Roll Yield (Futures Trading)

Roll yield is a concept in the commodities and futures market that can significantly impact the returns of futures trading strategies.

It arises from the shifting structure of futures prices over time.

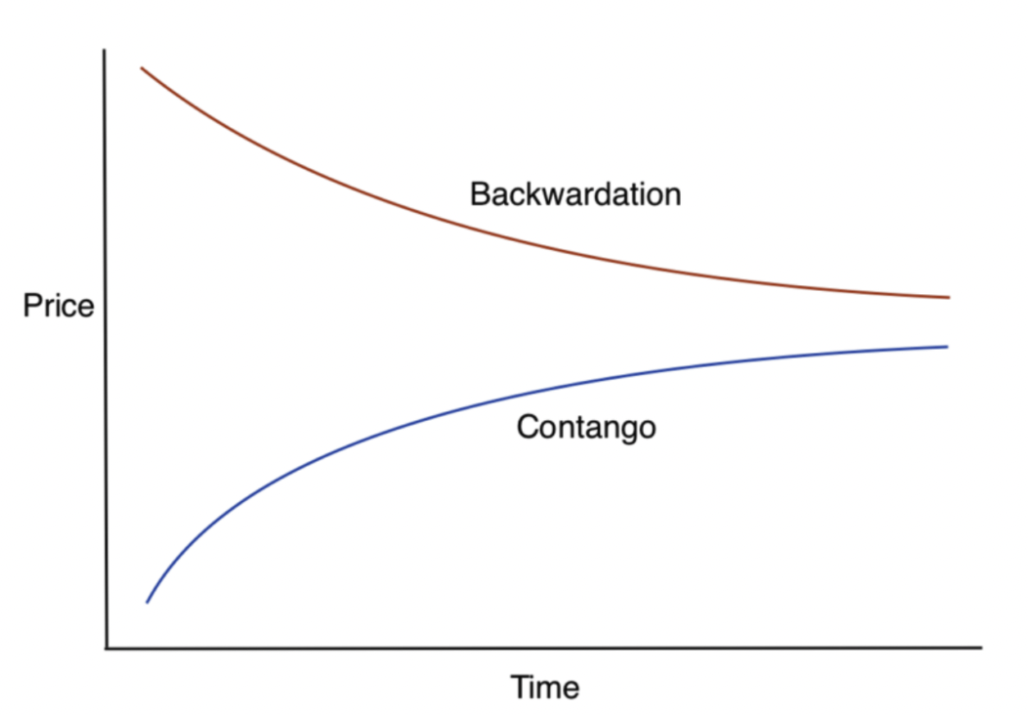

To grasp roll yield, one must first understand the futures market and the concept of contango and backwardation.

Key Takeaways – Roll Yield

- Roll yield is the profit or loss from rolling over futures contracts in commodities trading

- It’s influenced by the market’s structure, being positive in backwardation and negative in contango.

- Contango (upward sloping futures curve) = negative roll yield

- Backwardation (downward sloping futures curve) = positive roll yield

- Calculating Roll Yield

- Basic = (Far price – Near price) / Near price

- Adjusted = Consider storage costs, interest, and time between contracts for a more accurate picture.

The Basics of Futures Contracts

Futures contracts are agreements to buy or sell a commodity or asset at a predetermined price on a specified future date.

Traders use these contracts to hedge against price fluctuations or to speculate on price movements of various commodities such as oil, gold, or agricultural products.

Contango and Backwardation

Contango

This occurs when the futures prices are higher than the spot price.

This typically indicates that the market expects the commodity price to rise over time.

In contango, the futures curve is upward sloping.

For example, gold is generally a contango market to account for storage, holding, and insurance costs.

Backwardation

This happens when the futures prices are lower than the spot price, suggesting that the market expects the commodity price to decline over time.

In backwardation, the futures curve is downward sloping.

Roll Yield Explained

Roll yield refers to the profit or loss generated by rolling over futures contracts from one month to the next.

It is the difference between the price of the expiring contract and the price of the new contract.

The direction and magnitude of roll yield depend on the market structure – whether it’s in contango or backwardation.

Positive Roll Yield

In a backwardation market, traders experience a positive roll yield.

This is because they sell high-priced contracts expiring sooner and buy lower-priced contracts for a later date – capturing the difference as profit.

Negative Roll Yield

In a contango market, traders face a negative roll yield.

They sell lower-priced expiring contracts and buy higher-priced future contracts, resulting in a loss.

Impact on Commodity Trading Strategies

Roll yield is an important factor in the performance of commodity trading strategies – especially for those involving exchange-traded funds (ETFs) and commodity trading advisors (CTAs) that roll futures contracts regularly.

ETFs and Roll Yield

Commodity ETFs that track futures-based indexes must roll their contracts periodically.

In contango markets, these ETFs can underperform the spot commodity prices due to negative roll yields.

Conversely, in backwardation markets, they may outperform due to positive roll yields.

Strategic Implications

Understanding roll yield enables traders to make informed decisions about entering and exiting futures positions.

In markets characterized by persistent contango or backwardation, traders can adjust their strategies to capitalize on the expected roll yield.

Real-World Examples of Roll Yield

Oil

The oil market frequently experiences periods of contango and backwardation.

During the 2020 oil price crash, futures prices for oil fell into a steep contango due to storage concerns and plummeting demand.

Traders holding long positions faced significant negative roll yields as they had to sell contracts at low prices and buy more expensive future contracts.

Conversely, during supply cuts or geopolitical tensions (e.g., 2022 Russia invasion of Ukraine) that lead to expectations of tighter supplies, oil markets may enter backwardation, rewarding traders with positive roll yields for rolling their positions.

Agriculture

Another example is the agricultural sector, where seasonal patterns can influence the market structure.

Crop reports and harvest forecasts might push the futures into backwardation – i.e., anticipating higher near-term prices due to scarcity before the harvest.

Roll Yield & Risk Management

Managing roll yield effectively is vital for risk management in commodities trading:

Shorter-Dated Contracts

In contango markets, traders might opt for shorter-dated contracts to minimize the time exposure and thus the negative roll yield impact.

Options and Swaps

Employing options or swaps can offer ways to hedge against unfavorable roll yields.

Options can provide price level protection, while swaps can be used to manage the cost of rolling positions.

Diversification

Diversifying across different commodities or trading strategies can help mitigate the impact of negative roll yields in any single market.

Roll Yield Advanced Concepts

Calendar Spreads

These involve taking opposite positions in contracts with different expiration dates to capitalize on changes in the market structure.

Traders can use calendar spreads to speculate on the narrowing or widening of contango or backwardation.

Inter-Commodity Spreads

This strategy involves trading the price difference between related commodities, which can be influenced by their respective roll yields.

For example, trading the spread between crude oil and refined products like gasoline (e.g., crack spread).

Storage Costs

The impact of storage costs is particularly pronounced in physical commodities like oil and grains.

High storage costs can exacerbate the contango, increasing the negative roll yield.

Conversely, low storage costs might reduce the contango effect or support a market’s move into backwardation.

How to Calculate Roll Yield

Roll yield can be calculated by comparing the future contract being held to the next contract to be rolled into, considering the market’s structure.

Roll yield = (Price of further-out contract – Price of near-month contract) / Price of near-month contract

In a contango market, the calculation would highlight a loss (negative roll yield), as future prices are higher than current prices.

Conversely, in a backwardation market, it would show a gain (positive roll yield), as future prices are lower than current prices. This difference directly impacts the profitability of holding futures contracts over time.

Common Roll Yield Behavior Among Various Commodity Types

Given the wide variety of commodities traded in futures markets, roll yield behavior can vary a lot among different commodity types.

Each is influenced by its own supply, demand, and storage dynamics.

Energy

Energy commodities, especially crude oil, often exhibit pronounced roll yield effects due to storage costs and geopolitical factors.

Markets may shift into contango in anticipation of oversupply or backwardation during supply shortages.

Base Metals

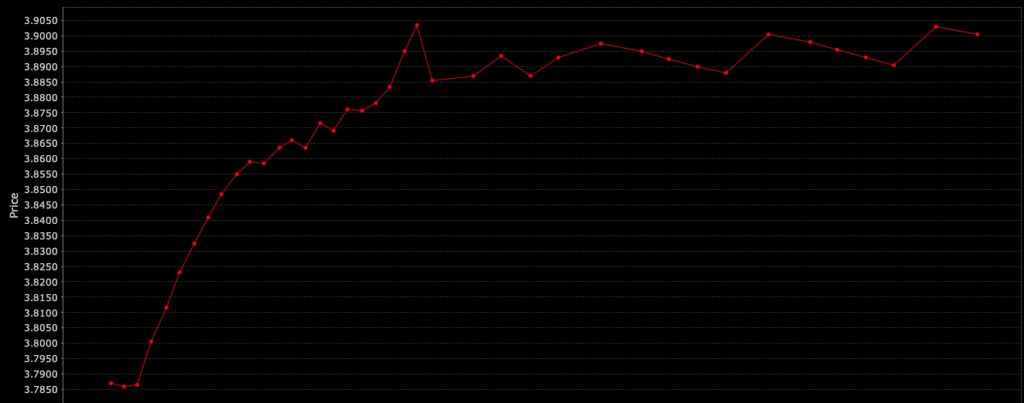

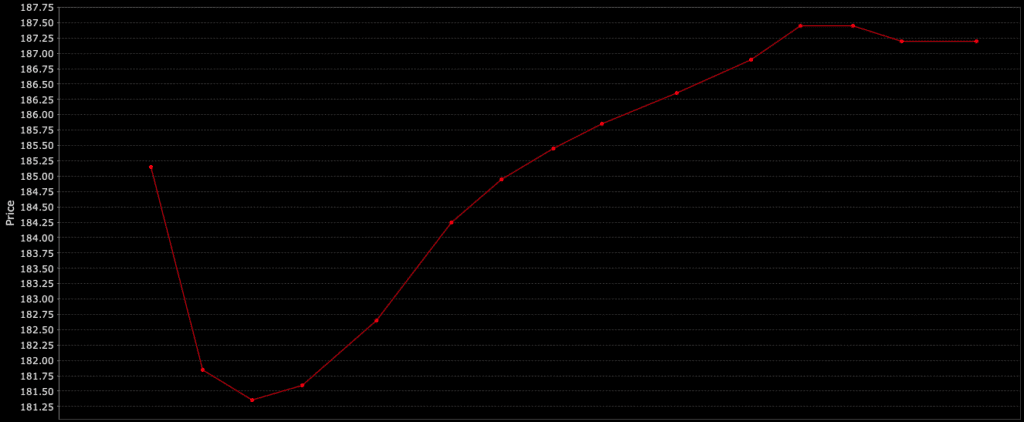

Base metals like copper are often in contango due to storage costs and expectations of future demand exceeding supply (see diagram of copper’s futures curve below), whereas backwardation might occur during supply disruptions or spikes in demand.

Precious Metals

Precious metals, including gold and silver, generally see contango (negative roll yield) due to storage costs.

But backwardation could arise in times of high demand for physical metal versus available futures contracts.

Agriculturals

Seasonality plays a big part in the roll yield behavior of agricultural commodities, with backwardation often occurring prior to harvest time due to anticipated supply increases, and contango potentially setting in post-harvest if supplies exceed expectations.

Softs

Commodities like coffee and sugar can experience backwardation during adverse weather conditions affecting crops or due to seasonality, which can lead to concerns about short-term supply shortages, while contango might occur during periods of oversupply or reduced demand.

Below is an example of a particular futures curve of coffee (it’s dynamic and doesn’t always look this way):

Livestock

Livestock futures, including cattle and hogs, might enter backwardation around times of expected tight supply due to disease, feed cost increases, or seasonality, while contango can happen during periods of oversupply or decreasing meat demand.

Summary

Each commodity’s unique physical market conditions and futures market structure significantly influence its roll yield behavior, making it an important consideration for traders in these markets.

Conclusion

Roll yield is a fundamental concept in commodity futures trading, as it influences the returns of various trading strategies.

By understanding and anticipating the conditions of contango and backwardation, traders can enhance their market performance.

Effective management of roll yield can provide a competitive edge in commodity and futures trading.