Gap Trading (Trading the Gap)

Gap trading is a popular strategy among day traders and swing traders in various financial markets, including stocks, currencies (forex), and futures.

This approach focuses on exploiting price gaps that occur between the closing price of an asset on one day and its opening price on the following trading day.

Traders can try to profit from these price discontinuities by understanding the nature of these gaps and the market psychology behind them.

Key Takeaways – Gap Trading

- Gap trading intro

- Gaps in markets occur when there is a significant price difference between the closing price of one trading period and the opening price of the next, creating a “gap” on the price chart.

- Gaps are most common in stocks due to their volatility and the fact that stock markets close overnight, naturally leading to price gaps between closing and the following market open.

- Identify gap types

- Common, breakaway, runaway, and exhaustion gaps each offer unique trading opportunities.

- Recognizing these can guide your entry and exit strategies.

- Managing risk

- Use tight stop losses, maintain a favorable risk-reward ratio, and limit position sizes to protect your capital when trading volatile gaps.

- Confirm with volume

- High-volume gaps are typically more significant and reliable.

What Is a Gap?

A gap in trading refers to a break between prices on a chart.

Gaps occur when there is a significant difference between the closing price of an asset and its opening price on the following trading day.

This price discontinuity can happen due to various factors, such as:

- markets closing (e.g., overnight, weekends)

- earnings reports

- economic data releases

- geopolitical events that occur outside of regular trading hours

- the discounting of new macroeconomic conditions

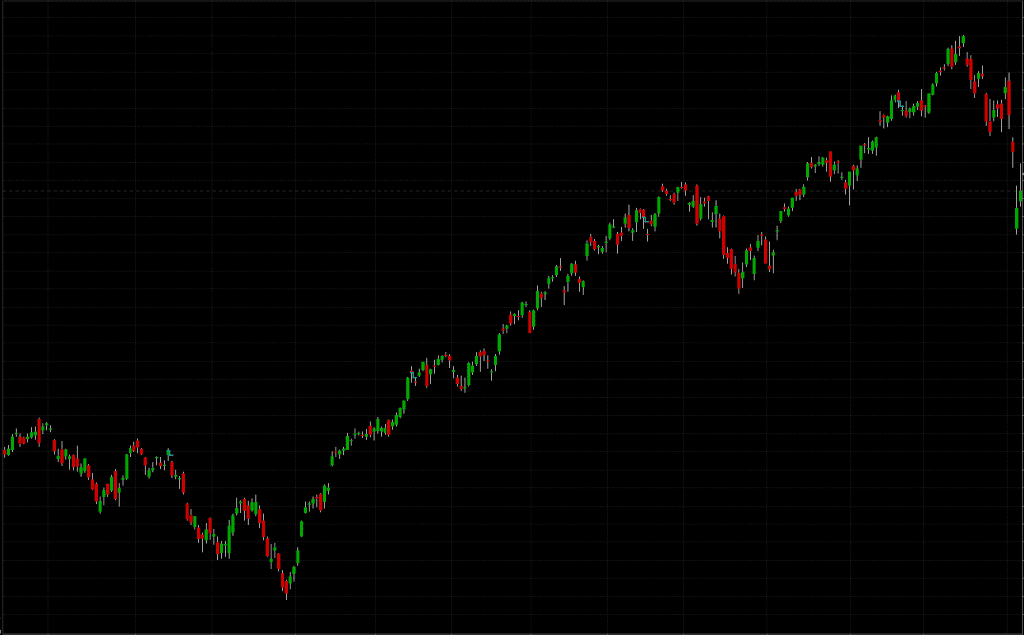

For example, you can see multiple gaps on this particular price chart, showing discontinuous pricing/liquidity:

The Psychology Behind Gap Trading

Understanding the emotions and behaviors of market participants can help traders make better decisions when trading gaps.

Fear and Greed

Gaps often represent sudden shifts in market sentiment, driven by fear or greed.

When unexpected news or events occur, traders may rush to buy or sell.

This might cause discontinuous liquidity, which can create significant price movements that result in gaps.

Types of Gaps

There are four main types of gaps that traders should be familiar with:

- Common gaps

- Breakaway gaps

- Runaway (or continuation) gaps

- Exhaustion gaps

Each type of gap has its own characteristics and implications for potential trading opportunities.

Common Gaps

Common gaps occur frequently and are typically the result of normal market fluctuations.

They are often seen in markets with lower liquidity or during periods of low trading volume.

They’re also common for markets that close overnight or during weekends.

These gaps usually get filled quickly and may not offer significant trading opportunities.

Breakaway Gaps

Breakaway gaps signal the start of a new trend or the continuation of a trend after a period of consolidation.

They often occur with high volume and can be seen when a stock breaks out of a trading range or pattern.

Breakaway gaps are less likely to be filled quickly and can offer good trading opportunities.

Runaway (Continuation) Gaps

Runaway gaps, also known as continuation gaps, occur in the middle of a strong trend.

They signal a rush of buyers or sellers entering the market, pushing the price rapidly in the direction of the existing trend.

These gaps often occur with high volume.

Overall, they can be a sign of a healthy, continuing trend.

Exhaustion Gaps

Exhaustion gaps typically appear near the end of a strong trend.

They represent a final surge of buying or selling pressure before the trend reverses.

These gaps are often accompanied by extremely high volume and can be followed by a period of price consolidation or reversal.

Gap Trading Strategies

Gap Fill Strategy

The gap fill strategy is based on the principle that gaps tend to be filled over time.

Traders using this strategy look for opportunities to profit as the price moves back to fill the gap.

This approach can be most effective for common gaps and some breakaway gaps.

But this isn’t foolproof.

Not all gaps will inevitably be filled, and some may remain unfilled for extended periods or indefinitely.

Traders should consider other factors and not rely solely on the expectation of a gap filling.

Entry and Exit Points

- Entry – Enter a trade in the opposite direction of the gap when price action shows signs of reversal.

- Exit – Set a profit target at the level where the gap would be filled.

- Stop Loss – Place a stop loss beyond the gap’s high (for short trades) or low (for long trades).

Gap and Go Strategy

The gap and go strategy involves trading in the direction of the gap, particularly for breakaway and runaway gaps.

This strategy tries to capitalize on the momentum created by the gap.

Entry and Exit Points

- Entry – Enter a trade in the direction of the gap after confirming the initial price movement.

- Exit – Set a profit target based on key support/resistance levels or using a trailing stop.

- Stop Loss – Place a stop loss at or near the opening price level.

Fading the Gap

Fading the gap involves taking a position opposite to the direction of the gap, anticipating that the price will reverse.

This strategy can be effective for exhaustion gaps or overextended moves.

Entry and Exit Points

- Entry – Enter a trade opposite to the gap direction when signs of reversal appear.

- Exit – Set a profit target at a key support/resistance level or use a trailing stop.

- Stop Loss – Place a stop loss beyond the extreme point of the gap.

Risk Management in Gap Trading

Effective risk management is necessary in gap trading due to the potential for sudden, large price movements.

Position Sizing

Limit the size of each trade to a small percentage of your total trading capital.

For day trading, this is typically 1-2%.

This helps protect your account from significant losses if a trade goes against you and a series of losses isn’t devastating.

Stop Loss Orders

In day trading and swing trading, stop loss orders are commonly used to limit potential losses.

Place stops at levels that invalidate your trading thesis, such as beyond the gap’s high or low.

For longer-term styles of trading, the use of options as a hedge becomes more popular.

Risk-Reward Ratio

Aim for a favorable risk-reward ratio.

Technical Analysis Tools for Gap Trading

Several technical analysis tools can be used in gap trading strategies:

Volume Analysis

Volume can provide important clues about the strength and potential durability of a gap.

High volume gaps are generally more significant and may offer better trading opportunities.

Related: Volume-Price Trend

Support and Resistance Levels

Identifying key support and resistance levels can help in setting profit targets and stop loss orders when trading gaps.

Moving Averages

Moving averages can help identify the overall trend and potential areas where gaps might be filled or continue.

Fibonacci Retracements

Fibonacci retracements are like an extra set of support and resistance levels that some traders find useful in identifying potential reversal levels after a gap, especially when fading the gap.

Common Mistakes in Gap Trading

Overtrading

Avoid the temptation to trade every gap you see.

Not all gaps offer good trading opportunities, and overtrading can lead to increased transaction costs and potential losses.

Ignoring the Broader Market Context

Always consider the broader market conditions and trends when trading gaps.

A gap that occurs against the prevailing trend may be less reliable than one that aligns with it.

For example, for a stock with strong upward momentum, shorting it to trade the gap may be risky.

Failing to Adapt to Different Market Conditions

Gap behavior can vary depending on market conditions, such as high volatility periods or during earnings seasons.

Be prepared to adjust your strategies accordingly.

Neglecting Risk Management

Failing to use proper risk management techniques, such as stop losses and position sizing, can lead to significant losses in gap trading.

Advanced Gap Trading Concepts

Multiple Time Frame Analysis

Analyzing gaps across multiple timeframes can provide a more thorough view of market dynamics and potential trading opportunities.

For instance, this could mean checking gaps across a 5-minute, 30-minute, and 4-hour time chart.

Correlation with Other Assets

Understanding how gaps in one asset may affect correlated assets can open up additional trading opportunities or help in risk management.

Gap Trading in Different Markets

While gap trading is commonly associated with stocks, it can also be applied to forex, futures, and other markets.

Each market may have unique characteristics that affect gap behavior.

Stocks nonetheless tend to be the most common for gap trading due to the fact the markets close overnight, whereas FX is a 24/5 market.

Conclusion

Gap trading can be a profitable strategy when executed with discipline and a solid understanding of market dynamics.

Traders can potentially capitalize on these price discontinuities by recognizing different types of gaps, implementing effective trading strategies, and maintaining strict risk management.

However, gap trading, like all trading strategies, requires practice, continuous learning, and adaptation to changing market conditions.

Successful gap traders often combine this approach with other technical and fundamental analysis techniques to make better trading decisions.

As with any trading strategy, it’s important to thoroughly backtest and paper trade gap trading methods before risking real capital.

Additionally, staying informed about market news and events that could potentially create gaps can be used for anticipating and capitalizing on these trading opportunities.