Contango & Backwardation Convergence Strategies

Contango and backwardation convergence strategies try to profit from the natural tendency of futures prices to converge toward the spot price of the underlying asset as the contract nears expiration.

Key Takeaways – Contango & Backwardation Trading Strategies

- Contango Convergence Strategy:

- Involves buying the front-month (or front-period) contract and shorting a later-dated contract.

- Tries to profit as the contango curve flattens or narrows over time.

- In other words, it’s a bet that prices will converge over time.

- Bears the risk of contango widening, leading to losses.

- Backwardation Convergence Strategy:

- Involves shorting the front-month/-period contract and buying a later-dated contract.

- Profits if the backwardation curve flattens or narrows with falling spot prices (or rising futures prices).

- Faces the risk of backwardation getting larger, which would cause losses.

- Things to Consider:

- These strategies aren’t without risk, are not arbitrage, and can be impacted by any number of factors.

- The main risk is that the spread simply widens and the trader incurs a loss.

- Ideal entry and exit points are important to maximize potential gains.

- Liquidity is important because futures contracts are not always liquid, especially those at later dates.

- Understanding the specific market dynamics for the chosen asset is essential.

- Futures trading is complex. These strategies are best suited for experienced traders.

What is Contango?

- Contango is a market condition where the price of a futures contract for a commodity (or other assets) is higher than the current spot price.

- This often occurs due to costs associated with storing and insuring the underlying asset.

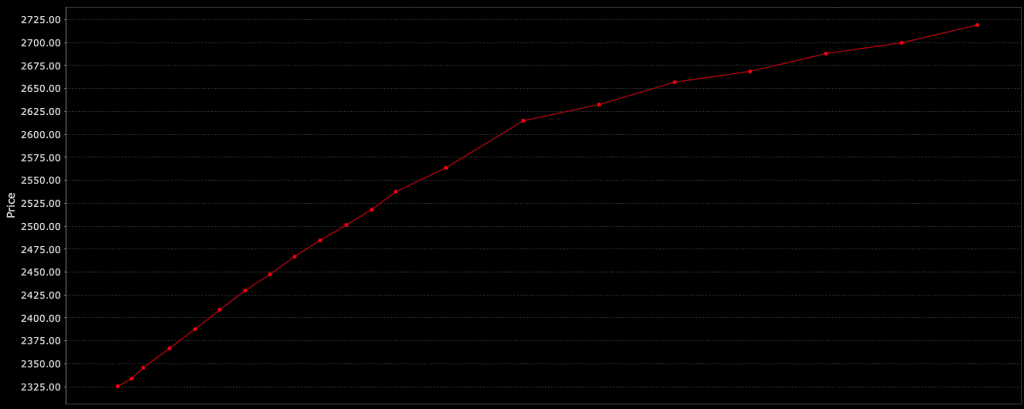

This is an image of gold in contango, which tends to be structurally that way primarily due to storage and insurance costs.

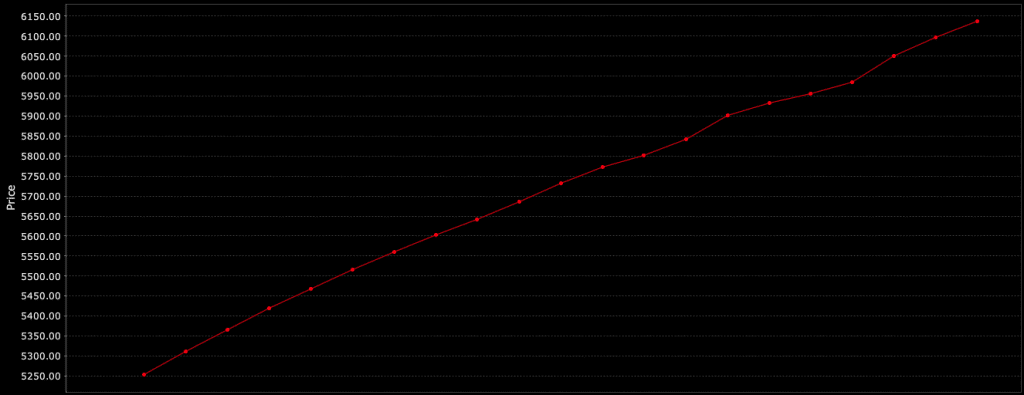

And this is an image of e-mini S&P 500 futures in contango due to the expectation of rising stock prices over time.

What is Backwardation?

- Backwardation is a market condition where the price of a futures contract for a commodity (or other asset) is lower than the current spot price.

- This can signal strong immediate demand for the asset.

- Potentially due to supply shortages or expectations of future price decreases.

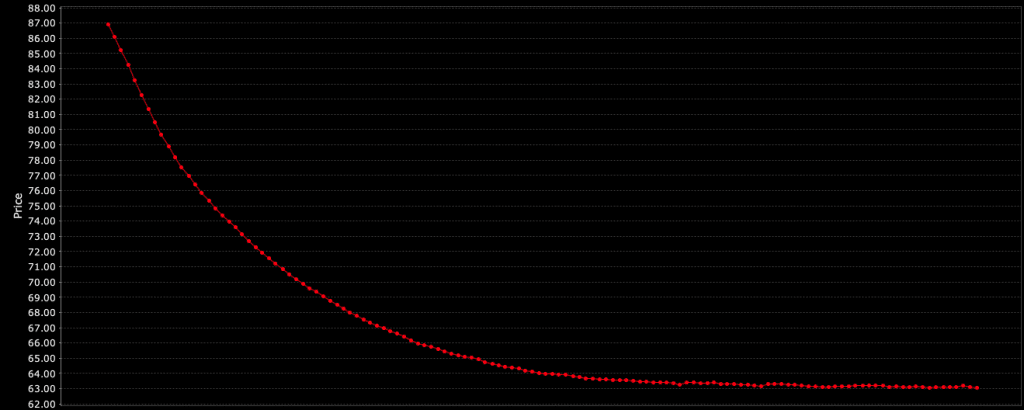

This is an image of oil in backwardation.

Contango & Backwardation Changes Due to Interest Rate Changes

Changes in interest rates can influence the degree of contango or backwardation in futures markets.

Here’s the connection:

Higher Interest Rates

When interest rates rise, the opportunity cost of holding physical commodities increases (financing storage gets more expensive).

This tends to widen the contango (or lessen backwardation), as traders factor in the higher cost through increased futures prices.

Lower Interest Rates

Lower rates decrease the opportunity cost of carrying physical assets.

This can reduce the contango or increase backwardation as the need to compensate for holding costs in futures prices diminishes.

Contango Convergence Trading Example

Let’s say a market is at $257,075 per futures contract in 1 year. The front-period contract for the same asset is $244,200.

Can the trader go long the front month contract and short the more expensive contract in 1 year and, on average, to make that price differential?

Here’s a breakdown of this scenario and why it’s more complex than it seems:

Scenario

The trader is considering a strategy where they’d:

- Go long (buy) the front-month futures contract at $244,200.

- Go short (sell) the contract expiring in one year at $257,075.

Profit Expectations: The Problem with Contango

Theoretical Profit

Ignoring other factors, you’d theoretically get a profit of $12,875 if the front-month price at expiry converged with the one-year futures price.

Or if the one-year futures price converged to the front-month price, or some permutation thereof where the gap is being whittled away over time.

Rollover Costs

In contango, to maintain your exposure as the front-month contract nears expiration, you need to “roll” your position.

This means:

- Closing your expiring front-month contract.

- Opening a new front-month contract (likely at a higher price due to contango).

- These rollovers eat into your profits due to transaction costs and negative roll.

Price Fluctuations

The price relationship between spot/front-month and futures contracts can change.

The contango situation could widen or narrow and affect your expected profit.

Both legs of a contract can lose money on the same day.

On a day-to-day level, many convergence trades will lose money.

Things to Consider

- Transaction costs – Every trade has fees that diminish returns.

- Storage and Insurance – If the asset underlying a futures contract has storage and insurance costs, those expenses get reflected in the higher prices of futures contracts further out in time.

- Margin Requirements – Futures trading involves margin, meaning you only put down a fraction of the contract’s value as collateral. This leverages potential gains but also magnifies losses.

- Risk – The futures market can be volatile, and you could end up losing money if prices move against you.

- Magnitude of costs – The extent of the daily implicit costs depends on the steepness of the contango curve and the time remaining until the contract expires.

Summary

While the initial price difference might look enticing, contango makes realizing the full theoretical profit difficult in practice.

The shape of futures curves change over time.

While you have the short end working for in the sense of the contango shape (all else equal), you have the front end working against you due to the roll.

Before using this type of strategy, it’s important to:

- Research the specific market.

- Understand all the costs and variables involved.

- Be prepared for the risks of futures trading.

What Impacts Futures Curve Pricing

The list of variables of what impacts futures curve pricing includes:

- Supply and demand

- Interest rates

- Inflation expectations

- Market liquidity

- Storage costs

- Transportation costs

- Seasonality

- Market expectations

- Geopolitical events

- Weather conditions

- Commodity inventory levels

- Currency exchange rates

- Production costs

- Government policies and regulations

- Environmental policies

- Speculative trading activity

Contango & Backwardation Trading Strategies vs. Cash and Carry Arbitrage

Contango and backwardation trading strategies and cash and carry arbitrage offer contrasting approaches to profiting from futures market inefficiencies.

Here’s a breakdown of the key distinctions and considerations:

Contango & Backwardation Strategies

Focus

Speculating on the narrowing or widening of the price difference between futures contracts.

How it Works

- Contango – Buy near-month futures, short further-out futures. Profit if contango narrows.

- Backwardation – Short near-month futures, buy further-out futures. Profit if backwardation flattens.

Risk

Relies on price convergence.

It’s susceptible to unexpected changes in market conditions or the contango/backwardation structure.

Cash-and-Carry Arbitrage

Focus

Exploiting a temporary mispricing between the spot and futures market where the futures price is misaligned with the theoretical price (which factors in carrying costs).

An example would be buying an S&P 500 ETF and shorting its futures equivalent if the latter was higher in price.

How it Works

- Contango – Buy the underlying asset at the spot price, simultaneously sell a futures contract. Deliver the asset at expiration for a theoretically risk-free profit.

- Backwardation – Short the underlying asset, simultaneously buy a futures contract. Purchase the asset later at a lower spot price for delivery, pocketing the difference.

If shorting, factor in borrowing/shorting costs as well as any obligations (paying a dividend, if applicable).

Risk

Less speculative with profit potential limited by the price discrepancy.

Risks include execution delays or sudden market shifts negating the arbitrage opportunity.

Choosing the Right Strategy

Risk tolerance

Cash and carry is generally less risky due to the theoretically locked-in profit potential (if identified and traded correctly), while contango/backwardation strategies depend on market movements (price convergence).

Investment Goals

Cash and carry offers modest but relatively certain returns. You can’t expect a big gap between the underlying and futures.

Contango/backwardation strategies have higher profit potential but also higher risk.

Market Conditions

Cash and carry opportunities are fleeting and might require significant capital.

Contango/backwardation strategies can be implemented with less capital but require correct market analysis.

Overall

Both approaches demand a deep understanding of futures markets, carrying costs, and execution risks.

Harvesting the Contango Premium

Harvesting the contango premium refers to a strategy where traders attempt to profit from the contango situation by buying commodities at a lower spot price and selling futures contracts at a higher price.

Here’s how it might work:

Buy physical commodity

Purchase the commodity at the current lower spot price.

Sell futures contract

Simultaneously sell a futures contract for the commodity at a higher price, locking in the price difference as profit.

Store and wait

Hold the commodity during the period until the futures contract expires.

Deliver on contract

At the expiration of the futures contract, deliver the commodity to fulfill the contract at the agreed-upon higher price.

Challenges and Risks

- Storage and Handling Costs – The costs of storing and insuring the commodity might offset the potential gains from the contango situation.

- Market Risk – Changes in the spot market can cause the commodity to fall a lot relative to the futures prices. This can lead to losses in excess of the contango premium.

- Liquidity Risk – Depending on the commodity, finding buyers for futures contracts or selling the physical commodity at expected prices may not always be straightforward.

Practical Considerations

While theoretically possible, the practical execution of harvesting the contango premium can be complex and risky.

It requires:

Sophisticated understanding of futures markets

Understanding contract specifications, delivery conditions, and market sentiment.

Effective risk management strategies

Being able to hedge against potential losses due to price volatility or other market changes.

Capital and infrastructure

Sufficient capital to purchase/grow/produce and store commodities, as well as infrastructure for handling and delivery.

Real-World Traders & the Contango Premium

Farmers

Farmers might use this strategy, but for prudent hedging purposes rather than profit-making.

They’re already “long” the underlying market – i.e., they make corn, soybeans, own lean hogs, cattle, etc. – and short the futures market to lock in their sales price on the anticipated delivery date.

That way, random price vagaries don’t negatively impact their business and it’s about what they produce rather than risking price fluctuations.

Jewelers

A jeweler is somebody who is essentially long gold, silver, precious metals, gems, etc.

To hedge the risk of prices falling and their inventory being worth less, they can short futures to lock in their price.

This again makes their business focused on what they produce and not random price fluctuations that are beyond their control.

Companies That Do Business in Other Countries

For example, a US company that sells in the eurozone will receive revenue in euros and thus be long the euro.

To avoid FX fluctuations from affecting their business, they can short euro futures against the dollar to hedge against this risk.