Crypto Margin Trading – Tutorial & Best Exchanges

With a boom in cryptocurrency, margin trading on this volatile asset provides new and potentially lucrative opportunities. In this tutorial, we explain how to trade crypto on margin plus offer tips for choosing the best exchanges and platforms. We also cover the pros and cons of crypto margin trading and a guide to getting started.

Crypto Margin Trading Platforms

-

1

Plus500 USTrading with leverage involves risk.

Plus500 USTrading with leverage involves risk. -

2

NinjaTrader

NinjaTrader -

3

Interactive Brokers

Interactive Brokers -

4

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

UpholdTerms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

UpholdTerms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Here is a short summary of why we think each broker belongs in this top list:

- Plus500 US - Plus500’s Micro-Bitcoin and Micro-Ethereum futures only allow traders to scratch the surface of crypto trading with bets on the two most popular digital assets. Importantly, you cannot buy and own the cryptos with these derivative contracts - you are speculating on their price.

- NinjaTrader - You can get exposure to micro Bitcoin futures through the CME Group’s centralized exchange, which is highly regulated by the US CFTC. Micro contracts allow you to trade a fractional size of one Bitcoin, giving you more risk control and order flexibility.

- Interactive Brokers - IBKR lets you purchase and hold Bitcoin, Bitcoin Cash, Ethereum, and Litecoin at competitive commission rates and without needing a crypto wallet. Additionally, there is a range of other diverse assets to explore, such as crypto indices like the NYSE Bitcoin Index, as well as futures contracts like the BAKKT Bitcoin Futures.

- eToro USA - eToro US offers 24 tradeable cryptoassets, with just a 1% buying/selling fee added to the spread. Additionally, there are 80 different coins available through the broker’s proprietary wallet service. You can also practice your crypto strategies easily by switching between live and demo mode. Crypto asset investing is highly volatile and unregulated. No consumer protection. Tax on profits may apply.

- OANDA US - Cryptocurrency trading is offered via Paxos, a separate entity from Oanda. You can speculate on the world’s biggest cryptos by market cap. Commissions are lower than many peers starting at 0.25%. Through the broker’s partnership with Paxos, clients can spot trade cryptocurrencies on the itBit exchange through the OANDA native platform.

- Uphold - You can buy and sell 250+ crypto assets with fiat currencies or in crypto pairs using the straightforward mobile app or through Uphold's browser-based account homepage. This is significantly more than many rivals. You can also earn up to 16% APY by staking one or more out of 32 valid tokens, or send tokens to an external wallet.

Plus500 US

"Plus500 US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500 US Quick Facts

| Bonus Offer | Welcome Deposit Bonus up to $200 |

|---|---|

| Coins | MicroBitcoin, MicroEthereum |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Regulator | CFTC, NFA |

| Account Currencies | USD |

Pros

- Plus500 US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls, instilling a sense of trust

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

Cons

- Despite competitive pricing, Plus500 US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

- While Plus500 US continues to broaden its investment offering, it's currently restricted to around 50+ futures with no stocks

- Although support response times were fast during tests, there is no telephone assistance

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Coins | BTC |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Floating |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Account Currencies | USD |

Pros

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

Cons

- There is a withdrawal fee on some funding methods

- Non forex and futures trading requires signing up with partner brokers

- The premium platform tools come with an extra charge

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Coins | BTC, LTC, ETH, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.12%-0.18% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

Cons

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Bonus Offer | Invest $100 and get $10 |

|---|---|

| Coins | BTC, ETH, BCH, DASH, LTC, ETC, MIOTA, XLM, EOS, NEO, ZEC, XTZ, MKR, COMP, LINK, UNI, YFI, DOGE, AAVE, ALGO, MANA, ENJ, BAT, MATIC, FLR, SHIBxM |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | BTC 0.75% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Regulator | SEC, FINRA |

| Account Currencies | USD |

Pros

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

- The online broker offers an intuitive social investment network with straightforward copy trading on cryptos

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

Cons

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Coins | BTC, ETH, LTC, BCH, PAXG, LINK, UNI, AAVE |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | $100 |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

- Day traders can enjoy fast and reliable order execution

- The proprietary OANDA web platform continues to deliver a highly competitive charting environment, including 65+ technical indicators powered by TradingView

Cons

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

Uphold

"Uphold remains a top choice for crypto investors looking for a one-stop-shop solution to accessing the markets. There are over 250 tokens to buy, sell and trade through flexible platform options."

William Berg, Reviewer

Uphold Quick Facts

| Coins | BTC, BTCO, AAVE, ALCX, DYDX, INH, XYO, API3, GHST, LSK, AUDIO, GLMR, NMR, CAKE, GODS, REQ, CHR, TRB, DAO, ROOK, XRP, ETH, BAT, ADA, ALGO, ATOM, AVAX, AXS, BCH, BAL, BTG, CSPR, COMP, CRV, DASH, DCR, DGB, DOGE, DOT, EGLD and many more |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Up to 1.5% |

| Crypto Lending | No |

| Crypto Staking | Yes |

| Platforms | Desktop Platform, Mobile App |

| Minimum Deposit | $0 |

| Account Currencies | USD, EUR, GBP |

Pros

- Two-step authentication bolsters user security

- Uphold continues to remain ahead of the industry, often being one of the first platforms to list new crypto tokens

- Over 250 cryptos are available including major tokens like Bitcoin and Ethereum

Cons

- There is a 2.49% fee if you want to use debit or credit cards

- The charting analysis features on the platform trail specialist exchanges

- Customer service is slow based on tests, with limited contact options

What Is Crypto Margin Trading?

Crypto margin trading is the practice of using leverage to multiply the results of a trade. The amount a trader has deposited in their account is known as the margin.

A broker offering margin trading will provide traders with a leverage quote, this is usually displayed as either a ratio (e.g 1:2) or a multiple (e.g 2x), meaning that for every 1 base crypto coin, the results of a trade are multiplied by 2.

To enable traders to open larger positions, the broker allows them to borrow capital. This will need to be paid back in full, but the profits can be retained by the trader.

For example, if your leverage is 1:2 and you deposit $1,000, you can open positions with a total value of $2000.

If you use this to purchase Ethereum and the price moves 5%, you’ll have $2,100 worth of ETH.

If you close your trade there and return the $1,000 borrowed, you’re left with $1,100, having made a $100 profit.

If you’d placed the same trade in your spot account, you’d have made a $50 profit.

It’s important to note that profits are amplified, but equally, so are losses. Plus, your borrowed amount will still need to be returned. Therefore, margin trading on cryptos should only be utilised by knowledgeable investors.

Some of the top crypto exchanges now offer crypto margin trading, including Binance, Kraken and Crypto.com. However, it is a fairly new practice, so some of the top brokers for professionals, such as TradeStation, are yet to facilitate crypto margin trading.

What Is A Margin Call?

If the price of the asset held on margin drops in value significantly, a broker will issue a margin call. This means that traders will have to prove that they can return the amount borrowed, by depositing more funds.

The account will usually be suspended from opening new trades until this has been completed, or the asset rises in value again.

A margin call is designed to protect traders from losing more than they can afford.

For example, if you’re trading $1,000 on margin with 5x leverage and the value of ETH drops 17.5%, the value of the asset you hold is now worth $4,125.

Your operating loss is -$875. Since you’ve only deposited $1,000, you’re in danger of losing more than your initial deposit amount if the value slips further. At this point, a margin call may be issued.

Pros Of Crypto Margin Trading

- Lower capital requirements – Some Bitcoin trading strategies that require large amounts of capital. For example, scalping is the practice of executing short and sharp trades to collect small profits regularly. Crypto margin trading allows traders to maximise the results of each trade and means profits can accumulate quickly.

- 24/7 margin trading – Unlike the forex and commodities markets, crypto can be traded 24/7. If you’re a weekend trader, this means you can take advantage of margin trading outside of usual operating hours.

Cons Of Crypto Margin Trading

- Losses are amplified – While crypto trading on margin can mean increased profits, it also means that any losses are multiplied. Losses can exceed the deposit amount, so the risk involved is significantly larger when compared with trading on a cash account. Traders should consider whether they can afford the risk.

- Interest on borrowed crypto – While traders keep all the profits from their trades, some exchanges, such as Binance, charge interest on the borrowed amount. The rate varies based on the cryptocurrency and the length of time capital is borrowed.

- Negative balance protection – In the world of forex, margin trading has been around a while. Therefore, most brokers are subject to regulation that aims to protect retail investors. In the UK, forex brokers regulated by the Financial Conduct Authority (FCA) must provide negative balance protection, for example. This means that traders are prevented from losing more than their deposit amount when trading on margin. This level of protection is not available in the crypto industry, leaving altcoin margin traders exposed to significant risk.

- Brokers and exchanges – Having mentioned the lack of regulation above, there is a global tightening of restrictions that is already impacting the availability of crypto margin trading. In 2020, Coinbase Pro, one of the top Bitcoin exchanges, suspended margin trading for US customers, citing new guidance from the Commodity Futures Trading Commission (CFTC). Binance and Robinhood also restrict margin trading on cryptos for US customers and eToro has suspended it at times due to volatility. These restrictions could increase and margin trading on crypto assets phased out on Bitcoin exchanges in the US and potentially other jurisdictions too.

- Limited trading pairs – Not all crypto margin trading platforms offer leverage on all pairs, sometimes it’s only available on one or two. This limits traders’ scope for utilising an arbitrage strategy. For example, crypto.com only offers margin trading on BTC/USDT.

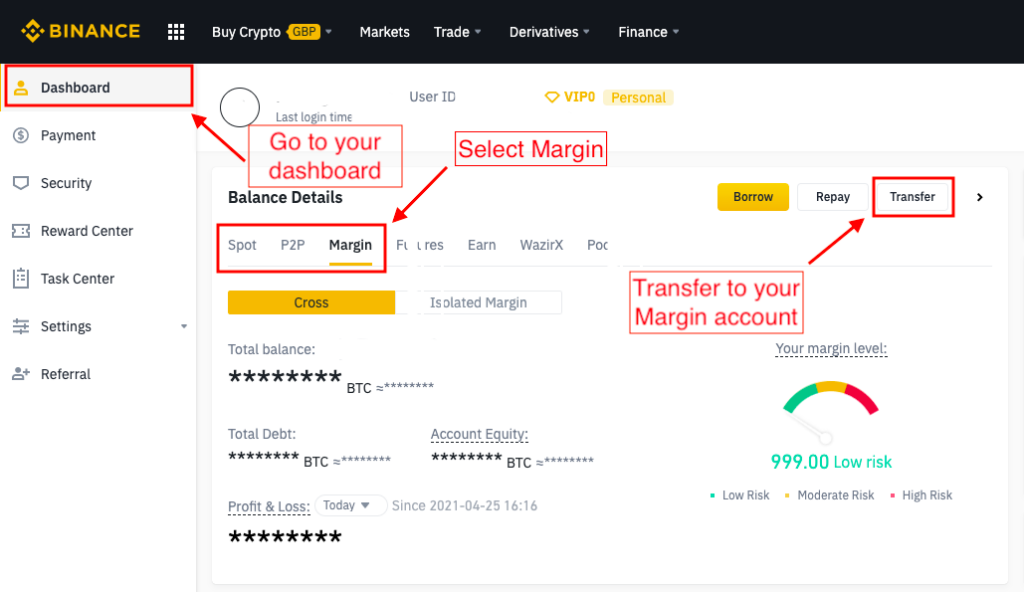

How To Start Crypto Margin Trading

To start crypto margin trading, you’ll first need to select a broker or an exchange that provides the service. Some of the best crypto exchanges that offer margin trading include Binance and Kraken. Then sign up to an account and complete any KYC checks. Most exchanges will require proof of identity if they also offer fiat exchange, however, there are some, such as Prime XTB, which have no KYC checks. Next, visit your settings. There will usually be an option to switch your account from spot to margin trading. In some cases, you’ll then need to transfer tokens to your margin account.

Choosing A Crypto Margin Trading Broker

- Leverage offered – Take a look a what leverage a broker is offering to understand how much you can trade. If you’re happy with the risks involved, higher leverages can mean higher profits, but they’re not always necessary. Both Binance and Kraken offer leverage of 1:5 when crypto margin trading. Crypto.com offers 1:3 and IC Markets offers 1:2.

- Fees – The fee structure for margin trading varies per broker. Some operate by allowing traders to borrow tokens as leverage, including Binance. In this instance, interest is usually charged on the borrowed amount. Kraken, on the other hand, charges an opening and closing fee on the spot value of the trade. A rollover fee is applied based on how long the position is held. Look for a broker whose fee structure you’re comfortable with. Also, taxes will usually need to be paid on any gains, in line with rules in your jurisdiction.

- Demo accounts – Since Bitcoin margin trading involves an increased level of risk, traders must have the opportunity to practice their strategies using signals beforehand. A trading simulator and online courses allow clients to trial strategies before using real money. Profit calculators are also useful to help predict the outcome of a trade and can replace the manual spreadsheet you’ve previously worked with. Plus500 offers a great CFD crypto-simulator with 2x leverage, however this is only available on their professional trading account.

Final Word On Crypto Margin Trading

Now we’ve explained the ins and outs of crypto margin trading, you’ve hopefully got the understanding to get started. Bitcoin and other cryptos are highly volatile markets and while trading on margin can mean huge upside, retail investors should also be aware of the risks involved. It’s possible this asset could suffer from increased regulation in the future, but for now, it represents an exciting opportunity for traders.

FAQ

How Does Bitcoin Margin Trading Work?

Crypto margin trading means investors can multiply the results of their Bitcoin trade by utilising leverage. Leverage is the number of times you can multiply the results, it is either written as a ratio (e.g 1:3) or a multiple (e.g 3x). Leverage allows traders to borrow funds from their broker. In this way, a trader can execute much larger positions than their deposit amount and can amplify profits.

Are There Many Crypto Exchanges That Allow Margin Trading?

The top crypto margin trading exchanges that allow margin trading include Kraken and Binance, but there are more to choose from. However, availability does vary by location. Some popular exchanges, including eToro and Coinbase, have suspended crypto margin trading at times due to volatility in the market.

Is Crypto Margin Trading Legal In The USA?

Bitcoin margin trading in the United States is restricted by the Commodity Futures Trading Commission (CFTC). Regulated exchanges that previously offered the service, such as Coinbase and Binance, have removed leveraged trading in 2021 for clients from the USA.

Will A Crypto Margin Call Go Away?

A margin call will cease once your account has been deposited with sufficient funds or the asset has increased in value. A margin call is designed to protect a trader from losses that exceed their deposit amount.

Can I Trade Crypto On Margin?

Yes, some of the top Bitcoin exchanges now offer trading on margin, with the opportunity to multiply the results of any trade. Whilst the practice is restricted in some jurisdictions, like the US, it is available in the UK, Australia, India, and Canada, to name just a few.