Selling ITM Options – Good Idea or Avoid?

Selling in-the-money (ITM) options is a strategy that often confuses both novice and experienced traders.

For those selling ITM options “naked,” it’s often pursued by traders as a way to avoid paying margin interest or borrowing fees by simply buying or shorting the underlying.

It can also be combined with other options positions as part of a certain trade structure or used on its own.

While it can potentially offer payoff profile potential similar to owning the underlying, it also comes with increased risk and capital requirements.

This article explores the pros and cons of selling ITM options, helping you decide whether it could be a viable strategy for your trading portfolio.

Key Takeaways – Selling ITM Options

- Selling in-the-money options can be risky due to their greater collateral requirements and greater likelihood of being exercised – i.e., forces you to buy (short puts) or sell (short calls) the underlying.

- While they offer larger upfront premiums, ITM options leave less room for profit potential if the underlying asset moves favorably.

- In other words, if the option goes from ITM to OTM, you won’t receive additional profit.

- Generally, selling ITM options is considered a more advanced strategy that should be approached cautiously by experienced traders who fully understand the risks involved.

Understanding ITM Options

What are ITM Options?

In-the-money options have intrinsic value because the strike price is favorable compared to the current market price of the underlying asset.

For call options, this means the strike price is below the market price.

For put options, the strike price is above the market price.

Characteristics of ITM Options

- Higher premiums due to intrinsic value

- More responsive to changes in the underlying asset’s price

- Generally more liquid than out-of-the-money (OTM) options (but not always)

Advantages of Selling ITM Options

Higher Premium Income

Selling ITM options generates more premium income compared to at-the-money (ATM) or OTM options.

Increased Probability of Profit

ITM options have a higher delta, meaning they’re more likely to remain ITM at expiration.

Potential for Early Assignment

While early assignment can be a risk, it can also be an advantage if the seller wants to acquire (for puts) or sell (for calls) the underlying asset at a certain price (while benefiting from roughly linear exposure for deep ITM options).

Risks and Challenges of Selling ITM Options

Larger Potential Losses

The higher intrinsic value of ITM options means that if the trade moves against the seller, potential losses can be significant.

This risk is especially pronounced when selling naked options.

Higher Margin Requirements

Brokers typically require larger margin deposits for selling ITM options due to their increased risk profile.

This can tie up more capital and potentially limit other trading opportunities.

Early Assignment Risk

ITM options are more likely to be exercised early, especially if they’re deep in-the-money or if there’s an upcoming dividend payment.

This can disrupt the seller’s strategy and lead to unexpected outcomes.

When to Consider Selling ITM Options

Bearish Market Outlook (for selling ITM calls)

Selling ITM call options can be appropriate when you have a bearish outlook on the underlying asset.

It’s similar to a covered put.

Bullish Market Outlook (for selling ITM puts)

ITM put options might be attractive to sell when you have a bullish view on the underlying.

Short ITM puts is similar to a covered call.

Portfolio Income Generation

For traders looking to enhance portfolio income, selling ITM options on stocks they already own (covered calls) or want to acquire (cash-secured puts) can be an effective strategy.

In this case, you’re using it in conjunction with the underlying asset, which is the most common approach.

Best Practices for Selling ITM Options

Use Proper Position Sizing

Given the increased risk of ITM options, it’s important to limit position sizes to manage potential losses.

Never risk more than you can afford to lose.

Implement Risk Management Techniques

Consider using stop-loss orders, rolling techniques, or combining the sale of ITM options with other options to create spreads and limit risk.

Monitor Positions Closely

ITM options require more active management due to their sensitivity to price changes and early exercise risk.

Stay vigilant and be prepared to adjust your strategy as things change.

Understand Tax Implications

Selling ITM options can have complex tax consequences, especially if early assignment occurs.

Consult with a tax professional to understand the potential impact on your tax situation.

Let’s look at an example where we’re selling a deep ITM put naked:

Selling 35% ITM Put on SPY (1-Year Expiration)

Selling a 35% in-the-money (ITM) put on SPY (SPDR S&P 500 ETF Trust) with a 1-year expiration as a strategy for obtaining leveraged exposure to the index, while avoiding margin interest or borrowing fees, has several considerations.

Here’s a detailed analysis of the pros and cons:

Objective

- Leverage Exposure – Gain leveraged exposure to SPY.

- Avoid Margin Fees – Use the premium received to fund other positions or hold in cash. Avoids traditional margin interest costs.

Mechanism

- Put Selling – When you sell an ITM put, you receive a premium upfront. If the option is exercised, you must buy the underlying stock at the strike price, which is higher than the current price because the put is ITM.

Considerations

1. Margin Requirements

- High Margin Requirement – Even though you avoid borrowing fees, selling a deep ITM put will require significant margin. Brokers calculate margin based on the potential risk of assignment.

- Initial Margin – Brokers typically require a margin deposit that could be as high as the difference between the strike price and the current price, plus a premium cushion. For a 35% ITM put, this is substantial.

2. Risk Exposure

- Substantial Downside Risk – Selling a 35% ITM put exposes you to significant downside risk. If SPY falls further, your losses increase.

- You are obligated to buy at the strike price regardless of how low the price goes.

- Assignment Risk – You could be assigned at any time before expiration, requiring you to purchase SPY at the strike price.

3. Leverage

- Implied Leverage – The premium received provides a form of leverage. However, this is indirect leverage since you only gain exposure through the obligation to buy SPY at a specific price.

- Effective Leverage – Selling ITM puts can provide more effective leverage than being long OTM calls, but it comes with higher immediate exposure to the underlying.

4. Cost and Benefit Analysis

- Premium Income – The premium received for selling a deep ITM can provide more immediate income if the position goes in your favor. If the prices of the underlying rises on a short put, you benefit.

- No Direct Margin Interest – By holding the premium instead of the underlying, you avoid borrowing costs associated with traditional margin buying if you’re already “fully invested” (using up your full cash balance).

Risk/Reward Scenario

Example:

- Current SPY Price = $550

- Strike Price of Put Sold = $750 (approximately 35% ITM)

- Premium Received = $200 per share. This is hypothetical. Actual premium depends on implied volatility, time to expiration, and liquidity. More thinly traded options – further OTM, further ITM, or longer in duration.

| Scenario | SPY Price at Expiration | Outcome | Net Effect |

| Above Strike | $750 (or above) | Put expires worthless | Keep the premium ($200) |

| At Current Price of the Underlying | $550 | Buy SPY at $550 | Break-even: effectively bought SPY at the current price less premium |

| Below Price of Underlying | $550 (or below) | Obligation to buy at $750 | Loss of $200 per share, plus the premium |

Pros

- Upfront Premium – Receive a large premium upfront which can be used for other investments or held as cash.

- No Direct Borrowing Costs – Avoid traditional margin interest associated with buying SPY directly on margin.

Cons

- High Risk – If SPY falls below the strike price significantly, you incur substantial losses.

- Significant Margin Requirements – Requires significant margin, tying up a large portion of your account balance as collateral.

- Early Assignment Risk – Risk of being assigned at any time, especially if the put remains ITM. This becomes increasingly likely when the value of the optionality falls (e.g., the further ITM it gets and the closer to expiration it gets).

Alternatives for Leveraged Exposure without Margin Interest

Bull Put Spread

Instead of selling a deep ITM put, consider selling a closer-to-the-money put and buying a further OTM put.

This reduces margin requirements and limits downside risk.

- Example: Sell 1 SPY 5500 Put, buy 1 SPY 500 Put

LEAPS Call Options

Long-term equity anticipation securities (LEAPS) call options provide leveraged exposure to SPY without the need for margin.

You can do these further ITM to get it to better emulate the price of the underlying and also reduce the cost of the optionality in exchange for taking on more downside risk.

- Example: Buy SPY 10-20% ITM Call.

Option Spreads

Use spreads such as bull call spreads or the aforementioned bull put spreads to gain leveraged exposure with defined risk.

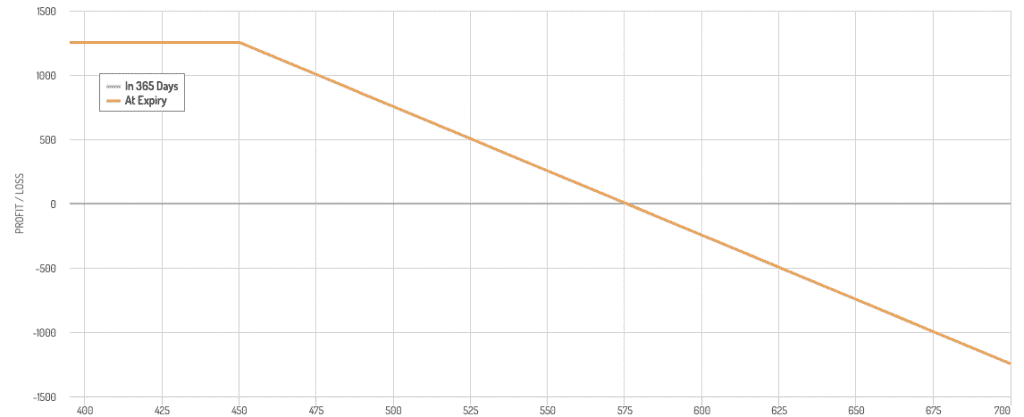

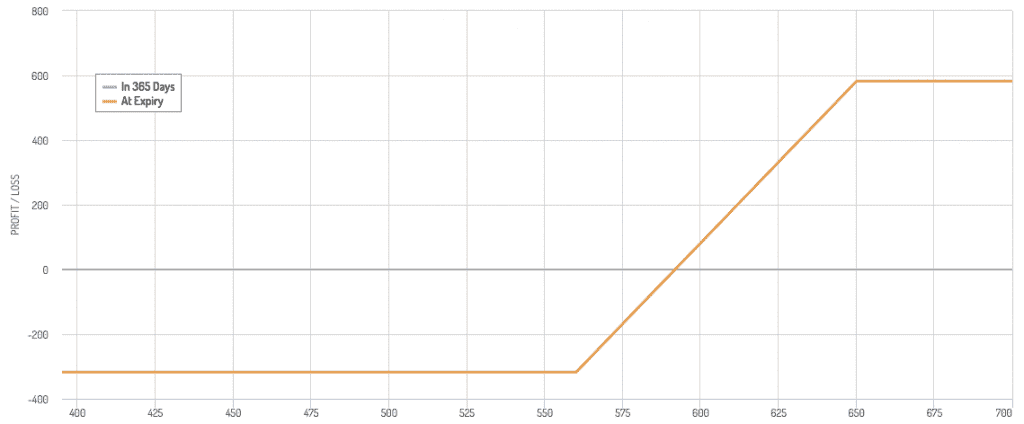

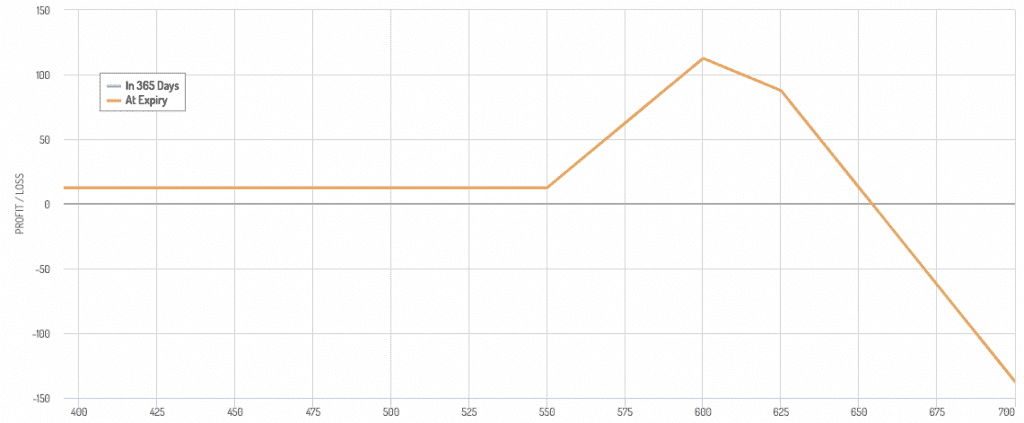

A bull call spread payoff diagram appears as such:

Selling ATM or OTM Options

For traders seeking a more conservative approach, selling ATM or OTM options can provide lower risk and still generate income – albeit with smaller premiums.

Hybrid Trade Structures

Example #1

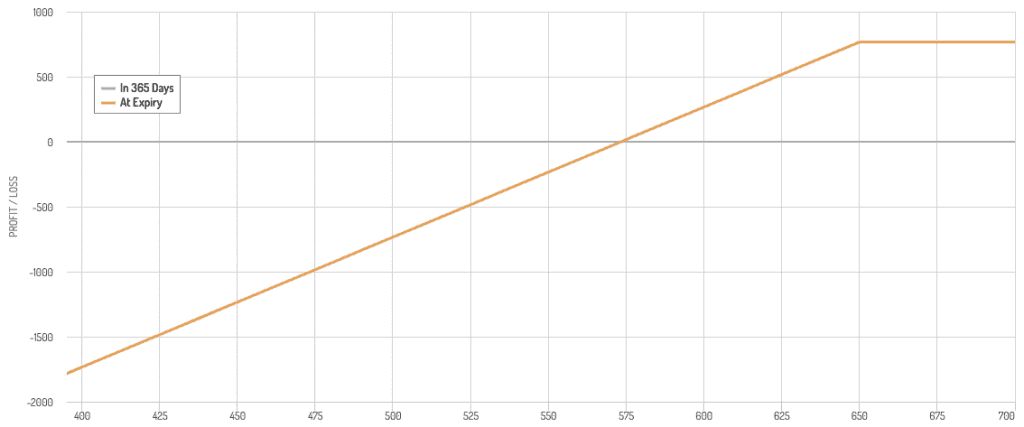

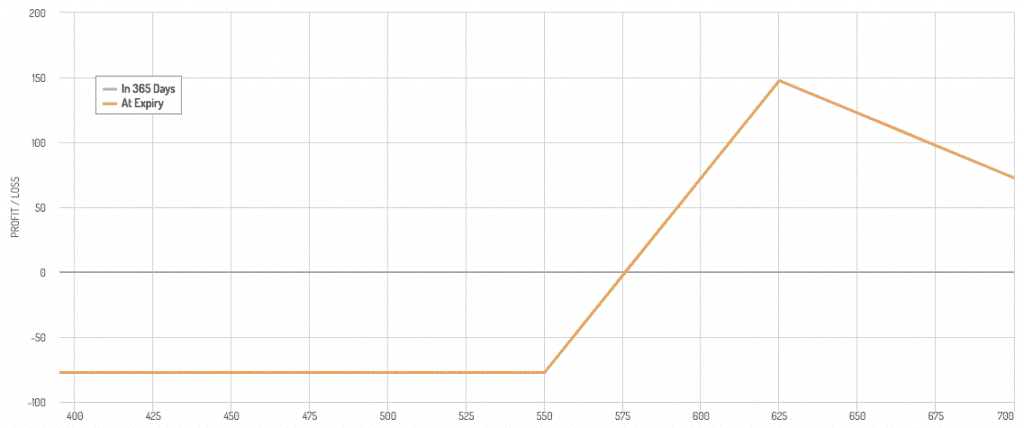

Below is an example of a type of bullish ratio spread.

It’s like a call spread, but you’re overweight on the OTM calls.

This is a long 3 calls / short 4 calls ratio, with the long calls ATM and short calls OTM.

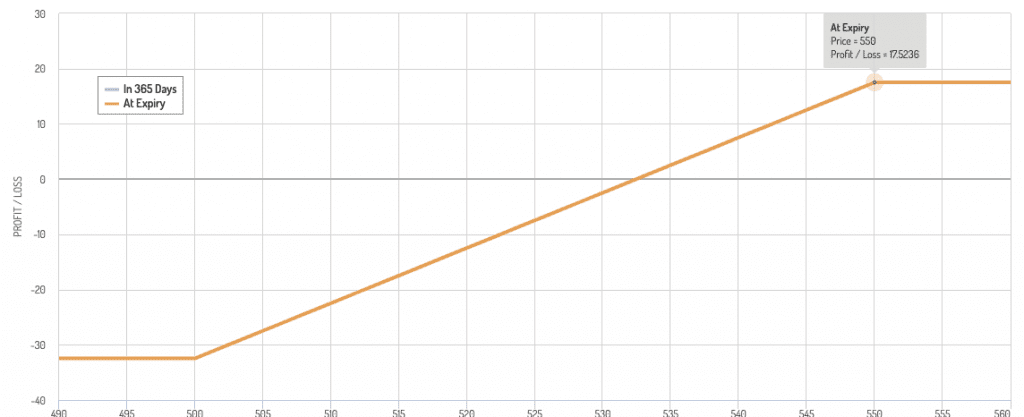

Example #2

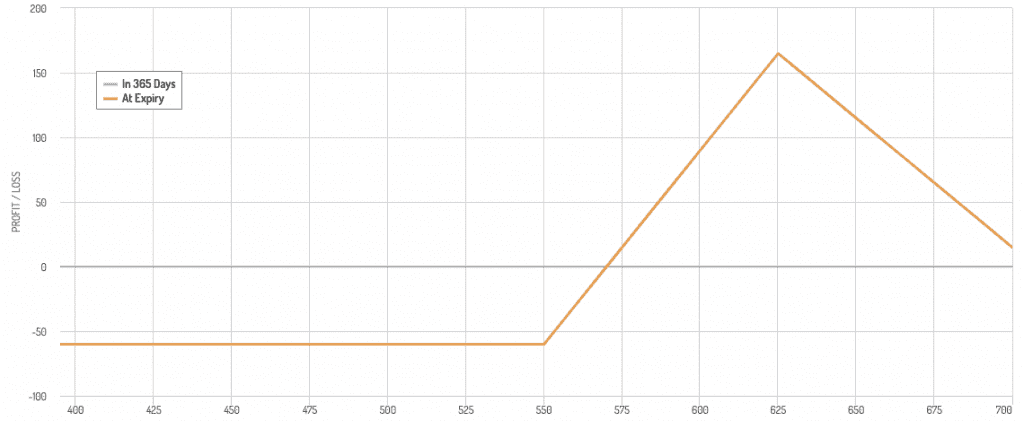

The following would be a 3 calls / short 5 calls ratio, with the long calls ATM and short calls OTM.

This would be used if the trader thinks larger gains are unlikely and can use some of the premium from selling an extra call to have a lower potential drawdown.

Note that this type of unbalanced structure requires greater collateral requirements.

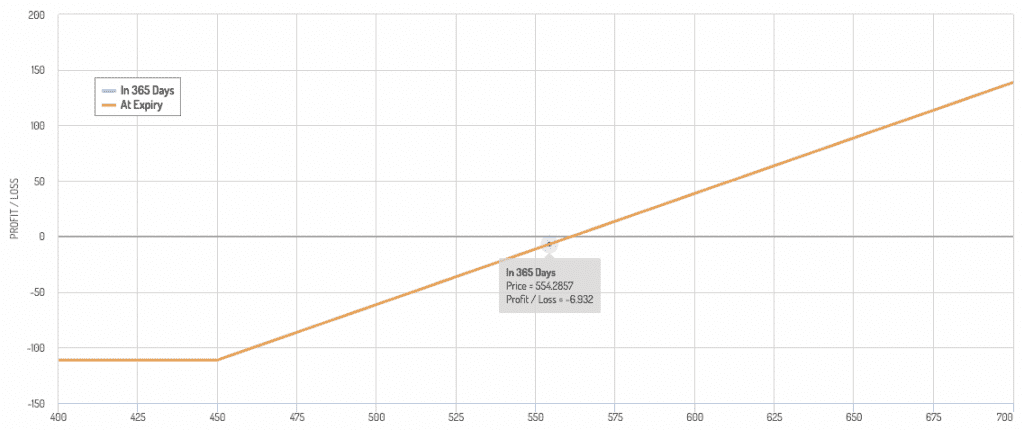

Example #3

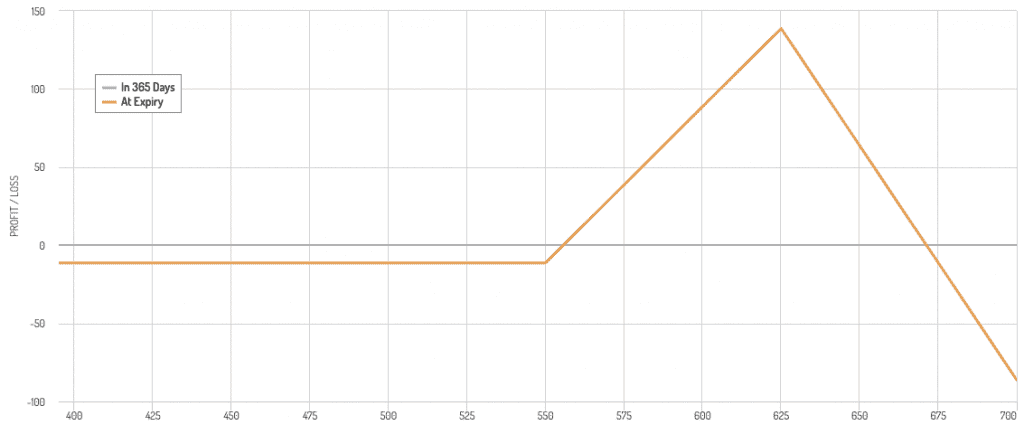

You can play around with these trade structure a lot until you get to something you like best that aligns with your goals.

Here is a long 2 ATM calls / short 5 OTM calls type structure:

Example #4

Similar to Example #3 (long 2 ATM calls, short 5 OTM calls) but here we stagger the maturities of the OTM calls.

Having some cheap short-term OTM hedges that you continuously roll can also be helpful to chop off the right-tail risk (the underlying moving up too much).

This will get you some collateral back.

Moreover, it can also provide less pressure on other parts of your portfolio.

If, for example, this was an equity trade and you were to have emerging market bonds in your portfolio, you have less equity left-tail risk in your portfolio with this trade structure and less pressure for risk-off assets elsewhere in the portfolio.

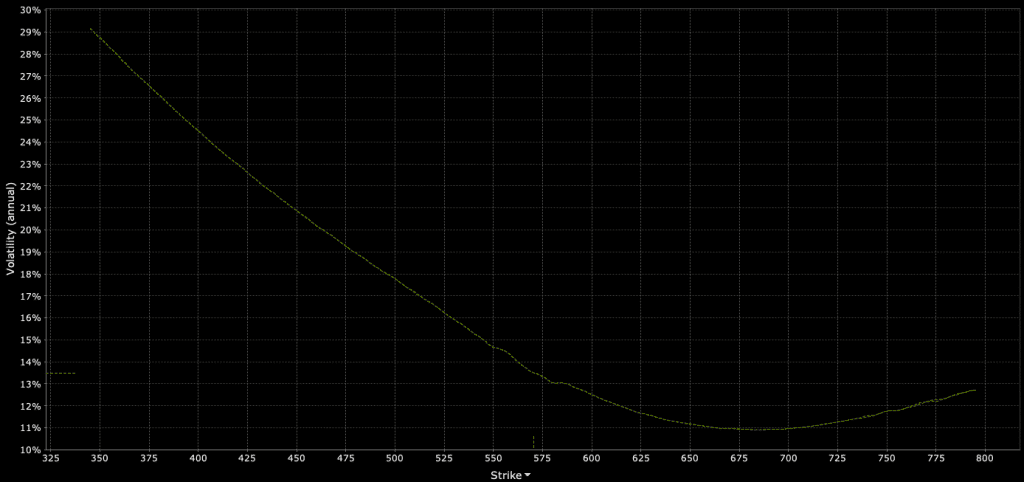

Implied Volatility Considerations

Another thing you have to consider is that implied volatilities on equity calls tend to fall the further you get OTM – up to a point.

So if you’re paying for ATM call vol you are going to be inherently getting less than that for the OTM call vol you’re shorting.

That means the profitability range on your trade shrinks.

Conclusion

Selling ITM options can provide leveraged exposure with the advantage of avoiding direct margin interest.

Nonetheless, it carries significant risks, including substantial margin requirements and potential losses if the underlying goes against your position.

It’s important to evaluate your risk tolerance and consider alternative strategies that might provide leverage with more controlled risk.

As with any options strategy, it’s essential to thoroughly educate yourself, start small, and continuously refine your approach based on market conditions and personal risk tolerance.

Consider alternatives like spreads or LEAPS if you seek leveraged exposure with potentially lower risk.