Options Strategies for Low Volatility

Options strategies for low volatility generally center around two main goals:

- Options strategies to take advantage of low volatility environments

- Options strategies to limit portfolio volatility to better balance risk and return, preserve capital, and limit drawdowns and tail risk

In low volatility environments, where price movements are expected to be smaller and more predictable, certain options strategies can be most effective.

Here, we focus on strategies that capitalize on limited price movement, generate income, and manage risk.

Key Takeaways – Options Strategies for Low Volatility

Strategies and categories we cover in the article:

Pure Premium Selling Strategies

- Covered Call Writing

- Naked Puts (Cash-Secured Put Writing)

Spread Strategies

- Credit Spreads

- Bull Put Spread

- Bear Call Spread

- Calendar Spread

Delta Neutral Strategies (Market Neutral Strategies)

- Iron Butterfly (Butterfly Spread)

- Iron Condor

More Advanced Options Strategies for Low Volatility

- Diagonal Spreads

- Broken Wing Butterfly

- Iron Condor Adjustment

- Reverse Iron Condor

- Double Diagonal Spread

- Box Spread

- Conversion and Reversal Arbitrage

- Collar Strategy (protective)

- Synthetic Long Stock

- Synthetic Short Stock

1. Selling Options

Covered Call Writing

Sell call options on a stock you own.

It generates income and provides some downside protection, but limits upside potential.

Cash-Secured Put Writing

Sell put options and hold cash as collateral.

It generates income and can potentially allow you to buy the stock at a lower price if assigned.

2. Spread Strategies

Credit Spreads

Sell options with a higher premium and buy options with a lower premium on the same underlying asset and expiration, but at different strike prices.

The “credit” part means your net premium is positive (you receive more in premium than what you pay).

The “call” or “put” part means whether they’re constructed with call or put options.

Call Credit Spread

For a call credit spread, sell a lower strike call and buy a higher strike call.

Here you make money if the price falls or doesn’t rise enough (with capped downside if it does).

Put Credit Spread

For a put credit spread, sell a higher strike put and buy a lower strike put.

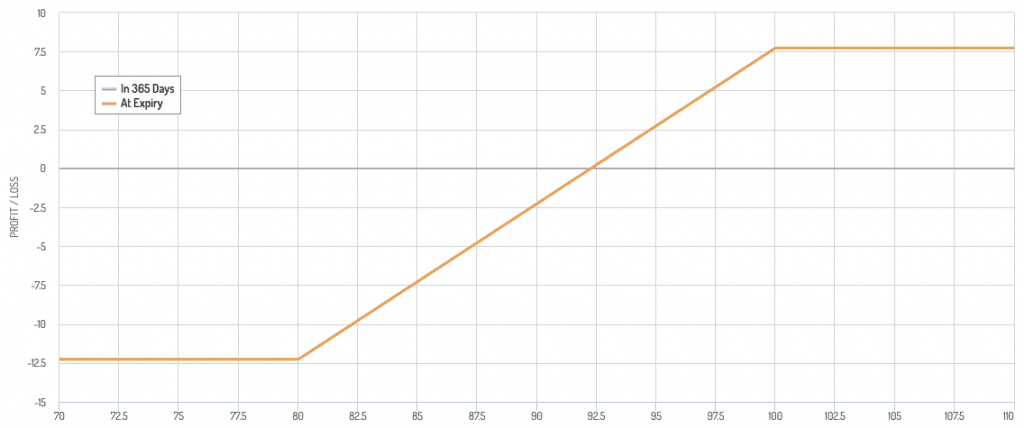

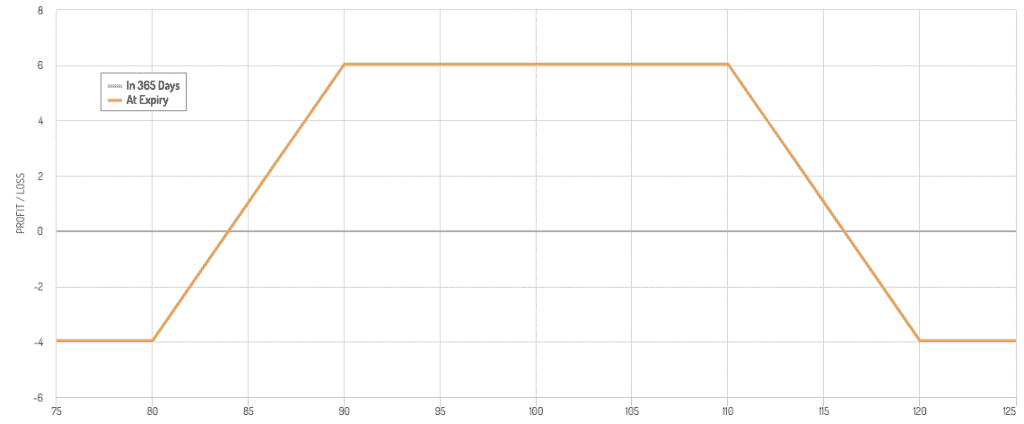

Iron Condor

A combination of a call credit spread and a put credit spread on the same underlying asset.

There are four legs to it.

This strategy profits when the underlying asset’s price stays within a certain range.

An example would be (if underlying at 100):

- Buy 80 Put

- Sell 90 Put

- Sell 110 Call

- Buy 120 Call

3. Straddle/Strangle (Short)

Short Straddle

Sell a call and a put at the same strike price and expiration.

This strategy profits if the stock stays near the strike price.

Short Strangle

Similar to a straddle but the call and put have different strike prices, both out of the money.

This strategy has a wider profitable range but with potentially unlimited risk if the underlying asset moves significantly.

Factors to Consider

Risk Management

Always consider the maximum potential loss, especially with strategies like short straddles and strangles.

Volatility Expectations

These strategies work best in low volatility environments, but if volatility increases, it can lead to significant losses.

Options trading requires more active monitoring and the need to be prepared to adjust your strategy.

Time Decay

Options are time-sensitive instruments, and these strategies typically benefit from the passage of time (to maximize income from theta decay), assuming price movements are low.

Below we categorize the various strategies:

Pure Premium Selling Strategies

Covered Calls

Sell call options on a stock you already own.

This strategy generates additional income and offers some downside protection but caps the upside potential.

Naked Puts

Sell put options on a stock you’re willing to own.

This generates income and allows you to potentially purchase the stock at a lower price if the options are exercised.

The Spread Strategies

Credit Spreads

Sell options with a higher premium and buy options with a lower premium, on the same underlying asset with the same expiration date but different strike prices.

The goal is to earn the premium difference.

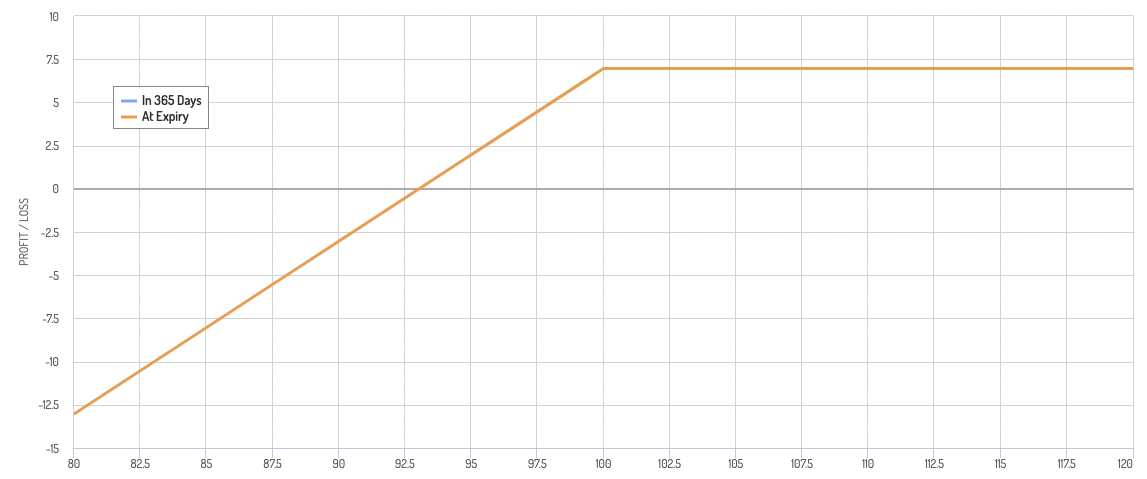

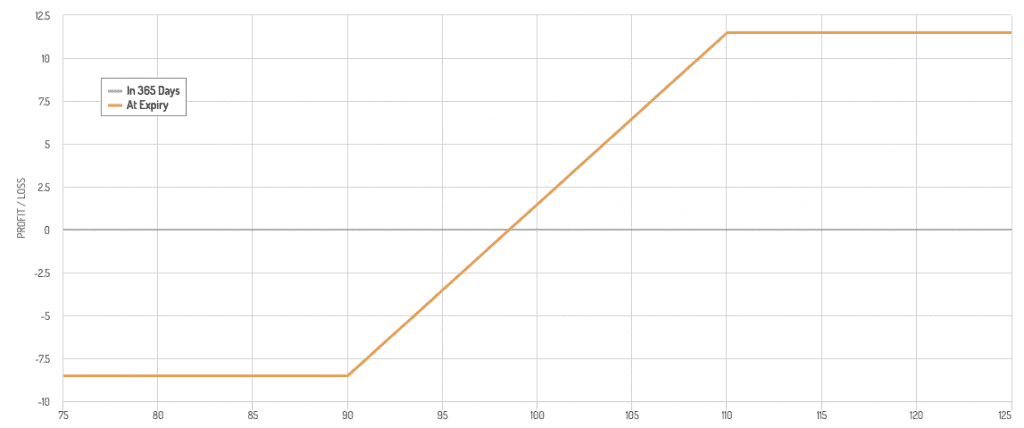

Bull Put Spread

Sell a put option at a higher strike price and buy a put option at a lower strike price.

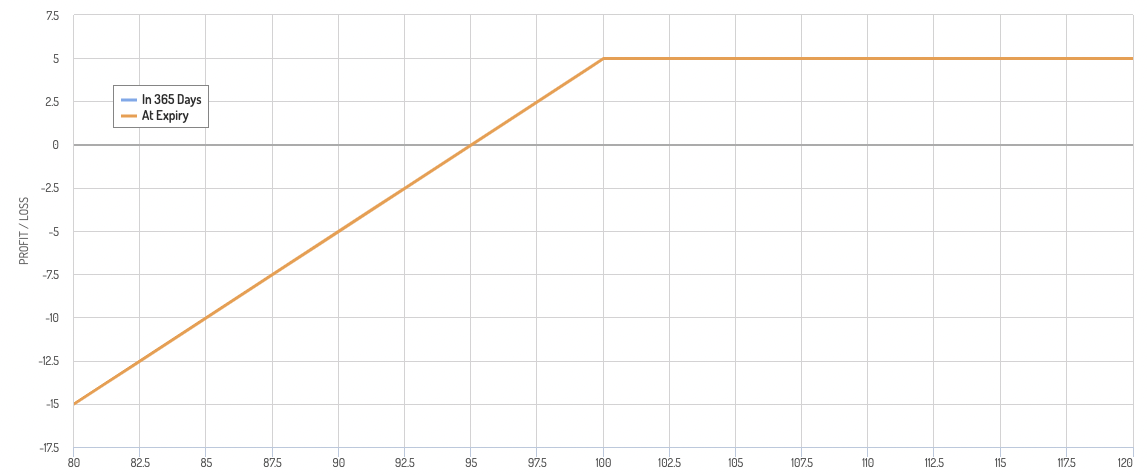

Bear Call Spread

Sell a call option at a lower strike price and buy a call option at a higher strike price.

Calendar Spread

Sell short-term options while buying longer-term options of the same strike price.

This strategy capitalizes on the accelerated time decay of the shorter-term option.

Delta Neutral Strategies (Market Neutral Strategies)

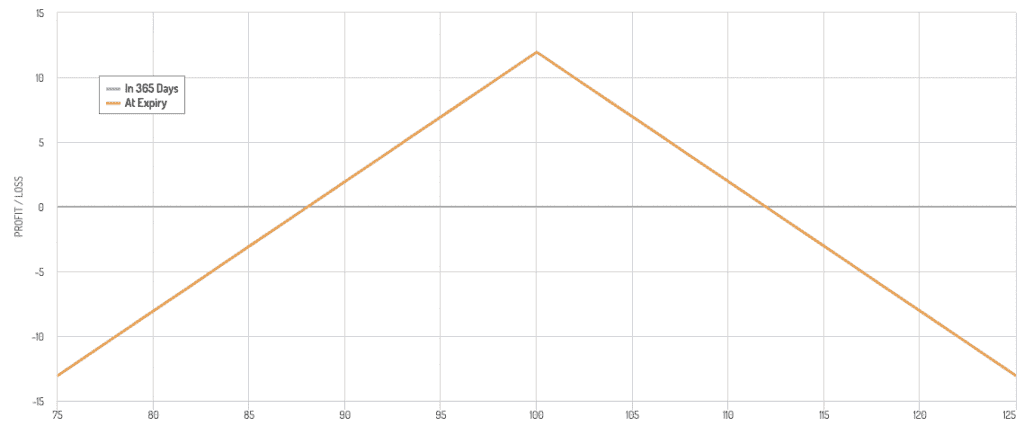

Straddle (Short)

Sell both a call and a put option at the same strike price and expiration date.

This strategy profits if the stock remains stable and time decay works in your favor.

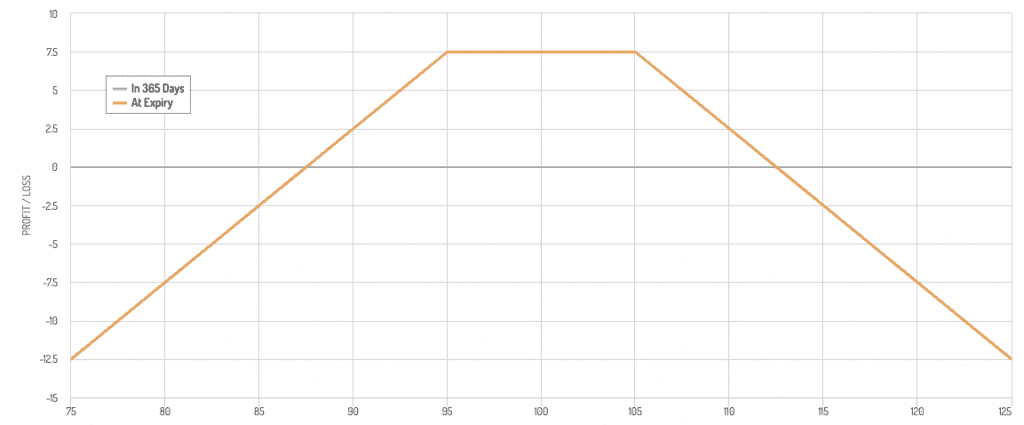

Strangle (Short)

Similar to a straddle but with different strike prices. Sell out-of-the-money call and put options.

This strategy provides a wider range for the underlying asset to trade while still profiting from time decay.

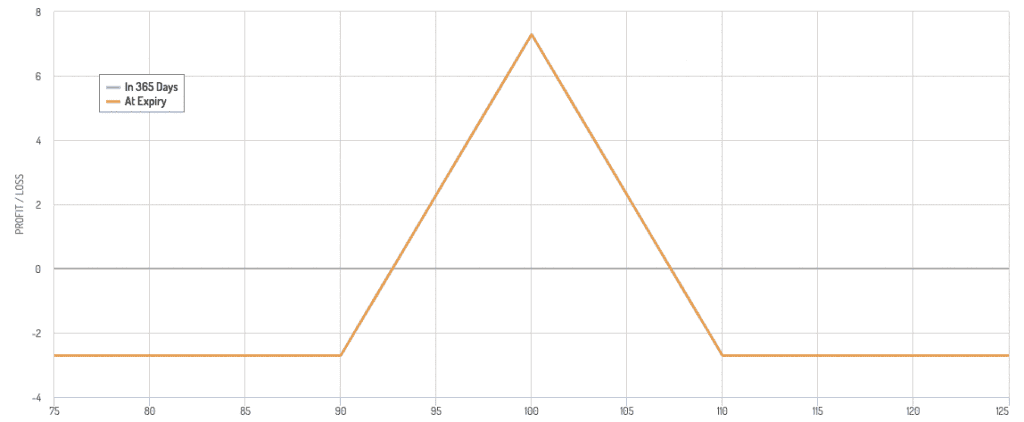

Butterfly Spread (Iron Butterfly)

Buy an in-the-money and out-of-the-money option, and sell two at-the-money options.

This strategy profits if the stock price stays close to the strike price of the short options.

Iron Condor

Sell a call and a put spread on the same underlying asset.

This strategy profits when the stock price stays within a specific range to capitalize on low volatility.

More Advanced Options Strategies for Low Volatility

1. Diagonal Spreads

Diagonal Call Spread

Involves buying long-term calls and selling short-term calls with a higher strike price.

This strategy benefits from time decay and a slight upward movement in the underlying asset.

Diagonal Put Spread

Involves buying long-term puts and selling short-term puts with a lower strike price.

It’s used to capitalize on time decay and a slight downward movement in the stock price.

2. Butterfly Variants

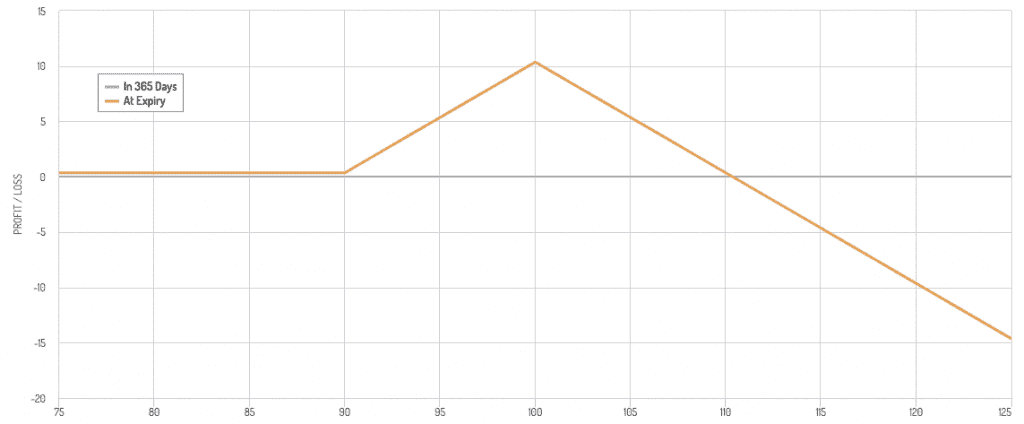

Iron Butterfly

Covered above, this combines a short straddle and a long strangle.

Sell at-the-money call and put options, and buy out-of-the-money call and put options.

It’s a non-directional strategy that profits from low volatility and time decay.

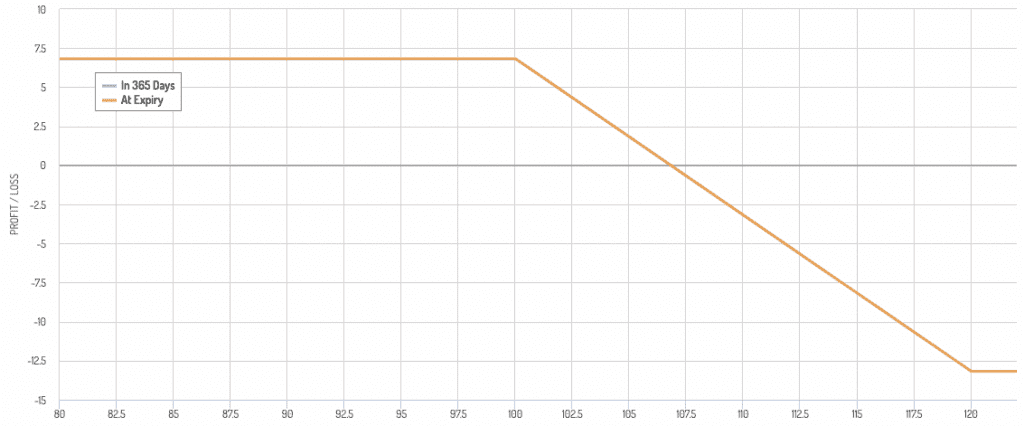

Broken Wing Butterfly

A variant of the butterfly spread that shifts risk to one side of the market.

Allows for an unlimited profit potential on one side while protecting against significant losses on the other.

An example below would be protecting against a price fall, but capturing moderate upside and being exposed to a lot of downside if the price rises a lot.

3. Condor Variants

Iron Condor Adjustment

If the underlying asset moves towards one of the strike prices.

Can adjust the position by rolling the threatened side can manage risk and potentially increase profits.

Reverse Iron Condor

Buy a strangle and sell a straddle, this strategy profits from large price movements, but can also be designed to take advantage of very flat markets if strikes are chosen appropriately.

4. Double Diagonal Spread

Combines features of double calendars and iron condors.

Involves selling near-term options at one strike price and buying longer-term options at a different strike price for both calls and puts.

It capitalizes on time decay while allowing for profit from a range-bound market.

5. Market Neutral Strategies

Box Spread

Involves creating a synthetic long and synthetic short position to lock in a risk-free profit.

This strategy capitalizes on discrepancies in options pricing.

Not easy to actually lock in risk-free profits in practice, however.

Conversion and Reversal Arbitrage

Use these strategies to exploit the mispricing between an option and its underlying stock.

A conversion involves buying the stock, buying a put, and selling a call.

A reversal is the opposite.

6. Collar Strategy

Own the underlying asset, buy a put option to protect against downward movement, and sell a call option to offset the put’s cost.

This strategy limits both gains and losses, creating a protective ‘collar’ around the asset’s price.

7. Synthetic Options

Synthetic Long Stock

Combine a long call and a short put at the same strike price to mimic owning the actual stock.

This can be adjusted for a low volatility environment by choosing strike prices that benefit from small price movements.

Synthetic Short Stock

Combine a long put and a short call to mimic short selling the stock, used when expecting minor downward movements in the stock price.

Conclusion

Selecting the right options strategy in a low volatility environment depends on your risk tolerance, market outlook, and overall goals.

It’s important to understand the potential risks and rewards of each strategy and to monitor the markets you’re trading as needed.

Changes in volatility can impact the effectiveness of these strategies.