Ripple Brokers & Exchanges

Ripple brokers facilitate the buying and selling of the unique cryptocurrency, XRP. Its aim to complement other currencies has made Ripple favourable among many traders, who rely on Ripple brokers to connect them to the crypto exchange and execute XRP deals.

In this article, we discuss the most important elements to consider when finding a Ripple broker.

Ripple Brokers & Exchanges

Here is a short overview of each broker's pros and cons

- Interactive Brokers - IBKR lets you purchase and hold Bitcoin, Bitcoin Cash, Ethereum, and Litecoin at competitive commission rates and without needing a crypto wallet. Additionally, there is a range of other diverse assets to explore, such as crypto indices like the NYSE Bitcoin Index, as well as futures contracts like the BAKKT Bitcoin Futures.

- FOREX.com - You can trade a small range of 8+ cryptos against USD, EUR, GBP and AUD with tight spreads and no virtual wallet required. Algo traders can also utilize Expert Advisors (EAs) to automate their crypto trades.

- UnitedPips - UnitedPips offers trading on four leading cryptos (Bitcoin, Ethereu, Litecoin, and Ripple) with high leverage up to 1:5. It also supports deposits and withdrawals in cryptos making it convenient for serious crypto enthusiasts.

- RedMars - RedMars offers 13 crypto CFDs, including the popular BTC/USD, ETH/USD, and LTC/USD. However, there's no option to buy the underlying cryptocurrency. As a comparison, eToro allows the underlying purchase of 44 cryptocurrencies with copy trading on digital currencies also supported.

- IQCent - IQCent offers 17 crypto pairs through its proprietary terminal, including Bitcoin, Ethereum and Litecoin. Leverage on crypto CFDs is capped at 1:10, whilst binary options payouts vary by token but remain competitive. OTC assets, for example, pay out up to 95%.

- Capitalcore - Capitalcore allows traders to speculate on the price movements of just five cryptocurrencies through CFDs. Popular options like Bitcoin (BTC/USD), Ethereum (ETH/USD), and Litecoin (LTC/USD) are available. However, unlike competitors like eToro, you cannot purchase the underlying crypto directly.

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Coins | BTC, LTC, ETH, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.12%-0.18% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

Cons

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Bonus Offer | Active Trader Program With A 15% Reduction In Costs |

|---|---|

| Coins | BTC, BCH, ETH, LTC, XRP |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | BTC 1.4%, ETH 2% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Minimum Deposit | $100 |

| Regulator | NFA, CFTC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- Alongside a choice of leading platforms, FOREX.com offers a superb suite of supplementary tools including Trading Central research, SMART Signals pattern scanner, trading signals, and strategy builders.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

UnitedPips

"UnitedPips is ideal for traders seeking leveraged trading opportunities, the security of fixed spreads, and the flexibility to deposit, withdraw, and trade cryptocurrencies - all in one sleek TradingView-powered platform."

Christian Harris, Reviewer

UnitedPips Quick Facts

| Bonus Offer | 40% Deposit Bonus |

|---|---|

| Coins | BTC, ETH, LTC, XRP |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 500 |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | UniTrader |

| Minimum Deposit | $10 |

| Regulator | IFSA |

| Account Currencies | USD |

Pros

- UnitedPips offers impressive leverage up to 1:1000 with zero swap fees or commissions, which can enhance potential returns for day traders and swing traders looking to control prominent positions with less capital.

- UnitedPips’ platform performs well, with an intuitive design that will appeal to beginners, while the TradingView integration delivers powerful charting tools without overwhelming users, making it straightforward to execute trades efficiently.

- Although being handed off mid-chat due to shift changes during testing was frustrating, customer support is generally good with quick, helpful responses, and 24/7 support via phone and email for regional teams is a definite advantage.

Cons

- UnitedPips' selection of tradable instruments is still minimal, comprising a bare minimum selection of forex, metals and crypto. There are no equities, indices or ETFs, which may be a drawback for experienced traders looking for diverse opportunities.

- UnitedPips lacks comprehensive research, while the educational content for beginner traders is woeful. Compared to brokers like eToro, which offers tutorials, webinars, and advanced courses, UnitedPips offers minimal resources to help new traders understand key concepts.

- Unlike brokers such as IG, UnitedPips is an offshore broker not regulated by any 'green tier' financial authorities, raising concerns for traders seeking assurance and protection under well-established regulatory frameworks.

RedMars

"RedMars is the best fit for experienced day traders familiar with the MetaTrader 5 platform and based in the EU, where the broker is authorized by the CySEC. However, the threadbare education and research tools make it unsuitable for beginners."

Christian Harris, Reviewer

RedMars Quick Facts

| Coins | BTC, ETH, LTC, XRP, XLM, DOT, ZEC, XMR, QTM, NEO, EOS, BCH, DSH |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 65 |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | MT5 |

| Minimum Deposit | €250 |

| Regulator | CySEC, AFM |

| Account Currencies | USD, EUR |

Pros

- Clients in the EU, in particular, can trade with peace of mind knowing RedMars is authorized by the CySEC with up to €20K compensation available through the ICF in the event of bankruptcy

- Getting started on RedMars is incredibly easy - you can be up and running in just a few minutes based on tests

- The broker is one of a limited number of firms to offer an account specially designed for VIPs with premium support and invites to exclusive events

Cons

- With just 300 instruments, RedMars offers a narrow trading environment, particularly compared to category leaders like BlackBull Markets which offers 26,000 assets

- RedMars falls short for newer traders, with little in the way of education, no beginner-friendly platform, a steep minimum deposit, and inadequate support during testing

- The no-frills trading environment offers little beyond the basics, with no Islamic account, PAMM account or copy trading.

IQCent

"IQCent will appeal to day traders looking for a straightforward binary options and CFD trading platform with low fees, a range of accounts, and copy trading. Getting started takes less than 1 minute and a $250 deposit. "

Jemma Grist, Reviewer

IQCent Quick Facts

| Bonus Offer | 20% to 200% Deposit Bonus |

|---|---|

| Coins | BTC, ETH, LTC, ETC, DOGE, MATIC, QNT, SOL, XRP, USDT, XMR, BNB |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Variable |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Online Platform, TradingView |

| Minimum Deposit | $250 |

| Regulator | IFMRRC |

| Account Currencies | USD, EUR |

Pros

- IQCent is one of the few binary options brokers that also offers a copy trading service for hands-off traders

- There's an accessible $0.01 minimum stake for new day traders with a small budget

- CFD trading fees are competitive based on tests, including 0.7 pips on major forex pairs such as EUR/USD

Cons

- The market analysis is very basic with limited technical summaries and insights from analysts

- IQCent charges a punitive $10 monthly inactivity fee if you fail to place at least 1 trade per month

- IQCent trails binary brokers like Quotex with its narrow investment offering of around 100 assets with no stocks

Capitalcore

"The major selling points of Capitalcore are its high leverage options up to 1:2000 and zero commission or swap fees. However, its weak regulatory oversight from the IFSA and non-existent education place it far behind the top brokers."

Christian Harris, Reviewer

Capitalcore Quick Facts

| Bonus Offer | 40% Deposit Bonus up to $2,500 |

|---|---|

| Coins | BTC, ETH, BCH, XRP, LTC |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | $45 |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | WebTrader, Pro |

| Minimum Deposit | $10 |

| Regulator | IFSA |

| Account Currencies | USD |

Pros

- The Capitalcore platform provides comprehensive charting tools and a wide range of 150+ technical indicators, ideal for detailed market analysis.

- Capitalcore has added binary options trading on 30+ currency pairs, metals and crypto with one-click trading and payouts up to 95%.

- While a relative newcomer to binary options space, its transparent, accessible service earned it runner up in DayTrading.com's 2025 'Best Binary Broker' award.

Cons

- Platform support is limited to proprietary software, so there's no integration with the market-leading MetaTrader or cTrader, which offer built-in economic news and support automated trading.

- The web platform was inconsistent during testing, with occasional technical glitches that meant the trading platform wouldn’t load.

- Capitalcore is not regulated by major financial authorities and has an unproven reputation, raising concerns about the safety of client funds.

What Is Ripple?

Ripple is the name of both a digital currency (XRP) and payment network solution that work together to provide instant, low cost and secure cross-border payments. The Ripple On-Demand Liquidity (ODL) solution uses the digital asset XRP to bridge any two currencies, removing the need for pre-funding of destination accounts and eliminating the transaction time.

How Does Ripple Work?

Ripple enables transactions using a process called ‘an issuance’, which allows assets to be transferred between two parties. Transactions are stored on a shared ledger that also contains information about all Ripple accounts. The solution is low cost, with Ripple taking a tiny XRP fee, but later destroying the small payment. This is to prevent people from spamming the network.

Ripple Versus Other Cryptos

Ripple serves a different purpose to other tokens, such as Bitcoin, by accompanying other currencies (including cryptos), rather than competing with them. Additionally, all of Ripple’s coins were created during its launch, meaning there are none that can be mined.

However, like other cryptos, XRP is highly volatile, which has made it an attractive opportunity for many day traders hoping to capitalise off its strong fluctuations.

How Ripple Brokers & Exchanges Work

Ripple can be purchased through an exchange or a broker. However, since a lawsuit was filed against Ripple by the US Securities and Exchange Commission (SEC) at the end of 2020, XRP has been removed from many exchanges, meaning traders have less flexibility about where they can purchase the crypto.

Using an exchange, customers can purchase XRP in exchange using another currency, such as USD. The exchange makes its money by setting the buy price to be higher than the sell price, with this difference called the spread. Exchanges are a good option for those who are simply looking to buy and hold XRP.

With a broker, clients can deposit funds in a fiat currency, such as USD, then later trade on the price of XRP. This includes buying spot XRP as well as accessing derivatives, such as futures and options. Derivatives enable traders to speculate on the price of XRP without owning the underlying asset and provide the option to use leverage. An XRP forex broker may make its money through the spread, commission fees or both.

Brokers and exchanges allow traders to store XRP in an online account, some of which come with an integrated crypto wallet. However, it is recommended to store XRP in an offline wallet, which is more secure and less susceptible to hacking.

How To Compare Ripple Brokers

Finding a suitable Ripple broker with reasonable fees is essential to successfully trade XRP. In this section, we list the most important elements to consider.

Fees

There are several fee types to consider when selecting a Ripple broker:

- Trading fees – These are the main fees paid for each transaction, usually a spread or a flat commission fee. Spreads can be fixed or variable, which determines if they will change in times of higher or lower volatility. A wider spread will reduce potential profits on each trade

- Overnight fees – Holding a leveraged position overnight may incur further fees in the form of interest payments

- Inactivity fees – Accounts without any activity for a set period of time will be classed as dormant and may incur inactivity fees

- Conversion fees – Conversion fees may apply when depositing funds using certain currencies – usually those that are less liquid

- Loan fees – Opening a short position involves borrowing the asset, meaning interest will be charged

Leveraged Products

Using leverage is possible with derivative XRP products, such as Contracts for Difference (CFDs). Leverage enables the trader to increase their position for a given outlay. Many brokers offer x2 leverage on cryptocurrencies, meaning it is possible to trade twice as much as is deposited. However, beware that this will multiply losses as well as profits.

Interest

While it is not possible to mine XRP as an extra source of income, some platforms offer traders the option to earn interest on their XRP, with returns as high as 5% APR.

Regulatory Status

Selecting regulated Ripple brokers means they have to comply with certain standards, which helps to protect against fraudulent brokers. Look for XRP brokers regulated by reputable authorities such as the FCA in the UK, CySEC in Cyprus and ASIC in Australia.

Accounts

Many brokers offer different account types to suit customer needs. This usually includes retail and professional account types, though there may be additional account choices based on minimum deposit requirements, the leverage offered and spreads available.

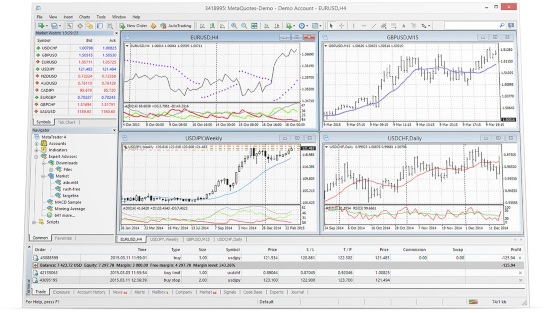

Platforms

Platforms enable traders to place XRP trades through a Ripple broker. As well as executing the trade, the platform software can also be used to carry out technical analysis using charts and indicators. While some brokers offer proprietary platforms, others provide services through popular platforms, such as MetaTrader.

The platform should be easy-to-use with quick execution speeds, to avoid slippage.

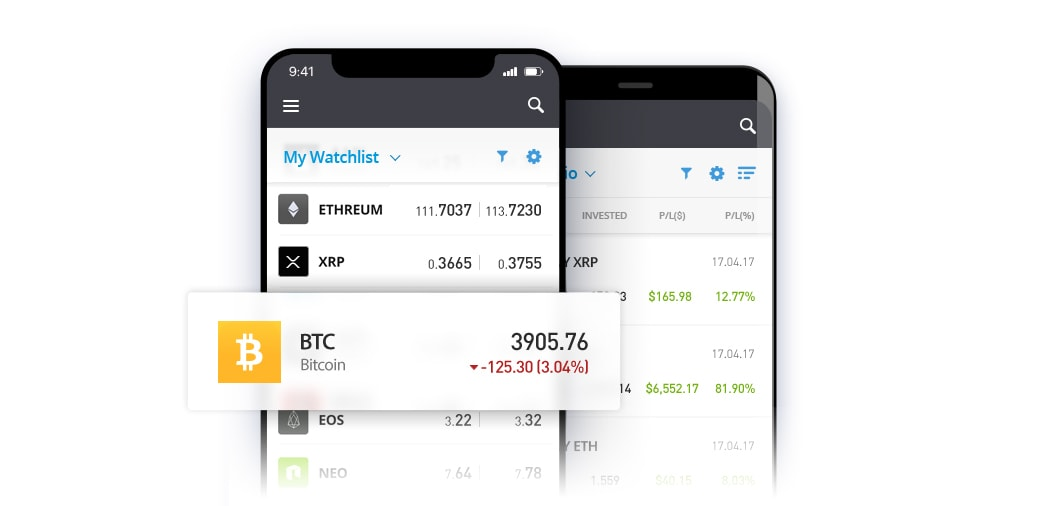

Mobile App

Many Ripple brokers offer mobile apps that provide a whole host of features that compete with desktop or web platforms. As well as executing trades, many mobile apps provide a range of chart and indicator types for carrying out technical analysis on the go too. Check that the app offers the technical features required and has good reviews on the Google Play or App Store.

Tools

Some Ripple brokers offer additional educational resources to help beginners start investing. Look out for YouTube videos, blogs and articles to learn the basics and pick up new strategies.

Customer Support

Good customer support can be a lifeline with new Ripple brokers. Live chat is a great way to get instant support that has become increasingly popular. Alternatives include telephone support and email contacts, but make sure to check these services are available when you’ll be investing, which is possible 24/7 for many crypto exchanges.

Payment Methods

Ripple brokers may limit the methods that can be used to purchase XRP. This could be certain credit/debit card types such as Visa or MasterCard or e-Wallets. In some cases, it may not be possible to directly purchase XRP. An initial deposit to a more liquid crypto, such as Bitcoin, may be required first, followed by an exchange to Ripple. Bitcoin payments may also be an option for those holding Bitcoin in a wallet already.

Low Minimum Deposits

As well as restricting payment methods, some Ripple brokers also place restrictions on the deposit amount. While Interactive Brokers has very high minimum deposit requirements of 10,000 USD, eToro has a more affordable minimum deposit requirement of 200 USD.

How To Check Ripple Brokers Aren’t A Scam

The most important thing for Ripple traders is trust in their broker. Follow our top tips to find a genuine XRP exchange service:

- Read online reviews – In particular research complaints from previous customers to develop an indication of their reputation

- Check regulatory status – Is the broker regulated by a reputable authority and to what standards does it have to comply? The broker’s license can also be checked via the regulator’s website

- Look out for unlikely offers – Some Ripple brokers may offer prices, spreads or sign up bonuses that seem too good to be true.

Final Word On Ripple Brokers

Ripple brokers enable traders to speculate on the price of XRP, a unique altcoin that acts as a bridge, complementing other currencies. Reviewing the features and account types offered by each broker will ensure you get the best deal on XRP.

FAQs

What Is Ripple?

Ripple is the name of both a cryptocurrency (XRP) and payment network solution. Unlike other cryptocurrencies, such as Bitcoin, it works with all other payment types such as fiat currency, air miles or cryptos, to provide quick, low cost and secure payments.

How Can I Trade Ripple?

Ripple can be traded by opening an account with a Ripple broker and purchasing XRP, or speculating on the price of the asset using derivatives, such as CFDs.

How Does A Ripple Broker Work?

Customers can place an order through a Ripple broker, which then files the order with the cryptocurrency exchange on their behalf.

What Are The Best Ripple Brokers?

Top Ripple brokers include IG and eToro, both of whom are regulated by the FCA and have minimum deposit requirements of $250 and $200 respectively.

What To Look For In A Ripple Broker?

When selecting a broker that offers XRP, look for one that is regulated, provides good platform features and has a fee structure to suit your strategy.