Trading Simulation Software Used by Professional Traders

Trading simulation software has become an integral part of professional trading.

This software allows traders to test strategies, practice decision-making, and analyze market behavior without risking real capital.

As the financial markets have gotten more complex and data-driven, the importance of strong simulation capabilities has increased dramatically.

Key Takeaways – Trading Simulation Software Used by Professional Traders

- Purpose-driven

- Simulations enable risk-free strategy testing, skill development, and market analysis, helping traders optimize performance before risking real capital.

- Customization

- Many firms develop bespoke software to tailor simulations to specific strategies, ensure security, and gain a competitive edge.

- C++ is commonly used where fast execution speeds are important. Python for fast development and prototyping.

- Data quality matters

- Accurate, comprehensive market data is necessary for reliable simulations and informed decision-making.

- Evolving technology

- Integration of AI, cloud computing, and big data processing is advancing simulation capabilities, allowing for more sophisticated modeling and analysis.

Purpose and Benefits

Trading simulations serve several crucial purposes for professional traders:

Strategy Testing

Traders can backtest their strategies against historical data to assess performance.

Forward Testing and Stress Testing

Traders can test data on synthetic data made to simulate a variety of forward conditions and stress test across various scenarios.

For example, in the real world, our data is often limited to decades and that only captures a small range of situations that can happen to you in many trading approaches.

Forward testing means you can simulate over as many years as you want with conditions set at whatever you want if it’s created and set up well.

Risk Management

Simulations help identify potential risks and optimize risk management techniques.

Skill Development

New traders can practice in a realistic environment without financial consequences.

Game-like competitions against other people are viable, but often create perverse incentives, such as taking big risks to get on top, which doesn’t create good habits.

In trading, it’s all about getting acceptable returns within your desired risk constraints.

Market Analysis

Simulations can reveal patterns and trends that might not be apparent in real-time trading.

Several widely-used trading simulation platforms cater to professional traders across various markets.

Here are some of the most prominent options:

MetaTrader 4 and 5

MetaTrader, developed by MetaQuotes Software, is one of the most popular trading platforms globally, particularly in the foreign-exchange (forex) market.

Key Features

- Backtesting capabilities

- Custom indicator development

- Automated trading through Expert Advisors (EAs)

- Large community of users and developers

While MetaTrader is widely used by retail traders, many professional traders and smaller firms also use its powerful features for simulation and live trading.

NinjaTrader

NinjaTrader is a trading and charting software that’s most popular among futures traders.

Key Features

- Quality charting and analysis tools

- Strategy backtesting and optimization

- Market replay for historical data simulation

- Integration with various data feeds and brokers

TradeStation

TradeStation is both a broker and a trading platform, known for its analytical and automation capabilities.

Key Features

- EasyLanguage programming for custom indicators and strategies

- Extensive historical data for backtesting

- Real-time scanning and alerts

- Portfolio-level backtesting and reporting

- Ties in with the brokerage

Interactive Brokers’ Trader Workstation (TWS)

Interactive Brokers is a favorite among professional traders and is good for individual traders as well.

It offers TWS as its flagship trading platform.

Key Features

- Paper trading accounts for risk-free simulations (can be limited)

- Advanced order types and algorithmic trading

- Gives VaR and expected shortfall calculations

- Risk Navigator for portfolio analysis

- API for custom application development

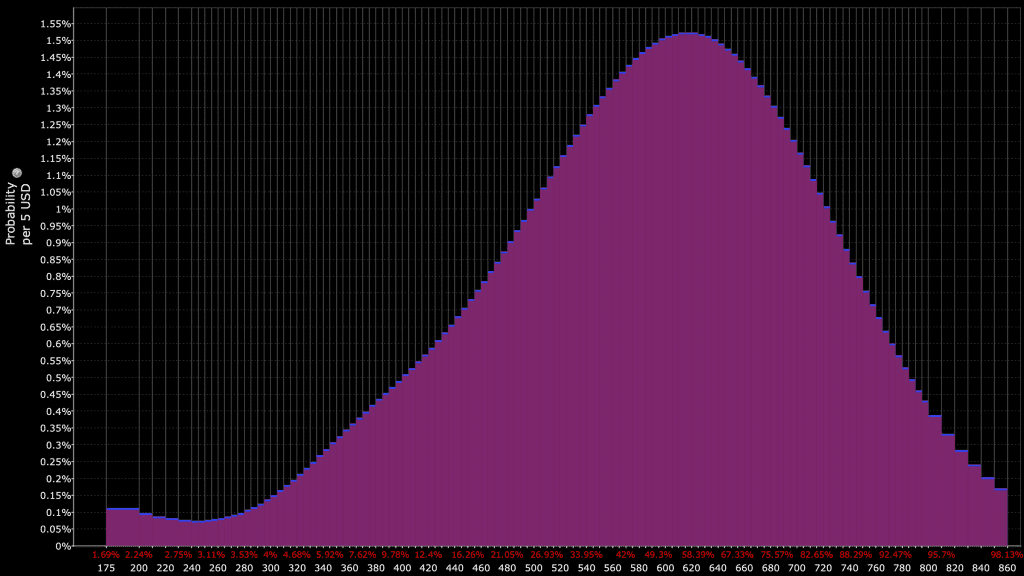

- Implied probability distributions (via options markets) and simulations via Probability Lab (see example image below)

Bespoke In-House Trading Simulation Software

Many professional trading firms and institutional investors prefer to develop their own proprietary trading simulation software.

Their quants tend to specialize in specific disciplines, such as pricing models or risk modeling.

This approach allows for greater customization, security, and competitive advantage.

Reasons include:

Customization

Tailored to specific trading strategies and asset classes.

Proprietary Algorithms

Protect unique trading approaches from competitors.

Integration

Seamless connection with existing systems and data sources.

Performance

Optimized for specific hardware and low-latency requirements.

Compliance

Easier to meet regulatory requirements with full control over the software.

Development Process

Creating bespoke trading simulation software is a complex undertaking that typically involves several stages:

1. Requirements Gathering

The development team works closely with traders, quants, and risk managers to define:

- What are your goals? This is where it all starts.

- Objective functions (e.g., desired returns, volatility constraints, downside volatility constraints, max drawdown constraints, tail risk metrics)

- Specific simulation scenarios needed

- Data sources to be integrated

- Performance requirements (e.g., speed, accuracy)

- User interface preferences

- Reporting and analysis needs

2. Architecture Design

Based on the requirements, software architects design the system structure, considering:

- Scalability for handling large datasets

- Modularity for easy updates and maintenance

- Integration points with existing systems

- Security measures to protect proprietary strategies

3. Data Management

A crucial aspect of any trading simulation is data handling:

- Historical data collection and storage

- Real-time data feed integration

- Data cleaning and normalization processes

- Efficient data retrieval for fast simulations

4. Core Simulation Engine

The heart of the software, responsible for:

- Accurate price and market condition modeling

- Order execution simulation

- Transaction cost modeling (slippage, fees, spreads, illiquidity risk premium vs. transaction costs, etc.)

- Time synchronization for multi-asset simulations

5. Strategy Implementation

Allowing traders to input and test their strategies, including:

- A domain-specific language for strategy definition

- Integration with common programming languages (e.g., Python for prototyping, lower-latency languages like Java or C++ for production)

- Support for machine learning and AI-driven strategies

6. Risk Management Module

Essential for assessing and controlling risk:

- Value at Risk (VaR) calculations

- Stress testing capabilities

- Correlation and portfolio effect modeling

7. Reporting and Analysis

Tools for understanding simulation results:

- Performance metrics calculation

- Visualization of trade data and results

- Comparative analysis of different strategies

- Export functionality for further analysis

8. User Interface (UI) Development

Creating an intuitive interface for:

- Setting up simulation parameters

- Monitoring simulation progress

- Interacting with results and analysis

9. Testing and Validation

Rigorous testing to ensure:

- Accuracy of simulations compared to real market behavior

- Performance under various market environments (e.g., high/low inflation, high/low growth, changing discount rates, changing risk premiums)

- Reliability and stability of the software

10. Deployment and Maintenance

Finally, the software is deployed and continuously updated:

- Integration with trading infrastructure

- Regular updates to reflect changing market environments

- Ongoing support and feature enhancements

Challenges in Developing In-House Software

Creating bespoke trading simulation software comes with various challenges:

- Cost – Substantial investment in development and ongoing maintenance

- Time – Long development cycles before the software is production-ready

- Expertise – Requires a team of quant developers with deep knowledge of both finance and software development (requires working with quants or those with more pure finance/economics/stats/math background)

- Data Quality – For accurate and comprehensive market data for simulations

- Regulatory Compliance – Adhering to evolving financial regulations

- Keeping Pace with Technology – Continual updates to leverage new technologies and methodologies

Related: How to Design an Institutional Trading System

The Future of Trading Simulation Software

As technology continues to advance, trading simulation software is evolving to incorporate new capabilities:

Machine Learning and AI

Increasingly, trading simulations are incorporating machine learning algorithms to:

- Improve market modeling accuracy

- Develop and test AI-driven trading strategies

- Enhance risk prediction and management

Cloud Computing

Cloud-based simulations offer advantages such as:

- Scalability for handling massive datasets and complex simulations

- Collaboration features for geographically dispersed teams

- Reduced hardware investment for firms

Real-Time Big Data Processing

The ability to process and analyze vast amounts of real-time data is becoming crucial:

- Incorporating alternative data sources (e.g., satellite imagery, NLP/social media sentiment)

- More accurate modeling of market microstructure

- Faster adaptation to changing market conditions

- Can help stay ahead of the curve

Conclusion

Trading simulation software is important for professional traders, whether they use mainstream platforms or develop bespoke solutions – with the latter being most common.

The choice between off-the-shelf and in-house software depends on a firm’s specific needs, resources, and competitive strategy.

The sophistication of these simulation software will growth as markets increase in complexity over time.

The integration of advanced technologies like AI, cloud computing, and big data analytics is pushing the boundaries of what’s possible in trading simulation.