Cattle Brokers 2026

Cattle may be more of a niche commodity market, but it forms a complex and dynamic ecosystem. It’s influenced by various factors ranging from feed costs and weather patterns to consumer trends and global trade policies.

Understanding the supply and demand dynamics, as well as the needs and motivations among various market participants, is important for cattle traders.

Leap into DayTrading.com’s pick of the best cattle brokers, evaluated by our industry experts and traders.

Best Brokers For Trading Cattle Hogs

These are the 4 best brokers for trading Cattle:

How Did We Choose The Best Cattle Brokers?

To identify the top cattle trading platforms:

Understanding Cattle Market Dynamics

To effectively trade cattle, it’s important to understand the various factors influencing market prices:

Supply and Demand

The most fundamental principle driving cattle prices.

Increased supply, without corresponding demand, usually lowers prices and vice versa.

Seasonality

There’s seasonality in cattle prices.

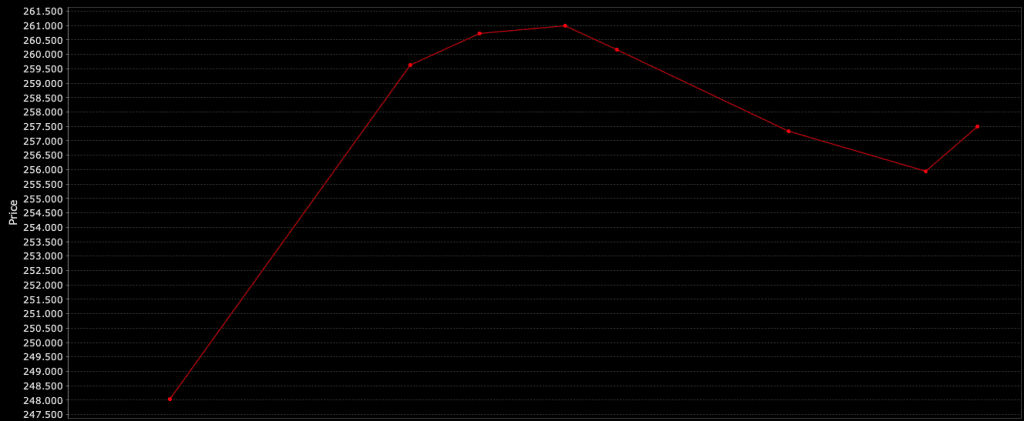

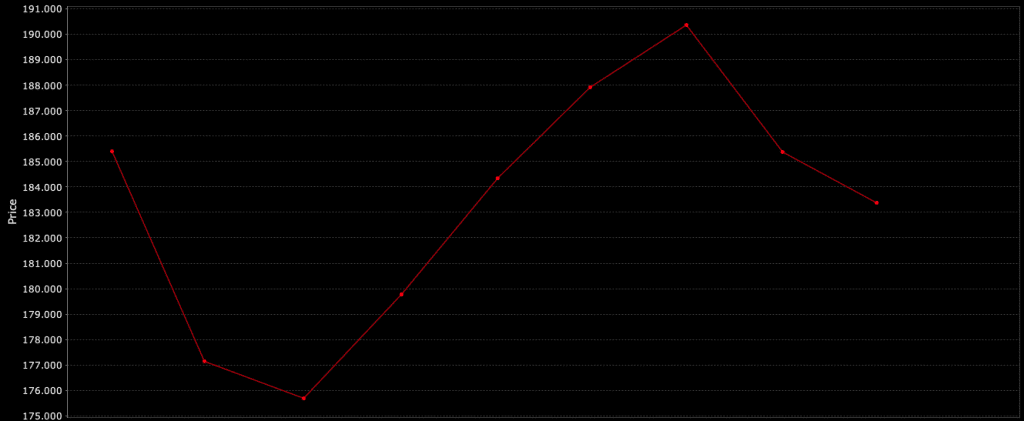

This example futures curve below of feeder cattle (GF) shows the higher prices in the summer relative to winter.

With live cattle (LE), you see prices tend to peak in the spring months (around April) and fall into the summer).

Feed Costs

One of the largest inputs in cattle farming.

Lower feed costs can increase profitability for farmers, potentially leading to increased production and lower beef prices.

Cattle feed primarily consists of grass, hay, silage, and grains such as corn and soybean meal, along with specialized feed supplements.

(Corn and soybeans have their own futures markets, which can add a layer of strategy, especially as it ties in with feeder cattle.)

The prices of these feed components can significantly impact cattle farming economics.

Higher feed costs can decrease profitability for farmers, which can lead to reduced production or higher beef prices to maintain margins.

Conversely, lower feed prices can increase production and potentially reduce beef prices.

Therefore, fluctuations in feed prices are critical to cattle market dynamics. They can influence decisions on herd sizes and feeding strategies and ultimately affect the overall supply and costs in the cattle industry.

Weather Conditions

Weather impacts cattle trading, influencing feed crop prices, and cattle health.

Drought or extreme weather can reduce supply, leading to higher prices.

Economic Indicators

General economic conditions affect consumer spending on meat products, influencing cattle prices.

Economic downturns typically reduce demand for higher-priced meat cuts.

Supply Chain Influences

- Feed Availability and Prices – Lower corn and soybean prices make cattle farming less costly, possibly increasing supply.

- Health Outbreaks – Diseases like BSE (“mad cow disease”) can cause sharp declines in demand and disrupt market stability.

Economic Impacts

- Interest Rates and Investment – Higher interest rates can reduce investment in cattle farming by increasing borrowing costs, leading to tighter supply. The effect on prices will depend on demand.

- Global Trade Policies – Tariffs and trade agreements impact the export and import levels of beef, affecting global supply and prices.

Environmental and Socioeconomic Factors

- Climatic Conditions – Long-term climate trends can affect grazing conditions and feed crop yields, impacting cattle prices.

- Consumer Trends – Shifts toward, e.g., plant-based diets or substitution (e.g., preferences for non-beef meats) can reduce demand for beef, impacting prices.

- Global Development – Conversely, growing populations and rising incomes in developing countries can increase demand.

Regulatory Impacts

- Government Subsidies – Subsidies for cattle farmers or feed crops can affect production costs and supply levels.

- Health Regulations – Stricter health regulations can increase production costs, reducing supply or raising prices to cover costs.

Industry Consolidation and Vertical Integration

Industry consolidation and vertical integration are reshaping the cattle market.

As producers, processors, and distributors merge or acquire one another, fewer companies control larger shares of the market.

This integration streamlines operations, reduces costs, and increases control over supply chains.

But it also reduces competition. This can lead to higher prices for consumers and fewer choices for cattle producers selling their livestock.

Such market concentration can influence price stability, availability of beef products, and the negotiating power of smaller industry players against these larger, integrated entities.

Live Cattle vs Feeder Cattle

Live cattle and feeder cattle are two distinct stages and opportunities within the cattle market.

Each are traded as separate futures contracts on the Chicago Mercantile Exchange (CME).

Feeder Cattle

These are young cattle that have been weaned but are not yet mature enough to be slaughtered.

Typically weighing between 650-850 pounds, feeder cattle are primarily fed in feedlots where they gain weight until they reach the marketable weight for live cattle, approximately 1,200 pounds.

Feeder cattle futures are often used by ranchers and feedlot operators to hedge against the cost of growing these young cattle to market weight.

Live Cattle

These are mature, fattened cattle ready for slaughter, typically weighing about 1,200-1,400 pounds.

Live cattle futures are important for meat packers and processors to hedge against fluctuations in meat prices.

Investors and traders also use live cattle futures to speculate on beef market trends.

The primary difference between feed cattle and live cattle lies in the market segment each represents: feeder cattle are an investment in the growth potential of young cattle, whereas live cattle represent the final product ready for processing.

Prices for each are influenced by different factors:

- feeder cattle prices by grain and feed prices

- live cattle by meat demand and broader economic conditions

Trading Strategies

Futures Contracts

Traders can use cattle futures to hedge against price volatility or speculate on future price movements.

Seasonal Patterns

Understanding and anticipating seasonal fluctuations in cattle supply can provide trading opportunities.

Hedging is often done by farmers (covered more below).

Market Participants

Producers (Farmers)

Directly affected by cattle prices, they might use futures to lock in prices for their livestock.

For example, farmers can reasonably predict herd size.

They have a much harder time predicting prices.

To hedge their risks, since they’re “long” cattle by owning the underlying asset, they can short cattle futures at the expected delivery date in the appropriate quantity to hedge their price risk.

Therefore, it turns into a volume-based business (which they have control over) rather than being exposed to random vagaries over the price (which they have virtually no control over).

In terms of country-level producers…

The top cattle producers in the world are the United States, Brazil, and India, which lead in terms of both the number of cattle and beef production.

Consumers

End consumers indirectly affect the market through their demand for beef products.

Traders and Speculators

They trade futures and options based on their market expectations, adding liquidity and sometimes volatility.

Implementation and Considerations

Via ETFs and Mutual Funds

Traders can access companies that participate in the commodities and cattle markets through exchange-traded funds (ETFs) and mutual funds that specialize in commodities.

Direct Investment in Futures

More experienced traders might consider direct investment in futures contracts for commodities and cattle, although this requires a good understanding of the nuances and risks involved.

Backwardation, contango, roll, trading on leverage, etc., are important elements of futures trading.

Rebalancing Strategy

Regular rebalancing is important to maintain desired risk levels and to adjust the portfolio in response to market movements and changes in outlook.

Bottom Line

Live and feeder cattle represent attractive trading opportunities for switched-on traders. However, a sensible approach to risk management and a comprehensive understanding of what drives market prices is essential.

To get started, use DayTrading.com’s pick of the top cattle trading platforms.