Listerine Royalties as a Trading & Investment Opportunity

Listerine royalty contracts offer a unique trading and investing opportunity that has been around for over a century.

Originally created due to unclear legal wording, these contracts have consistently provided passive income to institutions and private investors.

With the internet making these contracts more accessible, what was once a little-known investment is now easier to explore.

Key Takeaways – Listerine Royalties as a Trading & Investment Opportunity

- Enduring Contract

- Listerine royalties offer a unique income stream dating back to the 1800s upheld by legal precedent.

- Provides consistent payouts regardless of the formula’s public domain status.

- Accessible Trading

- Online platforms have better democratized access to various forms of royalty streams.

- Allows investors to buy royalty rights across a range of annual income levels.

- Attractive Yields

- Royalty claims often trade at competitive multiples compared to dividend stocks.

- Offers potentially high yields for income-focused investors.

- Inflation Risk

- The fixed royalty rate of $6 per 144 bottles since 1889 means real returns per bottle have significantly decreased over time due to inflation.

The Origins of Listerine

Listerine, a household name synonymous with oral hygiene, has a rich history dating back to the late 19th century.

In 1879, Dr. Joseph Joshua Lawrence, a St. Louis-based doctor and drugmaker, set out to create a novel antiseptic.

Inspired by the pioneering work of John Lister in antiseptic surgery, Lawrence christened his formula “Listerine.”

The Original Licensing Agreement

In 1881, Lawrence made a decision to license his Listerine formula to Jordan Wheat Lambert, a pharmacist with entrepreneurial ambitions.

The agreement they signed that year laid the foundation for what would become one of the most enduring royalty contracts in business history.

The Listerine Royalty Contract

Terms of the Agreement

The original contract stipulated that Lambert would pay Lawrence a royalty of $20 for every 144 bottles of Listerine sold.

The agreement extended this obligation to all future “heirs, executors or assigns.”

This seemingly innocuous clause would prove to be of large significance in the decades to come.

Modification and Oversight

In 1889, the parties revisited the contract and agreed to reduce the royalty rate to $6 per 144 bottles sold.

Nonetheless, in what would later be seen as a critical oversight, neither Lawrence nor Lambert thought to include an end date for the agreement.

Also, no account for inflation or unit-price increases was accounted for.

The Legal Battle and Its Aftermath

Public Domain and Legal Challenge

As Listerine’s popularity soared, so did the value of the royalty payments.

When the product’s formula entered the public domain in the 1940s, Warner-Lambert (then the manufacturers of Listerine) saw an opportunity to free themselves from the royalty obligation.

They filed a lawsuit, arguing that the public domain status of the formula negated the need for continued royalty payments.

A Landmark Decision

In a 1959 ruling that would have implications for contract law and intellectual property rights, the court sided with the royalty owners.

The decision upheld the licensing agreement, affirming the right of Lawrence’s heirs and assigns to continue receiving $6 for every 144 bottles of Listerine sold, regardless of the product’s public domain status.

Listerine Royalties as an Investment and Trading Vehicle

Institutional Appeal

The court’s decision transformed Listerine royalty rights into an investment opportunity.

Over the years, a wide variety of institutions, including endowments, pensions, and foundations, have acquired stakes in the licensing contract.

The steady, reliable income stream provided by these royalties has made them a quality addition to many institutional portfolios.

Appeal to Private Investors

Listerine royalties aren’t limited to institutional investors.

Private individuals have increasingly recognized the potential of these rights as a source of dependable recurring income.

The relatively low-risk nature of the investment and endurance for well over a century, coupled with its unique historical significance, has made it an option for those seeking to diversify their portfolios.

Monthly Payments

Listerine royalties are paid monthly.

US sales are distributed monthly, while the first month of each quarter sees a spike in proceeds due to foreign royalties, which are paid quarterly.

The Modern Marketplace for Listerine Royalties

The Role of the Internet

The digital era has changed the way Listerine royalty rights are traded.

Online platforms (e.g., royaltyexchange.com) are marketplaces where these claims are regularly listed and sold – along with various other forms of intellectual property, such as music royalties and movie scores.

This increased accessibility has opened up Listerine royalties to a broader range of investors than ever before.

Valuation and Yield

Listerine royalty claims often trade at an earnings multiple commensurate with dividend stocks.

Many offers provide relatively high yields, making them an attractive proposition for income-focused investors.

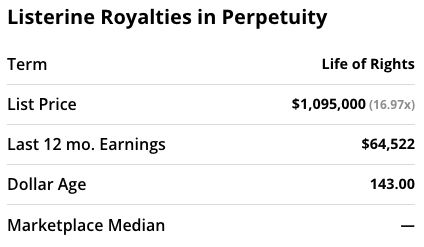

For example, a recent listing offered lifetime rights to a Listerine royalty claim for $1,095,000.

With annual royalties of $64,402, this represented a sales multiple of 17x.

This was lower than the price-to-earnings ratio of Kenvue, the current manufacturer and distributor of Listerine.

The payouts were relatively consistent, showing the fairly consistent demand for consumer staples:

| Year | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Earnings | $65,226.07 | $64,887.74 | $62,936.81 | $62,876.88 |

Accessibility for Smaller Investors

Some Listerine royalty rights command seven-figure price tags, but there are also opportunities for those with more modest budgets.

Claims selling for less than $25,000 occasionally come to market, though these tend to be snapped up quickly due to high demand.

Considerations for Potential Investors

The Inflation Challenge

As mentioned, one significant drawback of Listerine royalty rights stems from the original contract’s lack of provisions for inflation or unit-price increases.

The royalty rate remains fixed at $6 per 144 bottles, the same as it was in 1889.

This means that the real value of the royalty payments on a per-bottle basis has decreased substantially over time due to inflation.

Brand Strength and Market Position

Despite the inflation issue, Listerine remains a strong brand in the oral care market.

Its status as a household name and its consistent market presence provide a degree of security to royalty holders.

The product’s enduring popularity suggests that royalty payments are likely to continue for the foreseeable future.

Legal Precedent and Contract Validity

Perhaps the most compelling aspect of Listerine royalty rights is the strength of the legal precedent supporting them.

The court’s decision to uphold the royalty agreement, even after the product formula entered the public domain, demonstrates the strength of these contracts.

Overall

At the same time, nothing is risk-free.

Listerine has competition, the royalties have no inflation-indexing mechanism, and while the legal picture has been favorable to it in the past, it can’t be known for sure in future years or decades.

This article is simply to bring awareness to a unique type of enduring investment and legal backstory – and a commonly overlooked category of income streams (royalty payments) – not to endorse it.

Conclusion

Listerine royalty contracts are a case study in the intersection of legal history, corporate longevity, and unique investment opportunities.

For those seeking a unique addition to their portfolio – one that offers steady income and a touch of American business lore – Listerine royalty rights present an intriguing option.

At the least, it can introduce the idea of adding royalty payments to a portfolio, whether that’s specific consumer products, music, films/video, books, content, or other recurring income streams.

Listerine royalties are not without their flaws, particularly in terms of inflation protection, but these royalty rights continue to attract interest from both institutional and private investors.

As the digital marketplaces for such alternative investments continue to take shape, it’s likely that Listerine royalties will remain of interest for those looking to diversify their income streams with a unique type of exposure.