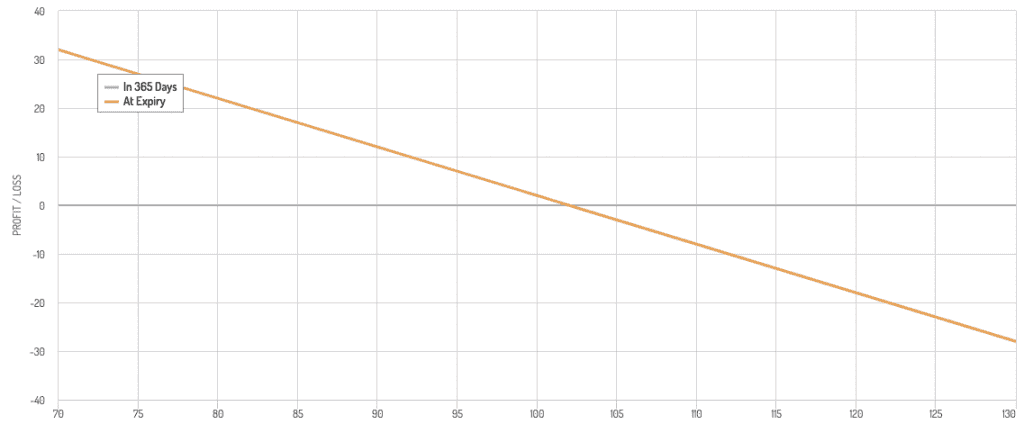

Synthetic Short Spread

- Sell a call option with a higher strike price

- Buy a put option with a lower strike price

- Profit from a decline in the underlying asset’s price

Christmas Tree Spread

- Buy a call option with a lower strike price

- Sell three call options with higher strike prices

- Buy two call options with an even higher strike price

- Profit from a moderate rise in the underlying asset’s price

Double Diagonal Spread

- Buy a longer-term call and put option with different strike prices

- Sell a shorter-term call and put option with different strike prices

- Profit from time decay and differences in volatility between the options

Double Calendar Spread

- Buy a call and a put option with longer expiration dates

- Sell a call and a put option with shorter expiration dates

- Profit from time decay and volatility differences

Pairs Trading (Statistical Arbitrage)

- Buy one asset and sell another related asset, expecting the price relationship between the two to revert to the mean

- Buy shares of Company A and sell shares of Company B if historically their prices move together and have diverged recently

- Profit from the reversion to the mean of the price relationship

Intercommodity Spread

- Buy and sell futures contracts on related commodities

- Buy crude oil futures and sell gasoline futures, profiting from the spread between the two (i.e., crack spread)

- Profit from changes in the price spread between the two commodities

Intermarket Spread

- Trade on the spread between related markets or exchanges

- Buy a stock index futures contract on one exchange and sell a similar contract on another exchange

- Profit from changes in the spread between the two markets

Related