XM copy trading ‘drawdown’ meaning

- This topic has 5 replies, 1 voice, and was last updated 9 months ago by .

-

Topic

-

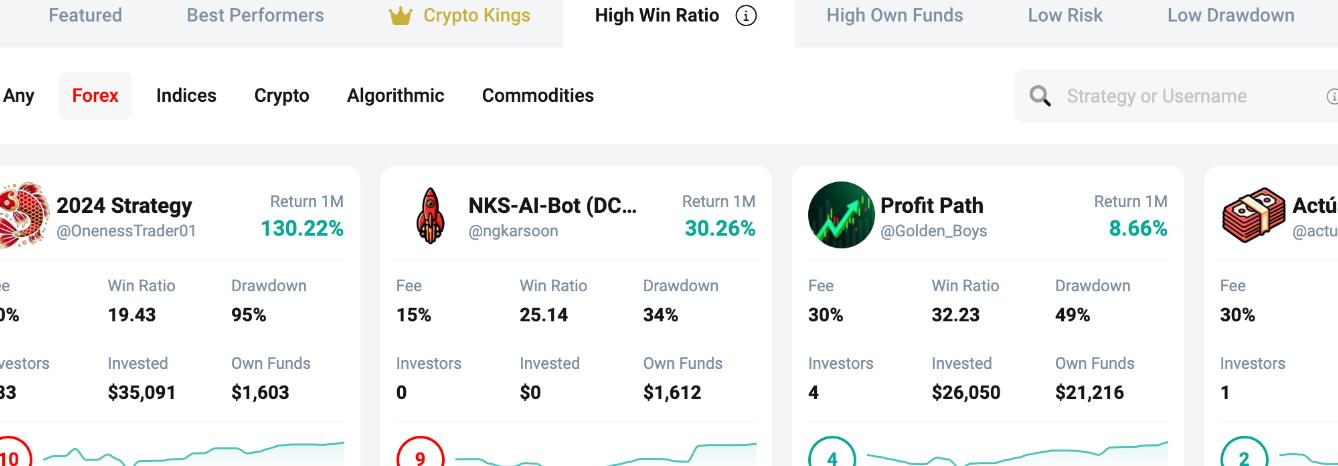

I’ve recently opened an XM account because I want to try copy trading. I have been reviewing a lot of options and I’m mainly interested in those wiht a high win ratio who trade currencies. You’ll see from the attached image the best performers in this cateogyr but could someone pls explain what “drawdown” means exactly? You’ll see it’s written in the top right corner of each trader as a percentage.

Cheers in advance.

Viewing 2 reply threads

Viewing 2 reply threads