Cryptocurrency Investing Is Coming To M1 Finance

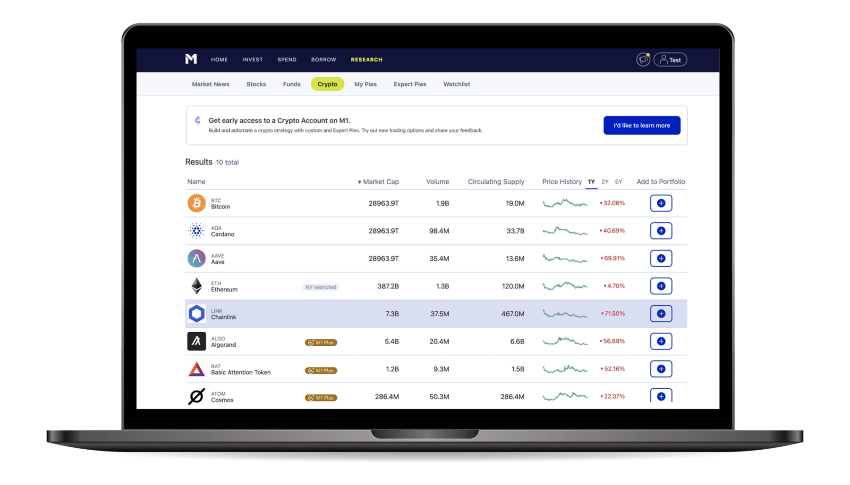

US-based robo-advisor, M1 Finance, is introducing crypto investing accounts. Clients will be able to speculate on 10 popular tokens, including Bitcoin (BTC) and Ethereum (ETH). Users will be able to build custom portfolios, known as Pies, or choose from expertly curated portfolios centred around thematic strategies, such as Web 3.0 and DeFi.

M1 Crypto

In the 13 years since Bitcoin emerged, the digital currency market has grown to be worth a trillion dollars, with one in five Americans having already invested or used cryptos. It’s unsurprising then, that over half of clients surveyed by M1 asked for access to crypto investing.

The new M1 Crypto service will offer low-cost crypto trading opportunities with automation capabilities and competitive costs. Key features include:

- Custom & expert portfolios – Clients can build a portfolio that aligns with their financial goals and risk appetite. Users can also choose from pre-built Pies, developed by M1’s trading experts. These will be based on thematic strategies, including large-cap cryptos, Web 3.0 and DeFi.

- Target allocations – Clients can choose a percentage allocation that suits their overall portfolio, as well as setting allocations for individual crypto assets. These can be amended as needed.

- Dynamic rebalancing – With the price of cryptos changing dramatically, M1 Crypto will automatically reallocate funds following each recurring deposit to ensure portfolios align with investment objectives.

- Recurring deposits – Traders can set up recurring deposits to support long-term investing strategies like dollar-cost averaging.

- Automation – The M1 auto-invest service helps traders stay actively engaged in the market and capitalize on potential opportunities. Clients can also choose a balance that remains uninvested.

- Commission-free – In line with the broker’s other trading products, M1 Crypto will offer zero commission trading. Clients can speculate on cryptos as they do with stocks and ETFs, but digital currency assets will be held in a secure custodial wallet, provided by Apex Crypto.

Note, that cryptocurrencies are not FDIC or SIPC insured.

Getting Started

M1 Crypto should be fully operational in the coming weeks. In the interim, clients can sign up for early access on the broker’s website. Users can also start researching the digital currency market and planning crypto Pies.

Importantly, M1 Crypto may suit traders looking to consolidate investments into one platform. Cryptocurrency trading might also benefit investors looking to diversify portfolios or speculate on a high-risk asset class.

Follow the sign-up link below to get started. Alternatively, head to our crypto trading guide for more insights.